Mga Batayang Estadistika

| Nilai Portofolio | $ 675,506,871 |

| Posisi Saat Ini | 43 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

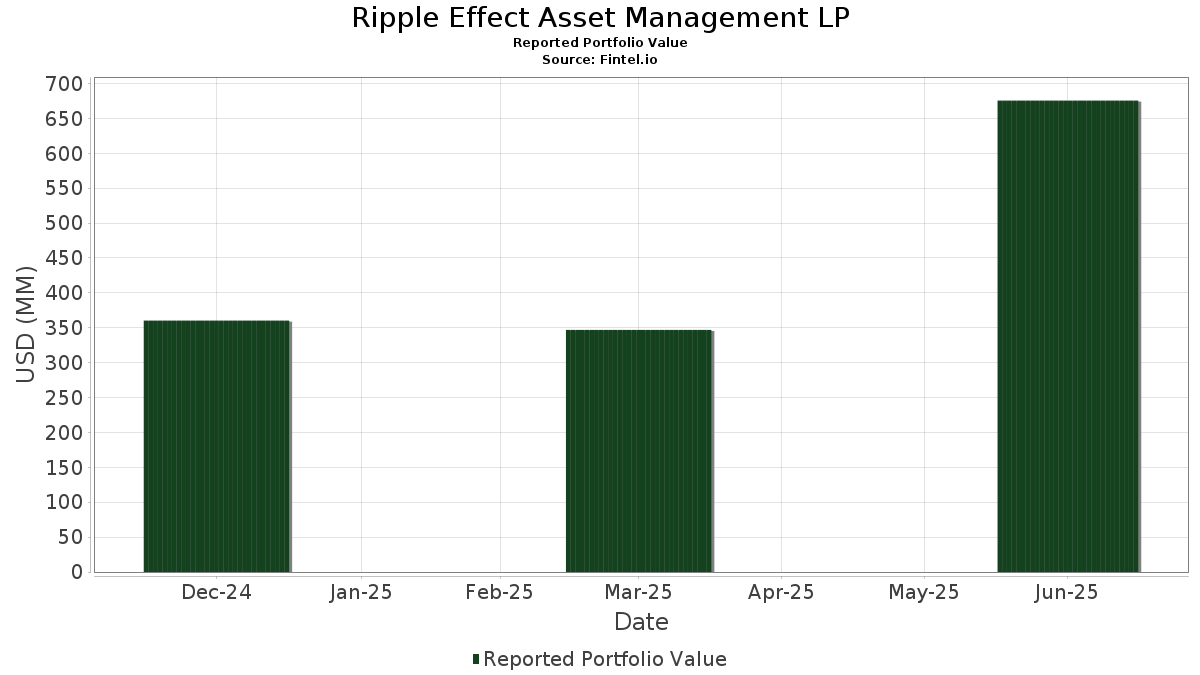

Ripple Effect Asset Management LP telah mengungkapkan total kepemilikan 43 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 675,506,871 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Ripple Effect Asset Management LP adalah SPDR S&P 500 ETF (US:SPY) , iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) , Vistra Corp. (US:VST) , EQT Corporation (US:EQT) , and Vistra Corp. (US:VST) . Posisi baru Ripple Effect Asset Management LP meliputi: Talen Energy Corporation (US:TLNE) , Cheniere Energy, Inc. (US:LNG) , Vertiv Holdings Co (US:VRT) , The Williams Companies, Inc. (US:WMB) , and SPDR Gold Trust (US:GLD) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.30 | 185.35 | 27.4394 | 15.3456 | |

| 0.17 | 32.95 | 4.8775 | 2.8463 | |

| 0.48 | 27.99 | 4.1441 | 2.6039 | |

| 0.06 | 17.45 | 2.5827 | 2.5827 | |

| 0.06 | 14.61 | 2.1630 | 2.1630 | |

| 0.11 | 14.13 | 2.0910 | 2.0910 | |

| 0.20 | 12.56 | 1.8596 | 1.8596 | |

| 0.04 | 12.19 | 1.8050 | 1.8050 | |

| 0.05 | 12.18 | 1.8025 | 1.8025 | |

| 0.04 | 11.62 | 1.7201 | 1.7201 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.75 | 60.49 | 8.9544 | -5.8272 | |

| 0.00 | 0.00 | -4.6205 | ||

| 0.00 | 0.00 | -2.7284 | ||

| 0.17 | 6.66 | 0.9863 | -2.6891 | |

| 0.12 | 4.69 | 0.6940 | -2.5089 | |

| 0.10 | 8.06 | 1.1939 | -1.9443 | |

| 0.06 | 15.99 | 2.3675 | -1.1723 | |

| 0.35 | 1.49 | 0.2212 | -0.5775 | |

| 0.14 | 27.60 | 4.0856 | -0.5185 | |

| 0.00 | 0.00 | -0.2339 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 0.30 | 300.00 | 185.35 | 341.81 | 27.4394 | 15.3456 | ||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | Put | 0.75 | 15.38 | 60.49 | 17.96 | 8.9544 | -5.8272 | ||

| VST / Vistra Corp. | Put | 0.17 | 183.33 | 32.95 | 367.60 | 4.8775 | 2.8463 | ||

| EQT / EQT Corporation | Put | 0.48 | 380.00 | 27.99 | 423.92 | 4.1441 | 2.6039 | ||

