Mga Batayang Estadistika

| Nilai Portofolio | $ 195,491,238 |

| Posisi Saat Ini | 152 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

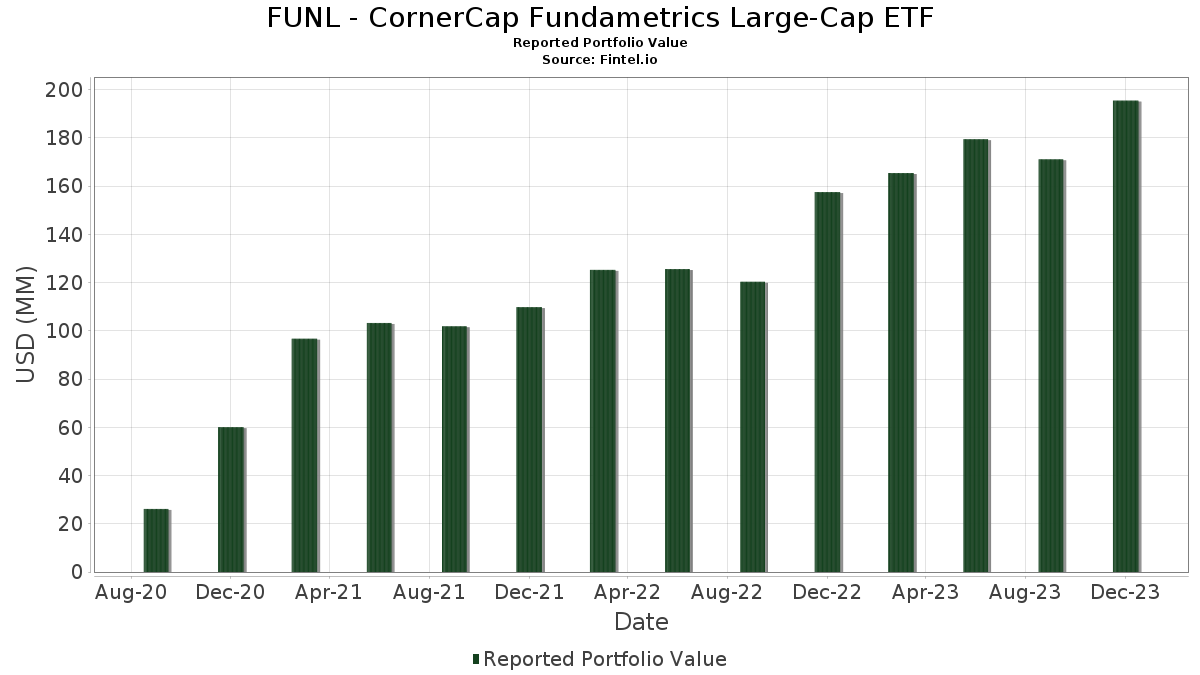

FUNL - CornerCap Fundametrics Large-Cap ETF telah mengungkapkan total kepemilikan 152 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 195,491,238 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FUNL - CornerCap Fundametrics Large-Cap ETF adalah Johnson & Johnson (US:JNJ) , Chevron Corporation (US:CVX) , Meta Platforms, Inc. (US:META) , JPMorgan Chase & Co. (US:JPM) , and Cisco Systems, Inc. (US:CSCO) . Posisi baru FUNL - CornerCap Fundametrics Large-Cap ETF meliputi: Atlassian Corporation (US:TEAM) , Stanley Black & Decker, Inc. (US:SWK) , Mastercard Incorporated (US:MA) , Baker Hughes Company (US:BKR) , and Halliburton Company (US:HAL) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 11.97 | 11.97 | 6.5172 | 6.1084 | |

| 0.02 | 3.32 | 1.8093 | 1.0536 | |

| 0.01 | 1.73 | 0.9412 | 0.9412 | |

| 0.00 | 1.48 | 0.8038 | 0.8038 | |

| 0.02 | 1.47 | 0.8024 | 0.8024 | |

| 0.03 | 1.42 | 0.7756 | 0.7756 | |

| 0.02 | 1.40 | 0.7640 | 0.7640 | |

| 0.00 | 1.38 | 0.7515 | 0.7515 | |

| 0.04 | 1.36 | 0.7392 | 0.7392 | |

| 0.04 | 1.31 | 0.7134 | 0.7134 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.0134 | ||

