Mga Batayang Estadistika

| Nilai Portofolio | $ 799,375,784 |

| Posisi Saat Ini | 56 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

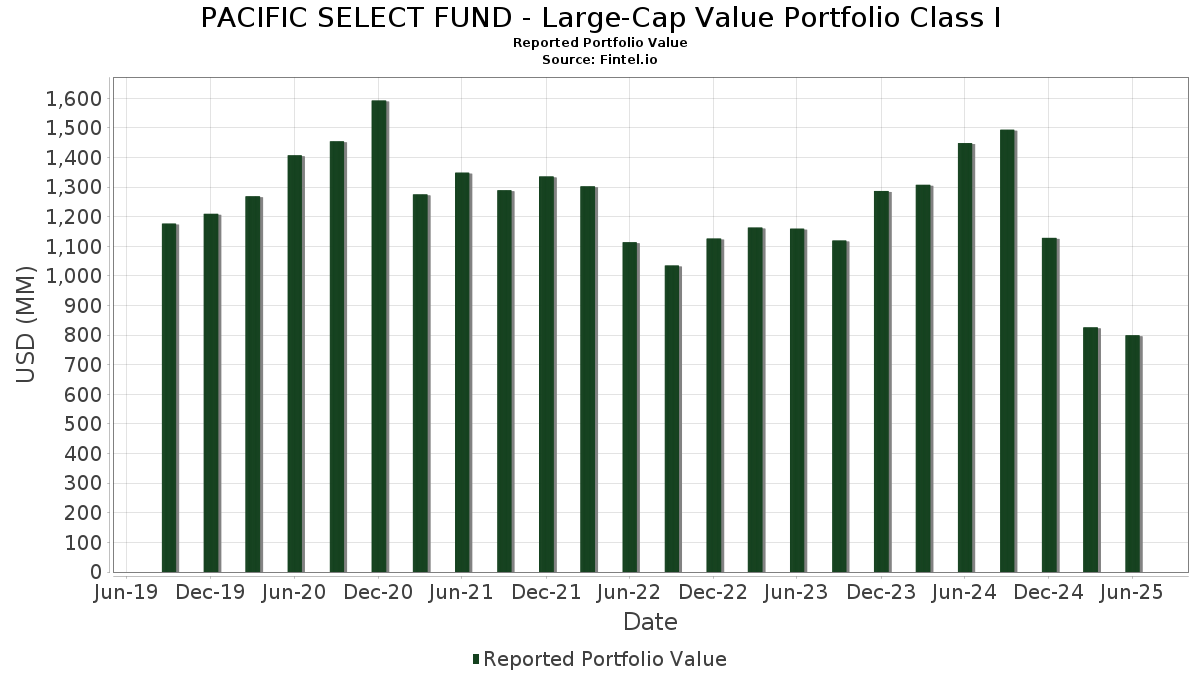

PACIFIC SELECT FUND - Large-Cap Value Portfolio Class I telah mengungkapkan total kepemilikan 56 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 799,375,784 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PACIFIC SELECT FUND - Large-Cap Value Portfolio Class I adalah JPMorgan Chase & Co. (US:JPM) , Sempra (US:SRE) , Air Products and Chemicals, Inc. (US:APD) , Microchip Technology Incorporated (US:MCHP) , and McKesson Corporation (US:MCK) . Posisi baru PACIFIC SELECT FUND - Large-Cap Value Portfolio Class I meliputi: The Boeing Company (US:BA) , AstraZeneca PLC - Depositary Receipt (Common Stock) (US:AZN) , The Procter & Gamble Company (US:PG) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 7.73 | 0.9601 | 0.9601 | |

| 0.34 | 24.03 | 2.9846 | 0.9401 | |

| 0.11 | 7.55 | 0.9381 | 0.9381 | |

| 0.17 | 47.95 | 5.9544 | 0.9375 | |

| 0.07 | 7.41 | 0.9197 | 0.9197 | |

| 0.07 | 18.65 | 2.3161 | 0.9152 | |

| 0.05 | 7.34 | 0.9121 | 0.9121 | |

| 0.04 | 19.49 | 2.4208 | 0.6891 | |

| 0.23 | 20.95 | 2.6019 | 0.3790 | |

| 0.02 | 12.69 | 1.5757 | 0.3504 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.50 | 15.54 | 1.9296 | -1.0820 | |

