Mga Batayang Estadistika

| Nilai Portofolio | $ 290,126,000 |

| Posisi Saat Ini | 169 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

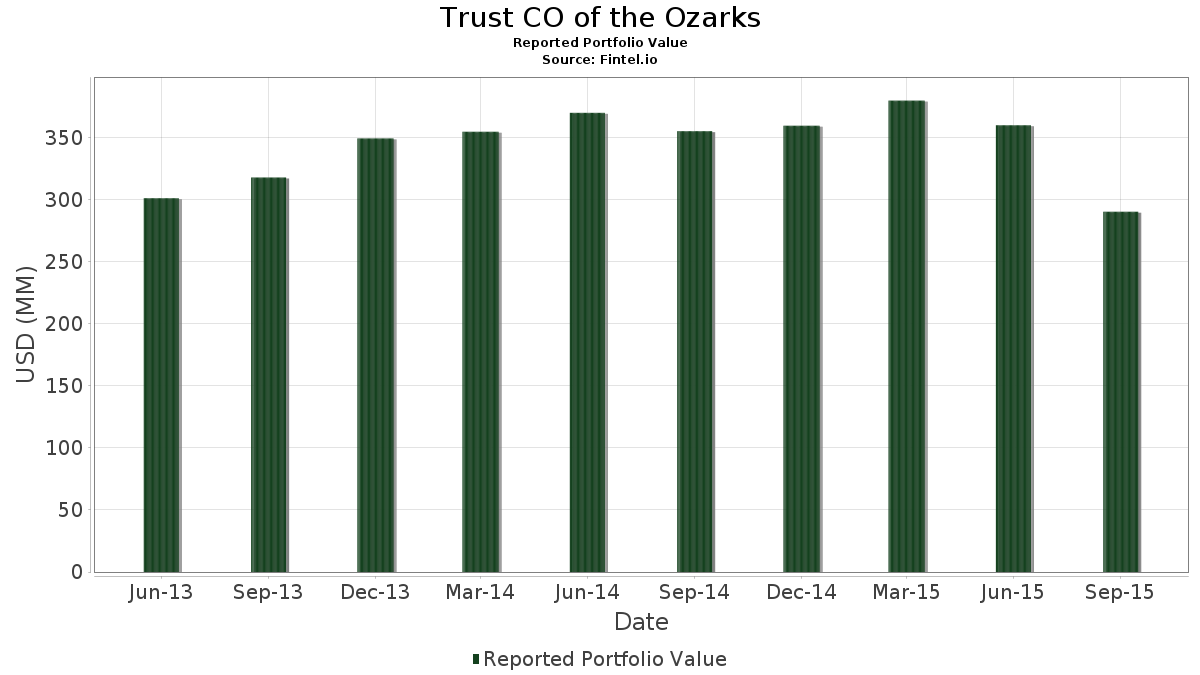

Trust CO of the Ozarks telah mengungkapkan total kepemilikan 169 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 290,126,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Trust CO of the Ozarks adalah Jack Henry & Associates, Inc. (US:JKHY) , O'Reilly Automotive, Inc. (US:ORLY) , Exxon Mobil Corporation (US:XOM) , AT&T Inc. (US:T) , and PepsiCo, Inc. (US:PEP) . Posisi baru Trust CO of the Ozarks meliputi: Baxalta Incorporated (US:BXLT) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.18 | 43.92 | 15.1376 | 4.1875 | |

| 0.16 | 2.46 | 0.8496 | 0.2892 | |

| 0.00 | 2.54 | 0.8758 | 0.2829 | |

| 0.04 | 3.80 | 1.3084 | 0.2577 | |

| 0.07 | 3.40 | 1.1729 | 0.2517 | |

| 0.11 | 3.40 | 1.1716 | 0.2426 | |

| 0.08 | 3.57 | 1.2295 | 0.2360 | |

| 0.06 | 4.63 | 1.5969 | 0.2073 | |

| 0.12 | 3.86 | 1.3318 | 0.1877 | |

| 0.03 | 2.31 | 0.7979 | 0.1700 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.10 | 76.45 | 26.3499 | -11.3862 | |

