Mga Batayang Estadistika

| Nilai Portofolio | $ 276,025,256 |

| Posisi Saat Ini | 102 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

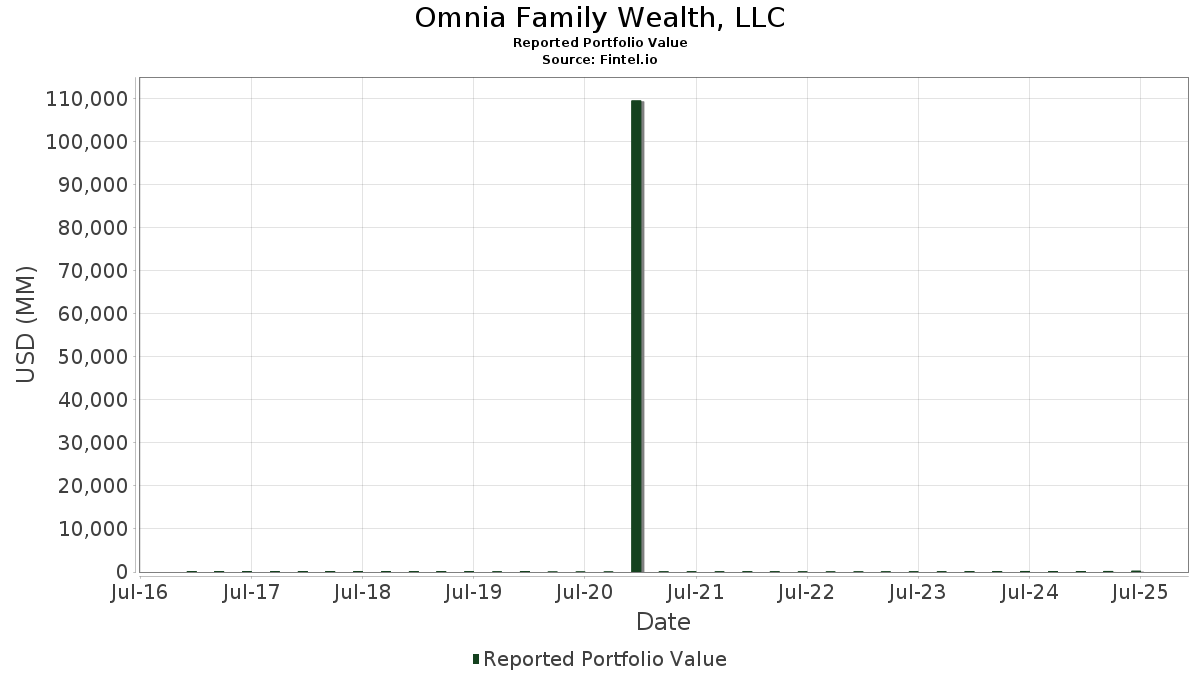

Omnia Family Wealth, LLC telah mengungkapkan total kepemilikan 102 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 276,025,256 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Omnia Family Wealth, LLC adalah Vanguard Index Funds - Vanguard Total Stock Market ETF (US:VTI) , SPDR Gold Trust (US:GLD) , iShares Trust - iShares 0-3 Month Treasury Bond ETF (US:SGOV) , Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF (US:VEA) , and iShares Trust - iShares Core MSCI EAFE ETF (US:IEFA) . Posisi baru Omnia Family Wealth, LLC meliputi: Palantir Technologies Inc. (US:PLTR) , Brookfield Corporation (US:BN) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 9.95 | 3.6043 | 1.4788 | |

| 0.04 | 5.73 | 2.0748 | 0.6136 | |

| 0.02 | 7.67 | 2.7791 | 0.5251 | |

| 0.23 | 13.23 | 4.7921 | 0.3461 | |

| 0.00 | 3.32 | 1.2037 | 0.2058 | |

| 0.01 | 1.40 | 0.5090 | 0.1961 | |

| 0.00 | 0.40 | 0.1455 | 0.1455 | |

| 0.00 | 0.34 | 0.1220 | 0.1220 | |

| 0.02 | 4.09 | 1.4832 | 0.1209 | |

| 0.02 | 2.68 | 0.9701 | 0.1011 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 8.37 | 3.0334 | -0.8144 | |

