Mga Batayang Estadistika

| Nilai Portofolio | $ 30,260,000 |

| Posisi Saat Ini | 68 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

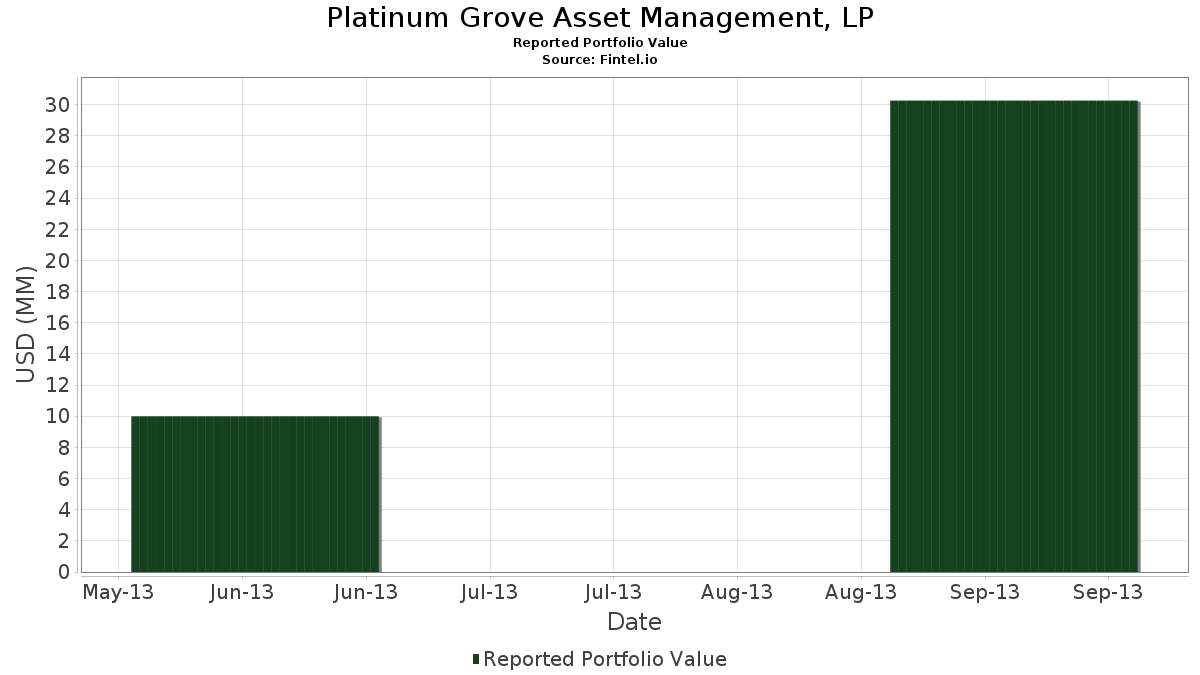

Platinum Grove Asset Management, LP telah mengungkapkan total kepemilikan 68 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 30,260,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Platinum Grove Asset Management, LP adalah SPDR S&P 500 ETF (US:SPY) , iShares, Inc. - iShares MSCI Emerging Markets ETF (US:EEM) , The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund (US:XLF) , iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF (US:LQD) , and Barclays Bank iPath S&P 500 VIX Mid-Term Futures ETN due 1/30/2019 (US:06740C519) . Posisi baru Platinum Grove Asset Management, LP meliputi: SPDR S&P 500 ETF (US:SPY) , iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF (US:LQD) , Booking Holdings Inc. (US:BKNG) , Vanguard Specialized Funds - Vanguard Real Estate ETF (US:VNQ) , and Microsoft Corporation (US:MSFT) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 10.69 | 35.3305 | 35.3305 | |

| 0.01 | 0.75 | 2.4719 | 2.4719 | |

| 0.04 | 0.68 | 2.2538 | 2.2538 | |

| 0.00 | 0.49 | 1.6358 | 1.6358 | |

| 0.01 | 0.49 | 1.6292 | 1.6292 | |

| 0.01 | 0.42 | 1.3847 | 1.3847 | |

| 0.00 | 0.40 | 1.3186 | 1.3186 | |

| 0.01 | 0.40 | 1.3153 | 1.3153 | |

| 0.01 | 0.31 | 1.0112 | 1.0112 | |

| 0.01 | 0.30 | 1.0046 | 1.0046 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 2.16 | 7.1348 | -3.3615 | |

| 0.00 | 0.00 | -3.2720 | ||

| 0.00 | 0.00 | -3.2520 | ||

| 0.05 | 1.00 | 3.2915 | -3.2024 | |

| 0.00 | 0.30 | 1.0079 | -1.1934 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2013-11-13 untuk periode pelaporan 2013-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 0.06 | 10.69 | 35.3305 | 35.3305 | ||||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.05 | 94.69 | 2.16 | 105.82 | 7.1348 | -3.3615 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | Put | 0.05 | 49.70 | 1.00 | 53.47 | 3.2915 | -3.2024 | ||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.01 | 0.75 | 2.4719 | 2.4719 | |||||