| 0.06 | 7.80 | 0.9684 | -1.0351 | |

| 0.05 | 16.43 | 2.0398 | -1.0140 | |

| 0.02 | 8.12 | 1.0079 | -0.7290 | |

| 0.16 | 8.37 | 1.0397 | -0.6904 | |

| 0.00 | 0.00 | -0.6755 | ||

| 0.09 | 15.59 | 1.9357 | -0.6275 | |

| 0.03 | 13.03 | 1.6183 | -0.3593 | |

| 0.17 | 15.33 | 1.9036 | -0.3147 | |

| 0.11 | 15.50 | 1.9244 | -0.3144 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-18 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | 0.17 | -4.30 | 47.95 | 13.10 | 5.9544 | 0.9375 | |||

| SRE / Sempra | 0.44 | -4.30 | 33.05 | 1.61 | 4.1044 | 0.2552 | |||

| APD / Air Products and Chemicals, Inc. | 0.09 | -4.30 | 25.81 | -8.47 | 3.2053 | -0.1320 | |||

| MCHP / Microchip Technology Incorporated | 0.34 | -4.30 | 24.03 | 39.11 | 2.9846 | 0.9401 | |||

| MCK / McKesson Corporation | 0.03 | -4.30 | 22.85 | 4.21 | 2.8376 | 0.2426 | |||

| SCHW / The Charles Schwab Corporation | 0.23 | -4.30 | 20.95 | 11.55 | 2.6019 | 0.3790 | |||

| DE / Deere & Company | 0.04 | 22.96 | 19.49 | 33.21 | 2.4208 | 0.6891 | |||

| BAC / Bank of America Corporation | 0.41 | -4.30 | 19.49 | 8.52 | 2.4197 | 0.2949 | |||

| TRV / The Travelers Companies, Inc. | 0.07 | -4.30 | 19.34 | -3.18 | 2.4019 | 0.0377 | |||

| INTC / Intel Corporation | 0.84 | -4.30 | 18.72 | -5.61 | 2.3241 | -0.0222 | |||

| AVGO / Broadcom Inc. | 0.07 | -4.30 | 18.65 | 57.57 | 2.3161 | 0.9152 | |||

| V / Visa Inc. | 0.05 | -4.30 | 18.07 | -3.05 | 2.2438 | 0.0384 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.04 | -4.30 | 17.92 | -12.71 | 2.2251 | -0.2041 | |||

| XPO / XPO, Inc. | 0.13 | -4.30 | 16.69 | 12.34 | 2.0727 | 0.3145 | |||

| MLM / Martin Marietta Materials, Inc. | 0.03 | -4.30 | 16.45 | 9.87 | 2.0428 | 0.2711 | |||

| UNH / UnitedHealth Group Incorporated | 0.05 | 6.86 | 16.43 | -36.35 | 2.0398 | -1.0140 | |||

| CVS / CVS Health Corporation | 0.23 | -4.30 | 16.08 | -2.56 | 1.9963 | 0.0439 | |||

| BDX / Becton, Dickinson and Company | 0.09 | -4.30 | 15.59 | -28.04 | 1.9357 | -0.6275 | |||

| PH / Parker-Hannifin Corporation | 0.02 | -4.30 | 15.54 | 9.97 | 1.9298 | 0.2575 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.50 | -32.78 | 15.54 | -38.94 | 1.9296 | -1.0820 | |||

| CVX / Chevron Corporation | 0.11 | -4.30 | 15.50 | -18.09 | 1.9244 | -0.3144 | |||

| AXP / American Express Company | 0.05 | -25.57 | 15.39 | -11.75 | 1.9106 | -0.1526 | |||

| COP / ConocoPhillips | 0.17 | -4.30 | 15.33 | -18.22 | 1.9036 | -0.3147 | |||

| JNJ / Johnson & Johnson | 0.10 | -4.30 | 15.01 | -11.85 | 1.8635 | -0.1512 | |||

