Mga Batayang Estadistika

| Nilai Portofolio | $ 2,601,369,033 |

| Posisi Saat Ini | 55 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

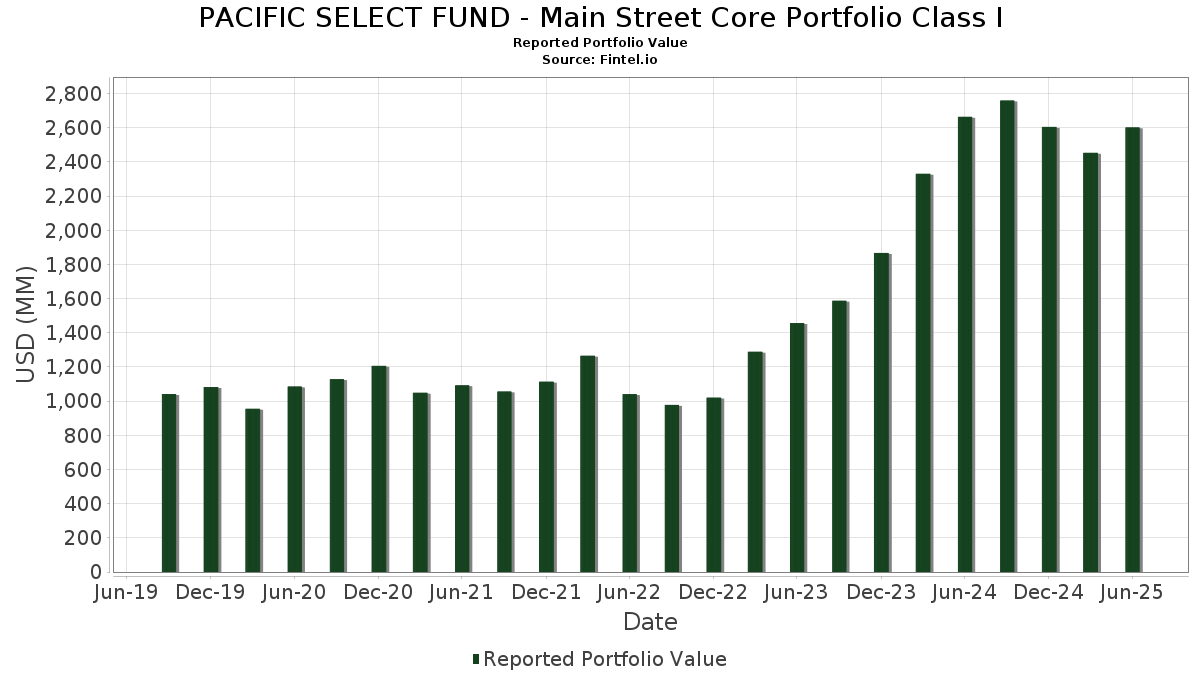

PACIFIC SELECT FUND - Main Street Core Portfolio Class I telah mengungkapkan total kepemilikan 55 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 2,601,369,033 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PACIFIC SELECT FUND - Main Street Core Portfolio Class I adalah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . Posisi baru PACIFIC SELECT FUND - Main Street Core Portfolio Class I meliputi: The Walt Disney Company (US:DIS) , United Rentals, Inc. (US:URI) , Blackstone Inc. (US:BX) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.12 | 176.83 | 6.7721 | 1.5213 | |

| 0.32 | 39.26 | 1.5036 | 1.5036 | |

| 0.48 | 237.68 | 9.1028 | 1.3239 | |

| 0.24 | 52.35 | 2.0050 | 0.7315 | |

| 0.02 | 17.96 | 0.6880 | 0.6880 | |

| 0.29 | 78.83 | 3.0190 | 0.5794 | |

| 0.49 | 35.86 | 1.3735 | 0.4781 | |

| 0.58 | 56.69 | 2.1710 | 0.4205 | |

| 0.06 | 9.55 | 0.3658 | 0.3658 | |

| 9.41 | 0.3605 | 0.3605 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.74 | 152.10 | 5.8252 | -1.5128 | |

