Mga Batayang Estadistika

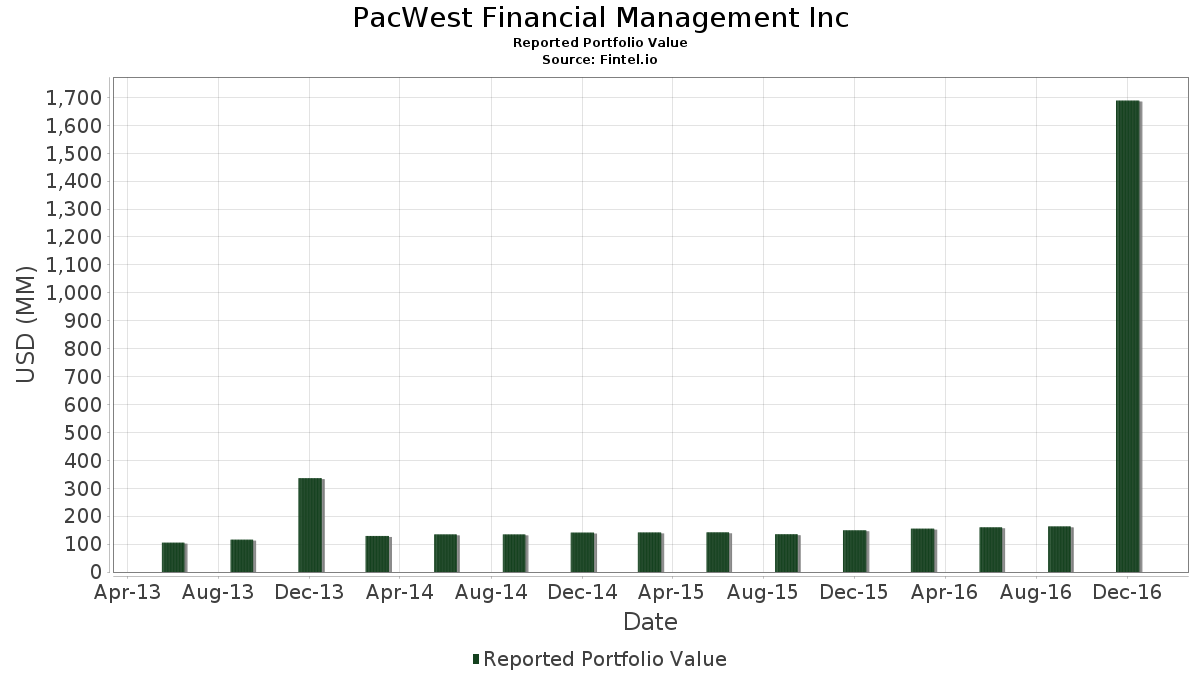

| Nilai Portofolio | $ 1,688,600,000 |

| Posisi Saat Ini | 81 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

PacWest Financial Management Inc telah mengungkapkan total kepemilikan 81 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,688,600,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PacWest Financial Management Inc adalah Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF (US:VCSH) , Vanguard Scottsdale Funds - Vanguard IT Corporate Bond Index Fund Admiral (US:VICSX) , iShares Trust - iShares Core S&P Small-Cap ETF (US:IJR) , WisdomTree Trust - WisdomTree International Hedged Quality Dividend Growth Fund (US:IHDG) , and Microsoft Corporation (US:MSFT) . Posisi baru PacWest Financial Management Inc meliputi: Vanguard Whitehall Funds - Vanguard International Dividend Appreciation ETF (US:VIGI) , FlexShares Trust - FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (US:TDTT) , SPDR S&P 500 ETF (US:SPY) , JPMorgan Chase & Co. (US:JPM) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.23 | 60.05 | 3.5562 | 3.5562 | |

