Mga Batayang Estadistika

| Nilai Portofolio | $ 408,425,339 |

| Posisi Saat Ini | 67 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

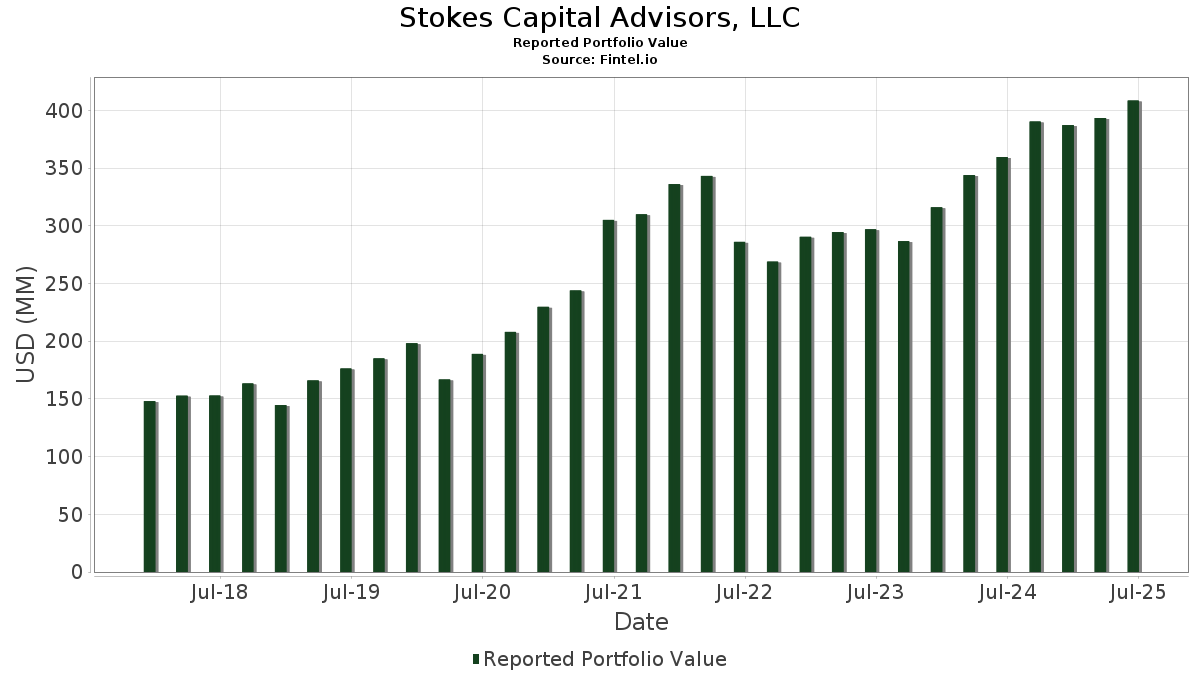

Stokes Capital Advisors, LLC telah mengungkapkan total kepemilikan 67 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 408,425,339 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Stokes Capital Advisors, LLC adalah Microsoft Corporation (US:MSFT) , PIMCO ETF Trust - PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (US:MINT) , Broadcom Inc. (US:AVGO) , JPMorgan Chase & Co. (US:JPM) , and The TJX Companies, Inc. (US:TJX) . Posisi baru Stokes Capital Advisors, LLC meliputi: Trane Technologies plc (US:TT) , EA Series Trust - TBG Dividend Focus ETF (US:TBG) , Tortoise Capital Series Trust - Tortoise North American Pipeline Fund (US:TPYP) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 17.26 | 4.2269 | 1.3450 | |

| 0.04 | 19.86 | 4.8615 | 1.1026 | |

| 0.19 | 18.84 | 4.6137 | 0.9660 | |

| 0.04 | 9.62 | 2.3561 | 0.8247 | |

| 0.02 | 4.26 | 1.0420 | 0.5651 | |

| 0.01 | 2.22 | 0.5441 | 0.5441 | |

| 0.04 | 11.26 | 2.7572 | 0.5159 | |

| 0.05 | 13.72 | 3.3583 | 0.4839 | |

| 0.05 | 1.52 | 0.3720 | 0.3720 | |

| 0.05 | 9.37 | 2.2933 | 0.2940 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 5.83 | 1.4267 | -1.2971 | |

| 0.03 | 5.63 | 1.3791 | -0.7331 | |

| 0.05 | 9.27 | 2.2699 | -0.4474 | |

| 0.04 | 4.92 | 1.2041 | -0.4013 | |

| 0.00 | 0.00 | -0.3920 | ||

| 0.01 | 0.70 | 0.1714 | -0.3485 | |

| 0.04 | 5.76 | 1.4113 | -0.2528 | |

| 0.04 | 7.08 | 1.7324 | -0.2263 | |

| 0.05 | 7.49 | 1.8335 | -0.2045 | |

| 0.04 | 11.01 | 2.6964 | -0.2044 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-09 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.04 | 1.36 | 19.86 | 34.30 | 4.8615 | 1.1026 | |||