| 0.00 | 0.00 | -0.2299 | ||

| 0.04 | 0.40 | 0.1375 | -0.0810 | |

| 0.00 | 0.00 | -0.0695 | ||

| 0.00 | 0.00 | -0.0628 | ||

| 0.00 | 0.00 | -0.0598 | ||

| 0.00 | 0.00 | -0.0587 | ||

| 0.00 | 0.00 | -0.0584 | ||

| 0.01 | 0.23 | 0.0796 | -0.0580 | |

| 0.01 | 0.42 | 0.1458 | -0.0577 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2015-11-04 untuk periode pelaporan 2015-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JKHY / Jack Henry & Associates, Inc. | 1.10 | -47.66 | 76.45 | -43.69 | 26.3499 | -11.3862 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.18 | 0.78 | 43.92 | 11.49 | 15.1376 | 4.1875 | |||

| XOM / Exxon Mobil Corporation | 0.06 | 3.73 | 4.63 | -7.32 | 1.5969 | 0.2073 | |||

| T / AT&T Inc. | 0.12 | 2.32 | 3.86 | -6.12 | 1.3318 | 0.1877 | |||

| PEP / PepsiCo, Inc. | 0.04 | -0.58 | 3.80 | 0.42 | 1.3084 | 0.2577 | |||

| MSFT / Microsoft Corporation | 0.08 | -0.42 | 3.57 | -0.20 | 1.2295 | 0.2360 | |||

| VZ / Verizon Communications Inc. | 0.08 | 0.19 | 3.46 | -6.49 | 1.1919 | 0.1640 | |||

| SFNC / Simmons First National Corporation | 0.07 | 0.00 | 3.40 | 2.69 | 1.1729 | 0.2517 | |||

| INTC / Intel Corporation | 0.11 | 2.64 | 3.40 | 1.71 | 1.1716 | 0.2426 | |||

| RTX / RTX Corporation | 0.03 | 1.80 | 3.01 | -18.34 | 1.0389 | 0.0129 | |||

| JNJ / Johnson & Johnson | 0.03 | -0.10 | 2.82 | -4.34 | 0.9734 | 0.1528 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | -3.42 | 2.78 | -13.11 | 0.9575 | 0.0688 | |||

| PG / The Procter & Gamble Company | 0.04 | 6.51 | 2.60 | -2.04 | 0.8951 | 0.1582 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 1.02 | 2.54 | 19.13 | 0.8758 | 0.2829 | |||

| BAC / Bank of America Corporation | 0.16 | 33.59 | 2.46 | 22.27 | 0.8496 | 0.2892 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.04 | -1.79 | 2.40 | 0.63 | 0.8279 | 0.1644 | |||

| WMT / Walmart Inc. | 0.04 | -0.13 | 2.37 | -8.69 | 0.8152 | 0.0952 | |||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.04 | -1.97 | 2.32 | -6.39 | 0.7983 | 0.1106 | |||

| LOW / Lowe's Companies, Inc. | 0.03 | -0.44 | 2.31 | 2.48 | 0.7979 | 0.1700 | |||

| CELG / Celgene Corp. | 0.02 | -1.02 | 2.25 | -7.48 | 0.7762 | 0.0996 | |||

| MRK / Merck & Co., Inc. | 0.05 | -0.52 | 2.23 | -13.73 | 0.7690 | 0.0501 | |||

| META / Meta Platforms, Inc. | 0.02 | -1.64 | 2.15 | 3.11 | 0.7421 | 0.1617 | |||

| ORCL / Oracle Corporation | 0.06 | 0.27 | 2.10 | -10.15 | 0.7235 | 0.0741 | |||

| GILD / Gilead Sciences, Inc. | 0.02 | 0.81 | 2.07 | -15.48 | 0.7131 | 0.0327 | |||