| 0.08 | 46.73 | 2.7676 | 2.7676 | |

| 0.02 | 38.78 | 2.2966 | 2.2966 | |

| 0.06 | 32.81 | 1.9433 | 1.9433 | |

| 0.02 | 20.92 | 1.2390 | 1.2390 | |

| 0.02 | 15.82 | 0.9368 | 0.9368 | |

| 0.03 | 15.17 | 0.8982 | 0.8982 | |

| 0.03 | 13.95 | 0.8260 | 0.8260 | |

| 0.01 | 12.28 | 0.7272 | 0.7272 | |

| 0.12 | 39.18 | 2.3203 | 0.6503 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.9385 | ||

| 0.07 | 21.87 | 1.2952 | -0.3682 | |

| 0.01 | 7.24 | 0.4289 | -0.3492 | |

| 0.09 | 75.63 | 4.4790 | -0.3237 | |

| 0.03 | 12.53 | 0.7423 | -0.2740 | |

| 0.08 | 48.00 | 2.8428 | -0.1912 | |

| 0.02 | 16.20 | 0.9595 | -0.1865 | |

| 0.01 | 16.50 | 0.9774 | -0.1772 | |

| 0.10 | 35.52 | 2.1037 | -0.1743 | |

| 0.05 | 16.46 | 0.9748 | -0.1632 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2017-01-10 untuk periode pelaporan 2016-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.10 | 2.91 | 76.44 | 913.99 | 4.5271 | -0.0882 | |||

| VICSX / Vanguard Scottsdale Funds - Vanguard IT Corporate Bond Index Fund Admiral | 0.09 | 0.77 | 75.63 | 864.08 | 4.4790 | -0.3237 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.05 | -3.53 | 67.89 | 968.63 | 4.0205 | 0.1312 | |||

| IHDG / WisdomTree Trust - WisdomTree International Hedged Quality Dividend Growth Fund | 0.23 | -4.19 | 60.05 | 857.43 | 3.5562 | 3.5562 | |||

| MSFT / Microsoft Corporation | 0.08 | -10.23 | 48.00 | 868.60 | 2.8428 | -0.1912 | |||

| HEDJ / WisdomTree Trust - WisdomTree Europe Hedged Equity Fund | 0.08 | 1.10 | 46.73 | 979.78 | 2.7676 | 2.7676 | |||

| GE / General Electric Company | 0.12 | 34.64 | 39.18 | 1,336.25 | 2.3203 | 0.6503 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.02 | -2.47 | 38.78 | 908.61 | 2.2966 | 2.2966 | |||

| VZ / Verizon Communications Inc. | 0.07 | 1.88 | 37.54 | 946.15 | 2.2229 | 0.0264 | |||

| TJX / The TJX Companies, Inc. | 0.05 | -1.07 | 36.85 | 893.82 | 2.1823 | -0.0877 | |||

| AAPL / Apple Inc. | 0.03 | -1.09 | 35.88 | 913.24 | 2.1248 | -0.0430 | |||

| INTC / Intel Corporation | 0.10 | -0.63 | 35.52 | 854.66 | 2.1037 | -0.1743 | |||

| VIGI / Vanguard Whitehall Funds - Vanguard International Dividend Appreciation ETF | 0.06 | 32.81 | 1.9433 | 1.9433 | |||||

| CSCO / Cisco Systems, Inc. | 0.10 | 39.99 | 31.61 | 1,233.40 | 1.8723 | 0.4208 | |||

| GIS / General Mills, Inc. | 0.05 | 57.03 | 30.16 | 1,418.73 | 1.7862 | 0.5704 | |||

| JNJ / Johnson & Johnson | 0.03 | 0.89 | 28.91 | 883.84 | 1.7124 | -0.0869 | |||

| C.WSA / Citigroup, Inc. | 0.01 | -0.44 | 28.66 | 945.30 | 1.6974 | 0.0188 | |||

| VFC / V.F. Corporation | 0.05 | -0.27 | 28.02 | 849.36 | 1.6597 | -0.1475 | |||

| PG / The Procter & Gamble Company | 0.03 | 25.57 | 27.94 | 1,076.34 | 1.6545 | 0.2006 | |||

| HD / The Home Depot, Inc. | 0.02 | -0.03 | 27.62 | 941.52 | 1.6357 | 0.0122 | |||