| SHW / The Sherwin-Williams Company | 0.04 | -4.30 | 14.86 | -5.90 | 1.8459 | -0.0234 | |||

| MSI / Motorola Solutions, Inc. | 0.04 | -4.30 | 14.86 | -8.09 | 1.8451 | -0.0680 | |||

| WEC / WEC Energy Group, Inc. | 0.14 | -4.30 | 14.60 | -8.50 | 1.8136 | -0.0752 | |||

| RTX / RTX Corporation | 0.10 | -5.64 | 14.46 | 4.03 | 1.7952 | 0.1507 | |||

| PGR / The Progressive Corporation | 0.05 | -4.30 | 13.91 | -9.76 | 1.7273 | -0.0968 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.06 | -4.30 | 13.64 | -14.26 | 1.6940 | -0.1887 | |||

| HD / The Home Depot, Inc. | 0.04 | -4.30 | 13.60 | -4.26 | 1.6885 | 0.0078 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 1.30 | -4.30 | 13.51 | -3.56 | 1.6775 | 0.0200 | |||

| COF / Capital One Financial Corporation | 0.06 | -28.02 | 13.04 | -14.58 | 1.6193 | -0.1873 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.03 | -4.30 | 13.03 | -22.02 | 1.6183 | -0.3593 | |||

| META / Meta Platforms, Inc. | 0.02 | -4.30 | 12.69 | 22.55 | 1.5757 | 0.3504 | |||

| CMCSA / Comcast Corporation | 0.35 | -4.30 | 12.61 | -7.44 | 1.5657 | -0.0462 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.14 | 1,335.47 | 12.21 | -9.69 | 1.5163 | -0.0837 | |||

| AMT / American Tower Corporation | 0.05 | -4.30 | 11.19 | -2.80 | 1.3894 | 0.0273 | |||

| USB / U.S. Bancorp | 0.23 | -4.30 | 10.61 | 2.56 | 1.3175 | 0.0934 | |||

| VLTO / Veralto Corporation | 0.10 | -4.30 | 10.20 | -0.86 | 1.2671 | 0.0491 | |||

| OTIS / Otis Worldwide Corporation | 0.10 | -4.30 | 9.70 | -8.17 | 1.2041 | -0.0455 | |||

| MSFT / Microsoft Corporation | 0.02 | -4.30 | 9.03 | 26.79 | 1.1213 | 0.2786 | |||

| GOOGL / Alphabet Inc. | 0.05 | -4.30 | 8.69 | 9.06 | 1.0796 | 0.1363 | |||

| EIX / Edison International | 0.16 | -34.61 | 8.37 | -42.74 | 1.0397 | -0.6904 | |||

| NOC / Northrop Grumman Corporation | 0.02 | -43.37 | 8.12 | -44.70 | 1.0079 | -0.7290 | |||

| ITW / Illinois Tool Works Inc. | 0.03 | -4.30 | 7.88 | -4.59 | 0.9788 | 0.0011 | |||

| DIS / The Walt Disney Company | 0.06 | -4.30 | 7.86 | 20.25 | 0.9757 | 0.2024 | |||

| PEP / PepsiCo, Inc. | 0.06 | -47.69 | 7.80 | -53.94 | 0.9684 | -1.0351 | |||

| BA / The Boeing Company | 0.04 | 7.73 | 0.9601 | 0.9601 | |||||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.11 | 7.55 | 0.9381 | 0.9381 | |||||

| XOM / Exxon Mobil Corporation | 0.07 | 7.41 | 0.9197 | 0.9197 | |||||

| PG / The Procter & Gamble Company | 0.05 | 7.34 | 0.9121 | 0.9121 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.10 | -4.30 | 6.71 | -4.88 | 0.8332 | -0.0015 | |||

| SBUX / Starbucks Corporation | 0.06 | -4.30 | 5.80 | -10.61 | 0.7200 | -0.0475 | |||

| CLEAR STREET / RA (000000000) | 0.45 | 0.0561 | 0.0561 | ||||||

| Pacific Life U.S. Government Fund Direct / STIV (000000000) | 0.06 | 0.06 | 0.0069 | 0.0069 | |||||

| VG / Venture Global, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6755 |