Mga Batayang Estadistika

| Nilai Portofolio | $ 373,020,726 |

| Posisi Saat Ini | 80 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

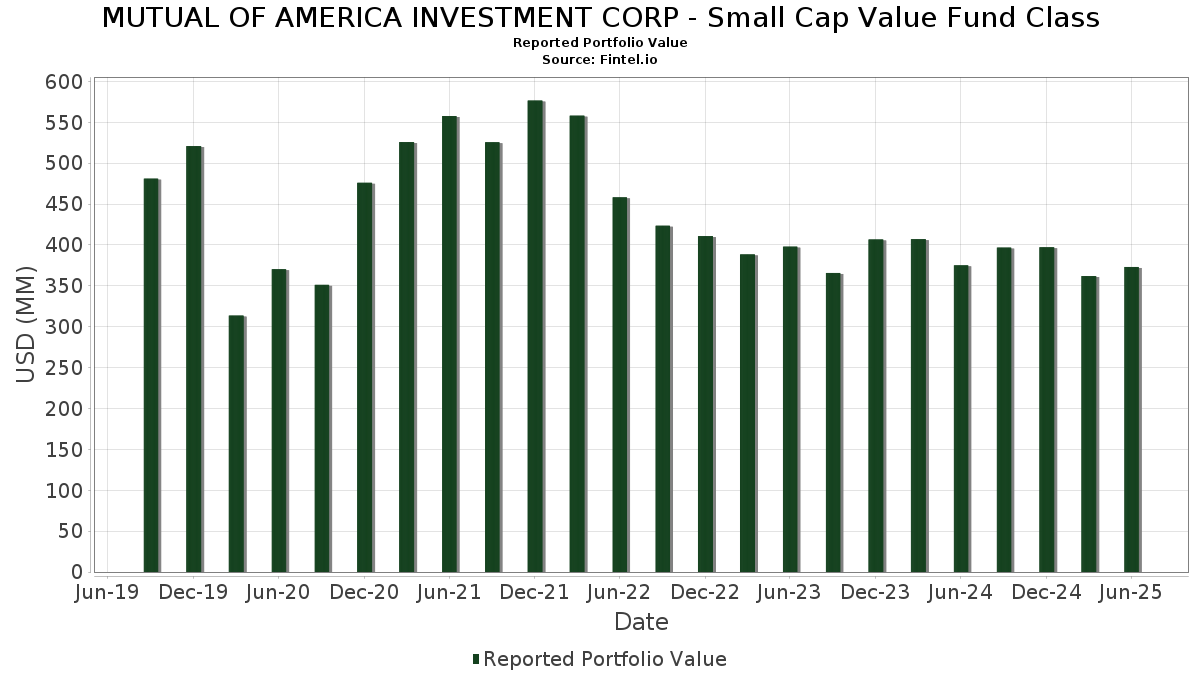

MUTUAL OF AMERICA INVESTMENT CORP - Small Cap Value Fund Class telah mengungkapkan total kepemilikan 80 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 373,020,726 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MUTUAL OF AMERICA INVESTMENT CORP - Small Cap Value Fund Class adalah American Healthcare REIT, Inc. (US:AHR) , Stock Yards Bancorp, Inc. (US:SYBT) , Mueller Industries, Inc. (US:MLI) , Essent Group Ltd. (DE:EG0) , and VSE Corporation (US:VSEC) . Posisi baru MUTUAL OF AMERICA INVESTMENT CORP - Small Cap Value Fund Class meliputi: RLI Corp. (US:RLI) , Core Scientific, Inc. (US:CORZ) , Simpson Manufacturing Co., Inc. (US:SSD) , Installed Building Products, Inc. (US:IBP) , and Curbline Properties Corp. (US:CURB) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.09 | 6.37 | 1.7047 | 1.7047 | |

| 0.24 | 4.10 | 1.0965 | 1.0965 | |

| 0.02 | 3.63 | 0.9718 | 0.9718 | |

| 0.02 | 3.51 | 0.9397 | 0.9397 | |

| 0.15 | 3.32 | 0.8873 | 0.8873 | |

| 0.06 | 3.30 | 0.8821 | 0.8821 | |

| 3.00 | 0.8023 | 0.8023 | ||

| 0.03 | 2.74 | 0.7326 | 0.7326 | |

| 0.09 | 2.72 | 0.7282 | 0.7282 | |

| 0.07 | 2.43 | 0.6493 | 0.6493 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 3.42 | 0.9148 | -0.9331 | |