| WFC / Wells Fargo & Company | 0.04 | 0.12 | 1.97 | -8.57 | 0.6800 | 0.0802 | |||

| BA / The Boeing Company | 0.01 | 0.35 | 1.88 | -5.26 | 0.6463 | 0.0962 | |||

| CSCO / Cisco Systems, Inc. | 0.07 | -6.38 | 1.86 | -10.56 | 0.6421 | 0.0631 | |||

| EMC / Global X Funds - Global X Emerging Markets Great Consumer ETF | 0.08 | -0.42 | 1.81 | -8.84 | 0.6256 | 0.0722 | |||

| KO / The Coca-Cola Company | 0.04 | 0.67 | 1.80 | 2.97 | 0.6218 | 0.1348 | |||

| HD / The Home Depot, Inc. | 0.02 | -1.59 | 1.78 | 2.30 | 0.6142 | 0.1300 | |||

| CVX / Chevron Corporation | 0.02 | 4.38 | 1.76 | -14.67 | 0.6073 | 0.0333 | |||

| D / Dominion Energy, Inc. | 0.02 | 1.22 | 1.76 | 6.48 | 0.6056 | 0.1469 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | 3.19 | 1.76 | -11.49 | 0.6056 | 0.0538 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | -0.36 | 1.69 | -17.09 | 0.5818 | 0.0159 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.00 | 1.66 | -5.14 | 0.5729 | 0.0859 | |||

| DIS / The Walt Disney Company | 0.02 | -0.57 | 1.62 | -10.95 | 0.5577 | 0.0526 | |||

| 74005P104 / Praxair, Inc. | 0.02 | -0.48 | 1.57 | -15.26 | 0.5418 | 0.0262 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 0.12 | 1.56 | 2.96 | 0.5394 | 0.1169 | |||

| COP / ConocoPhillips | 0.03 | -0.34 | 1.54 | -22.14 | 0.5322 | -0.0190 | |||

| MCHP / Microchip Technology Incorporated | 0.04 | 2.11 | 1.51 | -7.23 | 0.5215 | 0.0681 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.04 | 2.41 | 1.51 | -5.44 | 0.5208 | 0.0766 | |||

| PFE / Pfizer Inc. | 0.05 | -3.19 | 1.48 | -9.28 | 0.5091 | 0.0566 | |||

| NEE / NextEra Energy, Inc. | 0.01 | -0.69 | 1.40 | -1.13 | 0.4825 | 0.0889 | |||

| ADBE / Adobe Inc. | 0.02 | 0.00 | 1.40 | 1.53 | 0.4808 | 0.0989 | |||

| MO / Altria Group, Inc. | 0.03 | -1.70 | 1.40 | 9.33 | 0.4808 | 0.1261 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | -2.29 | 1.39 | -13.06 | 0.4794 | 0.0347 | |||

| COST / Costco Wholesale Corporation | 0.01 | -1.57 | 1.36 | 5.34 | 0.4691 | 0.1100 | |||

| AMGN / Amgen Inc. | 0.01 | -1.81 | 1.35 | -11.52 | 0.4660 | 0.0413 | |||

| USB / U.S. Bancorp | 0.03 | -0.22 | 1.31 | -5.69 | 0.4515 | 0.0654 | |||

| GOOGL / Alphabet Inc. | 0.00 | -3.40 | 1.29 | 14.11 | 0.4433 | 0.1300 | |||

| PM / Philip Morris International Inc. | 0.02 | -2.12 | 1.28 | -3.17 | 0.4415 | 0.0738 | |||

| SLB / Schlumberger Limited | 0.02 | -1.12 | 1.28 | -20.90 | 0.4408 | -0.0086 | |||

