Mga Batayang Estadistika

| Nilai Portofolio | $ 1,148,023,287 |

| Posisi Saat Ini | 275 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

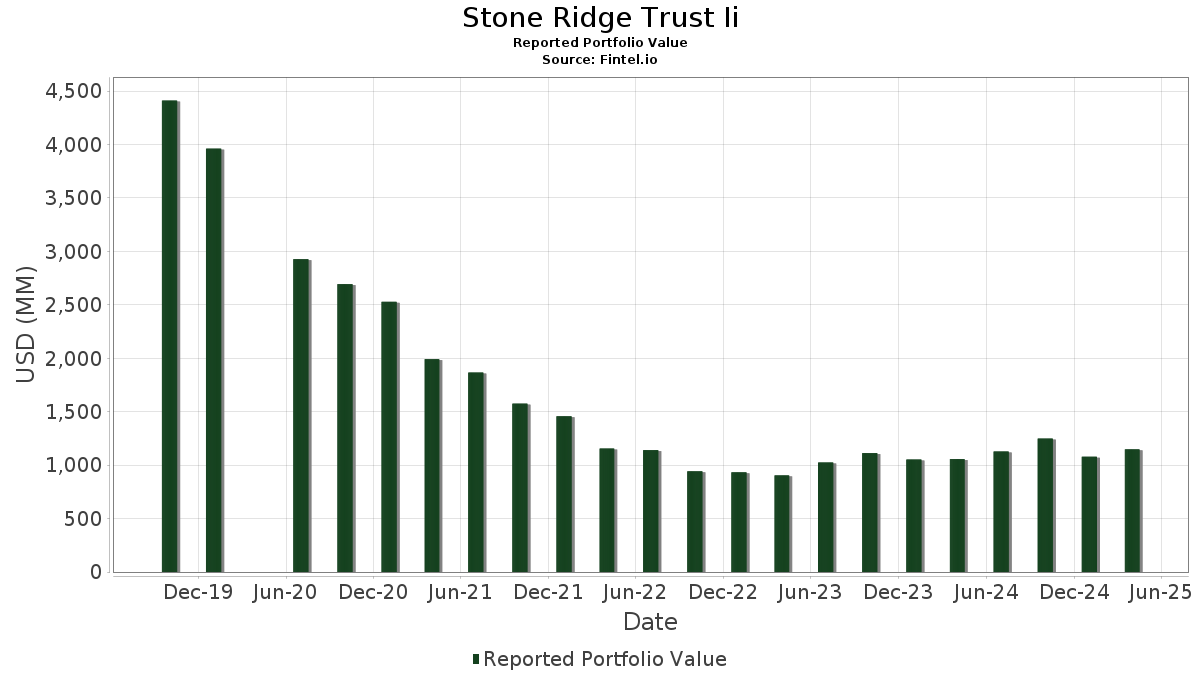

Stone Ridge Trust Ii telah mengungkapkan total kepemilikan 275 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,148,023,287 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Stone Ridge Trust Ii adalah Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) , Lightning Re, Series 2023 (US:US532242AA24) , Baldwin Re 2021-1 Class A (BM:US05826BAA44) , and Cape Lookout Re Ltd (BM:US13947LAE20) . Posisi baru Stone Ridge Trust Ii meliputi: Lightning Re, Series 2023 (US:US532242AA24) , Baldwin Re 2021-1 Class A (BM:US05826BAA44) , Cape Lookout Re Ltd (BM:US13947LAE20) , Residential Re 2023-I Class 14 (BM:US76133XAB38) , and IBRD CAR 131 (US:XS2599161192) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.14 | 209.60 | 18.2017 | 18.2017 | |

| 0.00 | 53.01 | 4.6030 | 4.6030 | |

| 0.06 | 49.69 | 4.3148 | 4.3148 | |

| 0.04 | 42.72 | 3.7098 | 3.7098 | |

| 0.17 | 41.89 | 3.6374 | 3.6374 | |

| 0.05 | 40.90 | 3.5513 | 3.5513 | |

| 0.20 | 40.51 | 3.5174 | 3.5174 | |

| 2.99 | 32.90 | 2.8570 | 2.8570 | |

| 2.25 | 30.29 | 2.6305 | 2.6305 | |

| 0.00 | 28.89 | 2.5091 | 2.5091 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.61 | 0.0533 | -0.0521 | ||

| 0.00 | 0.0003 | -0.0250 | ||

| 4.30 | 0.3735 | -0.0222 | ||

| 4.23 | 0.3670 | -0.0194 | ||

| 0.04 | 0.0031 | -0.0194 | ||

| 12.41 | 1.0775 | -0.0194 | ||

| 2.98 | 0.2588 | -0.0173 | ||

| 4.20 | 0.3647 | -0.0169 | ||

| 3.00 | 0.2605 | -0.0165 | ||

| 4.00 | 0.3477 | -0.0143 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-27 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Yorkville (Artex Segregated Account Company) / EP (000000000) | 0.14 | 209.60 | 18.2017 | 18.2017 | |||||

| Mohonk (Artex Segregated Account Company) / EP (000000000) | 0.00 | 53.01 | 4.6030 | 4.6030 | |||||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 52.99 | 68.09 | 52.99 | 68.10 | 4.6014 | 1.7865 | |||