| VST / Vistra Corp. | 0.14 | 4.71 | 27.60 | 72.80 | 4.0856 | -0.5185 | |||

| EQT / EQT Corporation | 0.47 | 121.43 | 27.12 | 141.69 | 4.0146 | 0.7802 | |||

| TLNE / Talen Energy Corporation | Put | 0.06 | 17.45 | 2.5827 | 2.5827 | ||||

| TLNE / Talen Energy Corporation | 0.06 | -10.57 | 15.99 | 30.24 | 2.3675 | -1.1723 | |||

| LNG / Cheniere Energy, Inc. | Put | 0.06 | 14.61 | 2.1630 | 2.1630 | ||||

| VRT / Vertiv Holdings Co | Put | 0.11 | 14.13 | 2.0910 | 2.0910 | ||||

| WMB / The Williams Companies, Inc. | Put | 0.20 | 12.56 | 1.8596 | 1.8596 | ||||

| GLD / SPDR Gold Trust | Put | 0.04 | 12.19 | 1.8050 | 1.8050 | ||||

| LNG / Cheniere Energy, Inc. | 0.05 | 12.18 | 1.8025 | 1.8025 | |||||

| CEG / Constellation Energy Corporation | Put | 0.04 | 11.62 | 1.7201 | 1.7201 | ||||

| GLD / SPDR Gold Trust | 0.04 | 10.99 | 1.6263 | 1.6263 | |||||

| CCJ / Cameco Corporation | Put | 0.14 | 10.39 | 1.5384 | 1.5384 | ||||

| GLD / SPDR Gold Trust | Call | 0.03 | 9.91 | 1.4666 | 1.4666 | ||||

| KGS / Kodiak Gas Services, Inc. | Put | 0.28 | 9.42 | 1.3951 | 1.3951 | ||||

| AR / Antero Resources Corporation | Call | 0.23 | 9.06 | 1.3417 | 1.3417 | ||||

| XIFR / XPLR Infrastructure, LP - Limited Partnership | Put | 1.10 | 9.02 | 1.3353 | 1.3353 | ||||

| EXE / Expand Energy Corporation | Put | 0.07 | 8.77 | 1.2984 | 1.2984 | ||||

| EXE / Expand Energy Corporation | 0.07 | 8.77 | 1.2984 | 1.2984 | |||||

| GEV / GE Vernova Inc. | Put | 0.02 | 8.73 | 1.2925 | 1.2925 | ||||

| FCX / Freeport-McMoRan Inc. | Put | 0.20 | 8.67 | 1.2835 | 1.2835 | ||||

| VRT / Vertiv Holdings Co | 0.07 | 8.39 | 1.2413 | 1.2413 | |||||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.10 | -27.54 | 8.06 | -25.91 | 1.1939 | -1.9443 | |||

| GEV / GE Vernova Inc. | 0.01 | 7.94 | 1.1750 | 1.1750 | |||||

| CCJ / Cameco Corporation | 0.10 | 7.79 | 1.1538 | 1.1538 | |||||

| WMB / The Williams Companies, Inc. | 0.11 | 7.10 | 1.0507 | 1.0507 | |||||

| CEG / Constellation Energy Corporation | 0.02 | 7.04 | 1.0416 | 1.0416 | |||||

| KGS / Kodiak Gas Services, Inc. | 0.20 | 6.85 | 1.0146 | 1.0146 | |||||

| TECK / Teck Resources Limited | Put | 0.17 | -52.86 | 6.66 | -47.75 | 0.9863 | -2.6891 | ||

| XIFR / XPLR Infrastructure, LP - Limited Partnership | 0.75 | 6.18 | 0.9142 | 0.9142 | |||||

| URA / Global X Funds - Global X Uranium ETF | Put | 0.15 | 5.82 | 0.8618 | 0.8618 | ||||

| TLNE / Talen Energy Corporation | Call | 0.02 | 5.82 | 0.8609 | 0.8609 | ||||

| NRG / NRG Energy, Inc. | Put | 0.03 | 5.22 | 0.7726 | 0.7726 | ||||

| FCX / Freeport-McMoRan Inc. | 0.12 | 5.18 | 0.7662 | 0.7662 | |||||

| TECK / Teck Resources Limited | 0.12 | -61.93 | 4.69 | -57.81 | 0.6940 | -2.5089 | |||

| HUT / Hut 8 Corp. | Call | 0.25 | 4.65 | 0.6884 | 0.6884 | ||||

| FSLR / First Solar, Inc. | Call | 0.02 | 3.81 | 0.5636 | 0.5636 | ||||

| NRG / NRG Energy, Inc. | 0.02 | 3.45 | 0.5111 | 0.5111 | |||||

| CORZ / Core Scientific, Inc. | Call | 0.20 | 3.41 | 0.5054 | 0.5054 | ||||

| NGL / NGL Energy Partners LP - Limited Partnership | Call | 0.35 | -42.65 | 1.49 | -46.06 | 0.2212 | -0.5775 | ||

| FCX / Freeport-McMoRan Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -2.7284 | |||

| EQT / EQT Corporation | Call | 0.00 | -100.00 | 0.00 | -100.00 | -4.6205 | |||

| ET / Energy Transfer LP - Limited Partnership | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AM / Antero Midstream Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GM / General Motors Company | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| NGL / NGL Energy Partners LP - Limited Partnership | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.2339 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AM / Antero Midstream Corporation | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| F / Ford Motor Company | Call | 0.00 | -100.00 | 0.00 | 0.0000 |