Mga Batayang Estadistika

| Nilai Portofolio | $ 874,328,957 |

| Posisi Saat Ini | 41 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

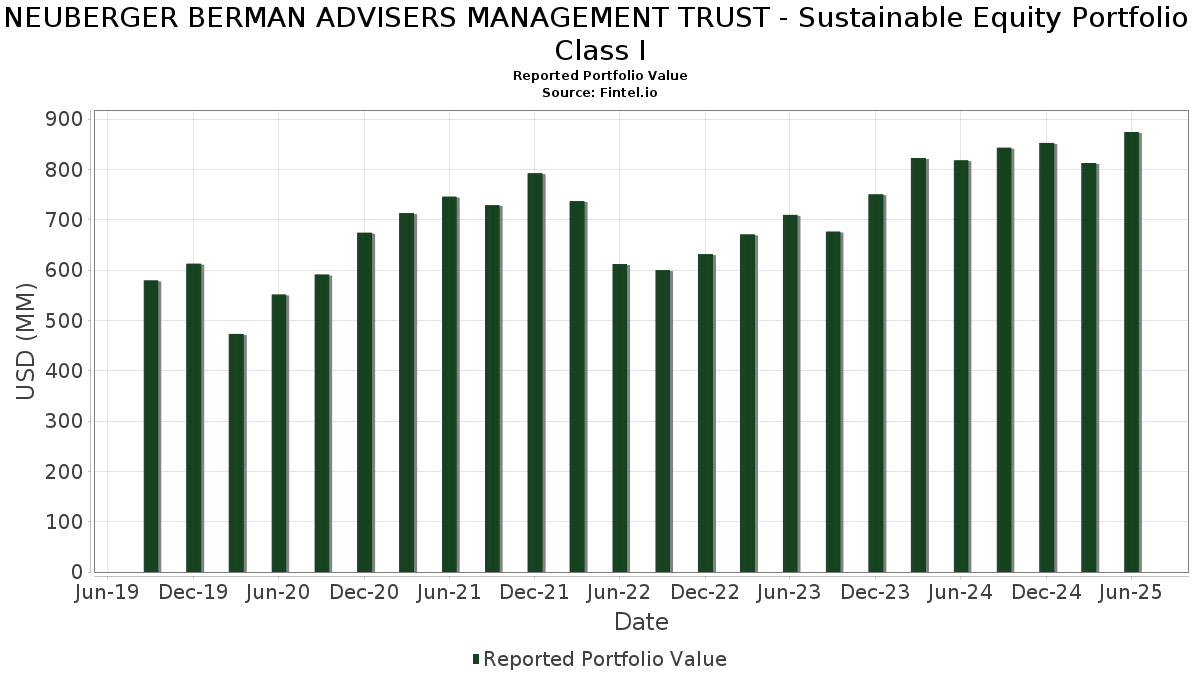

NEUBERGER BERMAN ADVISERS MANAGEMENT TRUST - Sustainable Equity Portfolio Class I telah mengungkapkan total kepemilikan 41 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 874,328,957 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama NEUBERGER BERMAN ADVISERS MANAGEMENT TRUST - Sustainable Equity Portfolio Class I adalah Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , Alphabet Inc. (US:GOOGL) , Interactive Brokers Group, Inc. (US:IBKR) , and Berkshire Hathaway Inc. (US:BRK.B) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.17 | 86.10 | 9.8473 | 1.8653 | |

| 0.97 | 53.67 | 6.1384 | 1.2127 | |

| 0.79 | 33.18 | 3.7945 | 0.7447 | |

| 0.00 | 6.34 | 0.7253 | 0.7253 | |

| 0.39 | 85.26 | 9.7509 | 0.6685 | |

| 0.02 | 4.14 | 0.4733 | 0.4733 | |

| 0.15 | 26.92 | 3.0791 | 0.4575 | |

| 0.02 | 3.86 | 0.4410 | 0.4410 | |

| 0.36 | 63.74 | 7.2898 | 0.4194 | |

| 0.18 | 18.26 | 2.0889 | 0.3898 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.13 | 21.73 | 2.4857 | -0.9487 | |

| 0.09 | 43.35 | 4.9580 | -0.8803 | |

| 0.10 | 26.73 | 3.0568 | -0.6880 | |

| 0.11 | 21.93 | 2.5077 | -0.4084 | |

| 0.09 | 28.32 | 3.2388 | -0.4028 | |

| 0.07 | 40.18 | 4.5953 | -0.3285 | |

| 0.19 | 33.37 | 3.8167 | -0.2845 | |

| 0.42 | 10.59 | 1.2108 | -0.2700 | |

| 0.03 | 5.30 | 0.6059 | -0.2595 | |

| 0.00 | 10.93 | 1.2503 | -0.2209 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.17 | 0.00 | 86.10 | 32.51 | 9.8473 | 1.8653 | |||

| AMZN / Amazon.com, Inc. | 0.39 | 0.00 | 85.26 | 15.31 | 9.7509 | 0.6685 | |||

| GOOGL / Alphabet Inc. | 0.36 | 0.00 | 63.74 | 13.96 | 7.2898 | 0.4194 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.97 | 300.00 | 53.67 | 33.85 | 6.1384 | 1.2127 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.09 | 0.00 | 43.35 | -8.79 | 4.9580 | -0.8803 | |||

