Mga Batayang Estadistika

| Nilai Portofolio | $ 4,220,224,995 |

| Posisi Saat Ini | 101 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

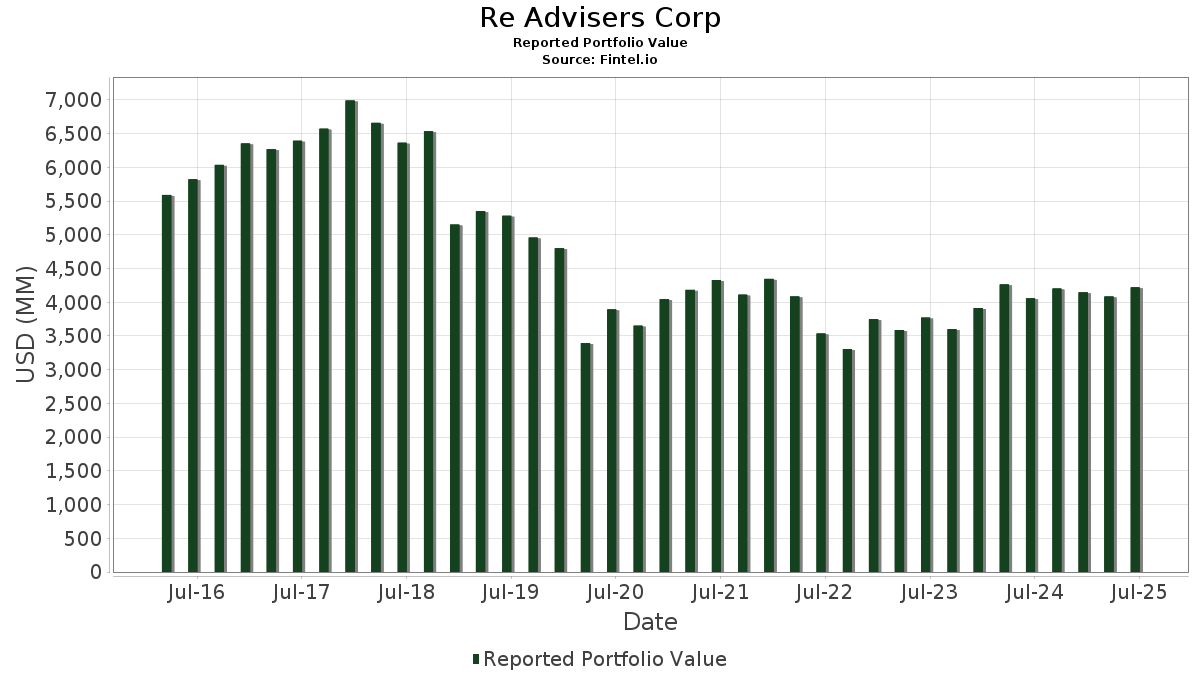

Re Advisers Corp telah mengungkapkan total kepemilikan 101 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,220,224,995 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Re Advisers Corp adalah JPMorgan Chase & Co. (US:JPM) , The Goldman Sachs Group, Inc. (US:GS) , Meta Platforms, Inc. (US:META) , AbbVie Inc. (US:ABBV) , and Parker-Hannifin Corporation (US:PH) . Posisi baru Re Advisers Corp meliputi: Walmart Inc. (US:WMT) , HealthEquity, Inc. (US:HQY) , ADMA Biologics, Inc. (US:ADMA) , Valvoline Inc. (US:VVV) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.79 | 77.61 | 1.8390 | 1.8390 | |