| 0.10 | 3.65 | 0.9776 | -0.6138 | |

| 0.09 | 4.63 | 1.2392 | -0.2990 | |

| 0.14 | 5.34 | 1.4299 | -0.2688 | |

| 0.22 | 2.52 | 0.6742 | -0.2412 | |

| 0.07 | 5.52 | 1.4768 | -0.2399 | |

| 0.06 | 2.25 | 0.6033 | -0.2324 | |

| 0.07 | 5.60 | 1.4994 | -0.2131 | |

| 0.07 | 6.20 | 1.6580 | -0.1628 | |

| 0.01 | 1.77 | 0.4744 | -0.1383 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AHR / American Healthcare REIT, Inc. | 0.29 | -3.12 | 10.81 | 17.48 | 2.8926 | 0.3523 | |||

| SYBT / Stock Yards Bancorp, Inc. | 0.12 | -1.10 | 9.87 | 13.11 | 2.6422 | 0.2323 | |||

| MLI / Mueller Industries, Inc. | 0.12 | 4.78 | 9.74 | 9.36 | 2.6072 | 0.1477 | |||

| EG0 / Essent Group Ltd. | 0.14 | -3.16 | 8.59 | 1.90 | 2.2998 | -0.0289 | |||

| VSEC / VSE Corporation | 0.06 | 4.78 | 8.30 | 14.38 | 2.2205 | 0.2176 | |||

| STVN / Stevanato Group S.p.A. | 0.34 | 4.78 | 8.24 | 25.35 | 2.2060 | 0.3905 | |||

| TDS / Telephone and Data Systems, Inc. | 0.21 | 39.53 | 7.63 | 28.16 | 2.0429 | 0.3982 | |||

| NPO / Enpro Inc. | 0.04 | -7.10 | 7.47 | 9.98 | 1.9998 | 0.1241 | |||

| WTFC / Wintrust Financial Corporation | 0.06 | 4.78 | 7.22 | 15.50 | 1.9331 | 0.2066 | |||

| HWC / Hancock Whitney Corporation | 0.12 | -1.43 | 7.16 | 7.87 | 1.9154 | 0.0835 | |||

| UMBF / UMB Financial Corporation | 0.07 | -3.90 | 7.06 | -0.04 | 1.8897 | -0.0606 | |||

| GABC / German American Bancorp, Inc. | 0.18 | 4.78 | 6.97 | 7.61 | 1.8663 | 0.0769 | |||

| EFSC / Enterprise Financial Services Corp | 0.12 | -0.75 | 6.89 | 1.77 | 1.8433 | -0.0255 | |||

| FA / First Advantage Corporation | 0.41 | -5.14 | 6.88 | 11.82 | 1.8402 | 0.1425 | |||

| FFIN / First Financial Bankshares, Inc. | 0.19 | 22.35 | 6.71 | 22.57 | 1.7948 | 0.2839 | |||

| UFPI / UFP Industries, Inc. | 0.07 | 4.78 | 6.63 | -2.74 | 1.7741 | -0.1077 | |||

| RLI / RLI Corp. | 0.09 | 6.37 | 1.7047 | 1.7047 | |||||

| TTMI / TTM Technologies, Inc. | 0.15 | -19.07 | 6.32 | 61.08 | 1.6912 | 0.6079 | |||

| SSB / SouthState Corporation | 0.07 | 16.80 | 6.30 | 15.80 | 1.6852 | 0.1839 | |||

| BLFS / BioLife Solutions, Inc. | 0.29 | 21.61 | 6.29 | 14.68 | 1.6837 | 0.1692 | |||

| MTN / Vail Resorts, Inc. | 0.04 | -1.14 | 6.28 | -2.94 | 1.6810 | -0.1056 | |||

| SIGI / Selective Insurance Group, Inc. | 0.07 | -0.75 | 6.20 | -6.05 | 1.6580 | -0.1628 | |||