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 52.79 | 68.23 | 52.79 | 68.23 | 4.5840 | 1.7821 | |||

| Hatteras (Artex Segregated Account Company) / EP (000000000) | 0.06 | 49.69 | 4.3148 | 4.3148 | |||||

| Hudson Charles 2 (Mt. Logan Re) / EP (000000000) | 0.04 | 42.72 | 3.7098 | 3.7098 | |||||

| Arenal (Artex Segregated Account Company) / EP (000000000) | 0.17 | 41.89 | 3.6374 | 3.6374 | |||||

| Rondout (Artex Segregated Account Company) / EP (000000000) | 0.05 | 40.90 | 3.5513 | 3.5513 | |||||

| Bowery (Artex Segregated Account Company) / EP (000000000) | 0.20 | 40.51 | 3.5174 | 3.5174 | |||||

| Peregrine LCA2 / EP (000000000) | 2.99 | 32.90 | 2.8570 | 2.8570 | |||||

| Peregrine LCA / EP (000000000) | 2.25 | 30.29 | 2.6305 | 2.6305 | |||||

| Trouvaille Re Ltd. / EP (000000000) | 0.00 | 28.89 | 2.5091 | 2.5091 | |||||

| Magnolia (Artex Segregated Account Company) / EP (000000000) | 0.02 | 28.10 | 2.4398 | 2.4398 | |||||

| Thopas Re Ltd. 2024-2 (S) / EP (000000000) | 0.24 | 26.19 | 2.2742 | 2.2742 | |||||

| Hudson Charles (Mt. Logan Re) / EP (000000000) | 0.02 | 23.59 | 2.0489 | 2.0489 | |||||

| Latigo (Artex Segregated Account Company) / EP (000000000) | 0.00 | 22.98 | 1.9957 | 1.9957 | |||||

| Madison (Artex Segregated Account Company) / EP (000000000) | 0.10 | 18.63 | 1.6174 | 1.6174 | |||||

| POINT DUME LLP / EP (N/A) | 0.00 | 17.97 | 1.5601 | 1.5601 | |||||

| Florblanca (Artex Segregated Account Company) / EP (000000000) | 0.08 | 15.69 | 1.3624 | 1.3624 | |||||

| United States Treasury Bill / DBT (US912797NX17) | 12.41 | 1.02 | 1.0775 | -0.0194 | |||||

| United States Treasury Bill / DBT (US912797NU77) | 12.18 | 1.0579 | 1.0579 | ||||||

| Greenshoots Re 2025-B / EP (000000000) | 0.01 | 10.19 | 0.8850 | 0.8850 | |||||

| United States Treasury Bill / DBT (US912797LN52) | 9.95 | 0.8641 | 0.8641 | ||||||

| United States Treasury Bill / DBT (US912797QA86) | 9.91 | 0.8608 | 0.8608 | ||||||

| Pelham (Horseshoe Re) / EP (000000000) | 0.26 | 6.06 | 0.5263 | 0.5263 | |||||

| Alamo Re 2024-1 Class B / DBT (US011395AP50) | 4.96 | 0.59 | 0.4310 | -0.0096 | |||||

| US532242AA24 / Lightning Re, Series 2023 | 4.30 | -2.93 | 0.3735 | -0.0222 | |||||

| Cape Lookout Re 2024-1 Class A / DBT (US13947LAF94) | 4.23 | -2.33 | 0.3670 | -0.0194 | |||||

| FloodSmart Re 2024-1 Class A / DBT (US33975CAP05) | 4.20 | -1.73 | 0.3647 | -0.0169 | |||||

| Alamo Re 2024-1 Class C / DBT (US011395AQ34) | 4.00 | -1.23 | 0.3477 | -0.0143 | |||||

| Alamo Re 2024-1 Class A / DBT (US011395AN03) | 3.99 | 7.52 | 0.3463 | 0.0151 | |||||

| US05826BAA44 / Baldwin Re 2021-1 Class A | 3.93 | -0.05 | 0.3410 | -0.0099 | |||||

| Cape Lookout Re 2025-1 Class A / DBT (US13947LAG77) | 3.90 | 0.3386 | 0.3386 | ||||||

| Yoho (Artex Segregated Account Company) / EP (000000000) | 0.36 | 3.60 | 0.3123 | 0.3123 | |||||

| US13947LAE20 / Cape Lookout Re Ltd | 3.52 | -1.76 | 0.3056 | -0.0143 | |||||

| Everglades Re II 2024-1 Class B / DBT (US30014LAN47) | 3.11 | 0.65 | 0.2698 | -0.0059 | |||||

| Everglades Re II 2024-1 Class A / DBT (US30014LAM63) | 3.10 | 0.68 | 0.2694 | -0.0058 | |||||

| St. Kevins (Artex Segregated Account Company) / EP (000000000) | 0.04 | 3.00 | 0.2608 | 0.2608 | |||||

| US76133XAB38 / Residential Re 2023-I Class 14 | 3.00 | -3.29 | 0.2605 | -0.0165 | |||||

| XS2599161192 / IBRD CAR 131 | 2.98 | -0.13 | 0.2588 | -0.0077 | |||||

| Merna Re II 2024-3 Class A / DBT (US59013MAM47) | 2.98 | -3.62 | 0.2588 | -0.0173 | |||||

| Ursa Re 2023-3 Class D / DBT (US90323WAQ33) | 2.74 | -0.62 | 0.2381 | -0.0082 | |||||

| US011395AJ90 / Alamo Re Ltd | 2.64 | -1.49 | 0.2296 | -0.0101 | |||||

| US90323WAN02 / Ursa Re Ltd | 2.61 | -0.72 | 0.2271 | -0.0081 | |||||

| High Point Re 2023-1 Class A / DBT (US429932AA44) | 2.60 | -0.99 | 0.2258 | -0.0087 | |||||

| Blue Ridge Re 2023-1 Class B / DBT (US096003AB44) | 2.58 | -1.38 | 0.2243 | -0.0095 | |||||