| 0.00 | 0.05 | 0.0283 | -0.8489 | |

| 0.00 | 0.00 | -0.8139 | ||

| 0.00 | 0.00 | -0.7670 | ||

| 0.00 | 0.00 | -0.7271 | ||

| 0.00 | 0.01 | 0.0038 | -0.6392 | |

| 1.12 | 1.12 | 0.6073 | -0.6254 | |

| 0.00 | 0.62 | 0.3395 | -0.4955 | |

| 0.01 | 0.74 | 0.4017 | -0.4687 | |

| 0.00 | 0.00 | -0.4313 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2024-02-29 untuk periode pelaporan 2023-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Mount Vernon Liquid Assets Portfolio, LLC / STIV (N/A) | 11.97 | 361,413.83 | 11.97 | 1,708.61 | 6.5172 | 6.1084 | |||

| JNJ / Johnson & Johnson | 0.02 | 3.67 | 3.58 | 4.35 | 1.9473 | -0.1696 | |||

| CVX / Chevron Corporation | 0.02 | 207.00 | 3.32 | 171.57 | 1.8093 | 1.0536 | |||

| META / Meta Platforms, Inc. | 0.01 | 2.69 | 3.19 | 21.08 | 1.7355 | 0.1098 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | 3.25 | 3.06 | 21.11 | 1.6647 | 0.1057 | |||

| CSCO / Cisco Systems, Inc. | 0.06 | 3.49 | 2.84 | -2.74 | 1.5454 | -0.2569 | |||

| BMY / Bristol-Myers Squibb Company | 0.04 | 24.74 | 2.23 | 10.28 | 1.2146 | -0.0347 | |||

| C / Citigroup Inc. | 0.04 | 3.55 | 1.96 | 29.50 | 1.0681 | 0.1327 | |||

| INTC / Intel Corporation | 0.04 | 2.70 | 1.94 | 45.18 | 1.0568 | 0.2312 | |||

| ALGN / Align Technology, Inc. | 0.01 | 125.02 | 1.83 | 160.77 | 0.9954 | 0.4370 | |||

| NEE.PRN / NextEra Energy Capital Holdings, Inc. - Corporate Bond/Note | 0.03 | 4.08 | 1.79 | 10.37 | 0.9734 | -0.0271 | |||

| CRM / Salesforce, Inc. | 0.01 | 2.75 | 1.75 | 33.28 | 0.9509 | 0.1421 | |||

| EXPE / Expedia Group, Inc. | 0.01 | -3.33 | 1.74 | 42.40 | 0.9492 | 0.1930 | |||

| TEAM / Atlassian Corporation | 0.01 | 1.73 | 0.9412 | 0.9412 | |||||

| ADSK / Autodesk, Inc. | 0.01 | 2.86 | 1.69 | 21.05 | 0.9208 | 0.0580 | |||

| CAT / Caterpillar Inc. | 0.01 | 3.19 | 1.64 | 11.76 | 0.8901 | -0.0132 | |||

| AXP / American Express Company | 0.01 | 108.46 | 1.62 | 161.75 | 0.8794 | 0.4984 | |||

| FNF / Fidelity National Financial, Inc. | 0.03 | 3.16 | 1.60 | 27.45 | 0.8696 | 0.0957 | |||

| SWKS / Skyworks Solutions, Inc. | 0.01 | 3.15 | 1.60 | 17.63 | 0.8685 | 0.0311 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | 121.48 | 1.59 | 172.04 | 0.8636 | 0.5031 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 2.77 | 1.58 | 18.20 | 0.8592 | 0.0348 | |||

| ADBE / Adobe Inc. | 0.00 | 2.74 | 1.57 | 20.26 | 0.8531 | 0.0482 | |||

| V / Visa Inc. | 0.01 | 2.88 | 1.56 | 16.46 | 0.8514 | 0.0221 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | -7.28 | 1.55 | 16.62 | 0.8447 | 0.0232 | |||

| APTV / Aptiv PLC | 0.02 | 47.74 | 1.54 | 34.44 | 0.8398 | 0.1314 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.02 | 3.10 | 1.54 | 16.83 | 0.8391 | 0.0248 | |||

