Mga Batayang Estadistika

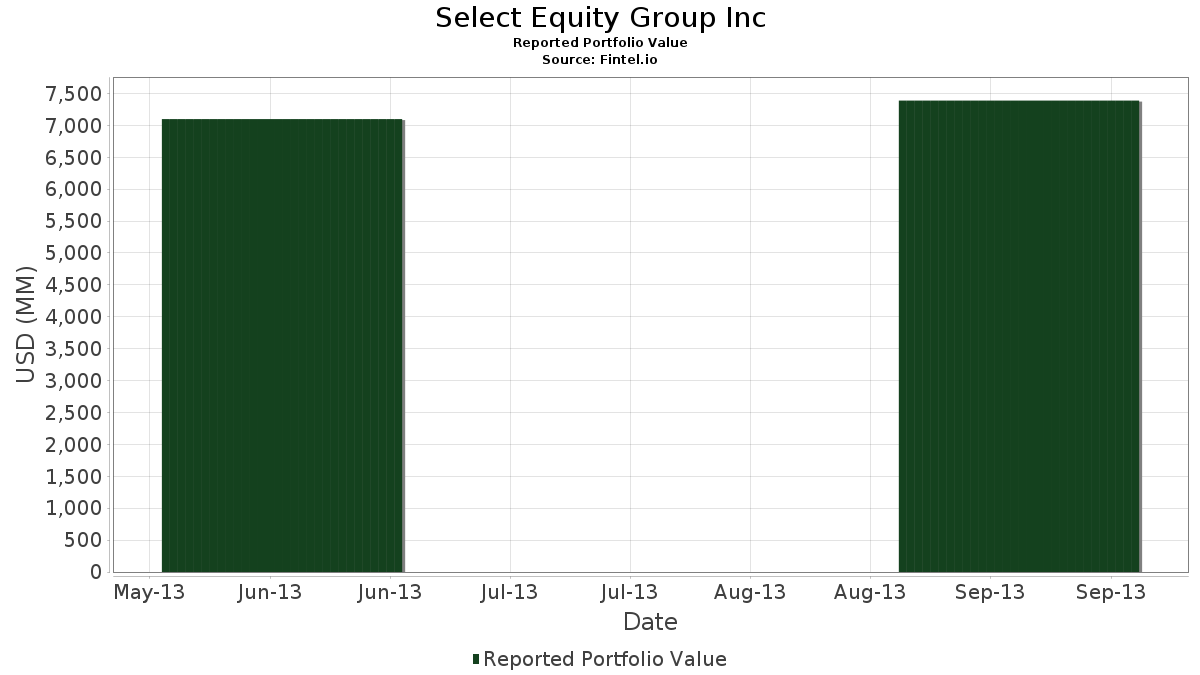

| Nilai Portofolio | $ 7,388,968,453 |

| Posisi Saat Ini | 88 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Select Equity Group Inc telah mengungkapkan total kepemilikan 88 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 7,388,968,453 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Select Equity Group Inc adalah Harley-Davidson, Inc. (US:HOG) , O'Reilly Automotive, Inc. (US:ORLY) , The Sherwin-Williams Company (US:SHW) , DENTSPLY SIRONA Inc. (US:XRAY) , and Kirby Corporation (US:KEX) . Posisi baru Select Equity Group Inc meliputi: Banco Santander, S.A. - Depositary Receipt (Common Stock) (US:SAN) , Mead Johnson Nutrition Co. (US:MJN) , Fiserv, Inc. (US:FI) , Walter Investment Management Corp. (US:WAC) , and SPDR S&P 500 ETF (US:SPY) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 4.95 | 318.15 | 4.3058 | 4.3058 | |

| 1.64 | 299.25 | 4.0499 | 4.0499 | |

| 6.36 | 276.10 | 3.7366 | 3.7366 | |

| 3.10 | 268.53 | 3.6342 | 3.6342 | |

| 1.87 | 243.05 | 3.2894 | 3.2894 | |

| 4.28 | 240.52 | 3.2551 | 3.2551 | |

| 3.22 | 230.94 | 3.1255 | 3.1255 | |

| 5.52 | 206.37 | 2.7929 | 2.7929 | |

| 0.39 | 199.96 | 2.7061 | 2.7061 | |

| 2.54 | 195.79 | 2.6498 | 2.6498 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.74 | 50.04 | 0.6772 | -0.4213 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2013-11-14 untuk periode pelaporan 2013-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HOG / Harley-Davidson, Inc. | 4.95 | -2.21 | 318.15 | 14.59 | 4.3058 | 4.3058 | |||