| US12765KAE55 / Caelus 2018-1 Class A | 2.51 | 18.38 | 0.2177 | 0.0286 | |||||

| Purple Re 2024-1 Class A / DBT (US74639NAC74) | 2.42 | 0.58 | 0.2098 | -0.0047 | |||||

| Ursa Re 2025-1 Class F / DBT (US90323WAR16) | 2.35 | 0.2041 | 0.2041 | ||||||

| US36779CAC01 / Gateway Re Ltd., Series A | 2.32 | -1.65 | 0.2015 | -0.0091 | |||||

| Ursa Re 2023-3 Class AA / DBT (US90323WAP59) | 2.28 | -0.26 | 0.1976 | -0.0061 | |||||

| US86944RAF55 / Sutter Re Ltd | 2.28 | -0.61 | 0.1976 | -0.0068 | |||||

| US799925AA07 / Sanders Re III Ltd., Series A | 2.20 | -1.21 | 0.1913 | -0.0078 | |||||

| Everglades Re II 2024-1 Class C / DBT (US30014LAP94) | 2.15 | 0.23 | 0.1865 | -0.0048 | |||||

| US57839MAB46 / Mayflower Re 2023-1 Class B | 2.12 | -1.35 | 0.1843 | -0.0078 | |||||

| Blue Ridge Re 2023-1 Class A / DBT (US096003AA60) | 2.12 | 0.76 | 0.1841 | -0.0038 | |||||

| IBRD CAR 136 / DBT (XS2806459314) | 2.11 | -0.52 | 0.1835 | -0.0062 | |||||

| US86944RAE80 / Sutter Re Ltd | 2.02 | -1.03 | 0.1757 | -0.0069 | |||||

| US148805AA28 / Catahoula Re II 2022-1 Class A | 2.01 | -2.85 | 0.1749 | -0.0101 | |||||

| Cypress (Horseshoe Re) / EP (000000000) | 125.09 | 1.99 | 0.1728 | 0.1728 | |||||

| Residential Re 2023-II Class 5 / DBT (US76090WAC47) | 1.96 | -0.91 | 0.1699 | -0.0064 | |||||

| Torrey Pines Re 2024-1 Class A / DBT (US89141WAH51) | 1.94 | -0.21 | 0.1681 | -0.0052 | |||||

| US76119YAE32 / Residential Re 2022-I Class 14 | 1.90 | -3.71 | 0.1648 | -0.0112 | |||||

| IBRD CAR 132 Class A / DBT (XS2799645515) | 1.90 | 0.26 | 0.1647 | -0.0042 | |||||

| Sanders Re II 2025-1 Class B-2 / DBT (US80001TAD90) | 1.85 | 0.1608 | 0.1608 | ||||||

| Merna Re II 2024-2 Class A / DBT (US59013MAL63) | 1.82 | -1.57 | 0.1578 | -0.0071 | |||||

| Veraison Re 2025-1 Class A / DBT (US92335TAD19) | 1.79 | -0.50 | 0.1551 | -0.0051 | |||||

| PoleStar Re 2024-3 Class A / DBT (US73110JAC62) | 1.73 | -0.17 | 0.1504 | -0.0045 | |||||

| Sanders Re III 2024-1 Class A / DBT (US799927AA62) | 1.68 | -1.18 | 0.1458 | -0.0059 | |||||

| US03843AAC62 / Aquila Re I Ltd., Series C-1 | 1.59 | 21.87 | 0.1380 | 0.0215 | |||||

| Acorn Re 2024-1 Class B / DBT (US00485YAF60) | 1.55 | 36.42 | 0.1343 | 0.0330 | |||||

| US747977AA45 / Queen Street 2023 RE DAC | 1.53 | -2.74 | 0.1326 | -0.0076 | |||||

| Gateway Re 2025-1 Class C2 / DBT (US36779CAN65) | 1.52 | 0.1317 | 0.1317 | ||||||

| US577092AD19 / MATTERHORN RE LTD REGD V/R 144A P/P SER A 5.00507000 | 1.50 | 0.00 | 0.1301 | -0.0037 | |||||

| Sanders Re II 2024-3 Class B / DBT (US80001RAB78) | 1.47 | -0.27 | 0.1274 | -0.0039 | |||||

| SR0001 (Horseshoe Re) / EP (000000000) | 0.00 | 1.45 | 0.1263 | 0.1263 | |||||

| IBRD CAR 134 Class C / DBT (XS2799645788) | 1.43 | -1.92 | 0.1245 | -0.0060 | |||||

| Merna Re II 2024-1 Class A / DBT (US59013MAK80) | 1.42 | -0.49 | 0.1236 | -0.0041 | |||||

| Sanders Re II 2024-3 Class A / DBT (US80001RAA95) | 1.42 | -1.66 | 0.1235 | -0.0057 | |||||

| Ocelot Re 2025-1 Class A / DBT (US675951AB39) | 1.40 | 0.1215 | 0.1215 | ||||||

| Armor Re II 2024-1 Class A / DBT (US04227FAE51) | 1.38 | 0.07 | 0.1195 | -0.0033 | |||||

| Matterhorn Re SR2023-1 Class CYB-A / DBT (US577092AV17) | 1.37 | 1.18 | 0.1189 | -0.0019 | |||||

| US011395AH35 / Alamo Re Ltd | 1.36 | -1.52 | 0.1181 | -0.0052 | |||||

| Nature Coast Re 2023-1 Class A / DBT (US63901CAA99) | 1.35 | 0.97 | 0.1173 | -0.0022 | |||||

| Galileo Re 2023-1 Class A / DBT (US36354TAN28) | 1.35 | -1.39 | 0.1172 | -0.0051 | |||||

| Bayou Re 2024-1 Class A / DBT (US07304LAC54) | 1.33 | 1.06 | 0.1156 | -0.0021 | |||||

