Mga Batayang Estadistika

| Nilai Portofolio | $ 657,507,305 |

| Posisi Saat Ini | 1,428 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

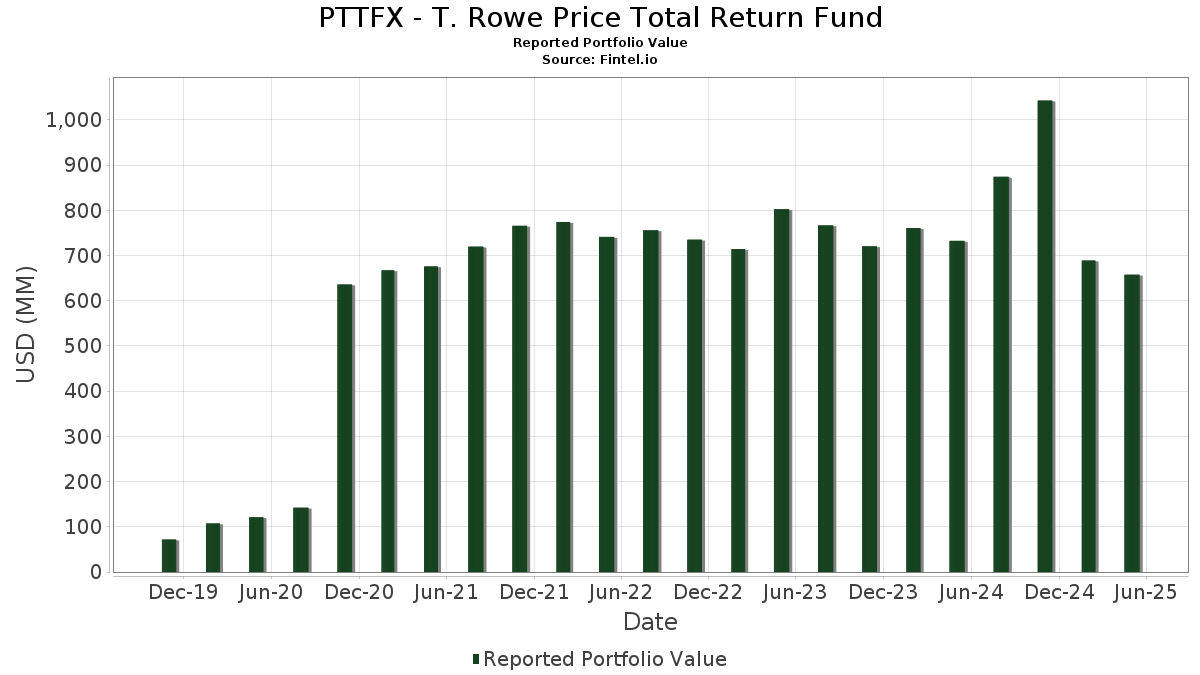

PTTFX - T. Rowe Price Total Return Fund telah mengungkapkan total kepemilikan 1,428 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 657,507,305 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PTTFX - T. Rowe Price Total Return Fund adalah T. Rowe Price Government Reserve Fund (US:US76105Y1091) , UNITED STATES TREASURY BOND 1.25% 05/15/2050 (US:US912810SN90) , US TREASURY N/B 4.75% 11-15-53 (US:US912810TV08) , US TREASURY NOTE 4.5% 11-15-33 (US:US91282CJJ18) , and United States Treasury Note/Bond (US:US912810TD00) . Posisi baru PTTFX - T. Rowe Price Total Return Fund meliputi: UNITED STATES TREASURY BOND 1.25% 05/15/2050 (US:US912810SN90) , US TREASURY N/B 4.75% 11-15-53 (US:US912810TV08) , US TREASURY NOTE 4.5% 11-15-33 (US:US91282CJJ18) , United States Treasury Note/Bond (US:US912810TD00) , and United States Treasury Note/Bond (US:US912810TW80) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 34.28 | 5.2712 | 5.2712 | ||

| 10.58 | 1.6278 | 1.6278 | ||

| 16.06 | 2.4691 | 1.4948 | ||

| 7.39 | 1.1369 | 1.1369 | ||

| 7.15 | 1.0999 | 1.0999 | ||

| 6.57 | 1.0107 | 1.0107 | ||

| 5.17 | 0.7950 | 0.7950 | ||

| 4.41 | 0.6780 | 0.6780 | ||

| 2.76 | 0.4244 | 0.4244 | ||

| 2.73 | 0.4204 | 0.4204 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.54 | 0.0834 | -1.0589 | ||

| -0.86 | -0.1321 | -0.9626 | ||

| 6.65 | 1.0232 | -0.9563 | ||

| -0.86 | -0.1327 | -0.5157 | ||

| 17.15 | 17.15 | 2.6380 | -0.3688 | |

| 3.18 | 0.4885 | -0.3564 | ||

| -2.27 | -0.3487 | -0.3487 | ||

| 0.45 | 0.0699 | -0.3334 | ||

| 1.63 | 0.2506 | -0.2775 | ||

| 1.99 | 0.3062 | -0.2672 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-29 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| UNITED STATES TREASURY NOTE/BOND / DBT (US91282CMZ13) | 34.28 | 5.2712 | 5.2712 | ||||||

| US76105Y1091 / T. Rowe Price Government Reserve Fund | 17.15 | -14.49 | 17.15 | -14.49 | 2.6380 | -0.3688 | |||

| UNITED STATES TREASURY NOTE/BOND / DBT (US91282CLF67) | 16.06 | 147.00 | 2.4691 | 1.4948 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US912810UC08) | 13.06 | -7.15 | 2.0086 | -0.0998 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US91282CLW90) | 10.58 | 1.6278 | 1.6278 | ||||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US912810UD80) | 7.39 | 1.1369 | 1.1369 | ||||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 7.27 | -7.48 | 1.1182 | -0.0597 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US91282CMT52) | 7.15 | 1.0999 | 1.0999 | ||||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 7.04 | -6.62 | 1.0831 | -0.0473 | |||||

| US91282CJJ18 / US TREASURY NOTE 4.5% 11-15-33 | 6.65 | -49.62 | 1.0232 | -0.9563 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US912810UJ50) | 6.57 | 1.0107 | 1.0107 | ||||||

| US912810TD00 / United States Treasury Note/Bond | 6.43 | -7.27 | 0.9883 | -0.0506 | |||||

| US912810TW80 / United States Treasury Note/Bond | 6.35 | -4.83 | 0.9762 | -0.0235 | |||||

| US91282CHR51 / U.S. Treasury Notes | 5.50 | 0.24 | 0.8453 | 0.0233 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US91282CMY48) | 5.17 | 0.7950 | 0.7950 | ||||||

| US91282CDJ71 / United States Treasury Note/Bond | 4.54 | 0.40 | 0.6974 | 0.0203 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US91282CMU26) | 4.41 | 0.6780 | 0.6780 | ||||||

| US912810SP49 / United States Treasury Note/Bond | 4.38 | -7.54 | 0.6731 | -0.0364 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US912810UF39) | 3.92 | -4.99 | 0.6028 | -0.0155 | |||||

| 76105YYY8 / T ROWE PRICE GOVERNMENT RESERVE INVESTMENT FUND - Collateral | 3.61 | -17.53 | 3.61 | -17.54 | 0.5548 | -0.1009 | |||

| SANTANDER DRIVE AUTO RECEIVABLES TRUST 2021-4 / ABS-O (US80285VAG41) | 3.48 | 0.17 | 0.5349 | 0.0145 | |||||

| US3132DWDJ99 / Freddie Mac Pool | 3.40 | -19.68 | 0.5234 | -0.1118 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US91282CKQ32) | 3.29 | -1.08 | 0.5060 | 0.0074 | |||||

| US31418EBR09 / Fannie Mae Pool | 3.18 | -43.65 | 0.4885 | -0.3564 | |||||

| SBA TOWER TRUST / DBT (US78403DBD12) | 2.81 | -0.18 | 0.4324 | 0.0103 | |||||

| CROSS 2025-H4 MORTGAGE TRUST / ABS-MBS (US22790AAA34) | 2.76 | 0.4244 | 0.4244 | ||||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US91282CMG32) | 2.73 | 0.4204 | 0.4204 | ||||||

| US3132DWDZ32 / FREDDIE MAC POOL UMBS P#SD8220 3.00000000 | 2.65 | -22.64 | 0.4078 | -0.1059 | |||||

| US55819MAW64 / Madison Park Funding XXXV Ltd | 2.50 | -0.04 | 0.3851 | 0.0095 | |||||

| US03236VAE11 / Amur Equipment Finance Receivables X LLC | 2.50 | 0.60 | 0.3850 | 0.0120 | |||||

| US21H0526606 / Ginnie Mae | 2.47 | 8.61 | 0.3802 | 0.0265 | |||||

| US912810TM09 / United States Treasury Note/Bond | 2.43 | -4.78 | 0.3737 | -0.0088 | |||||

| US31418DVA70 / FNMA 30YR 2% 12/01/2050# | 2.41 | -4.40 | 0.3713 | -0.0072 | |||||

| MONTENEGRO GOVERNMENT INTERNATIONAL BOND / DBT (US857305AA45) | 2.21 | -34.07 | 0.3403 | -0.1627 | |||||

| US31418CND29 / Federal National Mortgage Association | 2.20 | -3.47 | 0.3377 | -0.0033 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.06 | -2.10 | 0.3163 | 0.0014 | |||||

| US03789XAE85 / Applebee's Funding LLC / IHOP Funding LLC | 2.04 | -0.83 | 0.3137 | 0.0054 | |||||

| US31418EJ687 / Federal National Mortgage Association (FNMA) | 2.03 | -4.25 | 0.3120 | -0.0056 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US91282CMM00) | 2.02 | 0.3103 | 0.3103 | ||||||

| US36179WLN64 / GNII II 2% 08/20/2051#MA7533 | 1.99 | -47.96 | 0.3062 | -0.2672 | |||||

| US84055BAA17 / South32 Treasury Ltd | 1.95 | -1.86 | 0.3005 | 0.0021 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1.90 | -36.87 | 0.2927 | -0.1591 | |||||

| US31292SAV25 / Freddie Mac Gold Pool | 1.88 | -3.74 | 0.2887 | -0.0036 | |||||

| US36179XFG60 / Ginnie Mae II Pool | 1.86 | -4.99 | 0.2868 | -0.0075 | |||||

| US74514L3T29 / PUERTO RICO CMWLTH | 1.84 | -4.61 | 0.2831 | -0.0061 | |||||

| REAL ESTATE ASSET LIQUIDITY TRUST / ABS-MBS (CA75585RSU00) | 1.84 | 0.2830 | 0.2830 | ||||||

| US36179WQA98 / Government National Mortgage Association | 1.84 | -4.42 | 0.2829 | -0.0056 | |||||

| US40436VAJ08 / HPS Loan Management 11-2017 Ltd | 1.84 | -0.22 | 0.2824 | 0.0065 | |||||

| US36179V4U15 / Ginnie Mae II Pool | 1.84 | -4.23 | 0.2822 | -0.0050 | |||||

| US411707AH55 / Hardee's Funding LLC | 1.83 | -0.60 | 0.2813 | 0.0054 | |||||

| KKR CLO 43 LTD / ABS-CBDO (US48255UAN46) | 1.78 | -0.67 | 0.2744 | 0.0052 | |||||

| US3140XMBR65 / Fannie Mae Pool | 1.77 | -21.75 | 0.2728 | -0.0670 | |||||

| US3132DMZ819 / Freddie Mac Pool | 1.77 | -39.43 | 0.2724 | -0.1660 | |||||

| US85573HAD26 / Starwood Mortgage Residential Trust 2021-2 | 1.76 | 2.56 | 0.2710 | 0.0135 | |||||

| US43730NAG16 / Home Partners of America 2022-1 Trust | 1.72 | 0.17 | 0.2644 | 0.0071 | |||||

| US3140QS4E88 / Federal National Mortgage Association, Inc. | 1.71 | -3.98 | 0.2637 | -0.0038 | |||||

| US912810TN81 / United States Treasury Note/Bond | 1.71 | -6.86 | 0.2633 | -0.0121 | |||||

| VSTWF / Vast Renewables Limited - Equity Warrant | 1.71 | 31.01 | 0.2626 | 0.0671 | |||||

| US912810TF57 / TREASURY BOND | 1.71 | -4.75 | 0.2622 | -0.0062 | |||||

| US34417MAB37 / FOCUS Brands Funding LLC | 1.70 | -0.29 | 0.2619 | 0.0059 | |||||

| OCTAGON INVESTMENT PARTNERS 47 LTD / ABS-CBDO (US67576XBA72) | 1.68 | -1.06 | 0.2578 | 0.0038 | |||||

| OCTAGON INVESTMENT PARTNERS 47 LTD / ABS-CBDO (US67576XAY67) | 1.66 | 0.18 | 0.2557 | 0.0069 | |||||

| US36179R7J23 / Ginnie Mae II Pool | 1.66 | -31.50 | 0.2550 | -0.1077 | |||||

| US31418DYX47 / UMBS | 1.63 | -53.76 | 0.2506 | -0.2775 | |||||

| FRONTIER ISSUER LLC / ABS-O (US35910EAP97) | 1.62 | 1,766.67 | 0.2499 | 0.2368 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US912810UG12) | 1.62 | 0.2494 | 0.2494 | ||||||

| US36179XX434 / GOVERNMENT NATIONAL MORTGAGE CORPORATION | 1.62 | -4.60 | 0.2489 | -0.0053 | |||||

| HILCORP ENERGY I LP / LON (431319AH5) | 1.61 | 15.30 | 0.2482 | 0.0383 | |||||

| US07274EAJ29 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.25% 01-21-29 | 1.61 | 0.69 | 0.2470 | 0.0079 | |||||

| IVORY COAST GOVERNMENT INTERNATIONAL BOND / DBT (US221625AV83) | 1.60 | 0.2454 | 0.2454 | ||||||

| US14317HAF82 / CarMax Auto Owner Trust 2022-2 | 1.59 | -0.31 | 0.2451 | 0.0055 | |||||

| US361886CT91 / GMF Floorplan Owner Revolving Trust | 1.57 | -0.45 | 0.2407 | 0.0051 | |||||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 1.55 | -31.63 | 0.2391 | -0.1016 | |||||