| 0.06 | 18.54 | 6.7167 | -0.6557 | |

| 0.33 | 99.35 | 35.9941 | -0.5323 | |

| 0.13 | 8.07 | 2.9236 | -0.4486 | |

| 0.01 | 5.47 | 1.9826 | -0.3500 | |

| 0.17 | 16.94 | 6.1388 | -0.2901 | |

| 0.15 | 12.68 | 4.5940 | -0.2176 | |

| 0.01 | 5.60 | 2.0271 | -0.1762 | |

| 0.00 | 1.32 | 0.4792 | -0.1407 | |

| 0.00 | 1.46 | 0.5281 | -0.1399 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-28 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.33 | 2.58 | 99.35 | 13.77 | 35.9941 | -0.5323 | |||

| GLD / SPDR Gold Trust | 0.06 | -0.57 | 18.54 | 5.19 | 6.7167 | -0.6557 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.17 | 10.22 | 16.94 | 10.25 | 6.1388 | -0.2901 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.23 | 10.95 | 13.23 | 24.44 | 4.7921 | 0.3461 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.15 | -0.10 | 12.68 | 10.23 | 4.5940 | -0.2176 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.02 | 76.59 | 9.95 | 95.79 | 3.6043 | 1.4788 | |||

| AAPL / Apple Inc. | 0.04 | -1.46 | 8.37 | -8.98 | 3.0334 | -0.8144 | |||

| IAU / iShares Gold Trust | 0.13 | -5.36 | 8.07 | 0.10 | 2.9236 | -0.4486 | |||

| MSFT / Microsoft Corporation | 0.02 | 7.43 | 7.67 | 42.37 | 2.7791 | 0.5251 | |||

| ARES / Ares Management Corporation | 0.04 | -0.17 | 6.06 | 17.93 | 2.1969 | 0.0462 | |||

| NVDA / NVIDIA Corporation | 0.04 | 12.46 | 5.73 | 63.96 | 2.0748 | 0.6136 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.01 | -9.66 | 5.60 | 6.23 | 2.0271 | -0.1762 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -11.14 | 5.47 | -1.87 | 1.9826 | -0.3500 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 9.01 | 4.09 | 25.74 | 1.4832 | 0.1209 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.01 | -1.72 | 3.66 | 6.74 | 1.3259 | -0.1082 | |||

| META / Meta Platforms, Inc. | 0.00 | 8.75 | 3.32 | 39.29 | 1.2037 | 0.2058 | |||

| GOOGL / Alphabet Inc. | 0.02 | 13.10 | 2.68 | 28.89 | 0.9701 | 0.1011 | |||

| MA / Mastercard Incorporated | 0.00 | 5.45 | 2.13 | 8.13 | 0.7716 | -0.0524 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 10.24 | 2.12 | 30.34 | 0.7675 | 0.0874 | |||

| LLY / Eli Lilly and Company | 0.00 | 6.37 | 1.88 | 0.43 | 0.6793 | -0.1019 | |||

| DIS / The Walt Disney Company | 0.01 | 2.57 | 1.85 | 29.38 | 0.6686 | 0.0720 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.46 | -8.71 | 0.5281 | -0.1399 | |||

| GOOG / Alphabet Inc. | 0.01 | 0.00 | 1.45 | 13.57 | 0.5248 | -0.0088 | |||

| AVGO / Broadcom Inc. | 0.01 | 14.08 | 1.40 | 87.70 | 0.5090 | 0.1961 | |||

| V / Visa Inc. | 0.00 | 13.73 | 1.33 | 15.30 | 0.4804 | -0.0010 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -2.16 | 1.32 | -10.80 | 0.4792 | -0.1407 | |||

| TSLA / Tesla, Inc. | 0.00 | 20.32 | 1.24 | 47.56 | 0.4497 | 0.0977 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 14.01 | 1.03 | 57.47 | 0.3744 | 0.0999 | |||

| BAC / Bank of America Corporation | 0.02 | 4.90 | 1.01 | 18.96 | 0.3660 | 0.0108 | |||

| PG / The Procter & Gamble Company | 0.01 | 13.96 | 0.88 | 6.56 | 0.3180 | -0.0266 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 3.45 | 0.85 | 7.34 | 0.3072 | -0.0235 | |||

| ABBV / AbbVie Inc. | 0.00 | -6.62 | 0.83 | -17.25 | 0.3007 | -0.1190 | |||

| PM / Philip Morris International Inc. | 0.00 | 6.96 | 0.79 | 22.78 | 0.2852 | 0.0167 | |||