| MA / Mastercard Incorporated | 0.07 | -2.22 | 40.18 | 0.24 | 4.5953 | -0.3285 | |||

| GDDY / GoDaddy Inc. | 0.19 | 0.00 | 33.37 | -0.04 | 3.8167 | -0.2845 | |||

| KD / Kyndryl Holdings, Inc. | 0.79 | 0.00 | 33.18 | 33.63 | 3.7945 | 0.7447 | |||

| CI / The Cigna Group | 0.09 | -4.93 | 28.32 | -4.48 | 3.2388 | -0.4028 | |||

| COR / Cencora, Inc. | 0.09 | -6.37 | 27.98 | 0.96 | 3.1998 | -0.2045 | |||

| AMAT / Applied Materials, Inc. | 0.15 | 0.00 | 26.92 | 26.16 | 3.0791 | 0.4575 | |||

| PGR / The Progressive Corporation | 0.10 | -7.02 | 26.73 | -12.33 | 3.0568 | -0.6880 | |||

| CPG / Compass Group PLC | 0.67 | 0.00 | 22.74 | 2.38 | 2.6006 | -0.1277 | |||

| AAPL / Apple Inc. | 0.11 | 0.00 | 21.93 | -7.64 | 2.5077 | -0.4084 | |||

| FI / Fiserv, Inc. | 0.13 | -0.43 | 21.73 | -22.26 | 2.4857 | -0.9487 | |||

| JPM / JPMorgan Chase & Co. | 0.07 | -4.31 | 19.50 | 13.09 | 2.2306 | 0.1123 | |||

| BAC / Bank of America Corporation | 0.41 | -4.17 | 19.34 | 8.67 | 2.2113 | 0.0256 | |||

| TXN / Texas Instruments Incorporated | 0.09 | 0.00 | 19.03 | 15.54 | 2.1769 | 0.1532 | |||

| ANET / Arista Networks Inc | 0.18 | 0.00 | 18.26 | 32.04 | 2.0889 | 0.3898 | |||

| URI / United Rentals, Inc. | 0.02 | 0.00 | 16.83 | 20.21 | 1.9250 | 0.2051 | |||

| GWW / W.W. Grainger, Inc. | 0.02 | -8.27 | 16.42 | -3.41 | 1.8783 | -0.2102 | |||

| INTU / Intuit Inc. | 0.02 | 0.00 | 15.88 | 28.28 | 1.8157 | 0.2955 | |||

| CL / Colgate-Palmolive Company | 0.15 | 0.00 | 13.53 | -2.98 | 1.5472 | -0.1658 | |||

| SHW / The Sherwin-Williams Company | 0.04 | 0.00 | 12.29 | -1.67 | 1.4053 | -0.1297 | |||

| ROG / Roche Holding AG | 0.04 | 0.00 | 11.54 | -1.05 | 1.3204 | -0.1129 | |||

| COST / Costco Wholesale Corporation | 0.01 | -11.08 | 11.25 | -6.93 | 1.2872 | -0.1983 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 10.93 | -8.72 | 1.2503 | -0.2209 | |||

| CTRA / Coterra Energy Inc. | 0.42 | 0.00 | 10.59 | -12.18 | 1.2108 | -0.2700 | |||

| CSX / CSX Corporation | 0.32 | 0.00 | 10.31 | 10.87 | 1.1794 | 0.0369 | |||

| OTIS / Otis Worldwide Corporation | 0.10 | 0.00 | 10.14 | -4.05 | 1.1592 | -0.1384 | |||

| TJX / The TJX Companies, Inc. | 0.07 | 0.00 | 8.91 | 1.39 | 1.0188 | -0.0605 | |||

| SPACE EXPLORATION TECH SER E P / EC (000000000) | 0.00 | 6.34 | 0.7253 | 0.7253 | |||||

| HD / The Home Depot, Inc. | 0.02 | 0.00 | 6.01 | 0.05 | 0.6875 | -0.0506 | |||

| DHR / Danaher Corporation | 0.03 | 0.00 | 5.39 | -3.63 | 0.6159 | -0.0706 | |||

| BDX / Becton, Dickinson and Company | 0.03 | 0.00 | 5.30 | -24.80 | 0.6059 | -0.2595 | |||

| SPACE EXPLORATION TECH CLASS C / EC (000000000) | 0.02 | 4.14 | 0.4733 | 0.4733 | |||||

| SPACE EXPLORATION TECH CLASS A / EC (000000000) | 0.02 | 3.86 | 0.4410 | 0.4410 | |||||

| UNH / UnitedHealth Group Incorporated | 0.01 | 0.00 | 2.39 | -40.44 | 0.2737 | -0.2199 | |||

| TRIXX / State Street Institutional Investment Trust - State Street Institutional Treasury Fund Institutional Class | 0.74 | 0.74 | 0.0850 | 0.0850 | |||||

| SELF HELP FEDERAL CREDIT UNION / STIV (000000000) | 0.10 | 0.0114 | 0.0114 | ||||||

| SELF HELP CREDIT UNION / STIV (000000000) | 0.10 | 0.0114 | 0.0114 |