| US31418DXK35 / Fannie Mae Pool | 1.54 | -4.46 | 0.2376 | -0.0048 | |||||

| US31418DWR96 / Fannie Mae Pool | 1.54 | -4.28 | 0.2375 | -0.0044 | |||||

| US03465VAA17 / AOMT_22-6 | 1.51 | -3.21 | 0.2317 | -0.0016 | |||||

| US34417RAB24 / FOCUS Brands Funding LLC | 1.50 | -1.76 | 0.2314 | 0.0018 | |||||

| US36179SNU77 / Ginnie Mae II Pool | 1.47 | -4.29 | 0.2267 | -0.0041 | |||||

| US19688FAD78 / COLT 2021-3 Mortgage Loan Trust | 1.46 | -2.66 | 0.2253 | -0.0003 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US912810TZ12) | 1.46 | -4.84 | 0.2238 | -0.0054 | |||||

| US44332EAP16 / Hub International Ltd., Term Loan | 1.41 | -27.37 | 0.2172 | -0.0742 | |||||

| ICE_CDX HY CDSI S44 5Y 06/20/2030 BOFA / DCR (000000000) | 1.40 | 0.2158 | 0.2158 | ||||||

| TPIC SPV I LLC / ABS-O (US872660AA35) | 1.39 | -1.20 | 0.2145 | 0.0028 | |||||

| US449653AE45 / COMMERCIAL MORTGAGE PASS THROUGH | 1.39 | -2.52 | 0.2141 | 0.0002 | |||||

| US912810SK51 / United States Treasury Note/Bond | 1.39 | -6.53 | 0.2137 | -0.0090 | |||||

| US33767JAG76 / FirstKey Homes 2020-SFR2 Trust | 1.39 | 0.29 | 0.2132 | 0.0060 | |||||

| JAMESTOWN CLO XV LTD / ABS-CBDO (US47050EAN94) | 1.37 | -0.36 | 0.2107 | 0.0046 | |||||

| US912810SR05 / United States Treasury Note/Bond - When Issued | 1.37 | -4.67 | 0.2105 | -0.0047 | |||||

| REAL ESTATE ASSET LIQUIDITY TRUST / ABS-MBS (CA75585RSS53) | 1.37 | 0.2103 | 0.2103 | ||||||

| US15135BAT89 / CORPORATE BONDS | 1.35 | 0.52 | 0.2073 | 0.0063 | |||||

| US3132E0A778 / FREDDIE MAC POOL | 1.34 | -3.10 | 0.2067 | -0.0013 | |||||

| US36179SQV24 / Ginnie Mae II Pool | 1.33 | -4.26 | 0.2039 | -0.0038 | |||||

| WELLFLEET CLO 2018-2 LTD / ABS-CBDO (US94949JAN54) | 1.31 | 0.00 | 0.2019 | 0.0051 | |||||

| AH PARENT,INC. SER A PREFERRED SHARES PP / EP (TC3I9NQ04) | 0.00 | 0.00 | 1.31 | 1.00 | 0.2019 | 0.0070 | |||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1.30 | 0.1997 | 0.1997 | ||||||

| APPLIED SYSTEMS INC / LON (03827FBC4) | 1.29 | -12.67 | 0.1982 | -0.0221 | |||||

| US36251XAQ07 / GS Mortgage Securities Trust 2016-GS4 | 1.28 | 0.16 | 0.1961 | 0.0052 | |||||

| US3140QEYY27 / Fannie Mae Pool | 1.26 | -5.11 | 0.1941 | -0.0053 | |||||

| US3136BCD804 / FANNIE MAE REMICS FNR 2020-89 DI | 1.25 | 0.1923 | 0.1923 | ||||||

| US35910EAC84 / Frontier Issuer, LLC 11.5%, Due 08/20/2053 | 1.24 | -1.28 | 0.1902 | 0.0025 | |||||

| CYRUSONE DATA CENTERS ISSUER I LLC / ABS-O (US23284BAG95) | 1.23 | -0.57 | 0.1889 | 0.0037 | |||||

| CARMAX AUTO OWNER TRUST 2024-2 / ABS-O (US14319EAJ55) | 1.22 | -0.89 | 0.1884 | 0.0031 | |||||

| US126650DV97 / CVS Health Corp | 1.21 | -4.26 | 0.1866 | -0.0034 | |||||

| US36179VV317 / Ginnie Mae II Pool | 1.21 | -5.31 | 0.1866 | -0.0055 | |||||

| US3133KNLC55 / Freddie Mac Pool | 1.20 | -4.30 | 0.1851 | -0.0034 | |||||

| DRIVE AUTO RECEIVABLES TRUST 2021-3 / ABS-O (US262081AF92) | 1.20 | 0.1847 | 0.1847 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1.20 | -3.15 | 0.1846 | -0.0012 | |||||

| FOUNDRY JV HOLDCO LLC / DBT (US350930AB92) | 1.20 | -0.50 | 0.1841 | 0.0037 | |||||

| HPEFS EQUIPMENT TRUST 2024-1 / ABS-O (US403963AE13) | 1.19 | -0.75 | 0.1833 | 0.0033 | |||||

| OBX 2025-NQM8 TRUST / ABS-MBS (US67449AAA34) | 1.19 | 0.1830 | 0.1830 | ||||||

| CHARTER NEXT GENERATION / LON (16125TAM4) | 1.19 | -38.35 | 0.1828 | -0.1062 | |||||

| US14688DAF87 / Carvana Auto Receivables Trust | 1.18 | 0.51 | 0.1809 | 0.0054 | |||||

| ALLIANT HOLDINGS INTERMEDI / LON (US01881UAM71) | 1.17 | -28.26 | 0.1805 | -0.0646 | |||||

| US161175CA05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1.17 | -15.07 | 0.1804 | -0.0266 | |||||

| PROJECT ALPHA INTERMEDIA / LON (74339D9B6) | 1.17 | -18.05 | 0.1802 | -0.0340 | |||||

| US46657BAA26 / J.P. Morgan Mortgage Trust 2023-DSC2 | 1.17 | -3.71 | 0.1798 | -0.0022 | |||||

| US05606GAQ47 / BX Trust 2021-VIEW | 1.16 | 2.56 | 0.1784 | 0.0088 | |||||

| AMT / American Tower Corporation | 1.16 | -50.28 | 0.1784 | -0.1713 | |||||

| US31418EAP51 / FN MA4513 | 1.16 | -5.25 | 0.1777 | -0.0051 | |||||

| US91282CAE12 / United States Treasury Note/Bond | 1.14 | 1.07 | 0.1750 | 0.0063 | |||||

| US63935BAB99 / Navient Private Education Refi Loan Trust 2020-H | 1.13 | 0.00 | 0.1745 | 0.0043 | |||||

| US45276NAB73 / Imperial Fund Mortgage Trust 2022-NQM4 | 1.13 | -1.90 | 0.1744 | 0.0012 | |||||

| US3133KLZX80 / Freddie Mac Pool | 1.13 | -4.15 | 0.1741 | -0.0031 | |||||

| US3140XK6P03 / Fannie Mae Pool | 1.13 | -38.40 | 0.1741 | -0.1012 | |||||

| US3133KPMB12 / Freddie Mac Pool | 1.13 | -4.89 | 0.1737 | -0.0044 | |||||

| H1UM34 / Humana Inc. - Depositary Receipt (Common Stock) | 1.12 | 0.1730 | 0.1730 | ||||||

| US01F0506687 / Fannie Mae or Freddie Mac | 1.12 | -12.00 | 0.1727 | -0.0254 | |||||

| ELLUCIAN HOLDINGS INC / LON (83578B9H8) | 1.11 | -26.73 | 0.1708 | -0.0563 | |||||

| XS2278566299 / Autostrade per l'Italia SpA | 1.11 | 9.68 | 0.1708 | 0.0190 | |||||

| US31418D6F41 / Fannie Mae Pool | 1.11 | -3.23 | 0.1703 | -0.0013 | |||||

| DRYDEN 93 CLO LTD / ABS-CBDO (US26190TAS06) | 1.11 | 0.18 | 0.1700 | 0.0046 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 1.10 | -1.16 | 0.1697 | 0.0023 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1.10 | -33.84 | 0.1687 | -0.0799 | |||||

| US61765LAW00 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C24 | 1.10 | 1.67 | 0.1684 | 0.0069 | |||||

| US12593YBL65 / Commercial Mortgage Pass Through Certificates | 1.09 | 1.02 | 0.1681 | 0.0059 | |||||

| CHENANGO PARK CLO LTD / ABS-CBDO (US16409TAS87) | 1.08 | 0.1667 | 0.1667 | ||||||

| SFS AUTO RECEIVABLES SECURITIZATION TRUST 2024-1 / ABS-O (US78435VAE20) | 1.05 | -0.57 | 0.1616 | 0.0032 | |||||

| DELTA TOPCO INC / LON (US24780DAH08) | 1.05 | -13.06 | 0.1608 | -0.0194 | |||||

| US3140QL6V31 / Federal National Mortgage Association, Inc. | 1.05 | -4.83 | 0.1608 | -0.0038 | |||||

| CA19521DAD36 / Cologix Canadian Issuer LP | 1.04 | 5.68 | 0.1602 | 0.0124 | |||||

| US36179XX509 / GNMA | 1.04 | -4.23 | 0.1602 | -0.0027 | |||||

| US3140QLQZ27 / Fannie Mae Pool | 1.04 | -4.95 | 0.1597 | -0.0041 | |||||

| US3140QRET64 / FANNIE MAE POOL FN CB5545 | 1.04 | -7.41 | 0.1596 | -0.0084 | |||||

| US36262JAD72 / GS Mortgage-Backed Securities Trust 2021-GR2 | 1.03 | -4.72 | 0.1584 | -0.0036 | |||||

| US912810RG58 / United States Treas Bds Bond | 1.03 | -5.26 | 0.1579 | -0.0045 | |||||

| SOLV / Solventum Corporation | 1.02 | -0.19 | 0.1576 | 0.0036 | |||||

| US3133APQD42 / Freddie Mac Pool | 1.02 | -3.22 | 0.1570 | -0.0011 | |||||

| 1112 / Health and Happiness (H&H) International Holdings Limited | 1.02 | 0.1567 | 0.1567 | ||||||

| US912810RK60 / United States Treas Bds Bond | 1.02 | -5.57 | 0.1566 | -0.0051 | |||||

| GOLUB CAPITAL PRIVATE CREDIT FUND / DBT (US38179RAC97) | 1.02 | 465.00 | 0.1564 | 0.1294 | |||||

| SYMPHONY CLO XVI LTD / ABS-CBDO (US87165VAX73) | 1.02 | -12.86 | 0.1563 | -0.0185 | |||||

| US3140QMZC14 / Fannie Mae Pool | 1.01 | -4.80 | 0.1557 | -0.0036 | |||||

| EPICOR SOFTWARE CORP / LON (29426NAZ7) | 1.01 | -34.24 | 0.1553 | -0.0750 | |||||

| US912810SW99 / United States Treasury Note/Bond | 1.01 | -4.72 | 0.1552 | -0.0037 | |||||

| A1ES34 / The AES Corporation - Depositary Receipt (Common Stock) | 1.01 | 0.1549 | 0.1549 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 1.00 | -0.10 | 0.1545 | 0.0038 | |||||

| STELLANTIS FINANCE US INC / DBT (US85855CAK62) | 1.00 | 0.1542 | 0.1542 | ||||||

| US3140QMCC60 / Fannie Mae Pool | 1.00 | -4.21 | 0.1541 | -0.0026 | |||||

| HUNTINGTON BANK AUTO CREDIT-LINKED NOTES SERIES 2025-1 / ABS-O (US446438SX24) | 1.00 | 0.1538 | 0.1538 | ||||||

| US418751AD59 / HAT Holdings I LLC / HAT Holdings II LLC | 1.00 | -0.30 | 0.1538 | 0.0035 | |||||

| US83368RBH49 / Societe Generale SA | 0.99 | 0.61 | 0.1530 | 0.0048 | |||||

| GOVERNMENT NATIONAL MORTGAGE ASSOCIATION / ABS-MBS (US38383X3E26) | 0.99 | 0.1524 | 0.1524 | ||||||

| RENTOKIL TERMINIX FUNDING LLC / DBT (US760130AA26) | 0.99 | 0.1522 | 0.1522 | ||||||

| BANK OF AMERICA CORP / DBT (US06051GMB22) | 0.99 | -0.90 | 0.1520 | 0.0025 | |||||

| US852060AT99 / Sprint Capital Corp 8.750% Notes 03/15/32 | 0.99 | -0.70 | 0.1519 | 0.0029 | |||||

| BANK OF AMERICA CORP / DBT (US06051GMD87) | 0.99 | -0.70 | 0.1518 | 0.0028 | |||||

| ALERA GROUP INTERMEDIATE / LON (000000000) | 0.98 | 0.1515 | 0.1515 | ||||||

| CARMAX SELECT RECEIVABLES TRUST 2024-A / ABS-O (US14319FAF09) | 0.98 | -0.91 | 0.1513 | 0.0026 | |||||

| US854502AM31 / Stanley Black & Decker Inc | 0.98 | 0.1500 | 0.1500 | ||||||

| SEB FUNDING LLC / ABS-O (US78433DAC83) | 0.98 | -10.96 | 0.1500 | -0.0142 | |||||

| US31418DV742 / Fannie Mae Pool | 0.98 | -4.22 | 0.1499 | -0.0027 | |||||

| US3140J9VB42 / Fannie Mae Pool | 0.97 | -5.34 | 0.1498 | -0.0045 | |||||

| BULGARIA GOVERNMENT INTERNATIONAL BOND / DBT (XS3063879442) | 0.97 | 0.1497 | 0.1497 | ||||||

| US24381WAC29 / Deephaven Residential Mortgage Trust 2021-2 | 0.97 | -3.10 | 0.1490 | -0.0009 | |||||

| SANTANDER BANK AUTO CREDIT-LINKED NOTES SERIES 2023-B / ABS-O (US80290CCC64) | 0.97 | -13.03 | 0.1489 | -0.0181 | |||||