| ED / Consolidated Edison, Inc. | 0.01 | -0.29 | 0.76 | -9.49 | 0.2766 | -0.0763 | |||

| LEN / Lennar Corporation | 0.01 | -1.67 | 0.70 | -5.30 | 0.2529 | -0.0552 | |||

| NFLX / Netflix, Inc. | 0.00 | 15.11 | 0.69 | 65.39 | 0.2513 | 0.0758 | |||

| WMT / Walmart Inc. | 0.01 | 12.79 | 0.65 | 25.19 | 0.2361 | 0.0186 | |||

| HD / The Home Depot, Inc. | 0.00 | 43.85 | 0.65 | 44.10 | 0.2344 | 0.0464 | |||

| MCD / McDonald's Corporation | 0.00 | 1.03 | 0.63 | -5.56 | 0.2281 | -0.0506 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.30 | 0.57 | -7.67 | 0.2053 | -0.0513 | |||

| DLR / Digital Realty Trust, Inc. | 0.00 | 5.08 | 0.57 | 27.83 | 0.2049 | 0.0199 | |||

| COST / Costco Wholesale Corporation | 0.00 | 17.49 | 0.54 | 23.11 | 0.1951 | 0.0119 | |||

| MS / Morgan Stanley | 0.00 | 4.25 | 0.53 | 26.07 | 0.1927 | 0.0159 | |||

| CL / Colgate-Palmolive Company | 0.01 | -4.28 | 0.51 | -7.17 | 0.1833 | -0.0446 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | -3.56 | 0.49 | -7.36 | 0.1781 | -0.0439 | |||

| RTX / RTX Corporation | 0.00 | 5.37 | 0.44 | 16.09 | 0.1598 | 0.0010 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 15.32 | 0.42 | 29.81 | 0.1515 | 0.0166 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.40 | 0.1455 | 0.1455 | |||||

| PCAR / PACCAR Inc | 0.00 | -2.14 | 0.40 | -4.55 | 0.1448 | -0.0302 | |||

| ORCL / Oracle Corporation | 0.00 | 16.37 | 0.39 | 82.24 | 0.1413 | 0.0517 | |||

| KO / The Coca-Cola Company | 0.01 | 29.51 | 0.38 | 28.00 | 0.1392 | 0.0137 | |||

| ETN / Eaton Corporation plc | 0.00 | -2.11 | 0.38 | 28.38 | 0.1379 | 0.0140 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -15.43 | 0.37 | -12.35 | 0.1338 | -0.0424 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | -3.09 | 0.36 | -3.72 | 0.1314 | -0.0261 | |||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.00 | 10.86 | 0.35 | 43.90 | 0.1283 | 0.0252 | |||

| TRI / Thomson Reuters Corporation | 0.00 | 0.00 | 0.35 | 16.56 | 0.1275 | 0.0009 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.01 | -15.52 | 0.35 | -7.69 | 0.1263 | -0.0317 | |||

| WFC / Wells Fargo & Company | 0.00 | 9.02 | 0.35 | 21.68 | 0.1262 | 0.0065 | |||

| HON / Honeywell International Inc. | 0.00 | 15.44 | 0.35 | 27.21 | 0.1255 | 0.0114 | |||

| T / AT&T Inc. | 0.01 | 12.06 | 0.34 | 14.63 | 0.1224 | -0.0008 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.34 | 0.1220 | 0.1220 | |||||

| MRK / Merck & Co., Inc. | 0.00 | 5.73 | 0.34 | -6.67 | 0.1219 | -0.0288 | |||

| AXP / American Express Company | 0.00 | 16.24 | 0.34 | 37.86 | 0.1215 | 0.0196 | |||

| CAT / Caterpillar Inc. | 0.00 | 10.97 | 0.33 | 30.56 | 0.1195 | 0.0139 | |||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.02 | 3.93 | 0.31 | 11.03 | 0.1132 | -0.0044 | |||

| SBCF / Seacoast Banking Corporation of Florida | 0.01 | 0.00 | 0.31 | 7.64 | 0.1123 | -0.0085 | |||

| CMCSA / Comcast Corporation | 0.01 | -33.40 | 0.29 | -35.62 | 0.1056 | -0.0837 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.01 | 0.00 | 0.29 | -9.37 | 0.1054 | -0.0286 | |||