| Fuchsia 2 2024-1 Class A / DBT (US541917AA86) | 1.33 | 0.68 | 0.1154 | -0.0024 | |||||

| Vision 2039 2025-1 Class A / DBT (XS3019877813) | 1.32 | 0.1150 | 0.1150 | ||||||

| XS2630523749 / Totara Re Pte. 2023-1 | 1.32 | 5.51 | 0.1147 | 0.0029 | |||||

| US59013MAJ18 / Merna Reinsurance II Ltd | 1.32 | -1.20 | 0.1147 | -0.0047 | |||||

| Torrey Pines Re 2024-1 Class B / DBT (US89141WAJ18) | 1.32 | 0.53 | 0.1143 | -0.0026 | |||||

| US07304LAB71 / Bayou Re 2023-1 Class B | 1.29 | -2.20 | 0.1120 | -0.0058 | |||||

| Longleaf Pine Re 2024-1 Class A / DBT (US54307MAA62) | 1.25 | -2.57 | 0.1086 | -0.0060 | |||||

| XS2641776773 / Eiffel Re Ltd | 1.22 | 9.78 | 0.1062 | 0.0067 | |||||

| US982533AC50 / Wrigley Re 2023-1 Class B | 1.21 | -0.66 | 0.1053 | -0.0036 | |||||

| US62865LAD91 / Mystic Re IV Ltd | 1.19 | -1.50 | 0.1031 | -0.0045 | |||||

| US539694AA71 / Locke Tavern Re Ltd., Series A | 1.17 | -0.93 | 0.1017 | -0.0039 | |||||

| Nature Coast Re 2025-1 Class A / DBT (US63901CAD39) | 1.16 | 0.09 | 0.1006 | -0.0027 | |||||

| US547915AB43 / Lower Ferry Re 2023-1 Class B | 1.16 | -0.77 | 0.1006 | -0.0037 | |||||

| US89141WAF95 / Torrey Pines Re Ltd., Series A | 1.15 | -0.52 | 0.1001 | -0.0033 | |||||

| Hestia Re 2025-1 Class A / DBT (US42815KAC62) | 1.14 | 0.0991 | 0.0991 | ||||||

| Veraison Re 2024-1 Class A / DBT (US92335TAC36) | 1.12 | 31.88 | 0.0974 | 0.0214 | |||||

| US00485YAD13 / Acorn Re 2023-1 Class A | 1.12 | 0.00 | 0.0973 | -0.0027 | |||||

| Residential Re 2024-II Class 3 / DBT (US76112AAD46) | 1.11 | -0.71 | 0.0967 | -0.0034 | |||||

| US03843AAB89 / Aquila Re I Ltd Series 2023-1 | 1.11 | -1.16 | 0.0965 | -0.0039 | |||||

| US59013MAH51 / Merna Reinsurance II Ltd | 1.09 | -1.35 | 0.0950 | -0.0039 | |||||

| Acorn Re 2024-1 Class A / DBT (US00485YAE95) | 1.09 | 0.18 | 0.0944 | -0.0025 | |||||

| Sanders Re II 2025-1 Class A / DBT (US80001TAA51) | 1.07 | 0.0931 | 0.0931 | ||||||

| Kendall Re 2024-1 Class A / DBT (US48878QAD25) | 1.07 | -1.20 | 0.0926 | -0.0037 | |||||

| US177510AL87 / Citrus Re 2023-1 Class A | 1.03 | -1.15 | 0.0895 | -0.0036 | |||||

| PoleStar Re 2024-1 Class A / DBT (US73110JAA07) | 1.02 | 0.10 | 0.0885 | -0.0025 | |||||

| Torrey Pines Re 2025-1 Class B / DBT (US89141WAM47) | 1.02 | 0.0882 | 0.0882 | ||||||

| Bridge Street Re 2025-1 Class A / DBT (US10807LAA52) | 1.01 | -0.39 | 0.0880 | -0.0028 | |||||

| Bayou Re 2025-1 Class A / DBT (US07304LAE11) | 0.99 | 0.0862 | 0.0862 | ||||||

| US74639NAA19 / Purple Re Ltd | 0.99 | -0.60 | 0.0861 | -0.0030 | |||||

| Foundation Re 2023-1 Class A / DBT (US349939AA62) | 0.98 | -0.71 | 0.0853 | -0.0031 | |||||

| US76114NAF96 / Residential Reinsurance 2021 Ltd | 0.97 | -1.52 | 0.0844 | -0.0037 | |||||

| Winston Re 2024-1 Class A / DBT (US975660AA93) | 0.97 | 0.00 | 0.0844 | -0.0023 | |||||

| Palm Re 2024-1 Class A / DBT (US69664FAA66) | 0.97 | -0.52 | 0.0838 | -0.0029 | |||||

| FloodSmart Re 2024-1 Class B / DBT (US33975CAQ87) | 0.95 | -2.37 | 0.0822 | -0.0044 | |||||

| Sanders Re II 2025-1 Class A-2 / DBT (US80001TAB35) | 0.94 | 0.0817 | 0.0817 | ||||||

| Torrey Pines Re 2025-1 Class A / DBT (US89141WAL63) | 0.91 | 0.0793 | 0.0793 | ||||||

| Torrey Pines Re 2025-1 Class C / DBT (US89141WAN20) | 0.91 | 0.0793 | 0.0793 | ||||||

| US177510AM60 / Citrus Re 2023-1 Class B | 0.90 | -1.31 | 0.0785 | -0.0033 | |||||

| Residential Re 2024-II Class 4 / DBT (US76112AAE29) | 0.90 | -0.11 | 0.0782 | -0.0023 | |||||