| THL CREDIT WIND RIVER 2019-3 CLO LTD / ABS-CBDO (US97314JAN54) | 0.97 | 0.00 | 0.1488 | 0.0038 | |||||

| US92840MAB81 / Vistra Corp | 0.96 | 6.42 | 0.1479 | 0.0125 | |||||

| SIGNAL PEAK CLO 5 LTD / ABS-CBDO (US82666VAE48) | 0.96 | -0.52 | 0.1469 | 0.0029 | |||||

| KASEYA INC / LON (000000000) | 0.94 | 0.1452 | 0.1452 | ||||||

| XS2390849318 / MPT Operating Partnership LP / MPT Finance Corp | 0.93 | 9.00 | 0.1435 | 0.0152 | |||||

| BMO 2024-5C5 MORTGAGE TRUST / ABS-MBS (US05593RAF91) | 0.93 | -0.75 | 0.1424 | 0.0026 | |||||

| FILTRATION GROUP CORP / LON (31732FAV8) | 0.92 | -29.86 | 0.1420 | -0.0554 | |||||

| CIFC FUNDING 2013-IV LTD / ABS-CBDO (US12549FCA57) | 0.92 | 0.22 | 0.1420 | 0.0039 | |||||

| XS2385393587 / Cellnex Finance Co. SA | 0.92 | 391.98 | 0.1416 | 0.1135 | |||||

| US26658NAQ25 / Engineered Machinery Holdings Inc | 0.92 | 0.00 | 0.1415 | 0.0035 | |||||

| CROSS 2024-H6 MORTGAGE TRUST / ABS-MBS (US227919AA56) | 0.92 | -6.62 | 0.1411 | -0.0061 | |||||

| OPAL US LLC / LON (XAF7000QAB77) | 0.91 | 0.1400 | 0.1400 | ||||||

| US466365AC73 / Jack In The Box Funding LLC | 0.91 | -1.52 | 0.1400 | 0.0014 | |||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US912810TX63) | 0.91 | -6.89 | 0.1394 | -0.0065 | |||||

| US3133KYWH88 / Freddie Mac Pool | 0.90 | -3.34 | 0.1381 | -0.0011 | |||||

| US31418DYB27 / FN MA4305 | 0.89 | -4.18 | 0.1374 | -0.0024 | |||||

| US36179WY855 / GNII II 2% 03/20/2052# | 0.89 | -4.39 | 0.1373 | -0.0026 | |||||

| US3137FFHC47 / Freddie Mac REMICS | 0.89 | 0.1365 | 0.1365 | ||||||

| APPLIED SYSTEMS INC / LON (US03827FBD24) | 0.89 | -45.15 | 0.1365 | -0.1061 | |||||

| US36179WY939 / Ginnie Mae II Pool | 0.89 | -4.74 | 0.1362 | -0.0031 | |||||

| PORT OF BEAUMONT NAVIGATION DISTRICT / DBT (US73360CAS35) | 0.89 | -0.45 | 0.1361 | 0.0028 | |||||

| US3132ACSZ40 / Freddie Mac Pool | 0.88 | -3.93 | 0.1354 | -0.0020 | |||||

| US31418EW300 / Fannie Mae Pool | 0.88 | -3.83 | 0.1351 | -0.0018 | |||||

| CARVANA AUTO RECEIVABLES TRUST 2024-N1 / ABS-O (US14687QAE35) | 0.88 | -0.57 | 0.1350 | 0.0026 | |||||

| US12598RAA14 / COLT 21-5 A1 144A FRN 10-01-61 | 0.88 | -5.90 | 0.1349 | -0.0049 | |||||

| TRICON RESIDENTIAL 2024-SFR2 TRUST / ABS-O (US89616VAD29) | 0.87 | -0.91 | 0.1337 | 0.0021 | |||||

| ICE_ITRX EUR CDSI S43 5Y 06/20/2030 / DCR (000000000) | 0.87 | 0.1330 | 0.1330 | ||||||

| US3140XKG616 / Fannie Mae Pool | 0.86 | -4.65 | 0.1325 | -0.0030 | |||||

| AMUR EQUIPMENT FINANCE RECEIVABLES XIII LLC / ABS-O (US03237CAC64) | 0.85 | 0.12 | 0.1305 | 0.0034 | |||||

| US3140XFPM71 / FNMA 15YR 2% 02/01/2037# | 0.84 | -2.88 | 0.1297 | -0.0005 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 0.84 | -4.75 | 0.1296 | -0.0031 | |||||

| US63941GAC87 / Navient Private Education Refi Loan Trust 2020-B | 0.84 | 0.84 | 0.1290 | 0.0043 | |||||

| CONNECTICUT AVENUE SECURITIES TRUST 2025-R02 / ABS-MBS (US20754TAB89) | 0.84 | 0.1290 | 0.1290 | ||||||

| XS2198191962 / Vertical Holdco GmbH | 0.83 | 8.18 | 0.1282 | 0.0128 | |||||

| GA GLOBAL FUNDING TRUST / DBT (US36143L2T17) | 0.83 | 0.1280 | 0.1280 | ||||||

| USU5007TAD73 / KOSMOS ENERGY LTD 7.750000% 05/01/2027 | 0.83 | 0.1274 | 0.1274 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.82 | -5.51 | 0.1266 | -0.0040 | |||||

| US3132DWDC47 / Freddie Mac Pool | 0.82 | -4.23 | 0.1255 | -0.0022 | |||||

| HUNTINGTON BANK AUTO CREDIT-LINKED NOTES SERIES 2024-2 / ABS-O (US44644NAG43) | 0.82 | -11.89 | 0.1254 | -0.0133 | |||||

| ONEDIGITAL BORROWER LLC / LON (68252HAB0) | 0.81 | -21.65 | 0.1242 | -0.0302 | |||||

| US513075BW03 / Lamar Media Corp | 0.80 | 0.1236 | 0.1236 | ||||||

| US17328PAQ63 / Citigroup Mortgage Loan Trust Inc | 0.80 | -6.95 | 0.1236 | -0.0058 | |||||

| HILT COMMERCIAL MORTGAGE TRUST 2024-ORL / ABS-MBS (US403956AC97) | 0.80 | -0.25 | 0.1236 | 0.0029 | |||||

| US44332PAH47 / HUB International Ltd | 0.80 | 0.38 | 0.1235 | 0.0036 | |||||

| US674599EA94 / Occidental Petroleum Corp | 0.80 | -2.67 | 0.1234 | -0.0001 | |||||

| US3132DV7A70 / Freddie Mac Pool | 0.80 | -4.07 | 0.1232 | -0.0020 | |||||

| US3140QMTP90 / Fannie Mae Pool | 0.79 | -5.26 | 0.1220 | -0.0036 | |||||

| XS2445185916 / Axian Telecom | 0.79 | 0.26 | 0.1209 | 0.0033 | |||||

| HEALTH CARE SERVICE CORP A MUTUAL LEGAL RESERVE CO / DBT (US42218SAM08) | 0.78 | -6.13 | 0.1202 | -0.0045 | |||||

| TRUIST INSURANCE HOLDINGS LLC / LON (US89788VAE20) | 0.78 | -39.94 | 0.1199 | -0.0746 | |||||

| US53219LAW90 / LIFEPOINT HEALTH INC | 0.77 | 33.04 | 0.1183 | 0.0315 | |||||

| TRGP / Targa Resources Corp. | 0.77 | -2.66 | 0.1180 | -0.0002 | |||||

| US06540BAJ89 / BANK 2019-BNK21 | 0.77 | 3.38 | 0.1178 | 0.0067 | |||||

| US18912UAA07 / Cloud Software Group Inc | 0.77 | -11.87 | 0.1178 | -0.0123 | |||||

| KSPI / Joint Stock Company Kaspi.kz | 0.76 | 0.1175 | 0.1175 | ||||||

| HARBOUR ENERGY PLC / DBT (US411618AD32) | 0.76 | 0.1174 | 0.1174 | ||||||

| US759351AR05 / Reinsurance Group of America Inc | 0.76 | 17.47 | 0.1170 | 0.0199 | |||||

| US31292SAG57 / Freddie Mac Gold Pool | 0.76 | -3.68 | 0.1170 | -0.0014 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.76 | -4.06 | 0.1165 | -0.0018 | |||||

| US36254KAA07 / GS Mortgage Securities Trust 2017-GS8 | 0.76 | 2.85 | 0.1165 | 0.0061 | |||||

| US3140QNEW89 / UMBS | 0.76 | -4.91 | 0.1164 | -0.0029 | |||||

| US01F0504609 / Uniform Mortgage-Backed Security, TBA | 0.75 | 0.1154 | 0.1154 | ||||||

| US078774AB23 / Bellemeade Re 2022-1 Ltd | 0.75 | -24.57 | 0.1153 | -0.0336 | |||||

| US3140LVQG72 / Fannie Mae Pool | 0.75 | -3.49 | 0.1150 | -0.0011 | |||||

| US04649VAZ31 / ASURION LLC | 0.75 | -31.78 | 0.1147 | -0.0491 | |||||

| US33767MAC91 / FirstKey Homes 2020-SFR1 Trust | 0.74 | 0.41 | 0.1142 | 0.0034 | |||||

| US3133KYWJ45 / Federal Home Loan Mortgage Corporation | 0.74 | -3.52 | 0.1138 | -0.0012 | |||||

| VERUS SECURITIZATION TRUST 2025-INV1 / ABS-MBS (US924929AE29) | 0.74 | -2.52 | 0.1131 | -0.0001 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.73 | 0.1116 | 0.1116 | ||||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 0.73 | 982.09 | 0.1115 | 0.1014 | |||||

| US92539BAA08 / Verus Securitization Trust 2023-1 | 0.72 | -6.70 | 0.1114 | -0.0050 | |||||

| US74333TAJ88 / Progress Residential Trust, Series 2021-SFR8, Class E1 | 0.72 | 0.1114 | 0.1114 | ||||||

| MADISON PARK FUNDING XXIV LTD / ABS-CBDO (US55820NBA81) | 0.72 | -0.28 | 0.1112 | 0.0025 | |||||

| H1FC34 / HF Sinclair Corporation - Depositary Receipt (Common Stock) | 0.72 | 7.62 | 0.1107 | 0.0104 | |||||

| US26658NAN93 / Engineered Machinery Holdings Inc | 0.72 | 0.00 | 0.1107 | 0.0027 | |||||

| SCF EQUIPMENT LEASING 2024-1 LLC / ABS-O (US783896AF01) | 0.72 | -0.55 | 0.1107 | 0.0023 | |||||

| US31418ECT55 / UMBS | 0.72 | -2.97 | 0.1106 | -0.0006 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.72 | -1.24 | 0.1104 | 0.0013 | |||||

| US15089QAP90 / Celanese US Holdings LLC | 0.72 | 8.16 | 0.1102 | 0.0109 | |||||

| CIFC FUNDING 2016-I LTD / ABS-CBDO (US17180TBS06) | 0.71 | -2.46 | 0.1099 | 0.0001 | |||||

| TK ELEVATOR US NEWCO INC / LON (8869969C3) | 0.71 | 0.1091 | 0.1091 | ||||||

| US912810TL26 / TREASURY BOND | 0.71 | -6.62 | 0.1085 | -0.0048 | |||||

| OCP CLO 2017-13 LTD / ABS-CBDO (US67097LAX47) | 0.71 | -0.28 | 0.1085 | 0.0024 | |||||

| US31418EAV20 / Fannie Mae Pool | 0.70 | -3.96 | 0.1084 | -0.0016 | |||||

| RAIZEN FUELS FINANCE SA / DBT (US75102XAD84) | 0.70 | -2.09 | 0.1083 | 0.0005 | |||||

| SANTANDER MORTGAGE ASSET RECEIVABLE TRUST 2025-NQM2 / ABS-MBS (US802638AA49) | 0.70 | 0.1082 | 0.1082 | ||||||

| US36179WR263 / GINNIE MAE II POOL G2 MA7705 | 0.70 | -4.49 | 0.1080 | -0.0022 | |||||

| AP GRANGE HOLDINGS PP / DBT (000000000) | 0.70 | 0.1077 | 0.1077 | ||||||

| H1FC34 / HF Sinclair Corporation - Depositary Receipt (Common Stock) | 0.70 | -1.27 | 0.1075 | 0.0015 | |||||

| STLD / Steel Dynamics, Inc. | 0.70 | 0.1074 | 0.1074 | ||||||

| SANDISK CORP / LON (80004YAC7) | 0.70 | -28.78 | 0.1074 | -0.0395 | |||||

| XS2051670300 / Blackstone Property Partners Europe Holdings Sarl | 0.70 | 0.1070 | 0.1070 | ||||||

| JONES DESLAURIERS INSURA / LON (XAC4900AAM99) | 0.69 | -28.07 | 0.1065 | -0.0377 | |||||

| IMCD / IMCD N.V. | 0.69 | 0.1056 | 0.1056 | ||||||

| LTI HOLDINGS INC / LON (US50217UBF30) | 0.69 | -28.79 | 0.1054 | -0.0389 | |||||

| US845467AR03 / CORP. NOTE | 0.68 | 0.15 | 0.1052 | 0.0028 | |||||

| US3140QNWL23 / Fannie Mae Pool | 0.68 | -4.10 | 0.1045 | -0.0017 | |||||

| BX COMMERCIAL MORTGAGE TRUST 2024-MDHS / ABS-MBS (US12433BAA52) | 0.68 | -1.17 | 0.1043 | 0.0014 | |||||

| BX COMMERCIAL MORTGAGE TRUST 2024-MDHS / ABS-MBS (US12433BAC19) | 0.68 | -1.02 | 0.1041 | 0.0015 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.67 | -0.15 | 0.1036 | 0.0025 | |||||

| CONE TRUST 2024-DFW1 / ABS-MBS (US20682AAA88) | 0.67 | -0.44 | 0.1034 | 0.0021 | |||||

| FLUTTER TREASURY DAC / DBT (US344045AA72) | 0.67 | 0.45 | 0.1028 | 0.0030 | |||||

| ENEL FINANCE INTERNATIONAL NV / DBT (US29278GBD97) | 0.67 | 0.30 | 0.1027 | 0.0029 | |||||

| VEON HOLDINGS BV / DBT (XS2824764521) | 0.66 | 0.1013 | 0.1013 | ||||||

| US80282YAG17 / Santander Consumer Auto Receivables Trust 2021-A | 0.66 | 0.77 | 0.1012 | 0.0033 | |||||

| US44332EAP16 / Hub International Ltd., Term Loan | 0.66 | 46.33 | 0.1011 | 0.0337 | |||||

