Mga Batayang Estadistika

| Nilai Portofolio | $ 187,556,114 |

| Posisi Saat Ini | 69 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

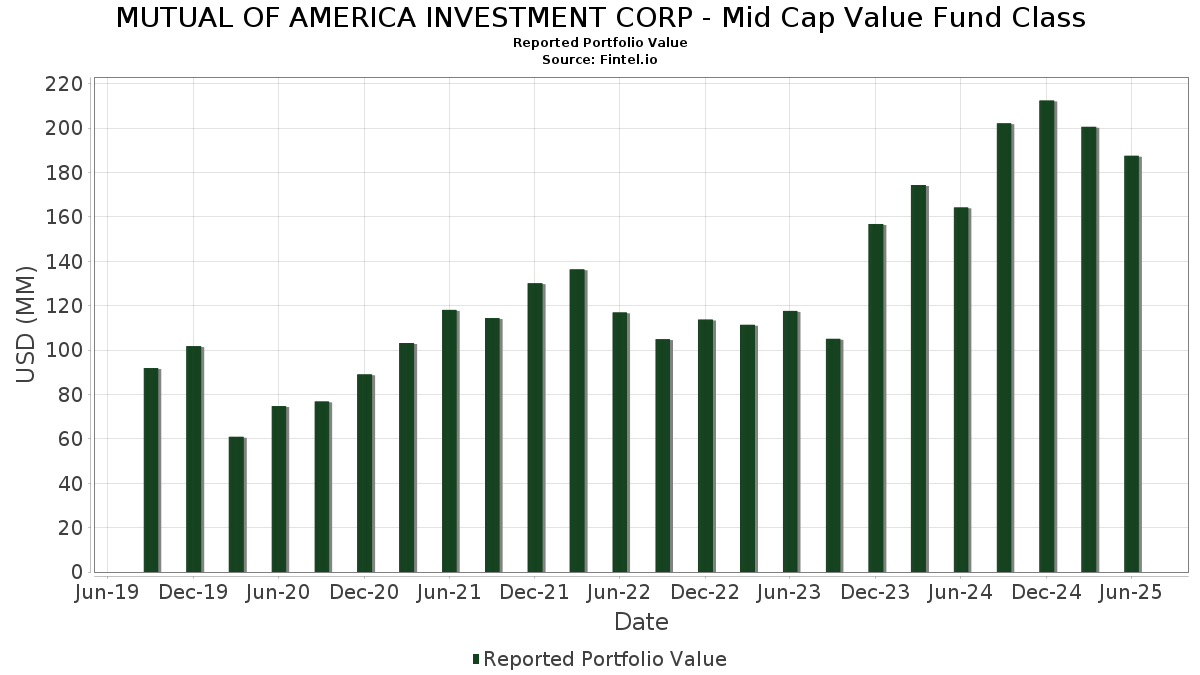

MUTUAL OF AMERICA INVESTMENT CORP - Mid Cap Value Fund Class telah mengungkapkan total kepemilikan 69 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 187,556,114 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MUTUAL OF AMERICA INVESTMENT CORP - Mid Cap Value Fund Class adalah Crown Holdings, Inc. (US:CCK) , Ameriprise Financial, Inc. (US:AMP) , Crane Company (US:CR) , Evergy, Inc. (US:EVRG) , and The Williams Companies, Inc. (US:WMB) . Posisi baru MUTUAL OF AMERICA INVESTMENT CORP - Mid Cap Value Fund Class meliputi: NiSource Inc. (US:NI) , Expand Energy Corporation (US:EXE) , Brixmor Property Group Inc. (US:BRX) , STERIS plc (US:STE) , and The Cooper Companies, Inc. (US:COO) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.90 | 2.0782 | 2.0782 | ||

| 0.08 | 3.21 | 1.7086 | 1.7086 | |

| 0.02 | 1.95 | 1.0377 | 1.0377 | |

| 0.07 | 1.89 | 1.0093 | 1.0093 | |

| 0.01 | 1.60 | 0.8501 | 0.8501 | |

| 0.02 | 3.26 | 1.7395 | 0.7050 | |

| 0.03 | 3.06 | 1.6281 | 0.5463 | |

| 0.01 | 0.93 | 0.4972 | 0.4972 | |

| 0.02 | 4.69 | 2.4991 | 0.4823 | |

| 0.01 | 2.42 | 1.2894 | 0.4326 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 2.46 | 1.3090 | -0.7241 | |

| 0.03 | 3.95 | 2.1065 | -0.4865 | |

| 0.03 | 2.46 | 1.3136 | -0.4283 | |

| 0.03 | 1.82 | 0.9676 | -0.3646 | |

| 0.02 | 2.82 | 1.5042 | -0.3089 | |

| 0.09 | 2.91 | 1.5518 | -0.2734 | |

| 0.05 | 2.63 | 1.4038 | -0.2522 | |

| 0.05 | 1.42 | 0.7550 | -0.2219 | |

| 0.05 | 1.03 | 0.5497 | -0.2210 | |

| 0.04 | 1.47 | 0.7839 | -0.2080 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CCK / Crown Holdings, Inc. | 0.05 | -18.74 | 5.19 | -6.24 | 2.7636 | 0.0087 | |||