| MMM / 3M Company | 0.01 | -0.90 | 26.58 | 904.16 | 1.5741 | -0.0464 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.02 | -2.36 | 25.08 | 1,001.54 | 1.4854 | 0.0914 | |||

| WFC / Wells Fargo & Company | 0.04 | -3.05 | 24.54 | 1,106.59 | 1.4534 | 0.2082 | |||

| USB / U.S. Bancorp | 0.05 | -6.82 | 23.64 | 1,015.76 | 1.4002 | 0.1029 | |||

| RY / Royal Bank of Canada | 0.03 | -3.11 | 22.68 | 958.64 | 1.3429 | 0.0316 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 1.05 | 22.37 | 944.79 | 1.3247 | 0.0140 | |||

| SPSB / SPDR Series Trust - SPDR Portfolio Short Term Corporate Bond ETF | 0.07 | -18.87 | 21.87 | 704.93 | 1.2952 | -0.3682 | |||

| SBUX / Starbucks Corporation | 0.04 | -4.03 | 21.84 | 884.18 | 1.2933 | -0.0651 | |||

| RTX / RTX Corporation | 0.02 | -2.24 | 21.34 | 954.82 | 1.2637 | 0.0252 | |||

| ACN / Accenture plc | 0.02 | -0.58 | 21.15 | 853.18 | 1.2526 | -0.1059 | |||

| ABBV / AbbVie Inc. | 0.03 | -1.07 | 21.10 | 882.40 | 1.2497 | -0.0653 | |||

| PFE / Pfizer Inc. | 0.06 | 4.03 | 21.04 | 897.68 | 1.2461 | -0.0450 | |||

| NVDA / NVIDIA Corporation | 0.02 | 0.05 | 20.92 | 1,458.94 | 1.2390 | 1.2390 | |||

| Mid Cap S P D R TRUST / (595635103) | 0.01 | -5.77 | 20.36 | 907.27 | 0.0000 | ||||

| MRK / Merck & Co., Inc. | 0.03 | 0.43 | 20.29 | 847.45 | 1.2013 | -0.1094 | |||

| APH / Amphenol Corporation | 0.03 | -4.92 | 19.37 | 884.25 | 1.1471 | -0.0577 | |||

| COST / Costco Wholesale Corporation | 0.01 | 0.06 | 19.18 | 950.60 | 1.1361 | 0.0182 | |||

| NEE / NextEra Energy, Inc. | 0.02 | 0.70 | 18.87 | 883.53 | 1.1177 | -0.0571 | |||

| BDX / Becton, Dickinson and Company | 0.01 | 2.70 | 18.55 | 845.89 | 1.0985 | -0.1020 | |||

| BCE / BCE Inc. | 0.04 | 2.93 | 18.39 | 863.94 | 1.0892 | -0.0789 | |||

| FAST / Fastenal Company | 0.04 | -1.76 | 16.82 | 1,004.99 | 0.9960 | 0.0642 | |||

| AMGN / Amgen Inc. | 0.01 | -0.18 | 16.50 | 775.08 | 0.9774 | -0.1772 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.05 | 2.72 | 16.46 | 785.48 | 0.9748 | -0.1632 | |||

| BK / The Bank of New York Mellon Corporation | 0.03 | -3.40 | 16.34 | 1,047.54 | 0.9677 | 0.0960 | |||

| 74005P104 / Praxair, Inc. | 0.01 | -1.36 | 16.26 | 856.80 | 0.9627 | -0.0774 | |||

| MDT / Medtronic plc | 0.02 | 4.98 | 16.20 | 765.49 | 0.9595 | -0.1865 | |||

| MA / Mastercard Incorporated | 0.02 | -4.93 | 15.90 | 864.62 | 0.9414 | -0.0675 | |||

| ED / Consolidated Edison, Inc. | 0.02 | -0.73 | 15.82 | 871.09 | 0.9368 | 0.9368 | |||

| SYK / Stryker Corporation | 0.01 | -4.07 | 15.55 | 887.37 | 0.9209 | -0.0433 | |||

| SO / The Southern Company | 0.03 | 3.04 | 15.24 | 887.88 | 0.9027 | -0.0419 | |||