| ORLY / O'Reilly Automotive, Inc. | 2.42 | 19.84 | 308.34 | 35.77 | 4.1730 | 0.9738 | |||

| SHW / The Sherwin-Williams Company | 1.64 | 26.36 | 299.25 | 30.35 | 4.0499 | 4.0499 | |||

| XRAY / DENTSPLY SIRONA Inc. | 6.36 | 2.28 | 276.10 | 8.41 | 3.7366 | 3.7366 | |||

| KEX / Kirby Corporation | 3.10 | 1.29 | 268.53 | 10.22 | 3.6342 | 3.6342 | |||

| MHK / Mohawk Industries, Inc. | 1.87 | 0.64 | 243.05 | 16.53 | 3.2894 | 3.2894 | |||

| WSM / Williams-Sonoma, Inc. | 4.28 | -0.02 | 240.52 | 0.53 | 3.2551 | 3.2551 | |||

| SIG / Signet Jewelers Limited | 3.22 | 7.98 | 230.94 | 14.74 | 3.1255 | 3.1255 | |||

| BAMH / Brookfield Finance Inc - 4.625% NT REDEEM 16/10/2080 USD 25 | 5.52 | 9.11 | 206.37 | 13.29 | 2.7929 | 2.7929 | |||

| MKL / Markel Group Inc. | 0.39 | 0.91 | 199.96 | -0.85 | 2.7061 | 2.7061 | |||

| PALL / abrdn Palladium ETF Trust - abrdn Physical Palladium Shares ETF | 2.54 | -0.64 | 195.79 | 15.23 | 2.6498 | 2.6498 | |||

| WWW / Wolverine World Wide, Inc. | 3.25 | -22.68 | 189.37 | -17.55 | 2.5628 | 2.5628 | |||

| 451734107 / IHS, Inc. | 1.46 | 3.41 | 166.77 | 13.12 | 2.2570 | 0.1801 | |||

| GRMN / Garmin Ltd. | 3.67 | 2.54 | 166.05 | 28.12 | 2.2473 | 2.2473 | |||

| MSM / MSC Industrial Direct Co., Inc. | 2.03 | 0.03 | 164.93 | 5.06 | 2.2321 | 2.2321 | |||

| MCRS / | 3.20 | 1.52 | 159.73 | 17.50 | 2.1617 | 2.1617 | |||

| ARG / Airgas, Inc. | 1.46 | 2.13 | 154.60 | 13.46 | 2.0923 | 2.0923 | |||

| / TD AmeriTrade Holding Corp. | Call | 5.83 | -30.38 | 152.76 | -24.96 | 2.0674 | 2.0674 | ||

| APH / Amphenol Corporation | 1.92 | -12.21 | 148.55 | -12.84 | 2.0104 | 2.0104 | |||

| CAB / Cabela's Incorporated | 2.32 | 111.08 | 146.30 | 105.44 | 1.9799 | 1.9799 | |||

| TDG / TransDigm Group Incorporated | 1.05 | 1.49 | 145.34 | -10.21 | 1.9670 | 1.9670 | |||

| TPX / Somnigroup International Inc. | 3.11 | 1,784.91 | 136.80 | 1,787.72 | 1.8514 | 1.8514 | |||

| FRC / First Republic Bank | 2.90 | -1.07 | 135.38 | 19.88 | 1.8322 | 1.8322 | |||

| AXLL / Axiall Corporation | 3.38 | 528.89 | 127.84 | 458.14 | 1.7302 | 1.7302 | |||

| NSM / Nationstar Mortgage Holdings Inc. | 2.22 | -7.92 | 124.64 | 38.29 | 1.6869 | 1.6869 | |||

| PBF / PBF Energy Inc. | 5.45 | 73.27 | 122.33 | 50.19 | 1.6556 | 1.6556 | |||

| CBRE / CBRE Group, Inc. | 5.18 | -18.99 | 119.88 | -19.79 | 1.6225 | 1.6225 | |||