| JHG / Janus Henderson Group plc | 0.16 | 7.60 | 6.18 | 15.61 | 1.6551 | 0.1781 | |||

| NOG / Northern Oil and Gas, Inc. | 0.21 | 4.78 | 5.93 | -1.74 | 1.5868 | -0.0792 | |||

| PR / Permian Resources Corporation | 0.41 | 4.78 | 5.62 | 3.04 | 1.5046 | -0.0019 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 0.07 | 0.67 | 5.60 | -9.67 | 1.4994 | -0.2131 | |||

| SR / Spire Inc. | 0.08 | 71.16 | 5.57 | 59.64 | 1.4896 | 0.5270 | |||

| TMHC / Taylor Morrison Home Corporation | 0.09 | -0.70 | 5.55 | 1.57 | 1.4853 | -0.0231 | |||

| SFBS / ServisFirst Bancshares, Inc. | 0.07 | -5.42 | 5.52 | -11.24 | 1.4768 | -0.2399 | |||

| HTO / H2O America | 0.11 | 39.24 | 5.51 | 32.33 | 1.4758 | 0.3251 | |||

| KRG / Kite Realty Group Trust | 0.24 | -0.05 | 5.51 | 1.19 | 1.4746 | -0.0287 | |||

| SBRA / Sabra Health Care REIT, Inc. | 0.30 | -2.86 | 5.48 | 2.53 | 1.4668 | -0.0091 | |||

| OVV / Ovintiv Inc. | 0.14 | -2.32 | 5.34 | -13.17 | 1.4299 | -0.2688 | |||

| KWR / Quaker Chemical Corporation | 0.05 | 4.78 | 5.21 | -5.12 | 1.3941 | -0.1217 | |||

| BKH / Black Hills Corporation | 0.09 | 4.89 | 5.08 | -2.98 | 1.3592 | -0.0861 | |||

| ARLO / Arlo Technologies, Inc. | 0.29 | -3.33 | 4.92 | 66.14 | 1.3158 | 0.4986 | |||

| NWE / NorthWestern Energy Group, Inc. | 0.09 | 25.89 | 4.85 | 11.62 | 1.2986 | 0.0981 | |||

| TCBK / TriCo Bancshares | 0.11 | -3.53 | 4.63 | -2.28 | 1.2395 | -0.0690 | |||

| ASH / Ashland Inc. | 0.09 | -2.00 | 4.63 | -16.89 | 1.2392 | -0.2990 | |||

| CUZ / Cousins Properties Incorporated | 0.14 | 4.78 | 4.30 | 6.67 | 1.1512 | 0.0377 | |||

| ACA / Arcosa, Inc. | 0.05 | -16.22 | 4.26 | -5.81 | 1.1411 | -0.1087 | |||

| CORZ / Core Scientific, Inc. | 0.24 | 4.10 | 1.0965 | 1.0965 | |||||

| BANF / BancFirst Corporation | 0.03 | -30.72 | 3.86 | 21.41 | 1.0337 | 0.4848 | |||

| SF / Stifel Financial Corp. | 0.04 | 4.78 | 3.78 | 15.36 | 1.0110 | 0.1069 | |||

| MLR / Miller Industries, Inc. | 0.08 | 4.78 | 3.77 | 9.96 | 1.0080 | 0.0622 | |||

| SUPN / Supernus Pharmaceuticals, Inc. | 0.12 | 4.78 | 3.75 | 0.86 | 1.0045 | -0.0231 | |||

| FOXF / Fox Factory Holding Corp. | 0.14 | 4.78 | 3.67 | 16.49 | 0.9833 | 0.1122 | |||

| PCH / PotlatchDeltic Corporation | 0.10 | -25.47 | 3.65 | -36.63 | 0.9776 | -0.6138 | |||

| SSD / Simpson Manufacturing Co., Inc. | 0.02 | 3.63 | 0.9718 | 0.9718 | |||||

| MIDD / The Middleby Corporation | 0.02 | 4.78 | 3.52 | -0.73 | 0.9433 | -0.0370 | |||