| MINT / PIMCO ETF Trust - PIMCO Enhanced Short Maturity Active Exchange-Traded Fund | 0.19 | 31.45 | 18.84 | 31.35 | 4.6137 | 0.9660 | |||

| AVGO / Broadcom Inc. | 0.06 | -7.49 | 17.26 | 52.30 | 4.2269 | 1.3450 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | 2.65 | 13.72 | 21.33 | 3.3583 | 0.4839 | |||

| TJX / The TJX Companies, Inc. | 0.11 | -2.36 | 13.40 | -1.00 | 3.2797 | -0.1605 | |||

| V / Visa Inc. | 0.03 | -0.00 | 11.77 | 1.31 | 2.8829 | -0.0721 | |||

| WMB / The Williams Companies, Inc. | 0.18 | -1.10 | 11.45 | 3.96 | 2.8035 | 0.0030 | |||

| AXP / American Express Company | 0.04 | 7.75 | 11.26 | 27.74 | 2.7572 | 0.5159 | |||

| MCD / McDonald's Corporation | 0.04 | 3.20 | 11.01 | -3.48 | 2.6964 | -0.2044 | |||

| SYK / Stryker Corporation | 0.03 | 0.61 | 10.98 | 6.92 | 2.6882 | 0.0775 | |||

| COST / Costco Wholesale Corporation | 0.01 | 0.75 | 10.78 | 5.46 | 2.6405 | 0.0404 | |||

| ORCL / Oracle Corporation | 0.04 | 2.17 | 9.62 | 59.75 | 2.3561 | 0.8247 | |||

| TXN / Texas Instruments Incorporated | 0.05 | 3.09 | 9.37 | 19.11 | 2.2933 | 0.2940 | |||

| AAPL / Apple Inc. | 0.05 | -6.09 | 9.27 | -13.26 | 2.2699 | -0.4474 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.04 | 6.52 | 9.13 | -4.56 | 2.2349 | -0.1968 | |||

| SHW / The Sherwin-Williams Company | 0.03 | 1.28 | 9.12 | -0.41 | 2.2337 | -0.0954 | |||

| MA / Mastercard Incorporated | 0.02 | 7.12 | 8.79 | 9.82 | 2.1521 | 0.1172 | |||

| HON / Honeywell International Inc. | 0.04 | 0.53 | 8.70 | 10.56 | 2.1302 | 0.1295 | |||

| NOC / Northrop Grumman Corporation | 0.02 | 2.82 | 8.03 | 0.40 | 1.9660 | -0.0674 | |||

| CB / Chubb Limited | 0.03 | 2.04 | 7.76 | -2.11 | 1.8992 | -0.1154 | |||

| HD / The Home Depot, Inc. | 0.02 | 2.20 | 7.64 | 2.24 | 1.8703 | -0.0293 | |||

| KO / The Coca-Cola Company | 0.11 | 1.23 | 7.53 | 0.00 | 1.8438 | -0.0708 | |||

| PG / The Procter & Gamble Company | 0.05 | -0.07 | 7.49 | -6.58 | 1.8335 | -0.2045 | |||

| ABBV / AbbVie Inc. | 0.04 | 3.67 | 7.08 | -8.16 | 1.7324 | -0.2263 | |||

| NEE / NextEra Energy, Inc. | 0.10 | 21.45 | 7.07 | 18.93 | 1.7321 | 0.2198 | |||

| CNQ / Canadian Natural Resources Limited | 0.22 | 8.16 | 6.99 | 10.25 | 1.7114 | 0.0997 | |||

| ACN / Accenture plc | 0.02 | -0.59 | 6.79 | -4.78 | 1.6632 | -0.1505 | |||

| ADP / Automatic Data Processing, Inc. | 0.02 | 2.58 | 6.74 | 3.55 | 1.6503 | -0.0048 | |||

| LIN / Linde plc | 0.01 | -1.26 | 6.63 | -0.53 | 1.6235 | -0.0711 | |||

| ABT / Abbott Laboratories | 0.05 | -4.04 | 6.43 | -1.61 | 1.5752 | -0.0873 | |||

| LNG / Cheniere Energy, Inc. | 0.03 | -5.93 | 6.33 | -1.00 | 1.5502 | -0.0759 | |||

| CL / Colgate-Palmolive Company | 0.07 | -2.02 | 6.14 | -4.95 | 1.5035 | -0.1391 | |||

| LMT / Lockheed Martin Corporation | 0.01 | 0.69 | 6.06 | 4.40 | 1.4829 | 0.0078 | |||