| AMP / Ameriprise Financial, Inc. | 0.01 | -6.59 | 4.99 | 2.99 | 2.6576 | 0.2460 | |||

| CR / Crane Company | 0.02 | -6.59 | 4.69 | 15.81 | 2.4991 | 0.4823 | |||

| EVRG / Evergy, Inc. | 0.06 | -6.58 | 4.29 | -6.60 | 2.2861 | -0.0016 | |||

| WMB / The Williams Companies, Inc. | 0.07 | -6.58 | 4.25 | -1.80 | 2.2649 | 0.1091 | |||

| TDY / Teledyne Technologies Incorporated | 0.01 | -6.58 | 4.05 | -3.84 | 2.1594 | 0.0608 | |||

| AFG / American Financial Group, Inc. | 0.03 | -20.99 | 3.95 | -24.07 | 2.1065 | -0.4865 | |||

| PFGC / Performance Food Group Company | 0.04 | -6.58 | 3.92 | 3.92 | 2.0891 | 0.2104 | |||

| EWBC / East West Bancorp, Inc. | 0.04 | -6.58 | 3.92 | 5.10 | 2.0884 | 0.2313 | |||

| ROP / Roper Technologies, Inc. | 0.01 | 15.18 | 3.91 | 10.76 | 2.0854 | 0.3255 | |||

| AUTOMATIC DATA PROCESSI 0.0 01JUL25 / DBT (000000000) | 3.90 | 2.0782 | 2.0782 | ||||||

| TTWO / Take-Two Interactive Software, Inc. | 0.02 | -6.58 | 3.83 | 9.47 | 2.0400 | 0.2983 | |||

| ETR / Entergy Corporation | 0.05 | -6.58 | 3.80 | -9.16 | 2.0240 | -0.0586 | |||

| AME / AMETEK, Inc. | 0.02 | 2.57 | 3.70 | 7.81 | 1.9716 | 0.2628 | |||

| MTN / Vail Resorts, Inc. | 0.02 | -6.59 | 3.60 | -8.27 | 1.9204 | -0.0362 | |||

| LW / Lamb Weston Holdings, Inc. | 0.07 | -6.58 | 3.40 | -9.12 | 1.8113 | -0.0514 | |||

| NRG / NRG Energy, Inc. | 0.02 | -6.59 | 3.26 | 57.15 | 1.7395 | 0.7050 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.02 | -6.58 | 3.23 | -5.88 | 1.7224 | 0.0120 | |||

| CSL / Carlisle Companies Incorporated | 0.01 | -24.01 | 3.21 | -16.68 | 1.7094 | -0.2076 | |||

| NI / NiSource Inc. | 0.08 | 3.21 | 1.7086 | 1.7086 | |||||

| CLH / Clean Harbors, Inc. | 0.01 | -6.58 | 3.19 | 9.59 | 1.6997 | 0.2500 | |||

| FA / First Advantage Corporation | 0.19 | -11.77 | 3.17 | 4.01 | 1.6876 | 0.1713 | |||

| CPT / Camden Property Trust | 0.03 | 36.26 | 3.15 | 25.54 | 1.6794 | 0.4293 | |||

| ACGL / Arch Capital Group Ltd. | 0.03 | -6.58 | 3.14 | -11.59 | 1.6753 | -0.0951 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 0.04 | -6.58 | 3.08 | -16.18 | 1.6402 | -0.1886 | |||

| APH / Amphenol Corporation | 0.03 | -6.58 | 3.06 | 40.65 | 1.6281 | 0.5463 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.02 | -13.28 | 3.05 | -11.07 | 1.6266 | -0.0830 | |||

| GLPI / Gaming and Leisure Properties, Inc. | 0.06 | -6.58 | 3.01 | -14.33 | 1.6023 | -0.1456 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.01 | -6.59 | 2.94 | -3.63 | 1.5687 | 0.0473 | |||

| DVN / Devon Energy Corporation | 0.09 | -6.58 | 2.91 | -20.55 | 1.5518 | -0.2734 | |||

| TMHC / Taylor Morrison Home Corporation | 0.05 | -18.60 | 2.90 | -16.76 | 1.5438 | -0.1889 | |||

| JHG / Janus Henderson Group plc | 0.07 | -6.58 | 2.85 | 0.39 | 1.5182 | 0.1046 | |||

| BLDR / Builders FirstSource, Inc. | 0.02 | -6.58 | 2.83 | -12.76 | 1.5085 | -0.1073 | |||