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | 0.03 | -6.43 | 15.17 | 1,130.09 | 0.8982 | 0.8982 | |||

| CHD / Church & Dwight Co., Inc. | 0.03 | 2.54 | 15.15 | 845.35 | 0.8974 | -0.0839 | |||

| US16941M1099 / China Mobile Ltd. | 0.03 | 3.19 | 15.14 | 779.38 | 0.8968 | -0.1574 | |||

| CVX / Chevron Corporation | 0.01 | -0.74 | 14.91 | 1,034.86 | 0.8831 | 0.0787 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.02 | -1.69 | 14.46 | 921.98 | 0.8564 | -0.0099 | |||

| NKE / NIKE, Inc. | 0.03 | 0.96 | 13.95 | 874.63 | 0.8260 | 0.8260 | |||

| DLTR / Dollar Tree, Inc. | 0.02 | -2.50 | 13.70 | 853.17 | 0.8111 | -0.0686 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.02 | -1.15 | 12.84 | 903.28 | 0.7605 | -0.0231 | |||

| META / Meta Platforms, Inc. | 0.01 | 6.05 | 12.74 | 851.31 | 0.7544 | -0.0654 | |||

| CERN / Cerner Corp. | 0.03 | -1.58 | 12.53 | 655.06 | 0.7423 | -0.2740 | |||

| HSIC / Henry Schein, Inc. | 0.01 | -1.28 | 12.28 | 819.16 | 0.7272 | 0.7272 | |||

| GOOG / Alphabet Inc. | 0.00 | -2.47 | 11.88 | 868.05 | 0.7034 | -0.0477 | |||

| AXP / American Express Company | 0.01 | -14.17 | 10.25 | 892.35 | 0.6071 | -0.0253 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.01 | -0.54 | 9.85 | 944.11 | 0.5831 | 0.0058 | |||

| ABT / Abbott Laboratories | 0.02 | -1.29 | 9.27 | 796.52 | 0.5490 | -0.0840 | |||

| HSY / The Hershey Company | 0.01 | -0.82 | 8.73 | 972.97 | 0.5172 | 0.0189 | |||

| SHM / SPDR Series Trust - SPDR Nuveen ICE Short Term Municipal Bond ETF | 0.02 | -26.20 | 8.60 | 624.35 | 0.5092 | 0.5092 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | -37.02 | 7.24 | 469.87 | 0.4289 | -0.3492 | |||

| IBM / International Business Machines Corporation | 0.00 | -0.89 | 5.52 | 935.46 | 0.3268 | 0.0005 | |||

| TDTT / FlexShares Trust - FlexShares iBoxx 3-Year Target Duration TIPS Index Fund | 0.02 | 5.00 | 0.2958 | 0.2958 | |||||

| ITW / Illinois Tool Works Inc. | 0.00 | -7.22 | 4.88 | 847.57 | 0.2890 | -0.0263 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 4.49 | 0.2660 | 0.2660 | |||||

| KO / The Coca-Cola Company | 0.01 | -12.38 | 3.98 | 759.18 | 0.2356 | -0.0479 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | -14.37 | 3.90 | 689.47 | 0.2310 | -0.0715 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.01 | -8.64 | 3.19 | 825.80 | 0.1892 | 0.1892 | |||

| CL / Colgate-Palmolive Company | 0.00 | 18.01 | 2.97 | 942.46 | 0.1759 | 0.0015 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 7.62 | 2.74 | 871.99 | 0.1623 | -0.0103 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.00 | 2.27 | 935.62 | 0.1343 | 0.0002 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.00 | 4.98 | 2.18 | 903.69 | 0.1290 | 0.1290 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 2.18 | 0.1290 | 0.1290 | |||||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.00 | 0.00 | 2.10 | 0.1241 | 0.1241 | ||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9385 | ||||

| EL / The Estée Lauder Companies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| TA / TravelCenters of America Inc | 0.04 | 0.00 | 0.00 | 0.0000 | 0.0000 |