| Charles River Re 2024-1 Class A / DBT (US159873AA63) | 0.90 | -0.77 | 0.0780 | -0.0029 | |||||

| Northshore Re II 2025-1 Class A / DBT (US666842AF60) | 0.89 | 0.0776 | 0.0776 | ||||||

| Hexagon IV Re 2023-1 Class A / DBT (XS2710192464) | 0.89 | 9.49 | 0.0771 | 0.0046 | |||||

| US80000XAA72 / Sanders Re III Ltd | 0.89 | 0.00 | 0.0769 | -0.0022 | |||||

| King Max Re DAC / DBT (XS2723834052) | 0.88 | 9.55 | 0.0767 | 0.0047 | |||||

| US79381MAC82 / Sakura RE Ltd | 0.87 | -2.02 | 0.0758 | -0.0037 | |||||

| Tomoni Re Pte 2024-1 Class B / DBT (US89009PAF53) | 0.87 | -0.80 | 0.0753 | -0.0027 | |||||

| Fish Pond Re 2024-1 Class A / DBT (US33774EAA29) | 0.86 | 0.12 | 0.0747 | -0.0021 | |||||

| Four Lakes Re 2024-1 Class A / DBT (US35087TAG31) | 0.85 | -0.35 | 0.0741 | -0.0023 | |||||

| Veraison Re 2025-1 Class B / DBT (US92335TAE91) | 0.85 | -0.35 | 0.0738 | -0.0023 | |||||

| US57839MAA62 / Mayflower Re Ltd | 0.85 | -0.82 | 0.0737 | -0.0027 | |||||

| Fuchsia 2023-1 Class A / DBT (US54180TAA34) | 0.84 | 0.12 | 0.0732 | -0.0020 | |||||

| Residential Re 2023-II Class 3 / DBT (US76090WAB63) | 0.84 | -2.22 | 0.0727 | -0.0037 | |||||

| US62426LAA70 / Mountain Re 2023-1 Class A | 0.82 | -1.08 | 0.0715 | -0.0028 | |||||

| Palm Re 2025-1 Class A / DBT (US69664FAB40) | 0.82 | 0.0714 | 0.0714 | ||||||

| US62983QAP81 / Nakama Re 2023-1 Class 2 | 0.82 | 0.12 | 0.0713 | -0.0019 | |||||

| Integrity Re 2024-1 Class D / DBT (US45833UAM36) | 0.82 | 1.23 | 0.0712 | -0.0011 | |||||

| US80000YAA55 / Sanders Re III Ltd | 0.81 | -0.74 | 0.0703 | -0.0025 | |||||

| Bonanza Re 2024-1 Class C / DBT (US09785EAQ44) | 0.80 | 0.12 | 0.0697 | -0.0019 | |||||

| US203235AB20 / Commonwealth RE Ltd | 0.79 | -1.00 | 0.0687 | -0.0027 | |||||

| US07304LAA98 / Bayou Re 2023-1 Class A | 0.79 | -1.74 | 0.0685 | -0.0033 | |||||

| US92335TAA79 / Veraison Re Ltd | 0.78 | -1.01 | 0.0680 | -0.0026 | |||||

| Integrity Re III 2025-1 Class C / DBT (US45870GAE61) | 0.78 | 0.0680 | 0.0680 | ||||||

| US92335TAB52 / VERAISON RE LTD UNSECURED 144A 03/31 VAR | 0.77 | -1.54 | 0.0668 | -0.0029 | |||||

| Genesee Street Re 2025-1 Class A / DBT (US37173WAA09) | 0.77 | 0.0665 | 0.0665 | ||||||

| Baltic PCC 2025-1 Class A / DBT (XS3037721118) | 0.73 | 0.0632 | 0.0632 | ||||||

| Azzurro Re II DAC 2024-1 Class A / DBT (XS2788028178) | 0.72 | 9.48 | 0.0622 | 0.0037 | |||||

| US45833UAH41 / Integrity Re Ltd., Series A | 0.69 | -2.67 | 0.0602 | -0.0034 | |||||

| US74639NAB91 / Purple Re Ltd., Series A | 0.69 | 0.87 | 0.0602 | -0.0012 | |||||

| Mona Lisa Re 2025-1 Class B / DBT (US608800AK40) | 0.69 | 0.29 | 0.0595 | -0.0015 | |||||

| MMIFS Re 2025-1 Class A / DBT (XS2969300081) | 0.68 | 5.26 | 0.0592 | 0.0014 | |||||

| Tomoni Re Pte 2024-1 Class A / DBT (US89009PAE88) | 0.68 | -0.58 | 0.0592 | -0.0020 | |||||

| Riverfront Re 2025 Class A / DBT (US76870YAF97) | 0.68 | 0.0588 | 0.0588 | ||||||

| Winston Re 2025-1 Class A / DBT (US975660AC59) | 0.67 | 0.0585 | 0.0585 | ||||||

| Mayflower Re 2024-1 Class A / DBT (US57839MAC29) | 0.66 | 0.00 | 0.0577 | -0.0016 | |||||

| IBRD CAR 133 Class B / DBT (XS2799645606) | 0.65 | 0.00 | 0.0567 | -0.0016 | |||||

| Mona Lisa Re 2025-1 Class A / DBT (US608800AJ76) | 0.65 | 0.00 | 0.0564 | -0.0016 | |||||

| Aragonite Re 2024-1 Class A / DBT (US03851YAA73) | 0.65 | 1.09 | 0.0563 | -0.0010 | |||||

| IBRD CAR 135 Class D / DBT (XS2809694198) | 0.65 | 0.78 | 0.0562 | -0.0011 | |||||

| Gateway Re 2025-1 Class AA / DBT (US36779CAP14) | 0.65 | 0.0561 | 0.0561 | ||||||