| BATTALION CLO XII LTD / ABS-CBDO (US07133RBA23) | 0.66 | -0.76 | 0.1009 | 0.0019 | |||||

| US05591UAE73 / BSREP Commercial Mortgage Trust 2021-DC | 0.65 | 0.31 | 0.1007 | 0.0029 | |||||

| AES ANDES SA / DBT (US00111VAD91) | 0.65 | 0.1005 | 0.1005 | ||||||

| US01449NAA46 / Alen 2021-ACEN Mortgage Trust | 0.65 | 0.00 | 0.1004 | 0.0025 | |||||

| US3132DWFG33 / Freddie Mac Pool | 0.65 | -3.70 | 0.1000 | -0.0012 | |||||

| US48020RAA32 / Jones Deslauriers Insurance Management Inc | 0.65 | -0.92 | 0.0996 | 0.0016 | |||||

| SOLV / Solventum Corporation | 0.64 | -5.03 | 0.0989 | -0.0026 | |||||

| ALDAR / Aldar Properties PJSC | 0.64 | 0.0988 | 0.0988 | ||||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.64 | -2.29 | 0.0986 | 0.0003 | |||||

| US20030NDS71 / CORPORATE BONDS | 0.64 | -5.20 | 0.0982 | -0.0027 | |||||

| BATTALION CLO XV LTD / ABS-CBDO (US07131AAT16) | 0.64 | 0.16 | 0.0977 | 0.0025 | |||||

| BOOZ ALLEN HAMILTON INC / DBT (US09951LAD55) | 0.63 | 0.0975 | 0.0975 | ||||||

| US3140QNCC44 / Fannie Mae Pool | 0.63 | -4.39 | 0.0972 | -0.0020 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.63 | -0.47 | 0.0969 | 0.0021 | |||||

| US62848PAB67 / MVWOT 2023-1A B | 0.63 | -9.77 | 0.0966 | -0.0077 | |||||

| MARS INC / DBT (US571676BA26) | 0.63 | 0.0964 | 0.0964 | ||||||

| US31418EKK54 / FNMA 15YR 4% 11/01/2037#MA4797 | 0.63 | -4.86 | 0.0963 | -0.0023 | |||||

| NFG / National Fuel Gas Company | 0.63 | 0.64 | 0.0963 | 0.0031 | |||||

| LPL HOLDINGS INC / DBT (US50212YAP97) | 0.63 | 0.0962 | 0.0962 | ||||||

| US05592AAJ97 / BPR Trust 2021-TY | 0.62 | -1.27 | 0.0960 | 0.0012 | |||||

| US3136BPUZ20 / FNMA, REMIC, Series 2023-2, Class DI | 0.62 | -2.96 | 0.0958 | -0.0004 | |||||

| FOUNDRY JV HOLDCO LLC / DBT (US350930AG89) | 0.62 | -1.11 | 0.0958 | 0.0014 | |||||

| CROWN POINT CLO 7 LTD / ABS-CBDO (US22846MAJ27) | 0.62 | -32.32 | 0.0957 | -0.0421 | |||||

| US43730NAA46 / Home Partners of America 2022-1 Trust | 0.62 | -18.05 | 0.0957 | -0.0181 | |||||

| US09031WAC73 / Bimbo Bakeries USA Inc | 0.62 | -39.03 | 0.0950 | -0.0568 | |||||

| CABK / CaixaBank, S.A. | 0.62 | -0.96 | 0.0949 | 0.0015 | |||||

| US3140XHHT72 / Federal National Mortgage Association Conventional 30-Yr. Pass Through | 0.61 | -4.39 | 0.0939 | -0.0017 | |||||

| US3137FVHM78 / Freddie Mac REMICS | 0.61 | 0.0938 | 0.0938 | ||||||

| US3132DWFQ15 / FHLG 30YR 4.5% 12/01/2052# | 0.60 | -4.01 | 0.0920 | -0.0014 | |||||

| US31418ECU29 / Fannie Mae Pool | 0.59 | -3.10 | 0.0912 | -0.0006 | |||||

| US64831KAG13 / New Residential Mortgage Loan Trust 2022-SFR1 | 0.59 | -0.34 | 0.0912 | 0.0020 | |||||

| US05765WAA18 / TIBCO Software Inc | 0.59 | -40.10 | 0.0908 | -0.0570 | |||||

| FS LUXEMBOURG SARL / DBT (US30315XAC83) | 0.59 | 0.0905 | 0.0905 | ||||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0.59 | -7.85 | 0.0903 | -0.0053 | |||||

| SWISS RE SUBORDINATED FINANCE PLC / DBT (US87088QAB05) | 0.59 | 0.0903 | 0.0903 | ||||||

| US3132DNAM56 / Freddie Mac Pool | 0.58 | -5.05 | 0.0898 | -0.0023 | |||||

| US3140XFY700 / Fannie Mae Pool | 0.58 | -4.11 | 0.0897 | -0.0015 | |||||

| US431318BC74 / Hilcorp Energy I LP / Hilcorp Finance Co. | 0.58 | 23.88 | 0.0894 | 0.0190 | |||||

| US337932AL12 / FIRSTENERGY CORP SR UNSEC 2.65% 03-01-30 | 0.58 | 0.52 | 0.0892 | 0.0028 | |||||

| US31418EGK01 / Federal National Mortgage Association | 0.58 | -60.79 | 0.0890 | -0.1319 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 0.58 | -6.02 | 0.0890 | -0.0032 | |||||

| US12597DAK19 / CSAIL Commercial Mortgage Trust, Series 2019-C18, Class C | 0.58 | -0.86 | 0.0886 | 0.0015 | |||||

| US3133KNGN75 / Freddie Mac Pool | 0.57 | -4.49 | 0.0884 | -0.0017 | |||||

| NORTHWOODS CAPITAL XIV-B LTD / ABS-CBDO (US66860CAL72) | 0.57 | -10.62 | 0.0880 | -0.0079 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0.57 | 0.0872 | 0.0872 | ||||||

| HARDEE'S FUNDING LLC / ABS-O (US411707AM41) | 0.56 | -39.63 | 0.0865 | -0.0532 | |||||

| XS1960589155 / HEATHROW FNDG | 0.56 | 0.0862 | 0.0862 | ||||||

| US87422LAV27 / Talen Energy Supply, LLC 2023 Term Loan B | 0.56 | -26.09 | 0.0858 | -0.0274 | |||||

| JAVELIN BUYER INC / LON (000000000) | 0.56 | 0.0857 | 0.0857 | ||||||

| VOYA CLO 2018-3 LTD / ABS-CBDO (US92917KAQ76) | 0.56 | 0.00 | 0.0857 | 0.0020 | |||||

| US3132DPUZ97 / FREDDIE MAC POOL | 0.56 | -4.48 | 0.0854 | -0.0018 | |||||

| VENTURE GLOBAL LNG INC / DBT (US92332YAF88) | 0.55 | 22.57 | 0.0853 | 0.0174 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 0.55 | -6.95 | 0.0845 | -0.0040 | |||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | 0.55 | 0.0842 | 0.0842 | ||||||

| HYT COMMERCIAL MORTGAGE TRUST 2024-RGCY / ABS-MBS (US449173AA16) | 0.54 | -0.55 | 0.0838 | 0.0018 | |||||

| XAC0787FAB85 / Bausch + Lomb Corp | 0.54 | -45.60 | 0.0837 | -0.0662 | |||||

| SATS / EchoStar Corporation | 0.54 | 5.45 | 0.0835 | 0.0063 | |||||

| GCAT 2025-NQM1 TRUST / ABS-MBS (US36171GAA94) | 0.54 | 0.0834 | 0.0834 | ||||||

| UNITED STATES TREASURY NOTE/BOND / DBT (US91282CJZ59) | 0.54 | -92.89 | 0.0834 | -1.0589 | |||||

| TERRIER MEDIA BUYER INC / LON (US88145LAF13) | 0.54 | 11.39 | 0.0829 | 0.0105 | |||||

| US81761LAC63 / Service Properties Trust | 0.54 | 12.82 | 0.0827 | 0.0113 | |||||

| US64072UAK88 / CSC Holdings, LLC, Term Loan | 0.54 | 17.80 | 0.0826 | 0.0142 | |||||

| CLEAR CHANNEL OUTDOOR HOLDINGS INC / LON (US18452RAF29) | 0.53 | -16.82 | 0.0822 | -0.0142 | |||||

| BX COMMERCIAL MORTGAGE TRUST 2024-GPA3 / ABS-MBS (US123910AC54) | 0.53 | -6.37 | 0.0815 | -0.0032 | |||||

| US85573AAD72 / Starwood Mortgage Residential Trust 2020-1 | 0.53 | 0.96 | 0.0813 | 0.0028 | |||||

| US36179WTY48 / Ginnie Mae II Pool | 0.53 | -72.84 | 0.0813 | -0.2102 | |||||

| XS2247549731 / Cellnex Telecom SA | 0.53 | 10.23 | 0.0812 | 0.0093 | |||||

| DYE & DURHAM LTD / DBT (US267486AA63) | 0.53 | 57.78 | 0.0812 | 0.0311 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0.53 | -2.41 | 0.0811 | 0.0000 | |||||

| US03769HAC16 / Apidos CLO XXXVII | 0.52 | -0.38 | 0.0807 | 0.0018 | |||||

| 1261229 BC LTD / DBT (US68288AAA51) | 0.52 | 0.0807 | 0.0807 | ||||||

| US63941KAD72 / NAVSL 2020 CA B 144A | 0.52 | 0.00 | 0.0802 | 0.0021 | |||||

| VLOE34 / Valero Energy Corporation - Depositary Receipt (Common Stock) | 0.52 | 0.19 | 0.0801 | 0.0022 | |||||

| CARMAX AUTO OWNER TRUST 2024-1 / ABS-O (US14318WAG24) | 0.52 | -0.76 | 0.0800 | 0.0013 | |||||

| CMG MEDIA CORP / DBT (US125773AA99) | 0.52 | 58.23 | 0.0799 | 0.0306 | |||||

| HIGHTOWER HOLDING LLC / DBT (US43118DAB64) | 0.52 | 33.25 | 0.0796 | 0.0215 | |||||

| US38382LNV98 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION GNR 2020-173 MI | 0.51 | -4.32 | 0.0784 | -0.0015 | |||||

| US14687BAL09 / CRVNA 2021 P1 D | 0.51 | 0.20 | 0.0783 | 0.0022 | |||||

| US63938CAN83 / Navient Corp | 0.51 | 14.22 | 0.0779 | 0.0114 | |||||

| US91282CDY49 / United States Treasury Note/Bond | 0.50 | 0.40 | 0.0774 | 0.0021 | |||||

| FORTITUDE GROUP HOLDINGS LLC / DBT (US34966XAA63) | 0.50 | 0.0770 | 0.0770 | ||||||

| ACRISURE INC SEC A-2 CVT PFD STK PP / EP (000000000) | 0.02 | 0.50 | 0.0769 | 0.0769 | |||||

| US3133GEL973 / Federal Home Loan Mortgage Corporation | 0.50 | -4.04 | 0.0768 | -0.0012 | |||||

| US125039AF45 / CD 2017-CD6 Mortgage Trust | 0.50 | 0.40 | 0.0766 | 0.0022 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0.49 | 12.93 | 0.0752 | 0.0103 | |||||

| US14319BAF94 / Carmax Auto Owner Trust 2023-3 | 0.49 | -0.41 | 0.0752 | 0.0017 | |||||

| US3140QLPR10 / Fannie Mae Pool | 0.49 | -3.94 | 0.0751 | -0.0012 | |||||

| CORNERSTONE GENERATION L / LON (21924NAB4) | 0.49 | -28.63 | 0.0749 | -0.0272 | |||||

| EFMT 2024-INV2 / ABS-MBS (US26844LAB45) | 0.49 | -2.61 | 0.0746 | -0.0001 | |||||

| CRESCENT ENERGY FINANCE LLC / DBT (US45344LAE39) | 0.48 | 9.01 | 0.0745 | 0.0079 | |||||

| US14686GAE61 / Carvana Auto Receivables Trust 2022-N1 | 0.48 | -18.52 | 0.0744 | -0.0147 | |||||

| US31418ECD04 / Fannie Mae Pool | 0.48 | -58.72 | 0.0744 | -0.1011 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 0.48 | 46.79 | 0.0739 | 0.0248 | |||||

| FR00140066D6 / ENGIE - Loyalty Line 2024 | 0.48 | -1.23 | 0.0738 | 0.0009 | |||||

| US893647BT37 / TransDigm Inc | 0.48 | 36.00 | 0.0732 | 0.0207 | |||||

| AVALARA INC / LON (05338G9A6) | 0.47 | 0.0730 | 0.0730 | ||||||

| BATBC / British American Tobacco Bangladesh Company Limited | 0.47 | 0.0727 | 0.0727 | ||||||

| ELLUCIAN HOLDINGS INC / LON (28917XAB6) | 0.47 | 0.0727 | 0.0727 | ||||||

| US36179WZA97 / Ginnie Mae II Pool | 0.47 | -4.66 | 0.0725 | -0.0016 | |||||

| US64072UAM45 / CSC Holdings LLC | 0.47 | -29.43 | 0.0724 | -0.0275 | |||||

| EDGEWATER GENERATION LLC / LON (28031FAM2) | 0.47 | -29.75 | 0.0724 | -0.0279 | |||||

| SUTTER HEALTH / DBT (US86944BAQ68) | 0.47 | 0.0717 | 0.0717 | ||||||

| ARSENAL AIC PARENT LLC / LON (04287KAG6) | 0.47 | -29.97 | 0.0716 | -0.0280 | |||||

| ICON PARENT INC / LON (45115MAB4) | 0.47 | -30.28 | 0.0715 | -0.0286 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0.46 | -1.07 | 0.0714 | 0.0012 | |||||

| XAC8000CAB90 / Panther BF Aggregator 2 LP USD Term Loan B | 0.46 | -30.17 | 0.0713 | -0.0282 | |||||

| DELTA TOPCO INC / LON (24780DAJ6) | 0.46 | -53.35 | 0.0708 | -0.0771 | |||||

| QUIKRETE HOLDINGS INC / LON (US74839XAL38) | 0.46 | -30.41 | 0.0708 | -0.0283 | |||||

| US87422VAK44 / Talen Energy Supply, LLC | 0.46 | -0.22 | 0.0708 | 0.0016 | |||||