| PAYX / Paychex, Inc. | 2.75 | -1.01 | 111.71 | 10.19 | 1.5119 | 1.5119 | |||

| US2692464017 / E*TRADE Financial, Inc. | 6.57 | -14.17 | 108.35 | 11.86 | 1.4664 | 1.4664 | |||

| SNI / Scripps Networks Interactive, Inc. | 1.34 | -18.16 | 104.85 | -4.24 | 1.4190 | 1.4190 | |||

| ESINQ / ITT Educational Services, Inc. | 3.26 | -1.60 | 101.04 | 25.01 | 1.3675 | 1.3675 | |||

| TAM / | 4.67 | 0.66 | 94.80 | 0.22 | 1.2830 | 1.2830 | |||

| BX / Blackstone Inc. | Call | 3.73 | -22.72 | 92.78 | -8.67 | 1.2556 | 1.2556 | ||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | Call | 10.74 | 87.75 | 1.1875 | 1.1875 | ||||

| AME / AMETEK, Inc. | 1.86 | -15.75 | 85.75 | -8.34 | 1.1606 | 1.1606 | |||

| BX / Blackstone Inc. | 3.34 | 23.50 | 83.08 | 45.96 | 1.1243 | 1.1243 | |||

| INTU / Intuit Inc. | 1.20 | -28.23 | 79.42 | -22.03 | 1.0748 | 1.0748 | |||

| MJN / Mead Johnson Nutrition Co. | 0.97 | 71.72 | 0.9706 | 0.9706 | |||||

| / TD AmeriTrade Holding Corp. | 2.73 | -25.75 | 71.47 | -19.97 | 0.9672 | 0.9672 | |||

| VSI / Vitamin Shoppe, Inc. | 1.55 | -33.15 | 67.72 | -34.77 | 0.9165 | 0.9165 | |||

| FI / Fiserv, Inc. | 1.98 | 59.23 | 0.8017 | 0.8017 | |||||

| PKI / Revvity Inc. | 1.50 | 5.00 | 56.46 | 21.96 | 0.7640 | 0.7640 | |||

| BRKR / Bruker Corporation | 2.65 | -15.45 | 54.79 | 8.11 | 0.7415 | 0.7415 | |||

| BERY / Berry Global Group, Inc. | 2.60 | -46.68 | 51.86 | -51.75 | 0.7019 | 0.7019 | |||

| SIRO / Sirona Dental Systems, Inc. | 0.75 | 410.60 | 50.40 | 418.78 | 0.6821 | 0.6821 | |||

| HEI / HEICO Corporation | 0.74 | -52.29 | 50.04 | -35.83 | 0.6772 | -0.4213 | |||

| KKR / KKR & Co. Inc. | Call | 2.39 | 0.00 | 49.11 | 4.68 | 0.6646 | 0.6646 | ||

| MRC / MRC Global Inc. | 1.67 | -59.23 | 44.78 | -60.44 | 0.6061 | 0.6061 | |||

| KKR / KKR & Co. Inc. | 2.13 | 30.03 | 43.84 | 36.11 | 0.5933 | 0.5933 | |||

| DHR / Danaher Corporation | 0.60 | -22.49 | 41.25 | -15.12 | 0.5583 | 0.5583 | |||

| TPL / Texas Pacific Land Corporation | 0.45 | -18.77 | 38.16 | -18.64 | 0.5164 | 0.5164 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.58 | 101.61 | 34.54 | 113.35 | 0.4675 | 0.4675 | |||

| LII / Lennox International Inc. | 0.46 | -59.63 | 34.44 | -52.93 | 0.4661 | 0.4661 | |||

| WAC / Walter Investment Management Corp. | 0.86 | 34.14 | 0.4620 | 0.4620 | |||||

| SPY / SPDR S&P 500 ETF | Put | 0.20 | 33.69 | 0.4559 | 0.4559 | ||||

| BKD / Brookdale Senior Living Inc. | 1.09 | 139.81 | 28.75 | 138.56 | 0.3891 | 0.3891 | |||

| US21871D1037 / Corelogic Inc | 1.01 | 27.30 | 0.3695 | 0.3695 | |||||

| MTG / MGIC Investment Corporation | Call | 3.64 | -21.69 | 26.51 | -6.07 | 0.3588 | 0.3588 | ||

| TMO / Thermo Fisher Scientific Inc. | 0.29 | -12.17 | 26.47 | -4.36 | 0.3583 | 0.3583 | |||