| TXT / Textron Inc. | 0.02 | 3.20 | 1.54 | 6.21 | 0.8380 | -0.0569 | |||

| TGT / Target Corporation | 0.01 | 3.14 | 1.54 | 32.90 | 0.8378 | 0.1225 | |||

| FITB / Fifth Third Bancorp | 0.04 | -4.30 | 1.52 | 30.31 | 0.8286 | 0.1074 | |||

| CB / Chubb Limited | 0.01 | 3.06 | 1.52 | 11.89 | 0.8250 | -0.0114 | |||

| HD / The Home Depot, Inc. | 0.00 | 3.07 | 1.51 | 18.22 | 0.8234 | 0.0334 | |||

| USB / U.S. Bancorp | 0.03 | 3.28 | 1.51 | 35.24 | 0.8231 | 0.1327 | |||

| MSCI / MSCI Inc. | 0.00 | 3.25 | 1.51 | 13.80 | 0.8217 | 0.0030 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 3.28 | 1.51 | 22.12 | 0.8207 | 0.0587 | |||

| CVS / CVS Health Corporation | 0.02 | -22.54 | 1.51 | -12.40 | 0.8192 | -0.2415 | |||

| EA / Electronic Arts Inc. | 0.01 | 3.00 | 1.50 | 17.07 | 0.8176 | 0.0253 | |||

| PAYC / Paycom Software, Inc. | 0.01 | 61.61 | 1.49 | 28.79 | 0.8137 | 0.0975 | |||

| DAL / Delta Air Lines, Inc. | 0.04 | 3.14 | 1.49 | 12.18 | 0.8122 | -0.0092 | |||

| LHX / L3Harris Technologies, Inc. | 0.01 | 3.27 | 1.49 | 24.92 | 0.8106 | 0.0746 | |||

| GD / General Dynamics Corporation | 0.01 | 3.23 | 1.49 | 21.31 | 0.8089 | 0.0526 | |||

| CNC / Centene Corporation | 0.02 | 3.17 | 1.48 | 11.20 | 0.8051 | -0.0164 | |||

| ZM / Zoom Communications Inc. | 0.02 | 116.10 | 1.48 | 122.44 | 0.8042 | 0.3937 | |||

| DOV / Dover Corporation | 0.01 | 3.37 | 1.48 | 13.97 | 0.8040 | 0.0038 | |||

| AVGO / Broadcom Inc. | 0.00 | 1.48 | 0.8038 | 0.8038 | |||||

| SWK / Stanley Black & Decker, Inc. | 0.02 | 1.47 | 0.8024 | 0.8024 | |||||

| MMM / 3M Company | 0.01 | 17.75 | 1.47 | 37.48 | 0.8010 | 0.1403 | |||

| ECL / Ecolab Inc. | 0.01 | 3.23 | 1.47 | 20.91 | 0.7999 | 0.0493 | |||

| PSX / Phillips 66 | 0.01 | -3.86 | 1.46 | 6.55 | 0.7964 | -0.0515 | |||

| MTB / M&T Bank Corporation | 0.01 | 3.30 | 1.45 | 12.03 | 0.7911 | -0.0101 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 3.26 | 1.45 | 18.24 | 0.7904 | 0.0321 | |||

| BAC / Bank of America Corporation | 0.04 | 3.49 | 1.45 | 27.30 | 0.7893 | 0.0859 | |||

| KHC / The Kraft Heinz Company | 0.04 | 3.29 | 1.45 | 13.49 | 0.7881 | 0.0009 | |||

| FDX / FedEx Corporation | 0.01 | 3.06 | 1.43 | -1.58 | 0.7796 | -0.1189 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | 86.39 | 1.43 | 117.53 | 0.7769 | 0.3716 | |||

| KR / The Kroger Co. | 0.03 | 1.42 | 0.7756 | 0.7756 | |||||

| MRK / Merck & Co., Inc. | 0.01 | 3.44 | 1.42 | 9.49 | 0.7728 | -0.0274 | |||

| NTAP / NetApp, Inc. | 0.02 | 3.25 | 1.42 | 19.97 | 0.7723 | 0.0421 | |||

| GOOGL / Alphabet Inc. | 0.01 | 3.51 | 1.41 | 10.50 | 0.7676 | -0.0203 | |||

| MSFT / Microsoft Corporation | 0.00 | -3.93 | 1.41 | 55.19 | 0.7653 | 0.0129 | |||

