Mga Batayang Estadistika

| Nilai Portofolio | $ 292,039,387 |

| Posisi Saat Ini | 37 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

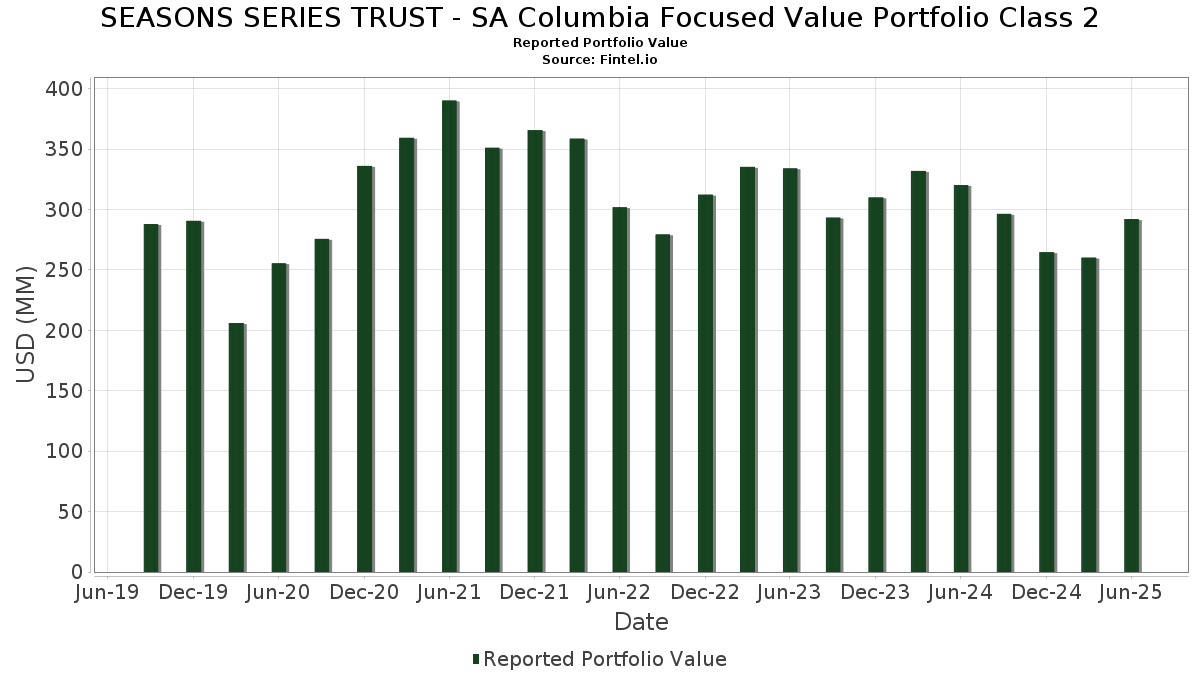

SEASONS SERIES TRUST - SA Columbia Focused Value Portfolio Class 2 telah mengungkapkan total kepemilikan 37 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 292,039,387 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SEASONS SERIES TRUST - SA Columbia Focused Value Portfolio Class 2 adalah Applied Materials, Inc. (US:AMAT) , Verizon Communications Inc. (US:VZ) , Corning Incorporated (US:GLW) , The Boeing Company (US:BA) , and Citigroup Inc. (US:C) . Posisi baru SEASONS SERIES TRUST - SA Columbia Focused Value Portfolio Class 2 meliputi: Constellation Brands, Inc. (US:STZ) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 6.49 | 2.2215 | 2.2215 | |

| 4.27 | 1.4625 | 1.4625 | ||

| 0.06 | 11.31 | 3.8718 | 0.9691 | |

| 0.21 | 10.98 | 3.7599 | 0.9049 | |

| 0.02 | 8.67 | 2.9678 | 0.8262 | |

| 0.05 | 8.78 | 3.0074 | 0.7812 | |

| 0.06 | 9.10 | 3.1178 | 0.4518 | |

| 0.06 | 8.71 | 2.9826 | 0.4299 | |

| 0.12 | 9.94 | 3.4028 | 0.4039 | |

| 0.03 | 9.92 | 3.3975 | 0.3598 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.14 | 6.59 | 2.2584 | -0.8859 | |

| 0.16 | 5.17 | 1.7705 | -0.7393 | |

| 0.02 | 6.35 | 2.1737 | -0.6124 | |

| 0.26 | 11.15 | 3.8190 | -0.6032 | |

| 0.13 | 8.92 | 3.0559 | -0.5818 | |

| 0.05 | 6.83 | 2.3389 | -0.5207 | |

| 0.16 | 5.15 | 1.7641 | -0.5125 | |

| 0.05 | 9.95 | 3.4062 | -0.4637 | |

| 0.12 | 6.66 | 2.2794 | -0.4146 | |

| 0.05 | 8.54 | 2.9255 | -0.4101 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMAT / Applied Materials, Inc. | 0.06 | 18.75 | 11.31 | 49.81 | 3.8718 | 0.9691 | |||