| 06740C519 / Barclays Bank iPath S&P 500 VIX Mid-Term Futures ETN due 1/30/2019 | 0.04 | -42.90 | 0.68 | -53.54 | 2.2538 | 2.2538 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.49 | 1.6358 | 1.6358 | |||||

| AIG / American International Group, Inc. | 0.01 | 13.43 | 0.49 | 23.25 | 1.6292 | 1.6292 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.01 | 0.42 | 1.3847 | 1.3847 | |||||

| AAPL / Apple Inc. | 0.00 | -6.90 | 0.40 | 12.08 | 1.3186 | 1.3186 | |||

| GPS / The Gap, Inc. | 0.01 | 25.84 | 0.40 | 21.34 | 1.3153 | 1.3153 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.31 | 1.0112 | 1.0112 | |||||

| GOOGL / Alphabet Inc. | 0.00 | 39.20 | 0.30 | 38.64 | 1.0079 | -1.1934 | |||

| C / Citigroup Inc. | 0.01 | 0.30 | 1.0046 | 1.0046 | |||||

| BA / The Boeing Company | 0.00 | 10.56 | 0.30 | 26.67 | 1.0046 | 1.0046 | |||

| IBM / International Business Machines Corporation | 0.00 | 40.58 | 0.30 | 36.32 | 1.0046 | 1.0046 | |||

| PG / The Procter & Gamble Company | 0.00 | 3.13 | 0.30 | 1.33 | 1.0046 | 1.0046 | |||

| LBTYK / Liberty Global Ltd. | 0.00 | 10.28 | 0.28 | 22.84 | 0.9418 | 0.9418 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| CF / CF Industries Holdings, Inc. | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| CLX / The Clorox Company | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| TPR / Tapestry, Inc. | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| KO / The Coca-Cola Company | 0.01 | 0.21 | 0.6940 | 0.6940 | |||||

| CL / Colgate-Palmolive Company | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| FOSL / Fossil Group, Inc. | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| GPC / Genuine Parts Company | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| LLY / Eli Lilly and Company | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| LO / | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| MCK / McKesson Corporation | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| PETM / | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| ROST / Ross Stores, Inc. | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| WDC / Western Digital Corporation | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| GRMN / Garmin Ltd. | 0.00 | 0.21 | 0.6940 | 0.6940 | |||||

| GCI / Gannett Co., Inc. | 0.01 | 0.21 | 0.6907 | 0.6907 | |||||

| EBAY / eBay Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| TJX / The TJX Companies, Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| MMM / 3M Company | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| US92220P1057 / Varian Medical Systems, Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| INTC / Intel Corporation | 0.01 | 0.21 | 0.6907 | 0.6907 | |||||

| BBWI / Bath & Body Works, Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| LLL / JX Luxventure Limited | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| VRSN / VeriSign, Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| LMT / Lockheed Martin Corporation | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| LYB / LyondellBasell Industries N.V. | 0.00 | -22.72 | 0.21 | -14.69 | 0.6907 | 0.6907 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| EMR / Emerson Electric Co. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| WU / The Western Union Company | 0.01 | 12.09 | 0.21 | 22.22 | 0.6907 | 0.6907 | |||

| INTU / Intuit Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| MCO / Moody's Corporation | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| NOC / Northrop Grumman Corporation | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| WHR / Whirlpool Corporation | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| ACN / Accenture plc | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| DG / Dollar General Corporation | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| PFG / Principal Financial Group, Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| DTV / DTE Energy Company | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| RTN / Raytheon Co. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| BBBY / Bed Bath & Beyond, Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| DAL / Delta Air Lines, Inc. | 0.01 | 0.21 | 0.6907 | 0.6907 | |||||

| CAT / Caterpillar Inc. | 0.00 | 0.21 | 0.6907 | 0.6907 | |||||

| JOY / Joy Global, Inc. | 0.00 | 0.21 | 0.6874 | 0.6874 | |||||

| CAIAF / CA Immobilien Anlagen AG | 0.01 | 0.21 | 0.6874 | 0.6874 | |||||

| GE / General Electric Company | 0.01 | 0.21 | 0.6874 | 0.6874 | |||||

| FFIV / F5, Inc. | 0.00 | 0.21 | 0.6874 | 0.6874 | |||||

| LDOS / Leidos Holdings, Inc. | 0.00 | -62.85 | 0.21 | 21.64 | 0.6874 | 0.6874 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.00 | -22.51 | 0.21 | -22.56 | 0.6808 | 0.6808 | |||

| NWSA / News Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -3.2520 | ||||

| DLTR / Dollar Tree, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.2720 | ||||

| MARKET VECTORS ETF TR / GOLD MINER ETF (57060U100) | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 |