| ABBV / AbbVie Inc. | 0.02 | -0.56 | 1.26 | -19.49 | 0.4329 | -0.0007 | |||

| DE / Deere & Company | 0.02 | -0.39 | 1.21 | -24.05 | 0.4181 | -0.0258 | |||

| TGT / Target Corporation | 0.02 | -1.26 | 1.21 | -4.89 | 0.4153 | 0.0631 | |||

| MCD / McDonald's Corporation | 0.01 | -0.90 | 1.13 | 2.72 | 0.3905 | 0.0839 | |||

| GE / General Electric Company | 0.04 | -1.29 | 1.13 | -6.30 | 0.3895 | 0.0543 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -1.64 | 1.12 | -5.72 | 0.3864 | 0.0559 | |||

| EXC / Exelon Corporation | 0.04 | 5.90 | 1.10 | 0.09 | 0.3788 | 0.0736 | |||

| DRI / Darden Restaurants, Inc. | 0.02 | -4.27 | 1.10 | -7.80 | 0.3788 | 0.0475 | |||

| CMI / Cummins Inc. | 0.01 | 9.79 | 1.09 | -9.17 | 0.3754 | 0.0421 | |||

| CAT / Caterpillar Inc. | 0.02 | 1.25 | 1.06 | -21.97 | 0.3660 | -0.0123 | |||

| ESRX / Express Scripts Holding Co. | 0.01 | 1.38 | 1.04 | -7.82 | 0.3578 | 0.0448 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | -3.22 | 1.04 | -9.52 | 0.3571 | 0.0388 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | -1.83 | 1.03 | -8.47 | 0.3540 | 0.0421 | |||

| MMM / 3M Company | 0.01 | -2.54 | 1.01 | -10.49 | 0.3471 | 0.0344 | |||

| EMR / Emerson Electric Co. | 0.02 | 0.00 | 1.00 | -20.30 | 0.3436 | -0.0041 | |||

| MHK / Mohawk Industries, Inc. | 0.01 | -0.46 | 0.99 | -5.18 | 0.3409 | 0.0510 | |||

| ETR / Entergy Corporation | 0.01 | 3.83 | 0.96 | -4.19 | 0.3312 | 0.0524 | |||

| C / Citigroup Inc. | 0.02 | 8.49 | 0.94 | -2.58 | 0.3250 | 0.0560 | |||

| IBM / International Business Machines Corporation | 0.01 | -7.77 | 0.94 | -17.79 | 0.3233 | 0.0061 | |||

| AAPL / Apple Inc. | 0.01 | -12.26 | 0.93 | -22.81 | 0.3219 | -0.0144 | |||

| AXP / American Express Company | 0.01 | 0.00 | 0.89 | -4.61 | 0.3068 | 0.0474 | |||

| PSX / Phillips 66 | 0.01 | 0.00 | 0.87 | -4.61 | 0.2995 | 0.0463 | |||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.02 | 0.00 | 0.83 | -16.82 | 0.2864 | 0.0087 | |||

| ABT / Abbott Laboratories | 0.02 | -0.88 | 0.81 | -18.77 | 0.2775 | 0.0020 | |||

| YUM / Yum! Brands, Inc. | 0.01 | 0.00 | 0.80 | -11.27 | 0.2740 | 0.0250 | |||

| SO / The Southern Company | 0.02 | 9.07 | 0.79 | 16.28 | 0.2733 | 0.0838 | |||

| EDE / Empire District Electric Company (The) | 0.04 | 11.24 | 0.78 | 12.37 | 0.2692 | 0.0760 | |||

| HAL / Halliburton Company | 0.02 | 0.00 | 0.77 | -17.96 | 0.2661 | 0.0045 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.01 | 4.16 | 0.76 | -25.42 | 0.2620 | -0.0213 | |||

| DUK / Duke Energy Corporation | 0.01 | -6.17 | 0.73 | -4.33 | 0.2513 | 0.0395 | |||

| CVS / CVS Health Corporation | 0.01 | -2.89 | 0.71 | -10.58 | 0.2447 | 0.0240 | |||