| IBP / Installed Building Products, Inc. | 0.02 | 3.51 | 0.9397 | 0.9397 | |||||

| CORT / Corcept Therapeutics Incorporated | 0.05 | -20.52 | 3.42 | -48.92 | 0.9148 | -0.9331 | |||

| DGII / Digi International Inc. | 0.10 | -5.15 | 3.32 | 18.80 | 0.8898 | 0.1171 | |||

| CURB / Curbline Properties Corp. | 0.15 | 3.32 | 0.8873 | 0.8873 | |||||

| XHR / Xenia Hotels & Resorts, Inc. | 0.26 | 4.78 | 3.31 | 12.01 | 0.8863 | 0.0699 | |||

| MRCY / Mercury Systems, Inc. | 0.06 | 3.30 | 0.8821 | 0.8821 | |||||

| TRNO / Terreno Realty Corporation | 0.06 | 4.78 | 3.26 | -7.07 | 0.8732 | -0.0962 | |||

| NOMD / Nomad Foods Limited | 0.19 | 4.78 | 3.17 | -9.40 | 0.8488 | -0.1178 | |||

| VCEL / Vericel Corporation | 0.07 | 4.78 | 3.07 | -0.10 | 0.8224 | -0.0267 | |||

| United States Treasury Bill / DBT (US912797PZ47) | 3.00 | 0.8023 | 0.8023 | ||||||

| GDEN / Golden Entertainment, Inc. | 0.10 | 0.00 | 2.95 | 11.52 | 0.7904 | 0.0592 | |||

| CWGL / Crimson Wine Group, Ltd. | 0.51 | 0.00 | 2.79 | -4.52 | 0.7465 | -0.0601 | |||

| IOSP / Innospec Inc. | 0.03 | 2.74 | 0.7326 | 0.7326 | |||||

| EPRT / Essential Properties Realty Trust, Inc. | 0.09 | 2.72 | 0.7282 | 0.7282 | |||||

| LBRT / Liberty Energy Inc. | 0.22 | 4.78 | 2.52 | -24.01 | 0.6742 | -0.2412 | |||

| VNT / Vontier Corporation | 0.07 | 2.43 | 0.6493 | 0.6493 | |||||

| RNA / Avidity Biosciences, Inc. | 0.08 | 4.78 | 2.36 | 0.81 | 0.6322 | -0.0148 | |||

| NE / Noble Corporation plc | 0.09 | 4.78 | 2.36 | 17.35 | 0.6319 | 0.0765 | |||

| FWRG / First Watch Restaurant Group, Inc. | 0.15 | -5.67 | 2.34 | -9.10 | 0.6257 | -0.0847 | |||

| OMCL / Omnicell, Inc. | 0.08 | 4.78 | 2.28 | -11.89 | 0.6109 | -0.1044 | |||

| PJT / PJT Partners Inc. | 0.01 | 2.28 | 0.6103 | 0.6103 | |||||

| TARS / Tarsus Pharmaceuticals, Inc. | 0.06 | -5.56 | 2.25 | -25.51 | 0.6033 | -0.2324 | |||

| CTO / CTO Realty Growth, Inc. | 0.13 | 4.78 | 2.21 | -6.37 | 0.5903 | -0.0600 | |||

| MTRN / Materion Corporation | 0.03 | 4.78 | 2.15 | 1.94 | 0.5757 | -0.0071 | |||

| ICHR / Ichor Holdings, Ltd. | 0.10 | 4.78 | 1.98 | -8.98 | 0.5289 | -0.0706 | |||

| KRYS / Krystal Biotech, Inc. | 0.01 | 4.78 | 1.77 | -20.14 | 0.4744 | -0.1383 | |||

| SLNO / Soleno Therapeutics, Inc. | 0.02 | 4.78 | 1.64 | 22.87 | 0.4401 | 0.0705 | |||

| ANNX / Annexon, Inc. | 0.49 | 4.78 | 1.18 | 30.28 | 0.3156 | 0.0657 | |||

| XENE / Xenon Pharmaceuticals Inc. | 0.04 | 1.18 | 0.3148 | 0.3148 | |||||

| DIRXX / Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares | 0.85 | 0.85 | 0.2276 | 0.2276 |