| 0.14 | 32.95 | 0.7808 | 0.7808 | |

| 0.21 | 145.82 | 3.4553 | 0.7048 | |

| 0.18 | 136.40 | 3.2320 | 0.6298 | |

| 0.24 | 118.08 | 2.7979 | 0.6216 | |

| 1.14 | 110.55 | 2.6195 | 0.6049 | |

| 0.29 | 64.45 | 1.5272 | 0.5242 | |

| 0.86 | 107.24 | 2.5412 | 0.4581 | |

| 0.72 | 209.30 | 4.9594 | 0.4198 | |

| 0.27 | 95.17 | 2.2552 | 0.3084 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.68 | 60.57 | 1.4353 | -0.9699 | |

| 0.12 | 20.98 | 0.4971 | -0.9211 | |

| 0.21 | 28.44 | 0.6739 | -0.8958 | |

| 0.66 | 113.74 | 2.6951 | -0.6004 | |

| 0.71 | 132.51 | 3.1398 | -0.5161 | |

| 0.76 | 81.57 | 1.9328 | -0.4940 | |

| 0.96 | 44.63 | 1.0576 | -0.3767 | |

| 0.27 | 46.36 | 1.0986 | -0.3554 | |

| 0.36 | 63.11 | 1.4954 | -0.3550 | |

| 0.94 | 101.82 | 2.4126 | -0.3322 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-05 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | 0.72 | -4.49 | 209.30 | 12.89 | 4.9594 | 0.4198 | |||

| GS / The Goldman Sachs Group, Inc. | 0.21 | 0.19 | 145.82 | 29.81 | 3.4553 | 0.7048 | |||

| META / Meta Platforms, Inc. | 0.18 | 0.22 | 136.40 | 28.34 | 3.2320 | 0.6298 | |||

| ABBV / AbbVie Inc. | 0.71 | 0.17 | 132.51 | -11.26 | 3.1398 | -0.5161 | |||

| PH / Parker-Hannifin Corporation | 0.19 | -10.02 | 131.02 | 3.39 | 3.1046 | 0.0018 | |||

| ABT / Abbott Laboratories | 0.91 | 0.20 | 123.60 | 2.74 | 2.9287 | -0.0169 | |||

| MSFT / Microsoft Corporation | 0.24 | 0.25 | 118.08 | 32.84 | 2.7979 | 0.6216 | |||

| FI / Fiserv, Inc. | 0.66 | 8.24 | 113.74 | -15.50 | 2.6951 | -0.6004 | |||

| DE / Deere & Company | 0.22 | 0.23 | 111.66 | 8.59 | 2.6459 | 0.1281 | |||

| LRCX / Lam Research Corporation | 1.14 | 0.34 | 110.55 | 34.36 | 2.6195 | 0.6049 | |||

| DIS / The Walt Disney Company | 0.86 | 0.32 | 107.24 | 26.05 | 2.5412 | 0.4581 | |||

| V / Visa Inc. | 0.30 | 0.23 | 107.18 | 1.55 | 2.5397 | -0.0446 | |||

| XOM / Exxon Mobil Corporation | 0.94 | 0.20 | 101.82 | -9.18 | 2.4126 | -0.3322 | |||

| HON / Honeywell International Inc. | 0.42 | -14.74 | 98.77 | -6.23 | 2.3403 | -0.2385 | |||

| ETN / Eaton Corporation plc | 0.27 | -8.85 | 95.17 | 19.70 | 2.2552 | 0.3084 | |||

| NOC / Northrop Grumman Corporation | 0.19 | 0.22 | 92.53 | -2.14 | 2.1926 | -0.1225 | |||

| CB / Chubb Limited | 0.31 | 0.26 | 90.63 | -3.82 | 2.1475 | -0.1596 | |||

| C / Citigroup Inc. | 1.01 | 0.33 | 86.20 | 20.30 | 2.0425 | 0.2881 | |||

| MCD / McDonald's Corporation | 0.29 | 0.24 | 84.96 | -6.24 | 2.0131 | -0.2055 | |||

| BAC / Bank of America Corporation | 1.78 | 0.30 | 84.28 | 13.74 | 1.9971 | 0.1828 | |||