| HESM / Hess Midstream LP | 0.16 | 4.53 | 6.04 | -4.82 | 1.4781 | -0.1344 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | -8.69 | 5.83 | -45.62 | 1.4267 | -1.2971 | |||

| JNJ / Johnson & Johnson | 0.04 | -4.39 | 5.76 | -11.93 | 1.4113 | -0.2528 | |||

| UNP / Union Pacific Corporation | 0.02 | -3.49 | 5.71 | -6.01 | 1.3972 | -0.1464 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.03 | -35.74 | 5.63 | -32.20 | 1.3791 | -0.7331 | |||

| INTU / Intuit Inc. | 0.01 | -1.38 | 5.46 | 26.50 | 1.3360 | 0.2394 | |||

| CNI / Canadian National Railway Company | 0.05 | -8.21 | 5.00 | -2.00 | 1.2252 | -0.0731 | |||

| PEP / PepsiCo, Inc. | 0.04 | -11.56 | 4.92 | -22.13 | 1.2041 | -0.4013 | |||

| ENB / Enbridge Inc. | 0.11 | 1.44 | 4.90 | 3.75 | 1.1994 | -0.0010 | |||

| ZTS / Zoetis Inc. | 0.03 | 10.59 | 4.88 | 4.74 | 1.1947 | 0.0104 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.07 | 11.38 | 4.81 | 10.70 | 1.1784 | 0.0731 | |||

| KMI / Kinder Morgan, Inc. | 0.15 | -0.17 | 4.52 | 2.87 | 1.1069 | -0.0104 | |||

| GOOG / Alphabet Inc. | 0.02 | 99.10 | 4.26 | 126.93 | 1.0420 | 0.5651 | |||

| CAT / Caterpillar Inc. | 0.01 | -2.28 | 4.15 | 15.03 | 1.0155 | 0.0988 | |||

| IWY / iShares Trust - iShares Russell Top 200 Growth ETF | 0.01 | -8.57 | 3.43 | 6.86 | 0.8394 | 0.0236 | |||

| TT / Trane Technologies plc | 0.01 | 2.22 | 0.5441 | 0.5441 | |||||

| TBG / EA Series Trust - TBG Dividend Focus ETF | 0.05 | 1.52 | 0.3720 | 0.3720 | |||||

| LHX / L3Harris Technologies, Inc. | 0.00 | 0.00 | 1.10 | 19.80 | 0.2698 | 0.0360 | |||

| HYS / PIMCO ETF Trust - PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund | 0.01 | 36.05 | 1.08 | 38.06 | 0.2648 | 0.0656 | |||

| ROP / Roper Technologies, Inc. | 0.00 | 0.00 | 1.03 | -3.82 | 0.2525 | -0.0202 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 0.00 | 0.91 | 14.94 | 0.2223 | 0.0214 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.00 | 0.80 | 10.48 | 0.1962 | 0.0119 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.02 | 0.00 | 0.70 | -9.18 | 0.1721 | -0.0247 | |||

| NKE / NIKE, Inc. | 0.01 | -69.41 | 0.70 | -65.75 | 0.1714 | -0.3485 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | -12.33 | 0.67 | -8.31 | 0.1648 | -0.0220 | |||

| SO / The Southern Company | 0.01 | 0.00 | 0.62 | -0.16 | 0.1528 | -0.0061 | |||

| TPYP / Tortoise Capital Series Trust - Tortoise North American Pipeline Fund | 0.02 | 0.59 | 0.1448 | 0.1448 | |||||

| SPGI / S&P Global Inc. | 0.00 | -34.21 | 0.42 | -31.76 | 0.1028 | -0.0535 | |||

| CHD / Church & Dwight Co., Inc. | 0.00 | 0.00 | 0.36 | -12.62 | 0.0882 | -0.0167 | |||

| OKE / ONEOK, Inc. | 0.00 | 0.00 | 0.32 | -17.57 | 0.0781 | -0.0205 | |||

| FDS / FactSet Research Systems Inc. | 0.00 | 0.00 | 0.29 | -1.72 | 0.0700 | -0.0039 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.28 | -4.81 | 0.0679 | -0.0062 | |||

| VIGI / Vanguard Whitehall Funds - Vanguard International Dividend Appreciation ETF | 0.00 | -13.93 | 0.24 | -6.51 | 0.0598 | -0.0066 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.22 | -8.94 | 0.0549 | -0.0076 | |||

| TPYP / Tortoise Capital Series Trust - Tortoise North American Pipeline Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMGN / Amgen Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMP / Ameriprise Financial, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CTAS / Cintas Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.3920 | ||||

| AMT / American Tower Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VTMGX / Vanguard Tax Managed Funds - Vanguard Developed Markets Index Admiral | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MUNI / PIMCO ETF Trust - PIMCO Intermediate Municipal Bond Active Exchange-Traded Fund | 0.00 | -100.00 | 0.00 | 0.0000 |