| MTB / M&T Bank Corporation | 0.01 | -6.58 | 2.83 | 1.36 | 1.5080 | 0.1179 | |||

| DOV / Dover Corporation | 0.02 | -25.66 | 2.82 | -22.47 | 1.5042 | -0.3089 | |||

| ATO / Atmos Energy Corporation | 0.02 | -6.58 | 2.79 | -6.89 | 1.4845 | -0.0051 | |||

| FOUR / Shift4 Payments, Inc. | 0.03 | 10.57 | 2.64 | 34.09 | 1.4088 | 0.4271 | |||

| ASH / Ashland Inc. | 0.05 | -6.58 | 2.63 | -20.78 | 1.4038 | -0.2522 | |||

| MUSA / Murphy USA Inc. | 0.01 | 9.88 | 2.58 | -4.86 | 1.3765 | 0.0244 | |||

| MLI / Mueller Industries, Inc. | 0.03 | -32.48 | 2.46 | -29.51 | 1.3136 | -0.4283 | |||

| BKR / Baker Hughes Company | 0.06 | -31.03 | 2.46 | -39.83 | 1.3090 | -0.7241 | |||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.01 | 16.47 | 2.42 | 40.64 | 1.2894 | 0.4326 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 9.65 | 2.41 | 40.02 | 1.2830 | 0.4268 | |||

| VNT / Vontier Corporation | 0.07 | -6.58 | 2.40 | 4.94 | 1.2786 | 0.1399 | |||

| DOC / Healthpeak Properties, Inc. | 0.14 | -6.58 | 2.39 | -19.10 | 1.2732 | -0.1977 | |||

| WY / Weyerhaeuser Company | 0.09 | -6.58 | 2.33 | -18.05 | 1.2442 | -0.1745 | |||

| FITB / Fifth Third Bancorp | 0.06 | -6.58 | 2.29 | -1.97 | 1.2198 | 0.0567 | |||

| VLTO / Veralto Corporation | 0.02 | -6.58 | 2.28 | -3.23 | 1.2144 | 0.0416 | |||

| MPLX / MPLX LP - Limited Partnership | 0.04 | -6.58 | 2.26 | -10.08 | 1.2034 | -0.0475 | |||

| LKQ / LKQ Corporation | 0.06 | 14.83 | 2.06 | -0.10 | 1.0989 | 0.0710 | |||

| HUM / Humana Inc. | 0.01 | 26.46 | 2.05 | 16.87 | 1.0933 | 0.2189 | |||

| MIDD / The Middleby Corporation | 0.01 | 7.39 | 1.96 | 1.76 | 1.0467 | 0.0854 | |||

| EXE / Expand Energy Corporation | 0.02 | 1.95 | 1.0377 | 1.0377 | |||||

| BRX / Brixmor Property Group Inc. | 0.07 | 1.89 | 1.0093 | 1.0093 | |||||

| TFX / Teleflex Incorporated | 0.02 | -6.59 | 1.87 | -20.01 | 0.9975 | -0.1676 | |||

| TSCO / Tractor Supply Company | 0.03 | -6.58 | 1.83 | -10.56 | 0.9751 | -0.0435 | |||

| VTR / Ventas, Inc. | 0.03 | -26.09 | 1.82 | -32.15 | 0.9676 | -0.3646 | |||

| TECH / Bio-Techne Corporation | 0.03 | -6.58 | 1.62 | -18.02 | 0.8633 | -0.1209 | |||

| MKSI / MKS Inc. | 0.02 | -6.58 | 1.60 | 15.81 | 0.8512 | 0.1643 | |||

| STE / STERIS plc | 0.01 | 1.60 | 0.8501 | 0.8501 | |||||

| IQV / IQVIA Holdings Inc. | 0.01 | -6.58 | 1.59 | -16.47 | 0.8489 | -0.1011 | |||

| FMC / FMC Corporation | 0.04 | -25.36 | 1.47 | -26.12 | 0.7839 | -0.2080 | |||

| AXTA / Axalta Coating Systems Ltd. | 0.05 | -19.31 | 1.42 | -27.79 | 0.7550 | -0.2219 | |||

| TRNO / Terreno Realty Corporation | 0.02 | -6.58 | 1.30 | -17.19 | 0.6911 | -0.0884 | |||

| ON / ON Semiconductor Corporation | 0.02 | -6.58 | 1.18 | 20.37 | 0.6270 | 0.1400 | |||

| KVUE / Kenvue Inc. | 0.05 | -23.64 | 1.03 | -33.35 | 0.5497 | -0.2210 | |||

| COO / The Cooper Companies, Inc. | 0.01 | 0.93 | 0.4972 | 0.4972 | |||||

| A / Agilent Technologies, Inc. | 0.01 | -37.97 | 0.78 | -37.40 | 0.4130 | -0.2038 | |||

| DIRXX / Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares | 0.04 | 0.04 | 0.0188 | 0.0188 |