| CARVANA AUTO RECEIVABLES TRUST 2024-N2 / ABS-O (US14687VAE20) | 0.46 | -0.65 | 0.0704 | 0.0014 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.46 | 0.0704 | 0.0704 | ||||||

| FIEMEX ENERGIA - BANCO ACTINVER SA INSTITUCION DE BANCA MULTIPLE / DBT (US05974EAA82) | 0.46 | -1.51 | 0.0703 | 0.0007 | |||||

| US21H0606630 / Ginnie Mae | 0.45 | -82.50 | 0.0699 | -0.3334 | |||||

| US92332YAC57 / Venture Global LNG Inc | 0.45 | 12.69 | 0.0698 | 0.0094 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.45 | -2.80 | 0.0696 | -0.0001 | |||||

| JANE STREET GROUP LLC / LON (US47077DAM20) | 0.45 | -60.95 | 0.0694 | -0.1037 | |||||

| BCPE PEQUOD BUYER INC / LON (05624AAB8) | 0.45 | -30.45 | 0.0693 | -0.0277 | |||||

| XAC6907UAB70 / ONTARIO GAMING GTA LP | 0.45 | -32.48 | 0.0692 | -0.0306 | |||||

| US912828Z948 / United States Treasury Note/Bond | 0.45 | 0.90 | 0.0689 | 0.0024 | |||||

| MEDLINE BORROWER LP / LON (58503UAF0) | 0.45 | -43.77 | 0.0688 | -0.0504 | |||||

| MARS INC / DBT (US571676BB09) | 0.45 | 0.0685 | 0.0685 | ||||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0.44 | 71.60 | 0.0679 | 0.0292 | |||||

| US03067BAF67 / Americredit Automobile Receivables Trust 2023-1 | 0.44 | -0.23 | 0.0675 | 0.0016 | |||||

| US04649VBA70 / Asurion LLC, Term Loan | 0.44 | -32.82 | 0.0674 | -0.0304 | |||||

| US12636FBJ12 / COMM 2015-LC23 Mortgage Trust | 0.44 | 0.23 | 0.0673 | 0.0018 | |||||

| VENTURE GLOBAL PLAQUEMINES LNG LLC / DBT (US922966AB20) | 0.44 | 0.0671 | 0.0671 | ||||||

| US82650BAC00 / Sierra Timeshare 2023-2 Receivables Funding LLC | 0.44 | -10.47 | 0.0671 | -0.0060 | |||||

| NEUBERGER BERMAN LOAN ADVISERS CLO 43 LTD / ABS-CBDO (US64134AAJ16) | 0.44 | 0.0669 | 0.0669 | ||||||

| US31418CR890 / Fannie Mae Pool | 0.43 | -61.37 | 0.0667 | -0.1014 | |||||

| SOLV / Solventum Corporation | 0.43 | -0.23 | 0.0667 | 0.0016 | |||||

| US3140QRKQ51 / Fannie Mae Pool | 0.43 | -4.21 | 0.0666 | -0.0011 | |||||

| HOMES 2025-NQM2 TRUST / ABS-MBS (US403966AA22) | 0.43 | 0.0665 | 0.0665 | ||||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0.43 | 0.0663 | 0.0663 | ||||||

| 1261229 BC LTD / LON (91911K9L8) | 0.43 | 0.0663 | 0.0663 | ||||||

| ICE_CDX IG CDSI S44 5Y 06/20/2030 BARC / DCR (000000000) | 0.43 | 0.0663 | 0.0663 | ||||||

| JAVELIN BUYER INC / LON (000000000) | 0.43 | 0.0663 | 0.0663 | ||||||

| US67114BAD91 / OBX 2021 NQM1 M1 144A | 0.43 | -1.38 | 0.0661 | 0.0008 | |||||

| JANE STREET GROUP / JSG FINANCE INC / DBT (US47077WAE84) | 0.43 | 0.0660 | 0.0660 | ||||||

| AADVANTAGE LOYALTY IP / LON (US02376CBS35) | 0.43 | 0.0657 | 0.0657 | ||||||

| MCAFEE CORP / LON (57906HAF4) | 0.43 | -34.16 | 0.0655 | -0.0316 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.43 | -2.52 | 0.0655 | 0.0000 | |||||

| IQVIA INC / DBT (US46266TAF57) | 0.42 | 0.24 | 0.0653 | 0.0017 | |||||

| US640695AA01 / Neptune Bidco US Inc | 0.42 | 27.11 | 0.0649 | 0.0151 | |||||

| AUXILIOR TERM FUNDING 2024-1 LLC / ABS-O (US05335FAC59) | 0.42 | -0.24 | 0.0641 | 0.0014 | |||||

| US03465AAD19 / AOMT_20-6 | 0.41 | -6.14 | 0.0636 | -0.0024 | |||||

| US07274NBH52 / Bayer US Finance II LLC | 0.41 | -2.36 | 0.0636 | 0.0001 | |||||

| US97655JCD28 / WinWater Mortgage Loan Trust 2016-1 | 0.41 | -2.61 | 0.0633 | -0.0001 | |||||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 0.41 | 0.74 | 0.0631 | 0.0021 | |||||

| VOYA CLO 2018-3 LTD / ABS-CBDO (US92917KAU88) | 0.41 | -0.24 | 0.0631 | 0.0015 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.41 | -7.48 | 0.0629 | -0.0033 | |||||

| US04686RAB96 / Athenahealth, Inc. 2022 Term Loan B | 0.41 | -36.22 | 0.0624 | -0.0329 | |||||

| QUIKRETE HOLDINGS INC / DBT (US74843PAA84) | 0.41 | 136.84 | 0.0623 | 0.0365 | |||||

| US34529NAG51 / Ford Credit Auto Lease Trust, Series 2023-B, Class C | 0.40 | -0.74 | 0.0622 | 0.0011 | |||||

| XS2300293003 / Cellnex Finance Co SA | 0.40 | 8.36 | 0.0620 | 0.0063 | |||||

| US63938CAP32 / Navient Corp. | 0.40 | 48.34 | 0.0619 | 0.0212 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.40 | -5.66 | 0.0617 | -0.0020 | |||||

| US912810TT51 / United States Treasury Note/Bond | 0.40 | -6.81 | 0.0612 | -0.0028 | |||||

| US513075BW03 / Lamar Media Corp | 0.40 | 19.64 | 0.0609 | 0.0112 | |||||

| US36179UWB42 / G2SF 5.0 MA6042 07-20-49 | 0.40 | -5.28 | 0.0609 | -0.0018 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.40 | -27.52 | 0.0608 | -0.0210 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.39 | 0.0606 | 0.0606 | ||||||

| ARSENAL AIC PARENT LLC / DBT (US04288BAC46) | 0.39 | 20.12 | 0.0606 | 0.0113 | |||||

| US04349HAM60 / ASCEND LEARNING LLC TL 2LN 5.75 | 0.39 | -18.16 | 0.0604 | -0.0115 | |||||

| US92538NAA54 / Verus Securitization Trust 2022-4 | 0.39 | -2.74 | 0.0601 | -0.0002 | |||||

| US1248EPCT83 / CCO Holdings LLC | 0.39 | 22.33 | 0.0598 | 0.0121 | |||||

| US1248EPCL57 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.39 | 47.15 | 0.0595 | 0.0201 | |||||

| US59567LAA26 / Midcap Financial Issuer Trust | 0.39 | 96.45 | 0.0595 | 0.0299 | |||||

| US3133AQFQ56 / Freddie Mac Pool | 0.39 | -6.76 | 0.0595 | -0.0027 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.39 | -2.03 | 0.0594 | 0.0003 | |||||

| US7593518852 / Reinsurance Group of America Inc | 0.38 | -1.54 | 0.0590 | 0.0007 | |||||

| US36179WNE48 / GNMA2 30YR | 0.38 | -4.26 | 0.0588 | -0.0012 | |||||

| US25470XBE40 / DISH DBS Corp | 0.38 | 18.32 | 0.0587 | 0.0104 | |||||

| VOLKSWAGEN GROUP OF AMERICA FINANCE LLC / DBT (US928668CQ37) | 0.38 | 0.0586 | 0.0586 | ||||||

| BINOM SECURITIZATION TRUST 2022-INV1 / ABS-MBS (US090975AC73) | 0.38 | -4.04 | 0.0586 | -0.0008 | |||||

| US36179WDR60 / Ginnie Mae II Pool | 0.38 | -4.52 | 0.0585 | -0.0012 | |||||

| X CORP / LON (US90184NAK46) | 0.38 | 0.0581 | 0.0581 | ||||||

| US38383REY99 / Government National Mortgage Association | 0.38 | -2.34 | 0.0578 | 0.0002 | |||||

| JANE STREET GROUP / JSG FINANCE INC / DBT (US47077WAC29) | 0.37 | 20.39 | 0.0573 | 0.0110 | |||||

| CONNECTICUT AVENUE SECURITIES SERIES 2025-R01 / ABS-MBS (US20755JAB98) | 0.37 | -8.68 | 0.0567 | -0.0037 | |||||

| US3140QS3D15 / FNMA 30YR 5% 09/01/2053#CB7095 | 0.37 | -2.39 | 0.0566 | 0.0001 | |||||

| US90346KAB52 / USI Inc/NY | 0.37 | 23.57 | 0.0564 | 0.0119 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.37 | -4.69 | 0.0563 | -0.0013 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.36 | -2.67 | 0.0561 | 0.0000 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 0.36 | 0.28 | 0.0561 | 0.0016 | |||||

| US36179VSG67 / GNII II 2.5% 08/20/2050#MA6819 | 0.36 | -4.47 | 0.0558 | -0.0011 | |||||

| US3140XDYA84 / Fannie Mae Pool | 0.36 | -4.51 | 0.0554 | -0.0012 | |||||

| US26844QAB32 / EFMT 2023-1 | 0.36 | -4.01 | 0.0553 | -0.0009 | |||||

| US87422LAM28 / Talen Energy Supply, LLC 2019 Term Loan B | 0.36 | -26.94 | 0.0552 | -0.0183 | |||||

| US1248EPCK74 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.36 | 24.13 | 0.0547 | 0.0119 | |||||

| US100743AN37 / Boston Gas Co. | 0.36 | -6.08 | 0.0546 | -0.0021 | |||||

| KASEYA INC / LON (48578AAB4) | 0.35 | 0.0546 | 0.0546 | ||||||

| CARVANA AUTO RECEIVABLES TRUST 2024-N2 / ABS-O (US14687VAD47) | 0.35 | -0.28 | 0.0545 | 0.0013 | |||||

| HPEFS EQUIPMENT TRUST 2024-2 / ABS-O (US40444MAL54) | 0.35 | -0.56 | 0.0545 | 0.0011 | |||||

| ACRISURE LLC / ACRISURE FINANCE INC / DBT (US00489LAM54) | 0.35 | -0.28 | 0.0545 | 0.0012 | |||||

| HUNTINGTON BANK AUTO CREDIT-LINKED NOTES SERIES 2024-1 / ABS-O (US44644NAA72) | 0.35 | -12.90 | 0.0541 | -0.0064 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0.35 | 21.95 | 0.0539 | 0.0108 | |||||

| US91159HJG65 / US Bancorp | 0.35 | 0.0538 | 0.0538 | ||||||

| LOIRE FINCO LUXEMBOURG / LON (5039999D8) | 0.35 | 0.0537 | 0.0537 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.35 | -4.13 | 0.0536 | -0.0010 | |||||

| US36179VHG86 / Ginnie Mae II Pool | 0.35 | -5.71 | 0.0535 | -0.0017 | |||||

| US579063AB46 / Condor Merger Sub Inc | 0.35 | 57.99 | 0.0533 | 0.0205 | |||||

| PANTHER ESCROW ISSUER LLC / DBT (US69867RAA59) | 0.35 | 60.19 | 0.0533 | 0.0209 | |||||

| SRI LANKA GOVERNMENT INTERNATIONAL BOND / DBT (XS2966242252) | 0.35 | -4.70 | 0.0531 | -0.0013 | |||||

| US3140QTEF27 / FNMA 30YR 5.5% 10/01/2053#CB7333 | 0.34 | -3.64 | 0.0529 | -0.0006 | |||||

| US44267DAD93 / Howard Hughes Corp/The | 0.34 | 68.63 | 0.0529 | 0.0223 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.34 | -3.92 | 0.0528 | -0.0007 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0.34 | 0.0525 | 0.0525 | ||||||

| US3140NLSV22 / Federal National Mortgage Association, Inc. | 0.34 | -5.06 | 0.0520 | -0.0014 | |||||

| ALLIED UNIVERSAL HOLDCO LLC / DBT (US019576AD90) | 0.34 | 72.68 | 0.0516 | 0.0224 | |||||

| VOYAGER PARENT LLC / DBT (US92921EAA01) | 0.34 | 0.0515 | 0.0515 | ||||||

| US63941XAB38 / Navient Private Education Refi Loan Trust 2020-F | 0.33 | 0.00 | 0.0514 | 0.0013 | |||||

| US34529NAH35 / Ford Credit Auto Lease Trust 2023-B | 0.33 | -0.89 | 0.0513 | 0.0009 | |||||

| CARVANA AUTO RECEIVABLES TRUST 2024-N1 / ABS-O (US14687QAD51) | 0.33 | -0.30 | 0.0513 | 0.0012 | |||||

| US92537MAF77 / VERUS SECURITIZATION TRUST 2019-INV3 SER 2019-INV3 CL M1 V/R REGD 144A P/P 3.27900000 | 0.33 | 0.91 | 0.0512 | 0.0016 | |||||

| EFMT 2025-INV2 / ABS-MBS (US281914AA90) | 0.33 | 0.0511 | 0.0511 | ||||||

| US38141GZM94 / Goldman Sachs Group Inc/The | 0.33 | 0.30 | 0.0510 | 0.0015 | |||||

| US92838WAE49 / Vista Point Securitization Trust 2020-1 | 0.33 | 0.30 | 0.0509 | 0.0015 | |||||