| US92851QAA76 / Vitality Re XIV Ltd | 0.65 | 1.42 | 0.0560 | -0.0008 | |||||

| US90323WAL46 / Ursa Re Ltd | 0.64 | -0.31 | 0.0558 | -0.0018 | |||||

| Gateway Re 2024-1 Class AA / DBT (US36779CAG15) | 0.64 | -1.69 | 0.0557 | -0.0025 | |||||

| US367927AA84 / Gateway Re II Ltd | 0.62 | -2.20 | 0.0541 | -0.0028 | |||||

| Sanders Re II 2025-1 Class B-1 / DBT (US80001TAC18) | 0.62 | 0.0535 | 0.0535 | ||||||

| US76133XAA54 / Residential Re 2023-I Class 13 | 0.61 | -48.01 | 0.0533 | -0.0521 | |||||

| Torrey Pines Re 2024-1 Class C / DBT (US89141WAK80) | 0.61 | -0.65 | 0.0532 | -0.0019 | |||||

| US92849MAA18 / VITALITY RE XIII LTD REGD V/R 144A P/P SER A 2.15721600 | 0.61 | 0.33 | 0.0530 | -0.0013 | |||||

| US36779CAF32 / Gateway Re Ltd., Series A | 0.59 | -2.31 | 0.0514 | -0.0026 | |||||

| Gateway Re 2025-2 Class A / DBT (US36779CAS52) | 0.58 | 0.0505 | 0.0505 | ||||||

| East Lane Re VII 2024-1 Class A / DBT (US27332EAA91) | 0.57 | 0.88 | 0.0499 | -0.0009 | |||||

| Titania Re 2024-1 Class A / DBT (US888329AE97) | 0.57 | 0.00 | 0.0493 | -0.0014 | |||||

| Integrity Re 2024-1 Class C / DBT (US45833UAL52) | 0.55 | -0.54 | 0.0482 | -0.0016 | |||||

| Armor Re II 2024-2 Class A / DBT (US04227FAF27) | 0.55 | 1.29 | 0.0478 | -0.0008 | |||||

| US91734PAG19 / Ursa Re II 2022-2 Class C | 0.54 | -1.27 | 0.0472 | -0.0020 | |||||

| Integrity Re 2024-1 Class A / DBT (US45833UAJ07) | 0.54 | -1.10 | 0.0470 | -0.0019 | |||||

| US80001QAB95 / Sanders Re III 2023-1 Class B | 0.54 | 15.35 | 0.0470 | 0.0051 | |||||

| Titania Re 2024-1 Class B / DBT (US888329AF62) | 0.54 | -1.11 | 0.0465 | -0.0019 | |||||

| Hestia Re 2025-1 Class B / DBT (US42815KAD46) | 0.53 | 0.0457 | 0.0457 | ||||||

| Citrus Re 2024-1 Class B / DBT (US177510AP91) | 0.53 | 0.19 | 0.0456 | -0.0012 | |||||

| US982533AB77 / Wrigley Re 2023-1 Class A | 0.52 | -0.19 | 0.0450 | -0.0013 | |||||

| Nature Coast Re 2024-1 Class A / DBT (US63901CAC55) | 0.51 | 4.49 | 0.0445 | 0.0008 | |||||

| Ashera Re 2024-1 Class A / DBT (US04401RAA59) | 0.51 | -0.58 | 0.0444 | -0.0015 | |||||

| Aquila Re I 2024-1 Class A-1 / DBT (US037987AA23) | 0.50 | -0.60 | 0.0435 | -0.0015 | |||||

| US36779CAD83 / Gateway Re 2023-1 Class B | 0.50 | -0.40 | 0.0435 | -0.0014 | |||||

| Sabine Re 2024-1 Class A / DBT (US785628AA63) | 0.50 | 0.00 | 0.0433 | -0.0013 | |||||

| Recoletos Re DAC 2024-1 Class A / DBT (US755933AA66) | 0.50 | 0.00 | 0.0433 | -0.0012 | |||||

| US613752AB07 / Montoya Re 2022-2 Class A | 0.50 | -2.54 | 0.0433 | -0.0024 | |||||

| Yosemite Re 2025-1 Class A / DBT (US98740RAB50) | 0.50 | 0.0430 | 0.0430 | ||||||

| 3264 Re 2025-1 Class B / DBT (US88577CAF86) | 0.49 | 0.20 | 0.0427 | -0.0012 | |||||

| 3264 Re 2025-1 Class A / DBT (US88577CAE12) | 0.49 | -0.41 | 0.0425 | -0.0014 | |||||

| Nature Coast Re 2023-1 Class B / DBT (US63901CAB72) | 0.48 | 3.00 | 0.0418 | 0.0000 | |||||

| Citrus Re 2025-1 Class A / DBT (US177510AQ74) | 0.48 | 0.0417 | 0.0417 | ||||||

| Integrity Re III 2025-1 Class D / DBT (US45870GAF37) | 0.47 | 0.0412 | 0.0412 | ||||||

| Herbie Re 2024-2 Class B / DBT (US42703VAK98) | 0.47 | -0.42 | 0.0408 | -0.0013 | |||||

| Kauai (Artex Segregated Account Company) / EP (000000000) | 0.05 | 0.47 | 0.0404 | 0.0404 | |||||

| US547915AA69 / Lower Ferry Re Ltd | 0.46 | -0.86 | 0.0401 | -0.0015 | |||||

| Herbie Re 2024-2 Class A / DBT (US42703VAJ26) | 0.46 | -1.50 | 0.0400 | -0.0017 | |||||

| Bayou Re 2024-1 Class B / DBT (US07304LAD38) | 0.46 | -0.22 | 0.0398 | -0.0012 | |||||