| PPG / PPG Industries, Inc. | 0.01 | 3.41 | 1.40 | 19.19 | 0.7645 | 0.0368 | |||

| JCI / Johnson Controls International plc | 0.02 | 1.40 | 0.7640 | 0.7640 | |||||

| HCA / HCA Healthcare, Inc. | 0.01 | 3.57 | 1.39 | 14.02 | 0.7573 | 0.0036 | |||

| MA / Mastercard Incorporated | 0.00 | 1.38 | 0.7515 | 0.7515 | |||||

| CSX / CSX Corporation | 0.04 | 3.59 | 1.38 | 16.79 | 0.7496 | 0.0216 | |||

| MET / MetLife, Inc. | 0.02 | 3.49 | 1.38 | 8.77 | 0.7493 | -0.0319 | |||

| NEM / Newmont Corporation | 0.03 | 3.70 | 1.37 | 16.19 | 0.7466 | 0.0176 | |||

| UHS / Universal Health Services, Inc. | 0.01 | 3.67 | 1.37 | 25.69 | 0.7432 | 0.0726 | |||

| EBAY / eBay Inc. | 0.03 | 13.42 | 1.36 | 12.26 | 0.7425 | -0.0080 | |||

| LDOS / Leidos Holdings, Inc. | 0.01 | -17.11 | 1.36 | -2.65 | 0.7403 | -0.1221 | |||

| BKR / Baker Hughes Company | 0.04 | 1.36 | 0.7392 | 0.7392 | |||||

| VRSN / VeriSign, Inc. | 0.01 | 3.30 | 1.35 | 5.06 | 0.7343 | -0.0585 | |||

| LYB / LyondellBasell Industries N.V. | 0.01 | 34.97 | 1.35 | 70.60 | 0.7330 | 0.0773 | |||

| CI / The Cigna Group | 0.00 | 3.64 | 1.35 | 8.47 | 0.7325 | -0.0333 | |||

| RF / Regions Financial Corporation | 0.07 | 3.87 | 1.34 | 17.07 | 0.7319 | 0.0226 | |||

| RPRX / Royalty Pharma plc | 0.05 | 121.84 | 1.34 | 129.67 | 0.7289 | 0.3689 | |||

| STT / State Street Corporation | 0.02 | 3.65 | 1.33 | 19.87 | 0.7227 | 0.0391 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -3.97 | 1.32 | 0.30 | 0.7207 | -0.0945 | |||

| GILD / Gilead Sciences, Inc. | 0.02 | 3.69 | 1.31 | 12.02 | 0.7156 | -0.0085 | |||

| HAL / Halliburton Company | 0.04 | 1.31 | 0.7134 | 0.7134 | |||||

| EMR / Emerson Electric Co. | 0.01 | 3.89 | 1.30 | 4.74 | 0.7095 | -0.0590 | |||

| CMI / Cummins Inc. | 0.01 | 3.69 | 1.29 | 8.74 | 0.7044 | -0.0304 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 3.66 | 1.29 | 4.19 | 0.7043 | -0.0621 | |||

| MOH / Molina Healthcare, Inc. | 0.00 | -11.92 | 1.28 | -2.95 | 0.6987 | -0.1178 | |||

| FTV / Fortive Corporation | 0.02 | 3.92 | 1.28 | 3.22 | 0.6981 | -0.0693 | |||

| HOLX / Hologic, Inc. | 0.02 | 3.78 | 1.28 | 6.85 | 0.6964 | -0.0429 | |||

| WTW / Willis Towers Watson Public Limited Company | 0.01 | -12.19 | 1.28 | 1.35 | 0.6959 | -0.0828 | |||

| GPN / Global Payments Inc. | 0.01 | -10.83 | 1.26 | -1.87 | 0.6867 | -0.1069 | |||

| DVN / Devon Energy Corporation | 0.03 | 3.88 | 1.26 | -1.33 | 0.6857 | -0.1026 | |||

| ANTM / Anthem Inc | 0.00 | 3.73 | 1.26 | 12.42 | 0.6848 | -0.0066 | |||

| MO / Altria Group, Inc. | 0.03 | 3.69 | 1.25 | -0.56 | 0.6786 | -0.0951 | |||

| DTE / DTE Energy Company | 0.01 | 3.80 | 1.25 | 15.26 | 0.6784 | 0.0110 | |||

| COG / Cabot Oil & Gas Corp. | 0.05 | 3.96 | 1.24 | -1.98 | 0.6744 | -0.1055 | |||