| XS1205617829 / APT PIPELINES | 0.33 | -6.52 | 0.0508 | -0.0023 | |||||

| US205768AS39 / Comstock Resources Inc | 0.33 | 67.86 | 0.0507 | 0.0213 | |||||

| CRC INSURANCE GROUP LLC / LON (89788VAG7) | 0.33 | -64.16 | 0.0507 | -0.0870 | |||||

| US01883LAF04 / ALLIANT HOLD / CO-ISSUER REGD 144A P/P 7.00000000 | 0.33 | 64.00 | 0.0505 | 0.0205 | |||||

| US36179VHU70 / G2SF MA6543 03-20-50 | 0.33 | -4.65 | 0.0505 | -0.0012 | |||||

| QUIKRETE HOLDINGS INC / DBT (US74843PAB67) | 0.33 | 73.80 | 0.0501 | 0.0221 | |||||

| US845467AS85 / Southwestern Energy Co | 0.32 | 0.00 | 0.0497 | 0.0012 | |||||

| US44328UAE64 / HPEFS Equipment Trust 2023-2 | 0.32 | -0.31 | 0.0497 | 0.0010 | |||||

| US40436VAG68 / HPS Loan Management 11-2017 Ltd | 0.32 | -22.41 | 0.0496 | -0.0128 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.32 | -2.73 | 0.0495 | -0.0000 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.32 | -2.43 | 0.0495 | 0.0000 | |||||

| TRANSDIGM INC / DBT (US893647BY22) | 0.32 | 0.0494 | 0.0494 | ||||||

| US18453HAE62 / Clear Channel Outdoor Holdings Inc | 0.32 | 26.59 | 0.0491 | 0.0114 | |||||

| BAYVIEW FINANCING TRUST 2024-2F A / DBT (07336XAA5) | 0.32 | -3.64 | 0.0489 | -0.0007 | |||||

| RNR / RenaissanceRe Holdings Ltd. | 0.32 | -2.16 | 0.0488 | 0.0002 | |||||

| RAIZEN FUELS FINANCE SA / DBT (US75102XAB29) | 0.32 | -1.25 | 0.0488 | 0.0005 | |||||

| US76954LAA70 / RIVIAN HOLDCO and RIVIAN LLC and RIVIAN AUTOMOTIVE LLC 1ML+600 10/08/2026 | 0.32 | -7.33 | 0.0487 | -0.0025 | |||||

| US3136BDEF10 / FANNIE MAE REMICS FNR 2020-97 AI | 0.32 | 0.0486 | 0.0486 | ||||||

| SANTANDER BANK AUTO CREDIT-LINKED NOTES SERIES 2024-A / ABS-O (US80290CCK80) | 0.32 | -12.26 | 0.0485 | -0.0053 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.31 | -2.19 | 0.0483 | 0.0003 | |||||

| CBRE SERVICES INC / DBT (US12505BAJ98) | 0.31 | 0.0480 | 0.0480 | ||||||

| LPL HOLDINGS INC / DBT (US50212YAN40) | 0.31 | 0.0478 | 0.0478 | ||||||

| SOUTHERN CALIFORNIA GAS CO / DBT (US842434DC38) | 0.31 | 0.0477 | 0.0477 | ||||||

| SABRE GLBL INC / LON (US78571YBK55) | 0.31 | -25.12 | 0.0477 | -0.0144 | |||||

| EFMT 2025-INV1 / ABS-MBS (US26846XAA81) | 0.31 | -3.13 | 0.0477 | -0.0003 | |||||

| JANE STREET GROUP / JSG FINANCE INC / DBT (US47077WAD02) | 0.31 | -0.64 | 0.0476 | 0.0010 | |||||

| US36179XLK09 / Ginnie Mae II Pool | 0.31 | -6.71 | 0.0472 | -0.0020 | |||||

| WAND NEWCO 3 INC / LON (93369PAM6) | 0.31 | -60.57 | 0.0471 | -0.0693 | |||||

| US3133ANKP87 / Freddie Mac Pool | 0.31 | -3.17 | 0.0469 | -0.0003 | |||||

| US3140XGYQ67 / Fannie Mae Pool | 0.30 | -5.30 | 0.0468 | -0.0014 | |||||

| US36179WLP13 / Ginnie Mae II Pool | 0.30 | -4.42 | 0.0466 | -0.0010 | |||||

| 081437AG0 / Bemis Inc Notes 5.65% 08/01/14 | 0.30 | 0.0464 | 0.0464 | ||||||

| TSQ / Townsquare Media, Inc. | 0.30 | -33.18 | 0.0459 | -0.0210 | |||||

| ALPHA GENERATION LLC / DBT (US02073LAA98) | 0.30 | 82.10 | 0.0454 | 0.0211 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0.29 | 0.0452 | 0.0452 | ||||||

| US28228PAC59 / eG Global Finance PLC | 0.29 | -1.68 | 0.0451 | 0.0005 | |||||

| US38013JAF03 / GMCAR 2023-1 B | 0.29 | -0.34 | 0.0449 | 0.0010 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.29 | -4.28 | 0.0449 | -0.0007 | |||||

| CHARTER COMMUNICATIONS OPERATING LLC / CHARTER COMMUNICATIONS OPERATING CAPITAL / DBT (US161175CQ56) | 0.29 | 1.04 | 0.0448 | 0.0015 | |||||

| US3132DQ6R23 / Freddie Mac Pool | 0.29 | -4.61 | 0.0446 | -0.0011 | |||||

| US146869AM47 / Carvana Co. | 0.29 | 30.91 | 0.0444 | 0.0114 | |||||

| US3140QNN990 / Uniform Mortgage-Backed Securities | 0.29 | -4.67 | 0.0441 | -0.0010 | |||||

| HOLCIM FINANCE US LLC / DBT (US43475RAC07) | 0.29 | 0.0441 | 0.0441 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.29 | -3.70 | 0.0440 | -0.0006 | |||||

| CHILE ELECTRICITY LUX MPC II SARL / DBT (US16882LAA08) | 0.28 | -1.74 | 0.0434 | 0.0002 | |||||

| BRAZOS DELAWARE II LLC / LON (10620UAL6) | 0.28 | 0.0434 | 0.0434 | ||||||

| ICON PARENT INC / LON (000000000) | 0.28 | 0.0430 | 0.0430 | ||||||

| PRAIRIE ACQUIROR LP / LON (US73955HAE45) | 0.28 | -19.65 | 0.0429 | -0.0091 | |||||

| US31418ED565 / FNMA 30YR 2.5% 06/01/2052#MA4623 | 0.28 | -3.81 | 0.0429 | -0.0005 | |||||

| FOUNDRY JV HOLDCO LLC / DBT (US350930AF07) | 0.28 | -0.36 | 0.0429 | 0.0009 | |||||

| GINNIE MAE II POOL / ABS-MBS (US36179XFL55) | 0.28 | -7.33 | 0.0428 | -0.0022 | |||||

| US845467AT68 / Southwestern Energy Co | 0.28 | -0.71 | 0.0428 | 0.0008 | |||||

| US33834DAA28 / Five Corners Funding Trust II | 0.28 | 0.0426 | 0.0426 | ||||||

| US05765WAA18 / TIBCO Software Inc | 0.28 | -58.81 | 0.0426 | -0.0579 | |||||

| CONNECT FINCO SARL / CONNECT US FINCO LLC / DBT (US20752TAB08) | 0.28 | 3.77 | 0.0424 | 0.0026 | |||||

| US38382QAU40 / GNMA, Series 2021-57, Class AI | 0.28 | 0.0423 | 0.0423 | ||||||

| PHOENIX NEWCO INC / LON (71911KAE4) | 0.28 | -19.35 | 0.0423 | -0.0089 | |||||

| US3140X9S638 / Fannie Mae Pool | 0.27 | -4.55 | 0.0420 | -0.0010 | |||||

| SECURITIZED TERM AUTO RECEIVABLES TRUST / ABS-O (US81378RAB06) | 0.27 | -10.20 | 0.0420 | -0.0036 | |||||

| US3132D9LJ12 / Freddie Mac Pool | 0.27 | -3.24 | 0.0415 | -0.0003 | |||||

| US36179WVU97 / Ginnie Mae II Pool | 0.27 | -4.61 | 0.0414 | -0.0009 | |||||

| EOC BORROWER LLC / LON (26875YAB8) | 0.27 | -42.27 | 0.0414 | -0.0286 | |||||

| CLARUS CAPITAL FUNDING 2024-1 LLC / ABS-O (US18271JAC62) | 0.27 | -0.37 | 0.0413 | 0.0010 | |||||

| US75025KAH14 / RADIATE HOLDCO LLC | 0.27 | -19.28 | 0.0413 | -0.0085 | |||||

| COGENTRIX FINANCE HOLDCO / LON (19239LAB2) | 0.27 | -17.85 | 0.0412 | -0.0076 | |||||

| US902613AK44 / UBS Group AG | 0.27 | -0.75 | 0.0409 | 0.0007 | |||||

| US28415AAC18 / Elara HGV Timeshare Issuer 2023-A LLC | 0.27 | -7.34 | 0.0408 | -0.0022 | |||||

| DELTA 2 LUX SARL / LON (3469959L9) | 0.26 | -32.31 | 0.0407 | -0.0178 | |||||

| US64069JAC62 / Neptune Bidco US Inc 2022 USD Term Loan B | 0.26 | -30.53 | 0.0407 | -0.0164 | |||||

| SSP / The E.W. Scripps Company | 0.26 | 0.0405 | 0.0405 | ||||||

| SANTANDER BANK AUTO CREDIT-LINKED NOTES SERIES 2024-A / ABS-O (US80290CCJ18) | 0.26 | -12.08 | 0.0404 | -0.0044 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 0.26 | 0.39 | 0.0401 | 0.0012 | |||||

| US36267KAG22 / GM Financial Consumer Automobile Receivables Trust 2023-3 | 0.26 | -0.38 | 0.0400 | 0.0008 | |||||

| ALPHA GENERATION LLC / LON (02072UAC6) | 0.26 | -20.00 | 0.0400 | -0.0088 | |||||

| EG AMERICA LLC / LON (XAN2820EAM02) | 0.26 | 0.0399 | 0.0399 | ||||||

| SANTANDER BANK AUTO CREDIT-LINKED NOTES SERIES 2024-B / ABS-O (US80280BAC28) | 0.26 | -0.38 | 0.0399 | 0.0008 | |||||

| US893830BX61 / Transocean Inc | 0.26 | 92.54 | 0.0398 | 0.0196 | |||||

| US3140XCV216 / Fannie Mae Pool | 0.26 | -4.09 | 0.0398 | -0.0005 | |||||

| US212015AQ46 / Continental Resources Inc/OK | 0.26 | -8.27 | 0.0394 | -0.0023 | |||||

| AGGREKO HOLDINGS INC / LON (00847NAE6) | 0.25 | -20.62 | 0.0391 | -0.0088 | |||||

| US60337JAA43 / Minerva Merger Sub Inc | 0.25 | 31.61 | 0.0391 | 0.0101 | |||||

| MADISON SAFETY & FLOW / LON (55822DAM3) | 0.25 | 0.0390 | 0.0390 | ||||||

| CHARTER COMMUNICATIONS OPERATING LLC / CHARTER COMMUNICATIONS OPERATING CAPITAL / DBT (US161175CR30) | 0.25 | 1.20 | 0.0389 | 0.0013 | |||||

| WEC US HOLDINGS INC / LON (92943LAC4) | 0.25 | -31.52 | 0.0389 | -0.0163 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.25 | -4.20 | 0.0387 | -0.0006 | |||||

| MSI / Motorola Solutions, Inc. - Depositary Receipt (Common Stock) | 0.25 | -1.18 | 0.0387 | 0.0006 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0.00 | 41.07 | 0.25 | 58.86 | 0.0387 | 0.0149 | |||

| MPT OPERATING PARTNERSHIP LP / MPT FINANCE CORP / DBT (US55342UAQ76) | 0.25 | 114.53 | 0.0386 | 0.0210 | |||||

| ASCEND LEARNING LLC / LON (04349HAN4) | 0.25 | -20.38 | 0.0386 | -0.0086 | |||||

| US63938PBU21 / Navistar Financial Dealer Note Master Owner Trust II, Series 2023-1, Class A | 0.25 | -0.40 | 0.0386 | 0.0008 | |||||

| US64132DAL29 / Neuberger Berman Loan Advisers CLO 32 Ltd., Series 2019-32A, Class BR | 0.25 | -0.40 | 0.0384 | 0.0009 | |||||

| SOUND POINT CLO XXII LTD / ABS-CBDO (US83611KAY82) | 0.25 | 0.00 | 0.0384 | 0.0010 | |||||

| UFC HOLDINGS LLC / LON (90266UAK9) | 0.25 | -20.70 | 0.0384 | -0.0088 | |||||

| SANTANDER BANK AUTO CREDIT-LINKED NOTES SERIES 2024-B / ABS-O (US80280BAB45) | 0.25 | -0.80 | 0.0384 | 0.0007 | |||||

| US3132DQLW41 / Federal National Mortgage Association, Inc. | 0.25 | -4.23 | 0.0383 | -0.0007 | |||||

| CME - USD IRS 4/30/35 PAY FIX_C / DIR (000000000) | 0.25 | 0.0383 | 0.0383 | ||||||

| US75606NAC39 / RealPage Inc | 0.25 | -62.82 | 0.0382 | -0.0618 | |||||

| BAYVIEW OPPORTUNITY MASTER FUND VII 2024-CAR1 LLC / ABS-O (US07336QAB86) | 0.25 | -12.68 | 0.0382 | -0.0045 | |||||

| CAESARS ENTERTAIN INC / LON (12768EAH9) | 0.25 | -57.78 | 0.0381 | -0.0496 | |||||

| IRB HOLDING CORP / LON (US44988LAL18) | 0.25 | -61.59 | 0.0380 | -0.0584 | |||||

| US18453HAC07 / Clear Channel Outdoor Holdings Inc | 0.25 | 35.91 | 0.0379 | 0.0108 | |||||

| US48020RAB15 / Jones Deslauriers Insurance Management Inc | 0.25 | -1.20 | 0.0379 | 0.0005 | |||||

| HOLCIM FINANCE US LLC / DBT (US43475RAB24) | 0.25 | 0.0378 | 0.0378 | ||||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP LLC / ABS-O (US05377RKG82) | 0.25 | 0.0378 | 0.0378 | ||||||

| NAVI / Navient Corporation | 0.24 | 0.0376 | 0.0376 | ||||||

| OPAL BIDCO SAS / DBT (US68348BAA17) | 0.24 | 0.0375 | 0.0375 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0.24 | 0.0375 | 0.0375 | ||||||