| XS2356204052 / LION III RE DAC /EUR/ REGD V/R 144A P/P SER 21-A 3.50000000 | 0.46 | 9.59 | 0.0398 | 0.0025 | |||||

| US91734PAD87 / Ursa Re II 2022-1 Class A | 0.46 | -0.65 | 0.0397 | -0.0014 | |||||

| Mystic Re IV 2025-1 Class A / DBT (US62865LAF40) | 0.44 | -0.45 | 0.0384 | -0.0013 | |||||

| Gateway Re 2025-1 Class C1 / DBT (US36779CAR79) | 0.44 | 0.0383 | 0.0383 | ||||||

| Residential Re 2024-II Class 2 / DBT (US76112AAC62) | 0.44 | 1.40 | 0.0378 | -0.0005 | |||||

| US80001QAA13 / Sanders Re III Ltd. | 0.43 | -1.15 | 0.0374 | -0.0016 | |||||

| Matterhorn Re 2025-1 Class B / DBT (US577092AX72) | 0.43 | -0.23 | 0.0374 | -0.0012 | |||||

| US05826BAB27 / Baldwin Re Ltd | 0.43 | -0.23 | 0.0373 | -0.0011 | |||||

| Greengrove Re 2025-1 Class A / DBT (US39526JAA97) | 0.42 | 0.0366 | 0.0366 | ||||||

| Residential Re 2024-I Class 14 / DBT (US76091BAC90) | 0.42 | -4.54 | 0.0366 | -0.0028 | |||||

| US42703VAF04 / Herbie Re 2022-1 Class A | 0.42 | -2.32 | 0.0366 | -0.0020 | |||||

| Gateway Re 2025-1 Class AAA / DBT (US36779CAM82) | 0.42 | 0.0361 | 0.0361 | ||||||

| US666842AE95 / Northshore Re II Ltd | 0.42 | 0.00 | 0.0361 | -0.0011 | |||||

| Blue Sky Re DAC 2023-1 / DBT (XS2728630596) | 0.42 | 9.79 | 0.0360 | 0.0022 | |||||

| Galileo Re 2023-1 Class B / DBT (US36354TAP75) | 0.41 | -0.97 | 0.0356 | -0.0014 | |||||

| Citrus Re 2025-1 Class B / DBT (US177510AR57) | 0.41 | 0.0355 | 0.0355 | ||||||

| Winston Re 2024-1 Class B / DBT (US975660AB76) | 0.40 | 1.26 | 0.0350 | -0.0006 | |||||

| US44914CAC01 / Hypatia Ltd., Series A | 0.39 | -1.76 | 0.0339 | -0.0016 | |||||

| Herbie Re 2024-2 Class C / DBT (US42703VAL71) | 0.39 | -2.50 | 0.0339 | -0.0019 | |||||

| US83427GAA31 / Solomon Re Ltd., Series A | 0.39 | -1.03 | 0.0336 | -0.0012 | |||||

| Nature Coast Re 2025-2 Class A / DBT (US63901CAE12) | 0.38 | 0.0331 | 0.0331 | ||||||

| Vitality Re XV 2024 Class A / DBT (US92847CAA53) | 0.38 | 1.08 | 0.0326 | -0.0006 | |||||

| Long Walk Re 2024-1 Class A / DBT (US54289CAA09) | 0.36 | -0.27 | 0.0316 | -0.0010 | |||||

| Vitality Re XVI 2025 Class A / DBT (US92849FAA66) | 0.36 | 0.28 | 0.0312 | -0.0009 | |||||

| US80001EAB65 / Sanders Re III 2022-2 Class B | 0.36 | -1.38 | 0.0310 | -0.0013 | |||||

| US90323WAM29 / Ursa Re 2023-1 Class C | 0.35 | -0.85 | 0.0302 | -0.0011 | |||||

| US85237TAA07 / Stabilitas Re Ltd | 0.34 | -1.15 | 0.0300 | -0.0012 | |||||

| US92851QAB59 / Vitality Re XIV Ltd | 0.34 | 0.89 | 0.0295 | -0.0006 | |||||

| Four Lakes Re 2024-1 Class B / DBT (US35087TAH14) | 0.34 | -0.29 | 0.0294 | -0.0009 | |||||

| US91734PAF36 / Ursa Re II Ltd | 0.34 | -0.88 | 0.0294 | -0.0011 | |||||

| Mona Lisa Re 2024-1 Class A / DBT (US608800AH11) | 0.32 | -1.83 | 0.0280 | -0.0014 | |||||

| US59165HAD17 / MetroCat Re Ltd | 0.32 | -1.53 | 0.0279 | -0.0012 | |||||

| Four Lakes Re 2023-1 Class A / DBT (US35087TAE82) | 0.32 | 0.00 | 0.0277 | -0.0007 | |||||

| Integrity Re III 2025-1 Class A-2 / DBT (US45870GAB23) | 0.31 | 0.0273 | 0.0273 | ||||||

| Aquila Re I 2024-1 Class B-1 / DBT (US037987AB06) | 0.31 | -0.96 | 0.0269 | -0.0010 | |||||

| Integrity Re 2024-1 Class B / DBT (US45833UAK79) | 0.31 | -0.96 | 0.0269 | -0.0011 | |||||

| US62984JAA60 / Nakama Re Pte. 2021-1 Class 1 | 0.31 | -0.33 | 0.0266 | -0.0009 | |||||

| Mystic Re IV 2025-1 Class C / DBT (US62865LAH06) | 0.30 | 21.69 | 0.0264 | 0.0040 | |||||

| Taranis Re DAC 2023-1 Class A / DBT (XS2721087653) | 0.30 | 9.85 | 0.0262 | 0.0016 | |||||