| PM / Philip Morris International Inc. | 0.01 | 3.99 | 1.20 | 5.75 | 0.6510 | -0.0477 | |||

| HSY / The Hershey Company | 0.01 | 3.90 | 1.19 | -3.17 | 0.6490 | -0.1113 | |||

| T / AT&T Inc. | 0.07 | -24.75 | 1.15 | -15.90 | 0.6250 | -0.2182 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 1.12 | -44.12 | 1.12 | -44.14 | 0.6073 | -0.6254 | |||

| SQ / Block, Inc. | 0.01 | 2.29 | 1.10 | 78.70 | 0.5986 | 0.2188 | |||

| PYPL / PayPal Holdings, Inc. | 0.02 | -16.58 | 1.05 | -12.38 | 0.5700 | -0.1678 | |||

| NOW / ServiceNow, Inc. | 0.00 | -4.58 | 0.97 | 20.62 | 0.5288 | 0.0315 | |||

| WDAY / Workday, Inc. | 0.00 | 0.83 | 0.4503 | 0.4503 | |||||

| IBM / International Business Machines Corporation | 0.00 | 2.90 | 0.81 | 19.91 | 0.4396 | 0.0239 | |||

| HST / Host Hotels & Resorts, Inc. | 0.04 | 3.36 | 0.80 | 25.31 | 0.4369 | 0.0412 | |||

| NXPI / NXP Semiconductors N.V. | 0.00 | 3.11 | 0.78 | 18.43 | 0.4269 | 0.0182 | |||

| MAS / Masco Corporation | 0.01 | 3.10 | 0.78 | 29.21 | 0.4263 | 0.0521 | |||

| NNN / NNN REIT, Inc. | 0.02 | 3.52 | 0.76 | 26.21 | 0.4117 | 0.0419 | |||

| VEEV / Veeva Systems Inc. | 0.00 | 0.75 | 0.4104 | 0.4104 | |||||

| MDT / Medtronic plc | 0.01 | 0.75 | 0.4068 | 0.4068 | |||||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | 0.74 | 0.4045 | 0.4045 | |||||

| O / Realty Income Corporation | 0.01 | 140.31 | 0.74 | 176.49 | 0.4038 | 0.2380 | |||

| INCY / Incyte Corporation | 0.01 | 9.90 | 0.74 | -17.91 | 0.4017 | -0.4687 | |||

| DFS / Discover Financial Services | 0.01 | 3.50 | 0.73 | 34.43 | 0.3997 | 0.0621 | |||

| STAG / STAG Industrial, Inc. | 0.02 | 3.73 | 0.73 | 18.04 | 0.3991 | 0.0155 | |||

| PINS / Pinterest, Inc. | 0.02 | -65.49 | 0.72 | -29.59 | 0.3925 | -0.4224 | |||

| GM / General Motors Company | 0.02 | 3.56 | 0.72 | 12.89 | 0.3911 | -0.0021 | |||

| GLPI / Gaming and Leisure Properties, Inc. | 0.01 | 123.45 | 0.72 | 141.89 | 0.3901 | 0.2074 | |||

| SBAC / SBA Communications Corporation | 0.00 | 3.44 | 0.72 | 31.14 | 0.3901 | 0.0526 | |||

| J / Jacobs Solutions Inc. | 0.01 | 0.71 | 0.3858 | 0.3858 | |||||

| HUM / Humana Inc. | 0.00 | 3.09 | 0.70 | -3.03 | 0.3830 | -0.0648 | |||

| DT / Dynatrace, Inc. | 0.01 | 3.31 | 0.70 | 21.03 | 0.3821 | 0.0237 | |||

| LAMR / Lamar Advertising Company | 0.01 | 3.53 | 0.70 | 31.77 | 0.3819 | 0.0533 | |||

| DASH / DoorDash, Inc. | 0.01 | 0.70 | 0.3815 | 0.3815 | |||||

| CNP / CenterPoint Energy, Inc. | 0.02 | 3.32 | 0.70 | 10.08 | 0.3805 | -0.0120 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.01 | 3.34 | 0.69 | 10.99 | 0.3742 | -0.0080 | |||

| CPB / The Campbell's Company | 0.02 | 42.72 | 0.69 | 50.22 | 0.3730 | 0.0913 | |||

