Mga Batayang Estadistika

| Nilai Portofolio | $ 975,246,694 |

| Posisi Saat Ini | 46 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

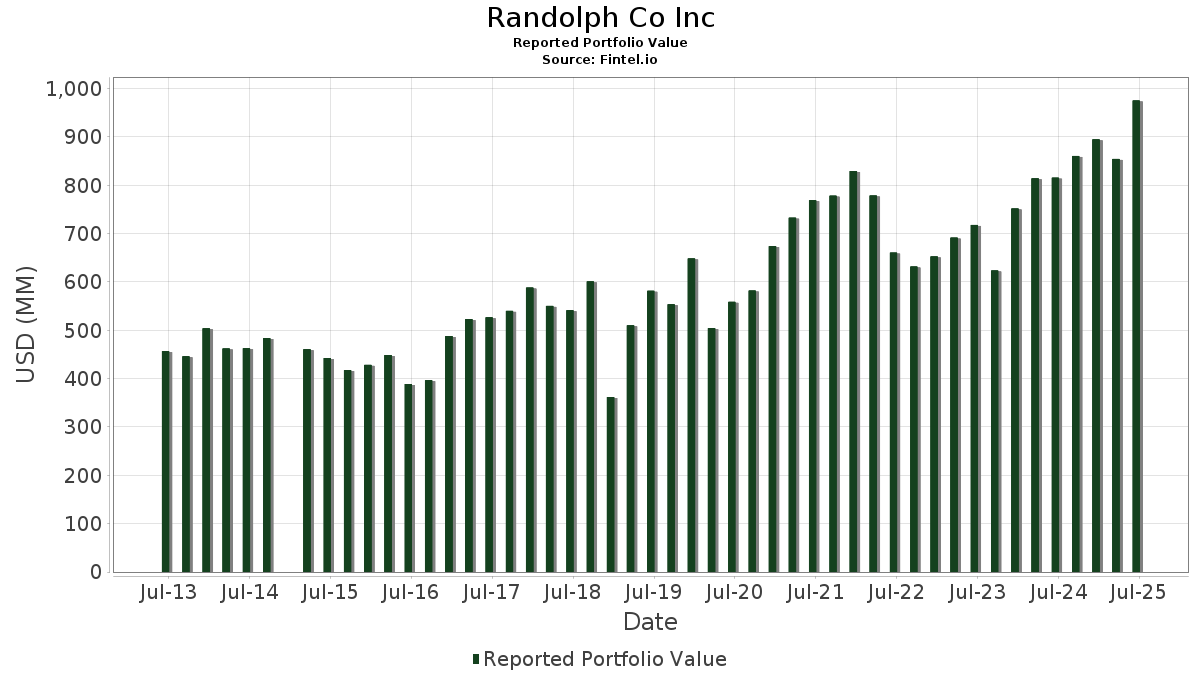

Randolph Co Inc telah mengungkapkan total kepemilikan 46 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 975,246,694 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Randolph Co Inc adalah Broadcom Inc. (US:AVGO) , Cintas Corporation (US:CTAS) , JPMorgan Chase & Co. (US:JPM) , Blackstone Inc. (US:BX) , and Microsoft Corporation (US:MSFT) . Posisi baru Randolph Co Inc meliputi: iShares Trust - iShares 7-10 Year Treasury Bond ETF (US:IEF) , Alexandria Real Estate Equities, Inc. (US:ARE) , Edwards Lifesciences Corporation (US:EW) , Vanguard Index Funds - Vanguard S&P 500 ETF (US:VOO) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.39 | 108.53 | 11.1284 | 3.4452 | |

| 0.82 | 27.62 | 2.8323 | 2.8323 | |

| 0.16 | 28.66 | 2.9384 | 2.4190 | |

| 0.25 | 23.56 | 2.4159 | 2.4159 | |

| 0.30 | 21.69 | 2.2241 | 2.2241 | |

| 0.27 | 59.39 | 6.0902 | 2.0788 | |

| 0.12 | 14.25 | 1.4609 | 1.2233 | |

| 0.14 | 14.64 | 1.5012 | 1.0449 | |

| 0.09 | 43.64 | 4.4750 | 0.7087 | |

| 0.05 | 36.57 | 3.7495 | 0.4373 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.28 | 25.99 | 2.6647 | -4.4386 | |

| 0.00 | 0.33 | 0.0335 | -2.1224 | |

| 0.22 | 24.12 | 2.4732 | -0.5980 | |

| 0.29 | 25.62 | 2.6274 | -0.4325 | |

| 0.04 | 39.27 | 4.0265 | -0.3325 | |

| 0.07 | 23.59 | 2.4187 | -0.2599 | |

| 0.33 | 48.70 | 4.9939 | -0.2380 | |

| 0.12 | 36.03 | 3.6942 | -0.2201 | |

| 0.67 | 19.69 | 2.0191 | -0.1922 | |

| 0.42 | 26.35 | 2.7022 | -0.1884 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-16 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AVGO / Broadcom Inc. | 0.39 | 0.41 | 108.53 | 65.32 | 11.1284 | 3.4452 | |||

| CTAS / Cintas Corporation | 0.27 | 59.80 | 59.39 | 73.29 | 6.0902 | 2.0788 | |||

| JPM / JPMorgan Chase & Co. | 0.17 | 0.43 | 49.64 | 18.69 | 5.0902 | 0.1952 | |||

| BX / Blackstone Inc. | 0.33 | 1.81 | 48.70 | 8.95 | 4.9939 | -0.2380 | |||

| MSFT / Microsoft Corporation | 0.09 | 2.35 | 43.64 | 35.61 | 4.4750 | 0.7087 | |||