| OXY / Occidental Petroleum Corporation | 0.01 | -1.34 | 0.71 | -16.00 | 0.2444 | 0.0098 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | 0.00 | 0.70 | 5.10 | 0.2416 | 0.0562 | |||

| NKE / NIKE, Inc. | 0.01 | 0.00 | 0.68 | 13.83 | 0.2354 | 0.0686 | |||

| APA / APA Corporation | 0.02 | 23.58 | 0.68 | -15.93 | 0.2347 | 0.0096 | |||

| PCP / Precision Castparts Corporation | 0.00 | -3.33 | 0.67 | 11.00 | 0.2296 | 0.0628 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | 0.00 | 0.67 | 7.26 | 0.2292 | 0.0569 | |||

| FE / FirstEnergy Corp. | 0.02 | 0.00 | 0.62 | -3.85 | 0.2154 | 0.0347 | |||

| SMBC / Southern Missouri Bancorp, Inc. | 0.03 | 0.00 | 0.62 | 9.93 | 0.2137 | 0.0569 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.01 | 0.00 | 0.61 | -1.62 | 0.2092 | 0.0377 | |||

| CL / Colgate-Palmolive Company | 0.01 | 0.00 | 0.58 | -3.01 | 0.1999 | 0.0337 | |||

| DHR / Danaher Corporation | 0.01 | -3.54 | 0.58 | -3.82 | 0.1996 | 0.0322 | |||

| XYL / Xylem Inc. | 0.02 | -1.12 | 0.58 | -12.41 | 0.1996 | 0.0158 | |||

| NLOK / NortonLifeLock Inc | 0.03 | -0.72 | 0.53 | -16.95 | 0.1841 | 0.0053 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | 0.00 | 0.53 | 1.91 | 0.1837 | 0.0383 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -3.77 | 0.53 | 7.52 | 0.1823 | 0.0456 | |||

| 847560109 / Spectra Energy Corp. | 0.02 | -8.00 | 0.51 | -25.72 | 0.1772 | -0.0152 | |||

| NUE / Nucor Corporation | 0.01 | 0.00 | 0.51 | -14.72 | 0.1758 | 0.0096 | |||

| ETN / Eaton Corporation plc | 0.01 | -5.26 | 0.51 | -27.94 | 0.1751 | -0.0209 | |||

| ACN / Accenture plc | 0.01 | -1.72 | 0.51 | -0.20 | 0.1741 | 0.0334 | |||

| ECL / Ecolab Inc. | 0.00 | 0.00 | 0.50 | -2.94 | 0.1710 | 0.0289 | |||

| PCG / PG&E Corporation | 0.01 | -0.79 | 0.49 | 6.68 | 0.1706 | 0.0416 | |||

| MET / MetLife, Inc. | 0.01 | -1.24 | 0.49 | -16.84 | 0.1685 | 0.0051 | |||

| COL / Rockwell Collins, Inc. | 0.01 | 0.00 | 0.49 | -11.45 | 0.1679 | 0.0150 | |||

| FDX / FedEx Corporation | 0.00 | -1.29 | 0.49 | -16.49 | 0.1675 | 0.0057 | |||

| PPG / PPG Industries, Inc. | 0.01 | 0.00 | 0.48 | -23.61 | 0.1661 | -0.0093 | |||

| J / Jacobs Solutions Inc. | 0.01 | -0.31 | 0.48 | -8.22 | 0.1654 | 0.0201 | |||

| BHI / Baker Hughes Inc. | 0.01 | 0.00 | 0.47 | -15.65 | 0.1617 | 0.0071 | |||

| K / Kellanova | 0.01 | 2.58 | 0.46 | 8.92 | 0.1599 | 0.0415 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 2.19 | 0.46 | 4.07 | 0.1586 | 0.0357 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 3.21 | 0.46 | 11.17 | 0.1579 | 0.0433 | |||