| BSX / Boston Scientific Corporation | 0.76 | -22.71 | 81.57 | -17.70 | 1.9328 | -0.4940 | |||

| WMT / Walmart Inc. | 0.79 | 77.61 | 1.8390 | 1.8390 | |||||

| BA / The Boeing Company | 0.35 | 0.42 | 74.30 | 23.38 | 1.7606 | 0.2861 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.99 | 0.32 | 73.46 | -7.93 | 1.7407 | -0.2129 | |||

| NXPI / NXP Semiconductors N.V. | 0.33 | -12.01 | 71.25 | 1.16 | 1.6883 | -0.0363 | |||

| ALL / The Allstate Corporation | 0.35 | 0.34 | 70.82 | -2.45 | 1.6781 | -0.0994 | |||

| CI / The Cigna Group | 0.21 | 0.33 | 70.76 | 0.81 | 1.6768 | -0.0419 | |||

| TJX / The TJX Companies, Inc. | 0.57 | 0.34 | 70.01 | 1.73 | 1.6588 | -0.0261 | |||

| RPRX / Royalty Pharma plc | 1.94 | 0.43 | 69.88 | 16.24 | 1.6558 | 0.1839 | |||

| FCX / Freeport-McMoRan Inc. | 1.53 | 0.40 | 66.20 | 14.96 | 1.5687 | 0.1587 | |||

| ORCL / Oracle Corporation | 0.29 | 0.61 | 64.45 | 57.34 | 1.5272 | 0.5242 | |||

| AVY / Avery Dennison Corporation | 0.36 | -15.31 | 63.11 | -16.50 | 1.4954 | -0.3550 | |||

| CSX / CSX Corporation | 1.89 | -11.77 | 61.59 | -2.18 | 1.4595 | -0.0822 | |||

| CCI / Crown Castle Inc. | 0.60 | 0.45 | 61.38 | -0.99 | 1.4545 | -0.0635 | |||

| COP / ConocoPhillips | 0.68 | -27.84 | 60.57 | -38.34 | 1.4353 | -0.9699 | |||

| UNH / UnitedHealth Group Incorporated | 0.19 | 76.75 | 59.99 | 5.28 | 1.4215 | 0.0263 | |||

| DD / DuPont de Nemours, Inc. | 0.85 | 0.37 | 58.16 | -7.82 | 1.3782 | -0.1667 | |||

| CACI / CACI International Inc | 0.12 | 0.61 | 55.28 | 30.71 | 1.3100 | 0.2744 | |||

| HD / The Home Depot, Inc. | 0.15 | 0.41 | 53.26 | 0.46 | 1.2621 | -0.0361 | |||

| MRK / Merck & Co., Inc. | 0.64 | -5.95 | 50.54 | -17.06 | 1.1975 | -0.2943 | |||

| PHM / PulteGroup, Inc. | 0.46 | 0.53 | 48.32 | 3.13 | 1.1450 | -0.0022 | |||

| PG / The Procter & Gamble Company | 0.29 | 0.48 | 46.55 | -6.06 | 1.1031 | -0.1103 | |||

| DLR / Digital Realty Trust, Inc. | 0.27 | -35.83 | 46.36 | -21.93 | 1.0986 | -0.3554 | |||

| TFC / Truist Financial Corporation | 1.06 | -16.36 | 45.42 | -12.62 | 1.0762 | -0.1964 | |||

| BMY / Bristol-Myers Squibb Company | 0.96 | 0.39 | 44.63 | -23.81 | 1.0576 | -0.3767 | |||

| TRU / TransUnion | 0.41 | 0.78 | 36.26 | 6.87 | 0.8593 | 0.0284 | |||

| TMUS / T-Mobile US, Inc. | 0.14 | 32.95 | 0.7808 | 0.7808 | |||||

| FANG / Diamondback Energy, Inc. | 0.21 | -48.38 | 28.44 | -55.64 | 0.6739 | -0.8958 | |||