| Mystic Re IV 2025-1 Class B / DBT (US62865LAG23) | 0.28 | 1.43 | 0.0247 | -0.0003 | |||||

| Matterhorn Re 2025-1 Class A / DBT (US577092AW99) | 0.28 | -0.35 | 0.0245 | -0.0008 | |||||

| Kizuna Re III 2024-1 Class A / DBT (US49835JAB26) | 0.27 | 0.37 | 0.0236 | -0.0006 | |||||

| US03843AAA07 / Aquila Re I Ltd., Series A-1 | 0.27 | -0.74 | 0.0234 | -0.0009 | |||||

| Nakama Re 2025-1 Class 1 / DBT (US62984JAD00) | 0.27 | 0.0233 | 0.0233 | ||||||

| US54279PAA30 / Long Point Re IV Ltd | 0.26 | -0.38 | 0.0228 | -0.0008 | |||||

| Vitality Re XV 2024 Class B / DBT (US92847CAB37) | 0.26 | 1.97 | 0.0225 | -0.0003 | |||||

| US577092AN90 / Matterhorn Re Ltd | 0.26 | -1.16 | 0.0222 | -0.0008 | |||||

| Integrity Re III 2025-1 Class B-2 / DBT (US45870GAD88) | 0.25 | 0.0221 | 0.0221 | ||||||

| Gateway Re 2025-1 Class A / DBT (US36779CAQ96) | 0.25 | 0.0220 | 0.0220 | ||||||

| Sheepshead (Horseshoe Re) / EP (000000000) | 0.97 | 0.25 | 0.0216 | 0.0216 | |||||

| Bonanza Re 2024-1 Class A / DBT (US09785EAN13) | 0.21 | 0.99 | 0.0178 | -0.0004 | |||||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.19 | 33.40 | 0.19 | 33.10 | 0.0168 | 0.0039 | |||

| FXFXX / First American Funds Inc - First American Treasury Obligations Fund Class X | 0.19 | 33.40 | 0.19 | 33.10 | 0.0168 | 0.0039 | |||

| US35087TAD00 / Four Lakes Re Ltd | 0.19 | -0.53 | 0.0164 | -0.0006 | |||||

| Brighton (Horseshoe Re) / EP (000000000) | 1.02 | 0.18 | 0.0160 | 0.0160 | |||||

| Woodside (Horseshoe Re) / EP (000000000) | 1.01 | 0.14 | 0.0125 | 0.0125 | |||||

| Kensington (Horseshoe Re) / EP (000000000) | 0.95 | 0.13 | 0.0116 | 0.0116 | |||||

| Residential Re 2019-I Class 12 / DBT (US76120FAA93) | 0.11 | 0.00 | 0.0093 | -0.0003 | |||||

| US76114NAB82 / RESIDENTIAL RE 21 LTD | 0.11 | -44.15 | 0.0091 | -0.0077 | |||||

| Harambee Re 2018 / EP (000000000) | 0.00 | 0.06 | 0.0053 | 0.0053 | |||||

| US27955GAB86 / EDEN RE II LTD | 0.06 | 13.73 | 0.0051 | 0.0005 | |||||

| Baldwin (Horseshoe Re) / EP (000000000) | 1.33 | 0.04 | 0.0038 | 0.0038 | |||||

| US33975CAK18 / FloodSmart Re 2022-1 Class B | 0.04 | -85.71 | 0.0031 | -0.0194 | |||||

| SR0006 (Horseshoe Re) / EP (000000000) | 39.38 | 0.03 | 0.0030 | 0.0030 | |||||

| LRe 2019 (Lorenz Re Ltd.) / EP (000000000) | 0.00 | 0.03 | 0.0026 | 0.0026 | |||||

| Harambee Re 2019 / EP (000000000) | 0.00 | 0.01 | 0.0013 | 0.0013 | |||||

| Mackinac (Artex Segregated Account Company) / EP (000000000) | 0.06 | 0.01 | 0.0011 | 0.0011 | |||||

| US27955KAB98 / Eden Re II 2022-1 Class B | 0.01 | 140.00 | 0.0011 | 0.0006 | |||||

| US12765KAF21 / Caelus 2018-1 Class B | 0.00 | 0.00 | 0.0004 | -0.0000 | |||||

| US42815KAA07 / HESTIA RE LTD UNSECURED 144A 04/25 VAR | 0.00 | -98.94 | 0.0003 | -0.0250 | |||||

| Viribus Re 2019 / EP (000000000) | 0.53 | 0.00 | 0.0001 | 0.0001 | |||||

| Iseo (Artex Segregated Account Company) / EP (000000000) | 0.18 | 0.00 | 0.0000 | 0.0000 | |||||

| Sussex Re 2021-A / DBT (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| Mulholland (Artex Segregated Account Company) / EP (000000000) | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| Sussex Re 2022-A / DBT (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| SR0005 (Horseshoe Re) / EP (000000000) | 6.97 | 0.00 | 0.0000 | 0.0000 | |||||

| Viribus Re 2018 / EP (000000000) | 0.27 | 0.00 | 0.0000 | 0.0000 | |||||

| Freeport (Horseshoe Re) / EP (000000000) | 0.75 | 0.00 | 0.0000 | 0.0000 | |||||

| Emerald Lake (Artex Segregated Account Company) / EP (000000000) | 0.50 | 0.00 | 0.0000 | 0.0000 | |||||

| US92846DAB29 / Vita Capital VI 2021-1 Class B | 0.00 | 0.0000 | -0.0000 | ||||||

| Riverdale (Horseshoe Re) / EP (000000000) | 0.25 | 0.00 | 0.0000 | 0.0000 |