| 0.85 | 11.87 | 0.4545 | -0.9011 | |

| 0.03 | 16.04 | 0.6144 | -0.7050 | |

| 0.44 | 47.23 | 1.8088 | -0.5632 | |

| 0.23 | 41.77 | 1.5997 | -0.4968 | |

| 1.66 | 63.82 | 2.4443 | -0.4523 | |

| 0.16 | 51.56 | 1.9747 | -0.4446 | |

| 0.05 | 20.20 | 0.7735 | -0.4175 | |

| 0.06 | 31.50 | 1.2065 | -0.3535 | |

| 0.04 | 19.98 | 0.7651 | -0.2317 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-18 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.48 | -6.33 | 237.68 | 24.11 | 9.1028 | 1.3239 | |||

| NVDA / NVIDIA Corporation | 1.12 | -6.16 | 176.83 | 36.79 | 6.7721 | 1.5213 | |||

| AAPL / Apple Inc. | 0.74 | -8.84 | 152.10 | -15.80 | 5.8252 | -1.5128 | |||

| AMZN / Amazon.com, Inc. | 0.56 | -2.28 | 123.15 | 12.68 | 4.7166 | 0.2771 | |||

| META / Meta Platforms, Inc. | 0.14 | -15.86 | 104.98 | 7.75 | 4.0205 | 0.0630 | |||

| WFC / Wells Fargo & Company | 1.10 | -2.07 | 88.14 | 9.30 | 3.3755 | 0.0998 | |||

| AVGO / Broadcom Inc. | 0.29 | -20.28 | 78.83 | 31.26 | 3.0190 | 0.5794 | |||

| MA / Mastercard Incorporated | 0.13 | -2.36 | 70.50 | 0.11 | 2.6999 | -0.1607 | |||

| AXP / American Express Company | 0.21 | -2.85 | 66.42 | 15.18 | 2.5436 | 0.2014 | |||

| GOOGL / Alphabet Inc. | 0.37 | -0.20 | 65.87 | 13.73 | 2.5226 | 0.1702 | |||

| BKR / Baker Hughes Company | 1.66 | 2.60 | 63.82 | -10.50 | 2.4443 | -0.4523 | |||

| ETN / Eaton Corporation plc | 0.17 | -7.44 | 60.85 | 21.56 | 2.3306 | 0.2971 | |||

| WMT / Walmart Inc. | 0.58 | 18.10 | 56.69 | 31.54 | 2.1710 | 0.4205 | |||

| NXPI / NXP Semiconductors N.V. | 0.26 | 6.59 | 56.23 | 22.53 | 2.1536 | 0.2895 | |||

| LOW / Lowe's Companies, Inc. | 0.24 | 1.63 | 53.27 | -3.32 | 2.0403 | -0.1980 | |||

| ORCL / Oracle Corporation | 0.24 | 6.79 | 52.35 | 66.99 | 2.0050 | 0.7315 | |||

| MCD / McDonald's Corporation | 0.18 | 3.49 | 52.12 | -3.20 | 1.9961 | -0.1910 | |||

| AJG / Arthur J. Gallagher & Co. | 0.16 | -6.64 | 51.56 | -13.43 | 1.9747 | -0.4446 | |||

| VMC / Vulcan Materials Company | 0.18 | -5.31 | 47.85 | 5.86 | 1.8326 | -0.0035 | |||

| XOM / Exxon Mobil Corporation | 0.44 | -10.77 | 47.23 | -19.12 | 1.8088 | -0.5632 | |||

| AMP / Ameriprise Financial, Inc. | 0.09 | -8.15 | 45.96 | 1.26 | 1.7602 | -0.0835 | |||

| SYK / Stryker Corporation | 0.12 | -6.35 | 45.68 | -0.47 | 1.7493 | -0.1149 | |||

| NOC / Northrop Grumman Corporation | 0.09 | -4.82 | 42.85 | -7.05 | 1.6411 | -0.2316 | |||