| VZ / Verizon Communications Inc. | 0.26 | 1.67 | 11.15 | -3.01 | 3.8190 | -0.6032 | |||

| GLW / Corning Incorporated | 0.21 | 28.75 | 10.98 | 47.91 | 3.7599 | 0.9049 | |||

| BA / The Boeing Company | 0.05 | -19.54 | 9.95 | -1.15 | 3.4062 | -0.4637 | |||

| C / Citigroup Inc. | 0.12 | 6.28 | 9.94 | 27.44 | 3.4028 | 0.4039 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 6.28 | 9.92 | 25.62 | 3.3975 | 0.3598 | |||

| FCX / Freeport-McMoRan Inc. | 0.22 | -5.83 | 9.70 | 7.81 | 3.3227 | -0.1383 | |||

| AMT / American Tower Corporation | 0.04 | 6.28 | 9.57 | 7.95 | 3.2782 | -0.1324 | |||

| AES / The AES Corporation | 0.91 | 37.01 | 9.57 | 16.05 | 3.2760 | 0.1056 | |||

| FTI / TechnipFMC plc | 0.27 | 6.38 | 9.43 | 15.61 | 3.2312 | 0.0924 | |||

| RTX / RTX Corporation | 0.06 | 19.14 | 9.10 | 31.34 | 3.1178 | 0.4518 | |||

| EPAM / EPAM Systems, Inc. | 0.05 | 15.59 | 8.99 | 21.05 | 3.0803 | 0.2224 | |||

| CVS / CVS Health Corporation | 0.13 | -7.34 | 8.92 | -5.66 | 3.0559 | -0.5818 | |||

| THC / Tenet Healthcare Corporation | 0.05 | 15.95 | 8.78 | 51.74 | 3.0074 | 0.7812 | |||

| LOW / Lowe's Companies, Inc. | 0.04 | 6.28 | 8.76 | 1.11 | 2.9986 | -0.3323 | |||

| MS / Morgan Stanley | 0.06 | 8.69 | 8.71 | 31.22 | 2.9826 | 0.4299 | |||

| CAT / Caterpillar Inc. | 0.02 | 32.22 | 8.67 | 55.62 | 2.9678 | 0.8262 | |||

| BAC / Bank of America Corporation | 0.18 | 6.28 | 8.64 | 20.52 | 2.9574 | 0.2015 | |||

| PM / Philip Morris International Inc. | 0.05 | -14.15 | 8.54 | -1.50 | 2.9255 | -0.4101 | |||

| PCG / PG&E Corporation | 0.61 | 21.57 | 8.53 | -1.35 | 2.9218 | -0.4049 | |||

| MET / MetLife, Inc. | 0.11 | 6.28 | 8.49 | 6.46 | 2.9067 | -0.1599 | |||

| QCOM / QUALCOMM Incorporated | 0.05 | 6.28 | 8.06 | 10.18 | 2.7606 | -0.0531 | |||

| WMB / The Williams Companies, Inc. | 0.12 | -6.52 | 7.29 | -1.74 | 2.4964 | -0.3570 | |||

| MPC / Marathon Petroleum Corporation | 0.04 | 6.28 | 7.10 | 21.17 | 2.4326 | 0.1780 | |||

| WFC / Wells Fargo & Company | 0.09 | 6.28 | 6.91 | 18.60 | 2.3676 | 0.1258 | |||

| CVX / Chevron Corporation | 0.05 | 7.32 | 6.83 | -8.14 | 2.3389 | -0.5207 | |||

| CNC / Centene Corporation | 0.12 | 6.28 | 6.66 | -4.98 | 2.2794 | -0.4146 | |||

| BMY / Bristol-Myers Squibb Company | 0.14 | 6.28 | 6.59 | -19.33 | 2.2584 | -0.8859 | |||

| STZ / Constellation Brands, Inc. | 0.04 | 6.49 | 2.2215 | 2.2215 | |||||

| CI / The Cigna Group | 0.02 | -12.80 | 6.35 | -12.38 | 2.1737 | -0.6124 | |||

| GOOGL / Alphabet Inc. | 0.03 | 12.07 | 6.14 | 27.72 | 2.1021 | 0.2537 | |||

| B / Barrick Mining Corporation | 0.28 | 9.41 | 5.90 | 17.18 | 2.0212 | 0.0839 | |||

| CSX / CSX Corporation | 0.16 | -28.54 | 5.17 | -20.78 | 1.7705 | -0.7393 | |||

| LUV / Southwest Airlines Co. | 0.16 | -9.92 | 5.15 | -12.96 | 1.7641 | -0.5125 | |||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 4.27 | 1.4625 | 1.4625 | ||||||

| TDC / Teradata Corporation | 0.13 | -14.91 | 2.79 | -15.54 | 0.9553 | -0.3151 | |||

| FE / FirstEnergy Corp. | 0.07 | 6.28 | 2.70 | 5.87 | 0.9261 | -0.0564 |