| CNC / Centene Corporation | 0.48 | -23.08 | 25.95 | -31.23 | 0.6150 | -0.3091 | |||

| LKQ / LKQ Corporation | 0.68 | 0.96 | 25.20 | -12.16 | 0.5970 | -0.1053 | |||

| KHC / The Kraft Heinz Company | 0.91 | 0.94 | 23.45 | -14.35 | 0.5557 | -0.1147 | |||

| GOOG / Alphabet Inc. | 0.12 | -68.10 | 20.98 | -63.78 | 0.4971 | -0.9211 | |||

| FSS / Federal Signal Corporation | 0.08 | -12.88 | 8.93 | 26.05 | 0.2116 | 0.0381 | |||

| AEIS / Advanced Energy Industries, Inc. | 0.06 | 0.00 | 7.91 | 39.03 | 0.1873 | 0.0481 | |||

| KNSL / Kinsale Capital Group, Inc. | 0.02 | 0.00 | 7.90 | -0.58 | 0.1872 | -0.0074 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.03 | -9.97 | 7.56 | -7.13 | 0.1792 | -0.0202 | |||

| ESAB / ESAB Corporation | 0.06 | 0.00 | 7.21 | 3.48 | 0.1707 | 0.0002 | |||

| DSGX / The Descartes Systems Group Inc. | 0.07 | -5.19 | 7.05 | -4.42 | 0.1671 | -0.0136 | |||

| HAYW / Hayward Holdings, Inc. | 0.44 | 0.00 | 6.13 | -0.86 | 0.1453 | -0.0061 | |||

| AVNT / Avient Corporation | 0.18 | 0.00 | 5.97 | -13.05 | 0.1414 | -0.0266 | |||

| QTWO / Q2 Holdings, Inc. | 0.06 | 0.00 | 5.83 | 16.97 | 0.1382 | 0.0161 | |||

| GIL / Gildan Activewear Inc. | 0.12 | 0.00 | 5.83 | 11.36 | 0.1380 | 0.0099 | |||

| NVST / Envista Holdings Corporation | 0.29 | 0.00 | 5.75 | 13.21 | 0.1363 | 0.0119 | |||

| FBK / FB Financial Corporation | 0.12 | -13.97 | 5.63 | -15.94 | 0.1335 | -0.0306 | |||

| PLXS / Plexus Corp. | 0.04 | 0.00 | 5.52 | 5.61 | 0.1308 | 0.0028 | |||

| ITGR / Integer Holdings Corporation | 0.04 | 0.00 | 5.00 | 4.21 | 0.1185 | 0.0010 | |||

| IRTC / iRhythm Technologies, Inc. | 0.03 | 0.00 | 4.99 | 47.10 | 0.1182 | 0.0352 | |||

| GBCI / Glacier Bancorp, Inc. | 0.11 | -6.25 | 4.84 | -8.68 | 0.1148 | -0.0151 | |||

| JBTM / JBT Marel Corporation | 0.04 | 0.00 | 4.77 | -1.59 | 0.1131 | -0.0057 | |||

| LNTH / Lantheus Holdings, Inc. | 0.06 | 0.00 | 4.76 | -16.13 | 0.1129 | -0.0262 | |||

| CADE / Cadence Bank | 0.15 | -6.54 | 4.71 | -1.57 | 0.1115 | -0.0055 | |||

| GMED / Globus Medical, Inc. | 0.08 | 0.00 | 4.50 | -19.37 | 0.1067 | -0.0301 | |||

| AUB / Atlantic Union Bankshares Corporation | 0.14 | -6.56 | 4.36 | -6.13 | 0.1034 | -0.0104 | |||

| KAR / OPENLANE, Inc. | 0.18 | 0.00 | 4.29 | 26.82 | 0.1017 | 0.0188 | |||

| FIX / Comfort Systems USA, Inc. | 0.01 | -50.36 | 4.18 | -17.41 | 0.0990 | -0.0249 | |||