| UBER / Uber Technologies, Inc. | 0.00 | 1.78 | 0.28 | 30.56 | 0.1022 | 0.0117 | |||

| DHI / D.R. Horton, Inc. | 0.00 | -1.00 | 0.28 | 0.36 | 0.1019 | -0.0153 | |||

| BX / Blackstone Inc. | 0.00 | -10.85 | 0.28 | -4.81 | 0.1006 | -0.0212 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 2.12 | 0.28 | 22.77 | 0.0998 | 0.0057 | |||

| NEE / NextEra Energy, Inc. | 0.00 | 7.71 | 0.27 | 5.45 | 0.0984 | -0.0093 | |||

| CB / Chubb Limited | 0.00 | 16.88 | 0.27 | 12.18 | 0.0970 | -0.0028 | |||

| LIN / Linde plc | 0.00 | 0.26 | 0.0950 | 0.0950 | |||||

| GE / General Electric Company | 0.00 | 0.25 | 0.0919 | 0.0919 | |||||

| ACN / Accenture plc | 0.00 | 5.22 | 0.25 | 0.80 | 0.0917 | -0.0134 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.00 | 0.00 | 0.25 | 9.61 | 0.0911 | -0.0051 | |||

| PFE / Pfizer Inc. | 0.01 | 22.21 | 0.25 | 17.22 | 0.0889 | 0.0011 | |||

| COF / Capital One Financial Corporation | 0.00 | 0.24 | 0.0886 | 0.0886 | |||||

| SBUX / Starbucks Corporation | 0.00 | -6.98 | 0.24 | -12.90 | 0.0880 | -0.0289 | |||

| TOL / Toll Brothers, Inc. | 0.00 | 0.00 | 0.24 | 8.07 | 0.0874 | -0.0060 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.24 | 0.0855 | 0.0855 | |||||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.00 | 3.25 | 0.23 | 3.59 | 0.0839 | -0.0098 | |||

| XOM / Exxon Mobil Corporation | 0.00 | -35.18 | 0.22 | -41.32 | 0.0809 | -0.0781 | |||

| CVX / Chevron Corporation | 0.00 | -21.33 | 0.22 | -32.83 | 0.0804 | -0.0574 | |||

| ABT / Abbott Laboratories | 0.00 | 0.22 | 0.0802 | 0.0802 | |||||

| INTC / Intel Corporation | 0.01 | 0.22 | 0.0796 | 0.0796 | |||||

| INTU / Intuit Inc. | 0.00 | 0.22 | 0.0793 | 0.0793 | |||||

| PHM / PulteGroup, Inc. | 0.00 | -11.49 | 0.22 | -9.17 | 0.0791 | -0.0214 | |||

| ADBE / Adobe Inc. | 0.00 | 0.22 | 0.0779 | 0.0779 | |||||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -2.23 | 0.21 | 7.00 | 0.0778 | -0.0059 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.21 | 0.0777 | 0.0777 | |||||

| FDX / FedEx Corporation | 0.00 | 11.84 | 0.21 | 4.50 | 0.0759 | -0.0081 | |||

| BN / Brookfield Corporation | 0.00 | 0.21 | 0.0755 | 0.0755 | |||||

| RCL / Royal Caribbean Cruises Ltd. | 0.00 | 0.21 | 0.0749 | 0.0749 | |||||

| CRM / Salesforce, Inc. | 0.00 | -34.59 | 0.20 | -33.55 | 0.0741 | -0.0544 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.20 | 0.0728 | 0.0728 | |||||

| NOW / ServiceNow, Inc. | 0.00 | 0.20 | 0.0726 | 0.0726 | |||||

| HCAT / Health Catalyst, Inc. | 0.03 | 0.00 | 0.13 | -16.67 | 0.0473 | -0.0183 | |||

| AKTX / Akari Therapeutics, Plc - Depositary Receipt (Common Stock) | 0.06 | -28.46 | 0.07 | -32.41 | 0.0266 | -0.0189 | |||

| NXPL / NextPlat Corp | 0.09 | 0.00 | 0.07 | -12.16 | 0.0236 | -0.0078 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMGN / Amgen Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SLB / Schlumberger Limited | 0.00 | -100.00 | 0.00 | 0.0000 |