| JNPR / Juniper Networks, Inc. | 0.02 | 0.00 | 0.44 | -0.90 | 0.1523 | 0.0284 | |||

| MWE / MarkWest Energy Partners, LP | 0.01 | 0.00 | 0.43 | -23.86 | 0.1496 | -0.0089 | |||

| SPLS / Staples, Inc. | 0.04 | 0.00 | 0.43 | -23.32 | 0.1496 | -0.0077 | |||

| TDC / Teradata Corporation | 0.01 | -6.35 | 0.43 | -26.76 | 0.1472 | -0.0149 | |||

| TRGP / Targa Resources Corp. | 0.01 | 0.00 | 0.42 | -42.21 | 0.1458 | -0.0577 | |||

| WFM / Whole Foods Market, Inc. | 0.01 | 11.01 | 0.42 | -11.16 | 0.1455 | 0.0134 | |||

| ADI / Analog Devices, Inc. | 0.01 | 0.00 | 0.42 | -12.08 | 0.1455 | 0.0120 | |||

| CAG / Conagra Brands, Inc. | 0.01 | -1.57 | 0.42 | -8.77 | 0.1434 | 0.0166 | |||

| TWTR / Twitter Inc | 0.02 | 36.28 | 0.41 | 1.47 | 0.1430 | 0.0294 | |||

| NTAP / NetApp, Inc. | 0.01 | 0.00 | 0.41 | -6.14 | 0.1424 | 0.0200 | |||

| NOV / NOV Inc. | 0.01 | -1.25 | 0.41 | -22.93 | 0.1413 | -0.0066 | |||

| FCX / Freeport-McMoRan Inc. | 0.04 | -2.53 | 0.40 | -49.24 | 0.1375 | -0.0810 | |||

| ABB / ABB Ltd. - ADR | 0.02 | 0.00 | 0.40 | -15.47 | 0.1375 | 0.0063 | |||

| CBSH / Commerce Bancshares, Inc. | 0.01 | -8.86 | 0.40 | -11.16 | 0.1372 | 0.0127 | |||

| DOW / Dow Inc. | 0.01 | 72.22 | 0.39 | 30.03 | 0.1358 | 0.0516 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.39 | -4.88 | 0.1344 | 0.0205 | |||

| EW / Edwards Lifesciences Corporation | 0.00 | 0.00 | 0.38 | 0.00 | 0.1310 | 0.0253 | |||

| NGLS / Targa Resources Partners LP | 0.01 | 0.00 | 0.35 | -24.68 | 0.1220 | -0.0086 | |||

| 30064K105 / Exacttarget, Inc. | 0.02 | 100.00 | 0.33 | -35.16 | 0.1144 | -0.0279 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 3.02 | 0.33 | -9.94 | 0.1124 | 0.0117 | |||

| ALL / The Allstate Corporation | 0.01 | 0.00 | 0.32 | -10.00 | 0.1117 | 0.0116 | |||

| UNP / Union Pacific Corporation | 0.00 | -1.80 | 0.32 | -8.76 | 0.1113 | 0.0129 | |||

| CSX / CSX Corporation | 0.01 | 0.00 | 0.32 | -17.48 | 0.1106 | 0.0025 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.32 | -3.61 | 0.1103 | 0.0180 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.32 | 0.31 | 0.1100 | 0.0216 | |||

| GD / General Dynamics Corporation | 0.00 | 0.00 | 0.32 | -2.48 | 0.1086 | 0.0188 | |||

| JCI / Johnson Controls International plc | 0.01 | -1.94 | 0.31 | -18.02 | 0.1082 | 0.0018 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 0.00 | 0.31 | -4.00 | 0.1075 | 0.0172 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.01 | -8.95 | 0.30 | -12.68 | 0.1044 | 0.0080 | |||

| CLX / The Clorox Company | 0.00 | 0.00 | 0.30 | 10.66 | 0.1037 | 0.0281 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.00 | 0.00 | 0.30 | 8.36 | 0.1027 | 0.0263 | |||