| ABBV / AbbVie Inc. | 0.23 | -8.65 | 41.77 | -19.07 | 1.5997 | -0.4968 | |||

| HWM / Howmet Aerospace Inc. | 0.22 | -20.87 | 40.04 | 13.53 | 1.5336 | 0.1009 | |||

| DIS / The Walt Disney Company | 0.32 | 39.26 | 1.5036 | 1.5036 | |||||

| CARR / Carrier Global Corporation | 0.49 | 40.93 | 35.86 | 62.69 | 1.3735 | 0.4781 | |||

| INTU / Intuit Inc. | 0.04 | -13.54 | 35.22 | 10.92 | 1.3488 | 0.0590 | |||

| NEE / NextEra Energy, Inc. | 0.51 | 32.18 | 35.19 | 29.44 | 1.3476 | 0.2434 | |||

| MS / Morgan Stanley | 0.24 | -2.38 | 34.16 | 17.87 | 1.3084 | 0.1310 | |||

| MDT / Medtronic plc | 0.38 | 8.21 | 33.28 | 4.97 | 1.2745 | -0.0133 | |||

| SO / The Southern Company | 0.36 | -4.28 | 32.65 | -4.40 | 1.2503 | -0.1368 | |||

| DE / Deere & Company | 0.06 | -24.29 | 31.50 | -17.97 | 1.2065 | -0.3535 | |||

| MAR / Marriott International, Inc. | 0.11 | 3.04 | 31.33 | 18.18 | 1.2000 | 0.1231 | |||

| TSLA / Tesla, Inc. | 0.09 | -17.89 | 28.83 | 0.65 | 1.1041 | -0.0594 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.49 | -14.07 | 27.69 | -3.90 | 1.0605 | -0.1099 | |||

| TRV / The Travelers Companies, Inc. | 0.10 | 8.55 | 26.91 | 9.81 | 1.0307 | 0.0352 | |||

| MDLZ / Mondelez International, Inc. | 0.40 | -4.80 | 26.76 | -5.37 | 1.0247 | -0.1238 | |||

| CSX / CSX Corporation | 0.81 | -15.87 | 26.53 | -6.72 | 1.0159 | -0.1392 | |||

| EW / Edwards Lifesciences Corporation | 0.33 | 11.83 | 25.57 | 20.67 | 0.9792 | 0.1185 | |||

| LLY / Eli Lilly and Company | 0.03 | 23.32 | 22.56 | 16.39 | 0.8638 | 0.0767 | |||

| TT / Trane Technologies plc | 0.05 | -46.94 | 20.20 | -31.12 | 0.7735 | -0.4175 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.04 | -11.35 | 19.98 | -18.59 | 0.7651 | -0.2317 | |||

| USB / U.S. Bancorp | 0.44 | -0.82 | 19.76 | 6.30 | 0.7570 | 0.0017 | |||

| MU / Micron Technology, Inc. | 0.16 | 4.34 | 19.36 | 48.01 | 0.7413 | 0.2101 | |||

| URI / United Rentals, Inc. | 0.02 | 17.96 | 0.6880 | 0.6880 | |||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.03 | -40.33 | 16.04 | -50.61 | 0.6144 | -0.7050 | |||

| PLD / Prologis, Inc. | 0.15 | -4.82 | 15.70 | -10.50 | 0.6012 | -0.1113 | |||

| ETR / Entergy Corporation | 0.17 | -15.11 | 13.76 | -17.47 | 0.5268 | -0.1502 | |||

| PCG / PG&E Corporation | 0.85 | -56.17 | 11.87 | -64.44 | 0.4545 | -0.9011 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 25.35 | 10.56 | 51.60 | 0.4044 | 0.1215 | |||

| BX / Blackstone Inc. | 0.06 | 9.55 | 0.3658 | 0.3658 | |||||

| CLEAR STREET / RA (000000000) | 9.41 | 0.3605 | 0.3605 | ||||||

| Pacific Life U.S. Government Fund Direct / STIV (000000000) | 1.16 | 1.16 | 0.0443 | 0.0443 | |||||

| S+P500 EMINI FUT SEP25 / DE (000000000) | 0.01 | 0.0002 | 0.0002 |