Mga Batayang Estadistika

| Nilai Portofolio | $ 327,602,395 |

| Posisi Saat Ini | 42 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

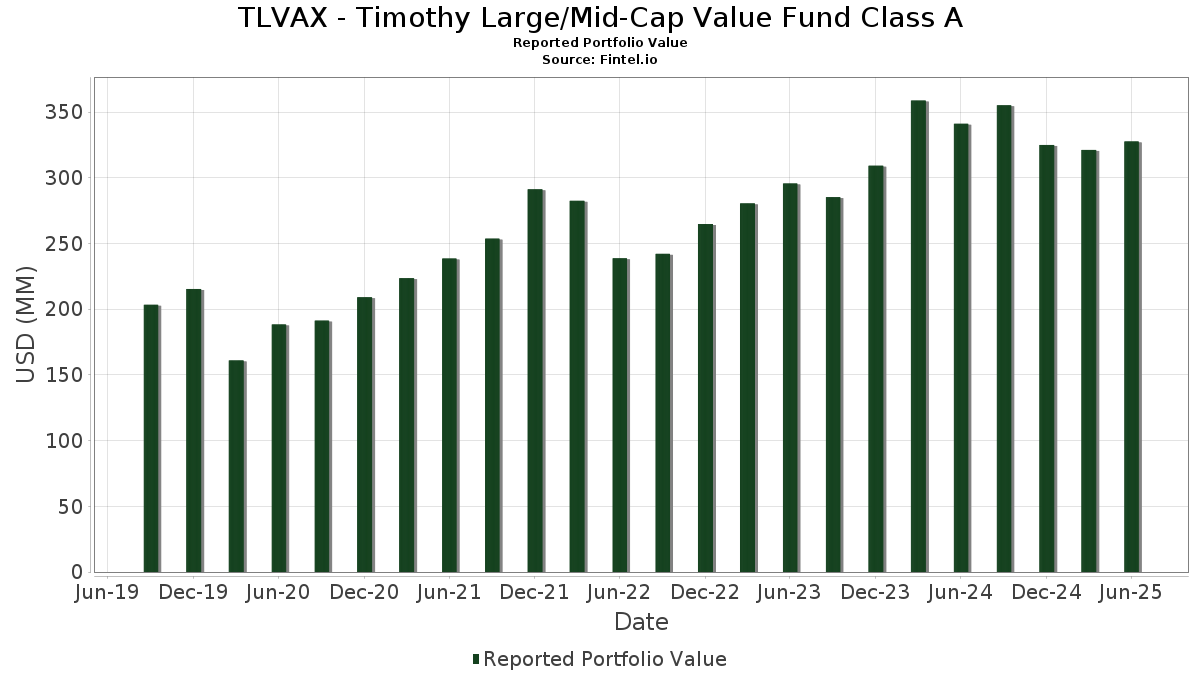

TLVAX - Timothy Large/Mid-Cap Value Fund Class A telah mengungkapkan total kepemilikan 42 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 327,602,395 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama TLVAX - Timothy Large/Mid-Cap Value Fund Class A adalah The Timothy Plan - Timothy Plan High Dividend Stock ETF (US:TPHD) , The Timothy Plan - Timothy Plan US Large/Mid Cap Core ETF (US:TPLC) , Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) , Broadcom Inc. (US:AVGO) , and Marvell Technology, Inc. (US:MRVL) . Posisi baru TLVAX - Timothy Large/Mid-Cap Value Fund Class A meliputi: Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) , Texas Instruments Incorporated (US:TXN) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.86 | 32.45 | 9.9080 | 7.7707 | |

| 0.62 | 27.66 | 8.4444 | 6.8854 | |

| 0.04 | 7.71 | 2.3537 | 2.3537 | |

| 0.10 | 8.06 | 2.4609 | 1.0443 | |

| 0.03 | 8.23 | 2.5142 | 0.8287 | |

| 0.05 | 7.26 | 2.2158 | 0.6660 | |

| 0.09 | 6.24 | 1.9046 | 0.5687 | |

| 0.01 | 7.47 | 2.2817 | 0.4369 | |

| 0.02 | 7.80 | 2.3817 | 0.4141 | |

| 0.03 | 6.74 | 2.0564 | 0.2370 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 17.37 | 5.3041 | -0.9412 | ||

| 0.01 | 5.10 | 1.5558 | -0.8094 | |

| 0.08 | 6.08 | 1.8570 | -0.7647 | |

| 0.03 | 5.65 | 1.7261 | -0.5513 | |

| 0.05 | 5.15 | 1.5715 | -0.5227 | |

| 0.07 | 6.07 | 1.8538 | -0.4294 | |

| 0.06 | 5.19 | 1.5844 | -0.3061 | |

| 0.08 | 5.62 | 1.7162 | -0.2921 | |

| 0.23 | 5.80 | 1.7714 | -0.2871 | |

| 0.02 | 5.82 | 1.7784 | -0.2832 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TPHD / The Timothy Plan - Timothy Plan High Dividend Stock ETF | 0.86 | 370.41 | 32.45 | 372.70 | 9.9080 | 7.7707 | |||

| TPLC / The Timothy Plan - Timothy Plan US Large/Mid Cap Core ETF | 0.62 | 422.03 | 27.66 | 452.37 | 8.4444 | 6.8854 | |||