| DOW / Dow Inc. | 0.01 | 0.00 | 0.27 | -17.02 | 0.0941 | 0.0941 | |||

| MDT / Medtronic plc | 0.00 | -2.18 | 0.27 | -11.44 | 0.0934 | 0.0083 | |||

| ADSK / Autodesk, Inc. | 0.01 | 0.00 | 0.27 | -11.73 | 0.0934 | 0.0081 | |||

| CME / CME Group Inc. | 0.00 | 0.00 | 0.27 | -0.37 | 0.0927 | 0.0177 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.26 | -23.44 | 0.0889 | -0.0047 | |||

| KSS / Kohl's Corporation | 0.01 | 0.24 | 0.0838 | 0.0838 | |||||

| AET / Aetna, Inc. | 0.00 | -21.54 | 0.24 | -32.39 | 0.0827 | -0.0160 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 0.00 | 0.23 | -16.37 | 0.0810 | 0.0029 | |||

| CBI / Chicago Bridge & Iron Co., N.V. | 0.01 | -2.95 | 0.23 | -23.03 | 0.0807 | -0.0038 | |||

| BAX / Baxter International Inc. | 0.01 | -0.61 | 0.23 | -53.33 | 0.0796 | -0.0580 | |||

| 002144110 / Altera Corporation | 0.00 | -35.35 | 0.23 | -36.89 | 0.0796 | -0.0221 | |||

| BIIB / Biogen Inc. | 0.00 | 13.33 | 0.22 | -18.32 | 0.0769 | 0.0010 | |||

| BXLT / Baxalta Incorporated | 0.01 | 0.22 | 0.0765 | 0.0765 | |||||

| BK / The Bank of New York Mellon Corporation | 0.01 | 0.00 | 0.22 | -6.78 | 0.0758 | 0.0102 | |||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | 0.01 | 4.10 | 0.22 | -9.09 | 0.0758 | 0.0086 | |||

| CMCSA / Comcast Corporation | 0.00 | -3.16 | 0.22 | -8.40 | 0.0751 | 0.0090 | |||

| MOS / The Mosaic Company | 0.01 | 0.00 | 0.21 | -33.44 | 0.0727 | -0.0154 | |||

| AEE / Ameren Corporation | 0.00 | 0.21 | 0.0720 | 0.0720 | |||||

| GOOG / Alphabet Inc. | 0.00 | 0.20 | 0.0693 | 0.0693 | |||||

| ARNC / Arconic Corporation | 0.02 | -1.12 | 0.19 | -14.67 | 0.0662 | 0.0036 | |||

| GG / Goldcorp, Inc. | 0.02 | 0.00 | 0.19 | -22.76 | 0.0655 | -0.0029 | |||

| RIG / Transocean Ltd. | 0.01 | 0.00 | 0.14 | -19.65 | 0.0479 | -0.0002 | |||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.08 | -28.44 | 0.0269 | -0.0034 | |||

| AVP / Avon Products, Inc. | 0.02 | -35.91 | 0.05 | -66.67 | 0.0172 | -0.0245 | |||

| BTU / Peabody Energy Corporation | 0.01 | 0.02 | 0.0055 | 0.0055 | |||||

| ESC Reliance Grp Hldg / Pfd Stk (7594647G9) | 0.01 | 0.00 | 0.0000 | ||||||

| WPZ / Access Midstream Partners, L.P | 0.00 | -100.00 | 0.00 | -100.00 | -0.0584 | ||||

| US0549371070 / BB&T Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0628 | ||||

| DCP / DCP Midstream LP - Unit | 0.00 | -100.00 | 0.00 | -100.00 | -0.0587 | ||||

| SU / Suncor Energy Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0598 | ||||

| 61166W101 / Monsanto Co. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0695 | ||||

| 441060100 / Hospira | 0.00 | -100.00 | 0.00 | -100.00 | -0.2299 | ||||

| F / Ford Motor Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0434 |