| US17888HAA14 / Civitas Resources Inc | 0.24 | 25.52 | 0.0372 | 0.0083 | |||||

| CRESCENT ENERGY FINANCE LLC / DBT (US45344LAD55) | 0.24 | 29.73 | 0.0371 | 0.0093 | |||||

| US31418DTQ50 / Fannie Mae Pool | 0.24 | -4.45 | 0.0364 | -0.0007 | |||||

| US418751AL75 / HAT HOLDINGS I LLC/HAT REGD 144A P/P 8.00000000 | 0.23 | -1.27 | 0.0359 | 0.0005 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.23 | -1.28 | 0.0358 | 0.0006 | |||||

| CARMAX SELECT RECEIVABLES TRUST 2024-A / ABS-O (US14319FAE34) | 0.23 | -0.43 | 0.0358 | 0.0008 | |||||

| US03464WAD48 / Angel Oak Mortgage Trust LLC 2020-5 | 0.23 | 1.31 | 0.0358 | 0.0014 | |||||

| MITER BRANDS ACQUISITION HOLDCO INC / LON (US55336CAK80) | 0.23 | 0.0356 | 0.0356 | ||||||

| US3132CW4G69 / FREDDIE MAC POOL | 0.23 | -4.56 | 0.0354 | -0.0008 | |||||

| US46591JAJ51 / JP Morgan Chase Commercial Mortgage Securities Trust 2019-BKWD | 0.23 | -5.37 | 0.0353 | -0.0011 | |||||

| US36179MVS69 / Ginnie Mae II Pool | 0.23 | -4.58 | 0.0353 | -0.0008 | |||||

| MEDLINE BORROWER LP/MEDLINE CO-ISSUER INC / DBT (US58506DAA63) | 0.23 | -22.18 | 0.0352 | -0.0088 | |||||

| OBX 2024-HYB1 TRUST / ABS-MBS (US67448MAA80) | 0.23 | -4.24 | 0.0349 | -0.0006 | |||||

| BX TRUST 2025-TAIL / ABS-MBS (US123912AA54) | 0.23 | 0.0346 | 0.0346 | ||||||

| FIRSTENERGY TRANSMISSION LLC / DBT (US33767BAH24) | 0.22 | -1.32 | 0.0345 | 0.0003 | |||||

| HXL / Hexcel Corporation | 0.22 | -3.45 | 0.0345 | -0.0004 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.22 | -3.88 | 0.0344 | -0.0005 | |||||

| US30166TAD54 / Exeter Automobile Receivables Trust 2023-4 | 0.22 | -50.88 | 0.0344 | -0.0338 | |||||

| NYMT LOAN TRUST 2025-INV1 / ABS-MBS (US67120YAC30) | 0.22 | 0.0344 | 0.0344 | ||||||

| SUN / Sunoco LP - Limited Partnership | 0.22 | 0.00 | 0.0343 | 0.0008 | |||||

| US36179XDF06 / GNMA II, 30 Year | 0.22 | -4.72 | 0.0342 | -0.0007 | |||||

| US57665RAG11 / Match Group Inc | 0.22 | 0.45 | 0.0342 | 0.0010 | |||||

| US92552VAR15 / Viasat Inc | 0.22 | 6.22 | 0.0342 | 0.0028 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0.22 | -0.45 | 0.0342 | 0.0006 | |||||

| WB COMMERCIAL MORTGAGE TRUST 2024-HQ / ABS-MBS (US92943PAA93) | 0.22 | 0.00 | 0.0339 | 0.0008 | |||||

| US126307AQ03 / CSC HOLDINGS LLC 5.50% 04/15/2027 144A | 0.22 | 1.88 | 0.0335 | 0.0015 | |||||

| C1OG34 / Coterra Energy Inc. - Depositary Receipt (Common Stock) | 0.22 | -2.25 | 0.0335 | 0.0001 | |||||

| CARMAX AUTO OWNER TRUST 2024-3 / ABS-O (US14319GAH48) | 0.22 | -0.46 | 0.0335 | 0.0008 | |||||

| TALLGRASS ENERGY PARTNERS LP / TALLGRASS ENERGY FINANCE CORP / DBT (US87470LAL53) | 0.22 | 42.76 | 0.0335 | 0.0106 | |||||

| US513075BW03 / Lamar Media Corp | 0.22 | 0.46 | 0.0334 | 0.0009 | |||||

| DLLST 2024-1 LLC / ABS-O (US23346HAD98) | 0.22 | 0.00 | 0.0332 | 0.0008 | |||||

| US78449DAB29 / SMB Private Education Loan Trust 2020-PTB | 0.22 | -6.52 | 0.0331 | -0.0014 | |||||

| FRONTIER ISSUER LLC / ABS-O (US35910EAK01) | 0.22 | -0.92 | 0.0331 | 0.0005 | |||||

| US88732JAU25 / Time Warner Cable Inc 6.75% 06/15/39 | 0.21 | -0.47 | 0.0329 | 0.0007 | |||||

| CLARIOS GLOBAL LP / CLARIOS US FINANCE CO / DBT (US18060TAD72) | 0.21 | -0.47 | 0.0328 | 0.0007 | |||||

| US38382LXR76 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2020-181 CL WI 2.00000000 | 0.21 | -2.30 | 0.0327 | 0.0002 | |||||

| US12636MAE84 / CSAIL 2016-C6 Commercial Mortgage Trust | 0.21 | 0.48 | 0.0325 | 0.0009 | |||||

| DELL EQUIPMENT FINANCE TRUST 2024-2 / ABS-O (US24704EAL20) | 0.21 | -0.47 | 0.0324 | 0.0008 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.21 | 0.0322 | 0.0322 | ||||||

| US455434BS82 / Indianapolis Power & Light Co | 0.21 | -6.31 | 0.0321 | -0.0012 | |||||

| US74759BAD55 / Qualitytech LP / QTS Finance Corp | 0.21 | 0.00 | 0.0321 | 0.0007 | |||||

| SRI LANKA GOVERNMENT INTERNATIONAL BOND / DBT (XS2966241528) | 0.21 | -3.27 | 0.0320 | -0.0001 | |||||

| US36179SYU58 / Ginnie Mae II Pool | 0.21 | -5.05 | 0.0320 | -0.0008 | |||||

| FOUNDRY JV HOLDCO LLC / DBT (US350930AC75) | 0.21 | -0.96 | 0.0319 | 0.0005 | |||||

| OCTANE RECEIVABLES TRUST 2024-RVM1 / ABS-O (US67579FAA49) | 0.21 | -10.39 | 0.0319 | -0.0029 | |||||

| US75281ABK43 / Range Resources Corp. | 0.21 | 0.98 | 0.0318 | 0.0011 | |||||

| US19828AAB35 / Columbia Pipelines Holding Co LLC | 0.21 | -0.49 | 0.0317 | 0.0006 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.20 | -1.45 | 0.0315 | 0.0004 | |||||

| ICON INVESTMENTS SIX DAC / DBT (US45115AAB08) | 0.20 | -0.97 | 0.0314 | 0.0005 | |||||

| DIAGEO INVESTMENT CORP / DBT (US25245BAC19) | 0.20 | 0.0313 | 0.0313 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.20 | -3.81 | 0.0312 | -0.0003 | |||||

| NGL ENERGY OPERATING LLC / NGL ENERGY FINANCE CORP / DBT (US62922LAD01) | 0.20 | 37.41 | 0.0311 | 0.0090 | |||||

| RFS OPCO LLC / LON (74970UAC8) | 0.20 | -0.50 | 0.0311 | 0.0007 | |||||

| US855170AA41 / Star Parent Inc | 0.20 | -1.47 | 0.0310 | 0.0004 | |||||

| ALBION FINANCING 1 SARL / AGGREKO HOLDINGS INC / DBT (US01330AAA43) | 0.20 | 0.0310 | 0.0310 | ||||||

| HYUNDAI CAPITAL AMERICA / DBT (US44891ACV70) | 0.20 | -1.47 | 0.0309 | 0.0003 | |||||

| US144285AM55 / Carpenter Technology Corp. | 0.20 | 0.00 | 0.0309 | 0.0007 | |||||

| SVC / Service Properties Trust | 0.20 | 0.0308 | 0.0308 | ||||||

| PRO MACH GROUP INC / LON (74273JAK9) | 0.20 | 47.41 | 0.0306 | 0.0104 | |||||

| ICON INVESTMENTS SIX DAC / DBT (US45115AAC80) | 0.20 | -2.93 | 0.0306 | -0.0002 | |||||

| SABRE GLBL INC / DBT (US78573NAL64) | 0.20 | -4.35 | 0.0306 | -0.0006 | |||||

| US55316HAB15 / GENESEE+WYOMING INC TERM LOAN | 0.20 | 0.51 | 0.0304 | 0.0010 | |||||

| US28415AAA51 / Elara HGV Timeshare Issuer 2023-A, LLC | 0.20 | -7.94 | 0.0304 | -0.0017 | |||||

| US126307BM89 / CSC Holdings LLC | 0.20 | -52.18 | 0.0304 | -0.0316 | |||||

| PRAIRIE ACQUIROR LP / DBT (US73943NAA46) | 0.20 | 47.01 | 0.0304 | 0.0102 | |||||

| US33850RAY80 / Flagstar Mortgage Trust 2017-2 | 0.20 | -1.01 | 0.0302 | 0.0004 | |||||

| US46652KBM09 / JP Morgan Mortgage Trust 2020-INV2 | 0.20 | -2.99 | 0.0300 | -0.0002 | |||||

| MOH / Molina Healthcare, Inc. | 0.19 | 1.04 | 0.0299 | 0.0011 | |||||

| ALLY BANK AUTO CREDIT-LINKED NOTES SERIES 2024-B / ABS-O (US02007G4B61) | 0.19 | -10.60 | 0.0299 | -0.0028 | |||||

| AMC / AMC Entertainment Holdings, Inc. | 0.19 | -1.52 | 0.0299 | 0.0003 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.19 | -3.98 | 0.0298 | -0.0004 | |||||

| ALLY BANK AUTO CREDIT-LINKED NOTES SERIES 2024-B / ABS-O (US02007G4D28) | 0.19 | -11.47 | 0.0298 | -0.0029 | |||||

| SIX FLAGS ENTERTAINMENT CORP /SIX FLAGS THEME PARKS INC/ CANADA'S WONDERLAND CO / DBT (US83002YAA73) | 0.19 | -0.52 | 0.0298 | 0.0007 | |||||

| US21871DAD57 / CoreLogic Inc | 0.19 | 0.0297 | 0.0297 | ||||||

| AVIS BUDGET CAR RENTAL LLC / AVIS BUDGET FINANCE INC / DBT (US053773BJ51) | 0.19 | -0.52 | 0.0297 | 0.0007 | |||||

| US59565JAA97 / MIDAS OPCO HOLDINGS LLC | 0.19 | 17.07 | 0.0296 | 0.0050 | |||||

| US914906AY80 / Univision Communications, Inc. | 0.19 | 3.78 | 0.0296 | 0.0018 | |||||

| WAND NEWCO 3 INC / DBT (US933940AA60) | 0.19 | 0.52 | 0.0296 | 0.0009 | |||||

| US78442FAZ18 / NAVIENT CORP SR UNSECURED 08/33 5.625 | 0.19 | -1.55 | 0.0294 | 0.0003 | |||||

| VERDANT RECEIVABLES 2024-1 LLC / ABS-O (US92339MAB63) | 0.19 | -8.25 | 0.0292 | -0.0017 | |||||

| US12769GAB68 / Caesars Entertainment, Inc. | 0.19 | -1.05 | 0.0291 | 0.0005 | |||||

| US82967NBJ63 / Sirius XM Radio Inc | 0.19 | 1.07 | 0.0291 | 0.0010 | |||||

| US88033GAV23 / Tenet Healthcare Corp 6 7/8% Notes 11/15/2031 | 0.19 | 2.17 | 0.0290 | 0.0013 | |||||

| US64072TAC99 / CSC Holdings LLC | 0.19 | -4.10 | 0.0288 | -0.0004 | |||||

| DYE & DURHAM CORP / LON (XAC3117CAB00) | 0.19 | -0.53 | 0.0287 | 0.0006 | |||||

| US38382UG391 / GNMA_21-96 | 0.18 | 0.0284 | 0.0284 | ||||||

| US3132DV4Y83 / Freddie Mac Pool | 0.18 | -4.66 | 0.0284 | -0.0006 | |||||

| US3140JAMK12 / Fannie Mae Pool | 0.18 | -3.16 | 0.0283 | -0.0002 | |||||

| R1IN34 / Realty Income Corporation - Depositary Receipt (Common Stock) | 0.18 | 0.0281 | 0.0281 | ||||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0.18 | 271.43 | 0.0281 | 0.0206 | |||||

| US674599DJ13 / Occidental Petroleum Corp | 0.18 | -8.12 | 0.0279 | -0.0017 | |||||

| US55303XAJ46 / MGM GROWTH/MGM FINANCE | 0.18 | -0.55 | 0.0279 | 0.0006 | |||||

| JPY/USD FWD 20250725 MRMDUS33 / DFE (000000000) | 0.18 | 0.0277 | 0.0277 | ||||||

| DELL EQUIPMENT FINANCE TRUST 2024-1 / ABS-O (US24702GAL95) | 0.18 | -0.56 | 0.0273 | 0.0005 | |||||

| PSEG POWER LLC / DBT (US69362BBD38) | 0.18 | 0.0272 | 0.0272 | ||||||

| HILCORP ENERGY I LP / HILCORP FINANCE CO / DBT (US431318BG88) | 0.18 | -5.38 | 0.0271 | -0.0008 | |||||

| US18453HAD89 / CLEAR CHANNEL OUTDOOR HOLDINGS INC 7.5% 06/01/2029 144A | 0.18 | 7.36 | 0.0270 | 0.0025 | |||||

| US23166MAC73 / Cushman & Wakefield US Borrower LLC | 0.18 | -1.13 | 0.0270 | 0.0004 | |||||

| ALERA GROUP INC / LON (01451PAB2) | 0.18 | 0.0269 | 0.0269 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.17 | -4.40 | 0.0268 | -0.0005 | |||||