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 17.37 | -13.41 | 5.3041 | -0.9412 | |||||

| AVGO / Broadcom Inc. | 0.03 | -7.62 | 8.23 | 52.09 | 2.5142 | 0.8287 | |||

| MRVL / Marvell Technology, Inc. | 0.10 | 40.90 | 8.06 | 77.14 | 2.4609 | 1.0443 | |||

| ICE / Intercontinental Exchange, Inc. | 0.04 | 0.00 | 7.84 | 6.36 | 2.3947 | 0.0991 | |||

| HUBB / Hubbell Incorporated | 0.02 | 0.00 | 7.80 | 23.42 | 2.3817 | 0.4141 | |||

| TXN / Texas Instruments Incorporated | 0.04 | 7.71 | 2.3537 | 2.3537 | |||||

| UNP / Union Pacific Corporation | 0.03 | 6.33 | 7.61 | 3.55 | 2.3244 | 0.0359 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.01 | 0.00 | 7.47 | 26.11 | 2.2817 | 0.4369 | |||

| CACI / CACI International Inc | 0.02 | -12.93 | 7.29 | 13.13 | 2.2257 | 0.2197 | |||

| NVDA / NVIDIA Corporation | 0.05 | 0.00 | 7.26 | 45.78 | 2.2158 | 0.6660 | |||

| GD / General Dynamics Corporation | 0.02 | 0.00 | 6.84 | 7.01 | 2.0884 | 0.0984 | |||

| LFUS / Littelfuse, Inc. | 0.03 | 0.00 | 6.74 | 15.25 | 2.0564 | 0.2370 | |||

| EOG / EOG Resources, Inc. | 0.06 | 15.85 | 6.69 | 8.06 | 2.0420 | 0.1152 | |||

| SSB / SouthState Corporation | 0.07 | 15.37 | 6.55 | 14.39 | 2.0002 | 0.2173 | |||

| NEE / NextEra Energy, Inc. | 0.09 | 0.00 | 6.54 | -2.07 | 1.9957 | -0.0822 | |||

| HCA / HCA Healthcare, Inc. | 0.02 | -2.83 | 6.53 | 7.72 | 1.9939 | 0.1067 | |||

| TYL / Tyler Technologies, Inc. | 0.01 | -1.17 | 6.46 | 0.78 | 1.9711 | -0.0231 | |||

| VRRM / Verra Mobility Corporation | 0.25 | 0.00 | 6.40 | 12.79 | 1.9552 | 0.1878 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.07 | 1,400.00 | 6.36 | -5.63 | 1.9405 | -0.1560 | |||

| MZTI / The Marzetti Company | 0.04 | 0.00 | 6.31 | -1.27 | 1.9266 | -0.0631 | |||

| CFR / Cullen/Frost Bankers, Inc. | 0.05 | -6.89 | 6.26 | -4.40 | 1.9101 | -0.1271 | |||

| MCHP / Microchip Technology Incorporated | 0.09 | 0.00 | 6.24 | 45.37 | 1.9046 | 0.5687 | |||

| AJG / Arthur J. Gallagher & Co. | 0.02 | 0.00 | 6.14 | -7.28 | 1.8742 | -0.1867 | |||

| WEC / WEC Energy Group, Inc. | 0.06 | 0.00 | 6.09 | -4.40 | 1.8593 | -0.1234 | |||

| MKC / McCormick & Company, Incorporated | 0.08 | -21.60 | 6.08 | -27.78 | 1.8570 | -0.7647 | |||

| DOX / Amdocs Limited | 0.07 | -16.98 | 6.07 | -17.22 | 1.8538 | -0.4294 | |||

| CDNS / Cadence Design Systems, Inc. | 0.02 | -7.23 | 6.02 | 12.42 | 1.8375 | 0.1708 | |||

| PLD / Prologis, Inc. | 0.06 | 2.79 | 6.00 | -3.34 | 1.8307 | -0.1005 | |||

| COST / Costco Wholesale Corporation | 0.01 | -14.38 | 5.86 | -10.39 | 1.7887 | -0.2463 | |||

| SHW / The Sherwin-Williams Company | 0.02 | -10.56 | 5.82 | -12.05 | 1.7784 | -0.2832 | |||

| WY / Weyerhaeuser Company | 0.23 | 0.00 | 5.80 | -12.27 | 1.7714 | -0.2871 | |||

| CCK / Crown Holdings, Inc. | 0.06 | 0.00 | 5.68 | 15.37 | 1.7329 | 0.2014 | |||

| WCN / Waste Connections, Inc. | 0.03 | -19.22 | 5.65 | -22.72 | 1.7261 | -0.5513 | |||

| CMS / CMS Energy Corporation | 0.08 | -5.54 | 5.62 | -12.87 | 1.7162 | -0.2921 | |||

| RVTY / Revvity, Inc. | 0.06 | 0.00 | 5.60 | -8.58 | 1.7106 | -0.1972 | |||

| STE / STERIS plc | 0.02 | 0.00 | 5.54 | 5.99 | 1.6903 | 0.0642 | |||

| DHR / Danaher Corporation | 0.03 | 0.00 | 5.54 | -3.64 | 1.6902 | -0.0982 | |||

| COP / ConocoPhillips | 0.06 | 0.00 | 5.19 | -14.54 | 1.5844 | -0.3061 | |||

| SJM / The J. M. Smucker Company | 0.05 | -7.74 | 5.15 | -23.49 | 1.5715 | -0.5227 | |||

| DPZ / Domino's Pizza, Inc. | 0.01 | -31.61 | 5.10 | -32.93 | 1.5558 | -0.8094 |