| AMCR / Amcor plc | 0.07 | 3.48 | 0.68 | 8.93 | 0.3722 | -0.0154 | |||

| BBY / Best Buy Co., Inc. | 0.01 | 3.62 | 0.68 | 16.75 | 0.3720 | 0.0106 | |||

| ETR / Entergy Corporation | 0.01 | 0.68 | 0.3697 | 0.3697 | |||||

| IPG / The Interpublic Group of Companies, Inc. | 0.02 | 3.57 | 0.68 | 17.98 | 0.3684 | 0.0141 | |||

| ELS / Equity LifeStyle Properties, Inc. | 0.01 | 112.86 | 0.68 | 124.58 | 0.3680 | 0.1802 | |||

| WRB / W. R. Berkley Corporation | 0.01 | -13.26 | 0.67 | -3.48 | 0.3630 | -0.0631 | |||

| EIX / Edison International | 0.01 | 3.72 | 0.66 | 17.17 | 0.3604 | 0.0115 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.00 | 4.07 | 0.66 | 8.79 | 0.3572 | -0.0153 | |||

| CLX / The Clorox Company | 0.00 | -51.12 | 0.66 | -46.83 | 0.3568 | -0.4042 | |||

| LPLA / LPL Financial Holdings Inc. | 0.00 | 3.57 | 0.65 | -0.77 | 0.3522 | -0.0505 | |||

| INVH / Invitation Homes Inc. | 0.02 | 4.03 | 0.64 | 12.06 | 0.3492 | -0.0045 | |||

| BAX / Baxter International Inc. | 0.02 | 3.87 | 0.64 | 6.31 | 0.3488 | -0.0230 | |||

| FR / First Industrial Realty Trust, Inc. | 0.01 | 4.22 | 0.64 | 15.25 | 0.3460 | 0.0058 | |||

| EG / Everest Group, Ltd. | 0.00 | -51.53 | 0.62 | -53.92 | 0.3395 | -0.4955 | |||

| UAL / United Airlines Holdings, Inc. | 0.01 | 3.84 | 0.62 | 1.31 | 0.3364 | -0.0403 | |||

| EXC / Exelon Corporation | 0.02 | 0.61 | 0.3342 | 0.3342 | |||||

| FOXA / Fox Corporation | 0.02 | 3.96 | 0.60 | -1.15 | 0.3271 | -0.0482 | |||

| NI / NiSource Inc. | 0.02 | 4.00 | 0.60 | 11.78 | 0.3259 | -0.0045 | |||

| GIS / General Mills, Inc. | 0.01 | 4.02 | 0.58 | 5.82 | 0.3173 | -0.0226 | |||

| FTNT / Fortinet, Inc. | 0.01 | -12.58 | 0.56 | -12.70 | 0.3032 | -0.0912 | |||

| CUBE / CubeSmart | 0.01 | 3.60 | 0.39 | 26.21 | 0.2125 | 0.0211 | |||

| ESS / Essex Property Trust, Inc. | 0.00 | 3.30 | 0.37 | 20.78 | 0.2030 | 0.0123 | |||

| KIM / Kimco Realty Corporation | 0.02 | 3.69 | 0.36 | 25.70 | 0.1944 | 0.0189 | |||

| AMH / American Homes 4 Rent | 0.01 | 3.79 | 0.33 | 10.96 | 0.1821 | -0.0043 | |||

| EQR / Equity Residential | 0.01 | 3.94 | 0.33 | 8.14 | 0.1810 | -0.0086 | |||

| ADC / Agree Realty Corporation | 0.00 | 4.30 | 0.31 | 18.77 | 0.1689 | 0.0077 | |||

| CME / CME Group Inc. | 0.00 | -96.52 | 0.05 | -96.34 | 0.0283 | -0.8489 | |||

| AEE / Ameren Corporation | 0.00 | -99.31 | 0.01 | -99.42 | 0.0038 | -0.6392 | |||

| AWK / American Water Works Company, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3286 | ||||

| KMI / Kinder Morgan, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7271 | ||||

| CCI / Crown Castle Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2112 | ||||

| DIS / The Walt Disney Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.0134 | ||||

| PTC / PTC Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4313 | ||||

| FIS / Fidelity National Information Services, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7670 | ||||

| WMT / Walmart Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8139 |