| US36179TE358 / Ginnie Mae II Pool | 0.17 | -4.95 | 0.0267 | -0.0006 | |||||

| SRI LANKA GOVERNMENT INTERNATIONAL BOND / DBT (XS2966241874) | 0.17 | -4.47 | 0.0264 | -0.0005 | |||||

| US31335CJ216 / Freddie Mac Gold Pool | 0.17 | -3.95 | 0.0262 | -0.0004 | |||||

| US36179XH338 / Ginnie Mae II Pool | 0.17 | -5.59 | 0.0260 | -0.0009 | |||||

| US81744YAF34 / Sequoia Mortgage Trust 2013-4 | 0.17 | -2.89 | 0.0259 | -0.0000 | |||||

| XS1205617829 / APT PIPELINES | 0.17 | -2.33 | 0.0259 | 0.0001 | |||||

| US912810QQ40 / United States Treas Bds Bond | 0.17 | -4.05 | 0.0256 | -0.0005 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.17 | -3.51 | 0.0255 | -0.0002 | |||||

| ANGEL OAK MORTGAGE TRUST 2025-3 / ABS-MBS (US03466RAA95) | 0.16 | 0.0251 | 0.0251 | ||||||

| ARES.PRB / Ares Management Corporation - Preferred Security | 0.00 | 0.00 | 0.16 | -1.22 | 0.0250 | 0.0004 | |||

| US05765WAA18 / TIBCO Software Inc | 0.16 | 1.25 | 0.0250 | 0.0010 | |||||

| US12593YBF97 / COMM 2016-CR28 Mortgage Trust | 0.16 | -0.61 | 0.0250 | 0.0005 | |||||

| ALLY BANK AUTO CREDIT-LINKED NOTES SERIES 2024-A / ABS-O (US02007GZ551) | 0.16 | -11.48 | 0.0249 | -0.0026 | |||||

| ALLY BANK AUTO CREDIT-LINKED NOTES SERIES 2024-A / ABS-O (US02007GZ635) | 0.16 | -11.48 | 0.0249 | -0.0026 | |||||

| VERUS SECURITIZATION TRUST 2025-2 / ABS-MBS (US92540VAA35) | 0.16 | 0.0248 | 0.0248 | ||||||

| US501797AM65 / L Brands Inc | 0.16 | -3.07 | 0.0244 | -0.0001 | |||||

| US36267KAF49 / GM Financial Consumer Automobile Receivables Trust 2023-3 | 0.16 | -0.63 | 0.0243 | 0.0005 | |||||

| TOWD POINT MORTGAGE TRUST 2024-3 / ABS-MBS (US89183FAQ19) | 0.15 | -3.77 | 0.0236 | -0.0003 | |||||

| US12597QAD88 / COLT 2020-3 Mortgage Loan Trust | 0.15 | 1.33 | 0.0234 | 0.0008 | |||||

| SUTTER HEALTH / DBT (US86944BAP85) | 0.15 | 0.0234 | 0.0234 | ||||||

| US3140J8ZH92 / Fannie Mae Pool | 0.15 | -4.43 | 0.0234 | -0.0004 | |||||

| US27034RAC79 / Earthstone Energy Holdings LLC | 0.15 | -1.31 | 0.0232 | 0.0003 | |||||

| US49427RAP73 / Kilroy Realty L.P. | 0.15 | -0.66 | 0.0231 | 0.0005 | |||||

| US46645WBC64 / JP Morgan Chase Commercial Mortgage Securities Trust 2018-WPT | 0.15 | 0.68 | 0.0229 | 0.0007 | |||||

| SOUTH BOW USA INFRASTRUCTURE HOLDINGS LLC / DBT (US83007CAC64) | 0.15 | -0.67 | 0.0228 | 0.0005 | |||||

| US25470XBF15 / DISH DBS Corp. | 0.15 | -4.55 | 0.0227 | -0.0004 | |||||

| A1RE34 / Alexandria Real Estate Equities, Inc. - Depositary Receipt (Common Stock) | 0.15 | -3.92 | 0.0227 | -0.0004 | |||||

| US44328UAF30 / HPEFS Equipment Trust 2023-2 | 0.15 | -0.68 | 0.0226 | 0.0004 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.15 | -3.95 | 0.0226 | -0.0003 | |||||

| US36179U3S95 / GINNIE MAE II POOL G2 MA6209 | 0.15 | -3.95 | 0.0226 | -0.0003 | |||||

| US3138A8YD25 / Fannie Mae Pool | 0.15 | -4.61 | 0.0223 | -0.0004 | |||||

| BLCO / Bausch + Lomb Corporation | 0.14 | -33.94 | 0.0223 | -0.0105 | |||||

| US11120VAA17 / Brixmor Operating Partnership LP | 0.14 | -0.69 | 0.0222 | 0.0003 | |||||

| SABRE GLBL INC / DBT (US78573NAM48) | 0.14 | 0.0221 | 0.0221 | ||||||

| BAYVIEW OPPORTUNITY MASTER FUND VII 2024-CAR1 LLC / ABS-O (US07336QAC69) | 0.14 | -12.88 | 0.0219 | -0.0026 | |||||

| US31418CYM09 / FNMA POOL MA3415 FN 07/48 FIXED 4 | 0.14 | -4.05 | 0.0219 | -0.0004 | |||||

| US69346EAG26 / BANK LOAN NOTE | 0.14 | -68.46 | 0.0218 | -0.0452 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0.14 | 0.0218 | 0.0218 | ||||||

| HPEFS EQUIPMENT TRUST 2024-2 / ABS-O (US40444MAG69) | 0.14 | 0.00 | 0.0217 | 0.0004 | |||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP LLC / ABS-O (US05377RKH65) | 0.14 | 0.0216 | 0.0216 | ||||||

| US893647BS53 / TransDigm Inc | 0.14 | 0.00 | 0.0215 | 0.0006 | |||||

| US097023CQ64 / Boeing Co/The | 0.14 | -4.14 | 0.0215 | -0.0004 | |||||

| US30168BAF76 / EART 23-1 D 6.69% 06-15-29/01-15-27 | 0.14 | -0.72 | 0.0211 | 0.0004 | |||||

| US31418D2M38 / Fannie Mae Pool | 0.14 | -4.20 | 0.0211 | -0.0004 | |||||

| US69357VAA35 / PMHC II Inc | 0.14 | -22.29 | 0.0210 | -0.0053 | |||||

| US513075BW03 / Lamar Media Corp | 0.14 | 7.09 | 0.0210 | 0.0018 | |||||

| US01883LAE39 / Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer | 0.14 | 0.00 | 0.0210 | 0.0005 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.14 | -2.16 | 0.0210 | -0.0000 | |||||

| HTHROW / Heathrow Funding Ltd | 0.13 | 0.0207 | 0.0207 | ||||||

| L1MN34 / Lumen Technologies, Inc. - Depositary Receipt (Common Stock) | 0.13 | 1.52 | 0.0206 | 0.0007 | |||||

| US3140X6GH80 / Fannie Mae Pool | 0.13 | -3.62 | 0.0206 | -0.0002 | |||||

| TRICON RESIDENTIAL 2024-SFR2 TRUST / ABS-O (US89616VAA89) | 0.13 | 0.00 | 0.0203 | 0.0004 | |||||

| US67448WAQ15 / OBX 2020-EXP3 Trust | 0.13 | -2.96 | 0.0202 | -0.0001 | |||||

| US3133KHKY17 / Freddie Mac Pool | 0.13 | -5.80 | 0.0201 | -0.0007 | |||||

| NAVISTAR FINANCIAL DEALER NOTE MASTER OWNER TRUST / ABS-O (US63938PBY43) | 0.13 | -0.76 | 0.0201 | 0.0004 | |||||

| US36179TZ734 / Ginnie Mae II Pool | 0.13 | -4.41 | 0.0200 | -0.0004 | |||||

| US17888HAB96 / Civitas Resources Inc | 0.13 | 0.0200 | 0.0200 | ||||||

| US36179UH706 / Ginnie Mae II Pool | 0.13 | -2.26 | 0.0200 | -0.0001 | |||||

| XAL2000DAC82 / Connect Finco Sarl Term Loan B | 0.13 | -31.75 | 0.0200 | -0.0085 | |||||

| US55760LAB36 / Madison IAQ LLC | 0.13 | -9.15 | 0.0200 | -0.0008 | |||||

| US49461MAA80 / Kinetik Holdings LP | 0.13 | 0.00 | 0.0198 | 0.0005 | |||||

| US60855RAL42 / Molina Healthcare Inc | 0.13 | 0.79 | 0.0198 | 0.0008 | |||||

| US3140JACE61 / Fannie Mae Pool | 0.13 | -4.48 | 0.0198 | -0.0004 | |||||

| ACRISURE LLC / ACRISURE FINANCE INC / DBT (US00489LAL71) | 0.13 | 0.00 | 0.0198 | 0.0005 | |||||

| US92555WAD74 / ViaSat, Inc. Term Loan | 0.13 | -8.03 | 0.0195 | -0.0011 | |||||

| 6539989A4 / NIELSEN HOLDINGS | 0.13 | -0.79 | 0.0195 | 0.0004 | |||||

| US3140J9NN71 / FNMA POOL BM4896 FN 02/47 FIXED VAR | 0.13 | -3.82 | 0.0194 | -0.0003 | |||||

| US87169DAB10 / Syneos Health (INC Research/inVentiv Health) T/L B (09/23) | 0.13 | -33.86 | 0.0193 | -0.0091 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0.13 | -0.79 | 0.0193 | 0.0004 | |||||

| VENTURE GLOBAL PLAQUEMINES LNG LLC / DBT (US922966AA47) | 0.13 | 0.0192 | 0.0192 | ||||||

| US3138XMF543 / FANNIE MAE POOL UMBS P#AV9187 4.00000000 | 0.13 | -5.30 | 0.0192 | -0.0006 | |||||

| US25470XAY13 / DISH DBS CORP 7.75% 07/01/2026 | 0.12 | -3.12 | 0.0192 | -0.0001 | |||||

| US3133KHDK95 / Freddie Mac Pool | 0.12 | -4.62 | 0.0192 | -0.0003 | |||||

| SHIFT4 PAYMENTS LLC / SHIFT4 PAYMENTS FINANCE SUB INC / DBT (US82453AAB35) | 0.12 | 0.0188 | 0.0188 | ||||||

| US59166DAA54 / Metlife Securitization Trust, Series 2018-1A, Class A | 0.12 | -1.63 | 0.0186 | 0.0001 | |||||

| US3140QBUF35 / Fannie Mae Pool | 0.12 | -4.00 | 0.0186 | -0.0002 | |||||

| COP/USD FWD 20250606 SCBLGB2L / DFE (000000000) | 0.12 | 0.0186 | 0.0186 | ||||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP LLC / ABS-O (US05377RFX70) | 0.12 | 0.00 | 0.0185 | 0.0004 | |||||

| US3132A9UX35 / FREDDIE MAC POOL | 0.12 | -4.84 | 0.0182 | -0.0004 | |||||

| US893790AA34 / Transocean Aquila Ltd | 0.12 | -11.28 | 0.0182 | -0.0019 | |||||

| US80290CBU71 / Santander Bank Auto Credit-Linked Notes Series 2023-A | 0.12 | -31.18 | 0.0181 | -0.0076 | |||||

| US3138LTJD15 / Fannie Mae Pool | 0.11 | -3.39 | 0.0176 | -0.0002 | |||||

| SSP / The E.W. Scripps Company | 0.11 | 0.0176 | 0.0176 | ||||||

| US81105DAA37 / SCRIPPS ESCROW II INC SR SECURED 144A 01/29 3.875 | 0.11 | 0.0171 | 0.0171 | ||||||

| EGP/USD FWD 20250911 SCBLGB2L / DFE (000000000) | 0.11 | 0.0168 | 0.0168 | ||||||

| US988498AR20 / Yum! Brands, Inc. | 0.11 | 0.00 | 0.0167 | 0.0004 | |||||

| US501797AW48 / L Brands Inc | 0.11 | 0.00 | 0.0165 | 0.0004 | |||||

| US31418CKV53 / FNMA 30YR 3% 04/01/2047#MA3007 | 0.11 | -3.67 | 0.0162 | -0.0002 | |||||

| STZB34 / Constellation Brands, Inc. - Depositary Receipt (Common Stock) | 0.10 | 0.0161 | 0.0161 | ||||||

| US36179M2Q20 / Ginnie Mae II Pool | 0.10 | -4.63 | 0.0160 | -0.0004 | |||||

| US31418EAN04 / FN MA4512 | 0.10 | -4.63 | 0.0160 | -0.0003 | |||||

| US68306MAA71 / Ontario Gaming GTA LP | 0.10 | -4.63 | 0.0159 | -0.0003 | |||||

| US3138ERHS29 / Fannie Mae Pool | 0.10 | -3.77 | 0.0157 | -0.0003 | |||||

| US49427RAQ56 / Kilroy Realty LP | 0.10 | 0.00 | 0.0157 | 0.0003 | |||||

| US3132A4LW65 / Freddie Mac Pool | 0.10 | -3.77 | 0.0157 | -0.0003 | |||||

| US67571CAD39 / Octane Receivables Trust 2023-3 | 0.10 | -1.94 | 0.0157 | 0.0002 | |||||

| US3140X7VE67 / Federal National Mortgage Association, Inc. | 0.10 | -4.72 | 0.0156 | -0.0004 | |||||

| US337932AP26 / FirstEnergy Corp | 0.10 | 1.00 | 0.0155 | 0.0004 | |||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP LLC / ABS-O (US05377RGN89) | 0.10 | 0.00 | 0.0155 | 0.0003 | |||||

| DELL EQUIPMENT FINANCE TRUST 2024-2 / ABS-O (US24704EAG35) | 0.10 | 0.00 | 0.0154 | 0.0004 | |||||

| US36179NNA27 / Ginnie Mae II Pool | 0.10 | -4.81 | 0.0153 | -0.0003 | |||||

| RFS OPCO LLC / LON (74970UAB0) | 0.10 | 0.00 | 0.0153 | 0.0004 | |||||

| US90357PAV67 / US Bank NA | 0.10 | -18.49 | 0.0150 | -0.0030 | |||||

| US3140XH4E46 / Fannie Mae Pool | 0.10 | -3.96 | 0.0149 | -0.0003 | |||||

| US36183W6J67 / Ginnie Mae II Pool | 0.10 | -4.90 | 0.0149 | -0.0004 | |||||