| GLW / Corning Incorporated | 0.77 | 0.50 | 40.75 | 15.45 | 4.1783 | 0.0476 | |||

| COST / Costco Wholesale Corporation | 0.04 | 0.73 | 39.27 | 5.43 | 4.0265 | -0.3325 | |||

| HON / Honeywell International Inc. | 0.16 | 1.31 | 36.82 | 11.42 | 3.7751 | -0.0920 | |||

| INTU / Intuit Inc. | 0.05 | 0.72 | 36.57 | 29.21 | 3.7495 | 0.4373 | |||

| GD / General Dynamics Corporation | 0.12 | 0.67 | 36.03 | 7.72 | 3.6942 | -0.2201 | |||

| CSCO / Cisco Systems, Inc. | 0.51 | 0.73 | 35.13 | 13.25 | 3.6021 | -0.0283 | |||

| HBAN / Huntington Bancshares Incorporated | 1.82 | 0.19 | 30.52 | 11.86 | 3.1295 | -0.0635 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.12 | 1.05 | 28.69 | 7.99 | 2.9423 | -0.1675 | |||

| NEM / Newmont Corporation | 0.49 | 0.39 | 28.67 | 21.15 | 2.9398 | 0.1701 | |||

| GOOGL / Alphabet Inc. | 0.16 | 466.61 | 28.66 | 545.70 | 2.9384 | 2.4190 | |||

| SLB / Schlumberger Limited | 0.82 | 27.62 | 2.8323 | 2.8323 | |||||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.42 | 0.38 | 26.35 | 6.70 | 2.7022 | -0.1884 | |||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.28 | -57.18 | 25.99 | -57.19 | 2.6647 | -4.4386 | |||

| MDT / Medtronic plc | 0.29 | 1.03 | 25.62 | -2.00 | 2.6274 | -0.4325 | |||

| XOM / Exxon Mobil Corporation | 0.22 | 1.40 | 24.12 | -8.09 | 2.4732 | -0.5980 | |||

| V / Visa Inc. | 0.07 | 1.73 | 23.59 | 3.06 | 2.4187 | -0.2599 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.25 | 23.56 | 2.4159 | 2.4159 | |||||

| ARE / Alexandria Real Estate Equities, Inc. | 0.30 | 21.69 | 2.2241 | 2.2241 | |||||

| SCCO / Southern Copper Corporation | 0.20 | 1.19 | 20.01 | 9.53 | 2.0517 | -0.0862 | |||

| KMI / Kinder Morgan, Inc. | 0.67 | 1.13 | 19.69 | 4.21 | 2.0191 | -0.1922 | |||

| PANW / Palo Alto Networks, Inc. | 0.08 | 0.15 | 16.92 | 20.11 | 1.7350 | 0.0863 | |||

| AEP / American Electric Power Company, Inc. | 0.14 | 295.46 | 14.64 | 275.58 | 1.5012 | 1.0449 | |||

| DUK / Duke Energy Corporation | 0.12 | 625.31 | 14.25 | 601.82 | 1.4609 | 1.2233 | |||

| SMIN / iShares Trust - iShares MSCI India Small-Cap ETF | 0.14 | 1.48 | 10.73 | 15.03 | 1.1005 | 0.0085 | |||

| EPI / WisdomTree Trust - WisdomTree India Earnings Fund | 0.22 | 1.67 | 10.25 | 10.42 | 1.0509 | -0.0354 | |||

| INDA / iShares Trust - iShares MSCI India ETF | 0.17 | 1.69 | 9.61 | 9.98 | 0.9850 | -0.0372 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 36.17 | 2.03 | 50.48 | 0.2085 | 0.0504 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.03 | 1.95 | 10.49 | 0.1998 | -0.0066 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.00 | -21.21 | 0.98 | -14.72 | 0.1004 | -0.0340 | |||

| EG / Everest Group, Ltd. | 0.00 | -7.31 | 0.93 | -13.36 | 0.0959 | -0.0303 | |||

| PG / The Procter & Gamble Company | 0.01 | 16.84 | 0.89 | 9.31 | 0.0915 | -0.0041 | |||

| AAPL / Apple Inc. | 0.00 | 0.59 | 0.49 | -7.05 | 0.0500 | -0.0114 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 26.20 | 0.40 | 28.03 | 0.0412 | 0.0044 | |||

| MRK / Merck & Co., Inc. | 0.00 | -97.99 | 0.33 | -98.23 | 0.0335 | -2.1224 | |||

| EW / Edwards Lifesciences Corporation | 0.00 | 0.30 | 0.0309 | 0.0309 | |||||

| DGRO / iShares Trust - iShares Core Dividend Growth ETF | 0.00 | -57.87 | 0.27 | -56.46 | 0.0280 | -0.0454 | |||

| MOAT / VanEck ETF Trust - VanEck Morningstar Wide Moat ETF | 0.00 | -58.03 | 0.24 | -55.28 | 0.0243 | -0.0378 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.00 | 0.23 | 0.0232 | 0.0232 | |||||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.21 | 0.0219 | 0.0219 | |||||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.21 | 0.0214 | 0.0214 | |||||

| GNK / Genco Shipping & Trading Limited | 0.01 | 0.00 | 0.13 | -2.26 | 0.0134 | -0.0022 | |||

| MTLS / Materialise NV - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PEP / PepsiCo, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ADBE / Adobe Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LYB / LyondellBasell Industries N.V. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TAP / Molson Coors Beverage Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| QCOM / QUALCOMM Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 |