| FSV / FirstService Corporation | 0.63 | -19.25 | 24.58 | 0.14 | 0.3326 | 0.3326 | |||

| CCI / Crown Castle Inc. | 0.30 | 158.75 | 21.83 | 161.06 | 0.2954 | 0.2954 | |||

| BLT / Blount International, Inc. | 1.59 | 5.63 | 19.31 | 8.22 | 0.2614 | 0.2614 | |||

| ADSK / Autodesk, Inc. | Call | 0.45 | 18.65 | 0.2524 | 0.2524 | ||||

| MTW / The Manitowoc Company, Inc. | Call | 0.93 | 18.11 | 0.2451 | 0.2451 | ||||

| SEIC / SEI Investments Company | 0.53 | -51.12 | 16.46 | -46.85 | 0.2228 | 0.2228 | |||

| WMAR / West Marine, Inc. | 1.34 | 1.10 | 16.21 | 11.40 | 0.2194 | 0.2194 | |||

| AIG / American International Group, Inc. | 0.31 | 51.87 | 15.11 | 65.24 | 0.2045 | 0.2045 | |||

| ROST / Ross Stores, Inc. | 0.20 | 33.62 | 14.73 | 50.10 | 0.1994 | 0.1994 | |||

| RL / Ralph Lauren Corporation | 0.08 | 13.98 | 0.1892 | 0.1892 | |||||

| MDLZ / Mondelez International, Inc. | 0.37 | 33.21 | 11.76 | 46.71 | 0.1591 | 0.1591 | |||

| BEL / Belmond Ltd. | 0.84 | -48.45 | 10.96 | -44.98 | 0.1484 | 0.1484 | |||

| TPR / Tapestry, Inc. | 0.16 | 8.58 | 0.1161 | 0.1161 | |||||

| AZO / AutoZone, Inc. | 0.02 | 8.35 | 0.1131 | 0.1131 | |||||

| 34958B106 / Fortress Investment Group LLC | 1.02 | -4.80 | 8.13 | 15.23 | 0.1101 | 0.1101 | |||

| MG / Mistras Group, Inc. | 0.46 | 30.37 | 7.82 | 26.08 | 0.1059 | 0.1059 | |||

| LL / LL Flooring Holdings, Inc. | 0.07 | 7.82 | 0.1058 | 0.1058 | |||||

| ROL / Rollins, Inc. | 0.29 | 7.63 | 0.1033 | 0.1033 | |||||

| TJX / The TJX Companies, Inc. | 0.13 | 32.17 | 7.54 | 48.88 | 0.1020 | 0.1020 | |||

| PLCMP0000017 / Comp SA | 0.19 | 7.27 | 0.0000 | ||||||

| VRSK / Verisk Analytics, Inc. | 0.11 | -3.59 | 7.18 | 4.91 | 0.0972 | 0.0972 | |||

| IR / Ingersoll Rand Inc. | 0.09 | 33.29 | 5.85 | 55.92 | 0.0791 | 0.0791 | |||

| HOT / Starwood Hotels & Resorts Worldwide, Inc. | 0.08 | 5.26 | 0.0712 | 0.0712 | |||||

| G / Genpact Limited | 0.24 | -32.48 | 4.50 | -33.74 | 0.0609 | 0.0609 | |||

| STAR / iStar Inc | 0.23 | 26.42 | 2.82 | 34.85 | 0.0381 | 0.0381 | |||

| PDH / Petrologistics Lp | 0.12 | -5.42 | 1.44 | -14.66 | 0.0195 | 0.0195 | |||

| NRZ / New Residential Investment Corp | 0.19 | -95.82 | 1.23 | -95.89 | 0.0167 | 0.0167 | |||

| CHEF / The Chefs' Warehouse, Inc. | 0.05 | 78.57 | 1.16 | 140.12 | 0.0156 | 0.0156 | |||

| NTI / Northern Tier Energy LP | 0.01 | 0.26 | 0.0035 | 0.0035 | |||||

| ISCB / iShares Trust - iShares Morningstar Small-Cap ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| PRGO / Perrigo Company plc | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| NCT.PRD / Newcastle Investment Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | Put | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | ||

| HAWK / Blackhawk Network Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| SIAL / Sigma-Aldrich Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 |