| KEX / Kirby Corporation | 0.04 | 0.00 | 4.08 | 12.27 | 0.0967 | 0.0077 | |||

| ECPG / Encore Capital Group, Inc. | 0.10 | -27.09 | 3.78 | -17.66 | 0.0896 | -0.0229 | |||

| DIOD / Diodes Incorporated | 0.07 | 0.00 | 3.63 | 22.50 | 0.0861 | 0.0135 | |||

| ESI / Element Solutions Inc | 0.16 | 0.00 | 3.55 | 0.17 | 0.0840 | -0.0026 | |||

| CWK / Cushman & Wakefield plc | 0.32 | 0.00 | 3.54 | 8.32 | 0.0839 | 0.0039 | |||

| CCCS / CCC Intelligent Solutions Holdings Inc. | 0.37 | 36.00 | 3.52 | 41.72 | 0.0834 | 0.0226 | |||

| ONB / Old National Bancorp | 0.15 | 149.57 | 3.13 | 151.49 | 0.0741 | 0.0436 | |||

| DBRG / DigitalBridge Group, Inc. | 0.30 | 3.62 | 3.08 | 21.63 | 0.0730 | 0.0110 | |||

| YETI / YETI Holdings, Inc. | 0.10 | 0.00 | 3.00 | -4.79 | 0.0712 | -0.0061 | |||

| NOG / Northern Oil and Gas, Inc. | 0.10 | 0.00 | 2.83 | -6.20 | 0.0670 | -0.0068 | |||

| HQY / HealthEquity, Inc. | 0.03 | 2.82 | 0.0668 | 0.0668 | |||||

| TGI / Triumph Group, Inc. | 0.11 | -31.27 | 2.78 | -30.16 | 0.0660 | -0.0316 | |||

| VRRM / Verra Mobility Corporation | 0.11 | 17.29 | 2.77 | 32.32 | 0.0657 | 0.0144 | |||

| ENOV / Enovis Corporation | 0.08 | 0.00 | 2.43 | -17.94 | 0.0576 | -0.0149 | |||

| ACLS / Axcelis Technologies, Inc. | 0.03 | 0.00 | 2.38 | 40.34 | 0.0565 | 0.0149 | |||

| KBH / KB Home | 0.04 | 0.00 | 2.29 | -8.84 | 0.0542 | -0.0073 | |||

| PR / Permian Resources Corporation | 0.16 | 0.00 | 2.23 | -1.67 | 0.0529 | -0.0027 | |||

| MTDR / Matador Resources Company | 0.04 | 0.00 | 2.08 | -6.60 | 0.0493 | -0.0052 | |||

| ADMA / ADMA Biologics, Inc. | 0.11 | 1.97 | 0.0468 | 0.0468 | |||||

| SVV / Savers Value Village, Inc. | 0.19 | 0.00 | 1.91 | 47.79 | 0.0452 | 0.0136 | |||

| MEDP / Medpace Holdings, Inc. | 0.01 | 0.00 | 1.80 | 3.03 | 0.0428 | -0.0001 | |||

| KTB / Kontoor Brands, Inc. | 0.03 | 0.00 | 1.74 | 2.84 | 0.0413 | -0.0002 | |||

| MBUU / Malibu Boats, Inc. | 0.05 | 0.00 | 1.51 | 2.17 | 0.0358 | -0.0004 | |||

| VVV / Valvoline Inc. | 0.03 | 1.27 | 0.0301 | 0.0301 | |||||

| HGV / Hilton Grand Vacations Inc. | 0.03 | 0.00 | 1.25 | 10.96 | 0.0295 | 0.0020 | |||

| LOB / Live Oak Bancshares, Inc. | 0.03 | 0.00 | 1.02 | 11.77 | 0.0241 | 0.0018 | |||

| SM / SM Energy Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DEA / Easterly Government Properties, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |