Mga Batayang Estadistika

| Nilai Portofolio | $ 4,483,871,059 |

| Posisi Saat Ini | 152 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

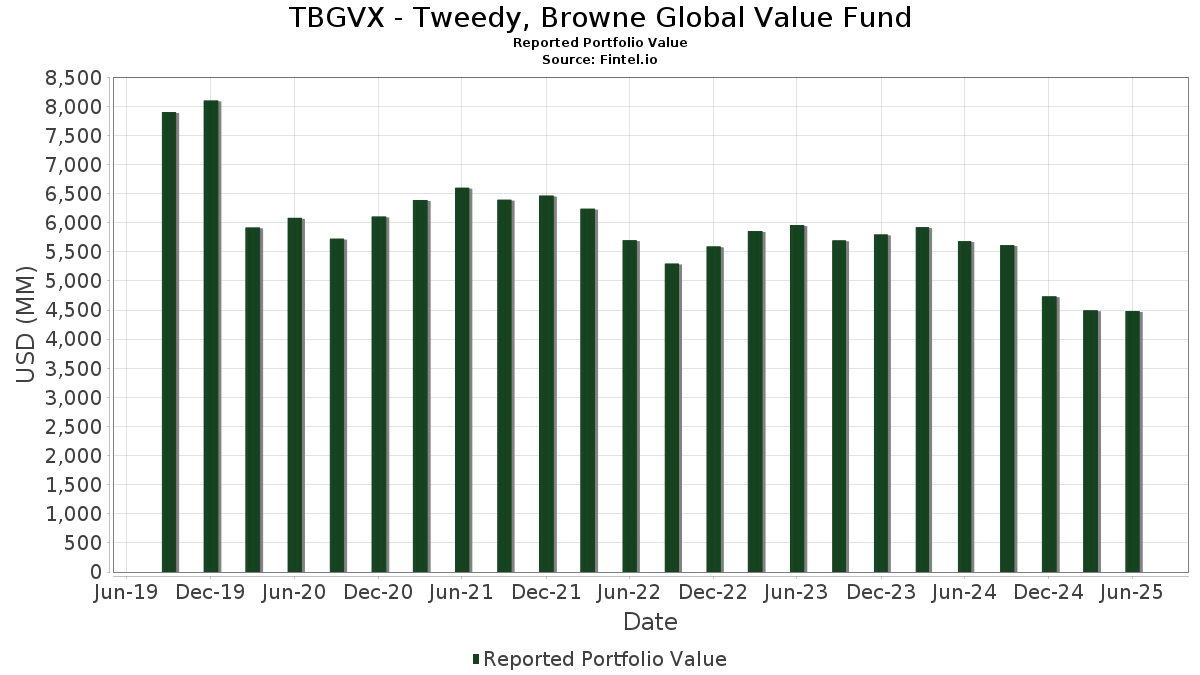

TBGVX - Tweedy, Browne Global Value Fund telah mengungkapkan total kepemilikan 152 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,483,871,059 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama TBGVX - Tweedy, Browne Global Value Fund adalah Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares (US:DIRXX) , Roche Holding AG (CH:ROG) , Nestlé S.A. (CH:NESN) , Safran SA (FR:SAF) , and United Overseas Bank Limited (DE:UOB) . Posisi baru TBGVX - Tweedy, Browne Global Value Fund meliputi: Nippon Sanso Holdings Corporation (US:TYNPF) , Azelis Group NV (MX:AZE N) , Nakanishi Inc. (US:NKNSF) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 234.98 | 234.98 | 5.1684 | 2.2903 | |

| 1.36 | 51.33 | 1.1290 | 1.1290 | |

| 49.95 | 1.0986 | 1.0986 | ||

| 1.02 | 65.07 | 1.4312 | 0.5151 | |

| 1.46 | 23.23 | 0.5109 | 0.5109 | |

| 1.12 | 115.82 | 2.5476 | 0.5011 | |

| 0.81 | 78.20 | 1.7199 | 0.4898 | |

| 0.38 | 98.64 | 2.1697 | 0.4857 | |

| 2.35 | 92.87 | 2.0426 | 0.4790 | |

| 21.76 | 45.32 | 0.9969 | 0.4018 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 32.56 | 0.7162 | -2.0973 | |

| 0.06 | 10.08 | 0.2216 | -1.0998 | |

| 5.24 | 135.56 | 2.9817 | -1.0989 | |

| 1.56 | 154.45 | 3.3972 | -0.8941 | |

| 0.48 | 156.78 | 3.4483 | -0.7574 | |

| 2.31 | 141.00 | 3.1012 | -0.5009 | |

| 1.45 | 22.77 | 0.5007 | -0.3294 | |

| 1.92 | 142.40 | 3.1321 | -0.3127 | |

| -13.47 | -0.2962 | -0.2962 | ||

| 0.21 | 2.49 | 0.0547 | -0.2794 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-20 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| DIRXX / Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares | 234.98 | 80.02 | 234.98 | 80.02 | 5.1684 | 2.2903 | |||

| ROG / Roche Holding AG | 0.48 | -16.67 | 156.78 | -17.81 | 3.4483 | -0.7574 | |||

| NESN / Nestlé S.A. | 1.56 | -19.02 | 154.45 | -20.64 | 3.3972 | -0.8941 | |||

| SAF / Safran SA | 0.47 | -12.44 | 153.33 | 7.81 | 3.3725 | 0.2367 | |||

| UOB / United Overseas Bank Limited | 5.32 | 0.00 | 150.47 | 0.21 | 3.3095 | -0.0011 | |||

| NOVN / Novartis AG | 1.20 | -6.53 | 145.10 | 1.68 | 3.1914 | 0.0451 | |||

| HEIO / Heineken Holding N.V. | 1.92 | -11.24 | 142.40 | -8.85 | 3.1321 | -0.3127 | |||

| FP / TotalEnergies SE | 2.31 | -9.16 | 141.00 | -13.69 | 3.1012 | -0.5009 | |||

| BA. / BAE Systems plc | 5.24 | -42.83 | 135.56 | -26.75 | 2.9817 | -1.0989 | |||

| CNH / CNH Industrial N.V. | 9.79 | 0.00 | 126.87 | 5.54 | 2.7906 | 0.1399 | |||

| DPW / Deutsche Post AG | 2.64 | 0.00 | 121.72 | 7.31 | 2.6774 | 0.1763 | |||

| SOL / SOL S.p.A. | 2.09 | -30.34 | 117.82 | -2.51 | 2.5915 | -0.0732 | |||

| NTIOF / National Bank of Canada | 1.12 | 0.00 | 115.82 | 24.79 | 2.5476 | 0.5011 | |||

| DGEAF / Diageo plc | 4.23 | -3.87 | 105.87 | -7.78 | 2.3285 | -0.2028 | |||

| TXGN / TX Group AG | 0.38 | 0.00 | 98.64 | 29.16 | 2.1697 | 0.4857 | |||

| PRU / Prudential plc | 7.67 | 0.00 | 95.88 | 15.98 | 2.1090 | 0.2861 | |||

| IONS / Ionis Pharmaceuticals, Inc. | 2.35 | 0.00 | 92.87 | 30.96 | 2.0426 | 0.4790 | |||

| KOF / Coca-Cola FEMSA, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.92 | -5.53 | 89.19 | 0.10 | 1.9617 | -0.0029 | |||

| RHM / Rheinmetall AG | 0.04 | -21.39 | 88.78 | 16.01 | 1.9527 | 0.2653 | |||

| TLLB / Trelleborg AB (publ) | 2.27 | 0.00 | 83.74 | -0.73 | 1.8419 | -0.0181 | |||

| TEP / Teleperformance SE | 0.81 | 45.70 | 78.20 | 40.16 | 1.7199 | 0.4898 | |||

| RUI / Rubis | 2.39 | 0.00 | 77.02 | 14.04 | 1.6940 | 0.2049 | |||

| 4C9 / CVS Group plc | 4.13 | 0.00 | 70.75 | 32.18 | 1.5561 | 0.3759 | |||

| KEMIR / Kemira Oyj | 2.92 | 0.00 | 67.42 | 6.26 | 1.4828 | 0.0839 | |||

| 086790 / Hana Financial Group Inc. | 1.02 | 0.00 | 65.07 | 56.61 | 1.4312 | 0.5151 | |||

| WIPKF / Winpak Ltd. | 1.93 | 0.00 | 63.01 | 20.12 | 1.3859 | 0.2293 | |||

| 003550 / LG Corp. | 1.00 | 0.00 | 58.91 | 33.73 | 1.2957 | 0.3244 | |||

| SSNLF / Samsung Electronics Co., Ltd. | 1.31 | 0.00 | 58.11 | 11.76 | 1.2782 | 0.1317 | |||

| COUD / Computacenter plc | 1.67 | 0.00 | 54.79 | 3.64 | 1.2050 | 0.0395 | |||

| FRE / Frendy Energy S.p.A. | 1.08 | 0.00 | 54.33 | 17.47 | 1.1950 | 0.1752 | |||

| IJCA / Inchcape plc | 5.27 | 0.00 | 52.46 | 15.04 | 1.1539 | 0.1484 | |||

| TYNPF / Nippon Sanso Holdings Corporation | 1.36 | 51.33 | 1.1290 | 1.1290 | |||||

| United States Treasury Bill / DBT (US912797LW51) | 49.95 | 1.0986 | 1.0986 | ||||||

| AKE / Arkema S.A. | 0.66 | 19.68 | 48.24 | 14.88 | 1.0610 | 0.1351 | |||

| 858 / Wuliangye Yibin Co Ltd | 2.77 | 0.00 | 45.94 | -8.46 | 1.0106 | -0.0961 | |||

| JSG / Johnson Service Group PLC | 21.76 | 38.61 | 45.32 | 67.93 | 0.9969 | 0.4018 | |||

| KSB / KSB SE & Co. KGaA | 0.04 | 0.00 | 44.25 | 18.18 | 0.9732 | 0.1477 | |||

| KURRF / Kuraray Co., Ltd. | 3.36 | 0.00 | 42.73 | 2.79 | 0.9397 | 0.0232 | |||

| FUH / Subaru Corporation | 2.45 | 0.00 | 42.67 | -3.05 | 0.9386 | -0.0319 | |||

| AALB / Aalberts N.V. | 1.17 | -9.97 | 42.25 | -4.56 | 0.9294 | -0.0468 | |||

| ATE / Alten S.A. | 0.48 | 27.52 | 41.98 | 14.31 | 0.9233 | 0.1136 | |||

| BNR / Burning Rock Biotech Limited - Depositary Receipt (Common Stock) | 0.61 | 0.00 | 40.04 | 1.88 | 0.8807 | 0.0141 | |||

| LSDAF / Lassonde Industries Inc. | 0.25 | 0.00 | 38.43 | 4.38 | 0.8453 | 0.0335 | |||

| DEVL / DBS Group Holdings Ltd | 1.08 | -24.50 | 38.20 | -22.45 | 0.8401 | -0.2459 | |||

| GFTU / Grafton Group plc | 2.70 | 0.00 | 37.88 | 25.80 | 0.8332 | 0.1693 | |||

| ALV / Autoliv, Inc. | 0.33 | 0.00 | 37.46 | 26.51 | 0.8240 | 0.1711 | |||

| ANDINAA / Embotelladora Andina SA | 11.04 | 0.00 | 36.67 | 15.81 | 0.8066 | 0.1084 | |||

| SOP / SPINNAKER OPPORTUNITIES PLC | 0.15 | 0.00 | 36.40 | 30.73 | 0.8005 | 0.1867 | |||

| PMN / Phoenix Mecano AG | 0.06 | 0.00 | 34.94 | 11.77 | 0.7684 | 0.0792 | |||

| ZURN / Zurich Insurance Group AG | 0.05 | -74.44 | 32.56 | -74.48 | 0.7162 | -2.0973 | |||

| 4368 / Fuso Chemical Co.,Ltd. | 1.05 | 0.00 | 28.03 | 15.52 | 0.6165 | 0.0815 | |||

| NGKSF / Niterra Co., Ltd. | 0.82 | 0.00 | 27.28 | 8.60 | 0.5999 | 0.0462 | |||

| MEGACPO / Megacable Holdings SAB de CV | 9.07 | 0.00 | 25.20 | 32.86 | 0.5543 | 0.1361 | |||

| FAGR / Fagron NV | 0.93 | 0.00 | 24.42 | 28.69 | 0.5370 | 0.1187 | |||

| 4182 / Mitsubishi Gas Chemical Company, Inc. | 1.57 | 0.00 | 24.04 | -2.12 | 0.5288 | -0.0128 | |||

| 7276 / Koito Manufacturing Co., Ltd. | 1.96 | 0.00 | 23.38 | -3.50 | 0.5142 | -0.0199 | |||

| 4401 / Adeka Corporation | 1.22 | 0.00 | 23.27 | 5.42 | 0.5119 | 0.0251 | |||

| AZE N / Azelis Group NV | 1.46 | 23.23 | 0.5109 | 0.5109 | |||||

| BAB / Babcock International Group PLC | 1.45 | -63.86 | 22.77 | -39.54 | 0.5007 | -0.3294 | |||

| 10 / Hang Lung Group Limited | 12.58 | 0.00 | 21.90 | 18.16 | 0.4816 | 0.0730 | |||

| 1882 / Haitian International Holdings Limited | 8.38 | 0.00 | 21.79 | -2.18 | 0.4792 | -0.0119 | |||

| 6P8 / Pets at Home Group Plc | 5.99 | 317.11 | 21.50 | 433.29 | 0.4729 | 0.3840 | |||

| 9WM / Nifco Inc. | 0.90 | 0.00 | 21.37 | -1.77 | 0.4699 | -0.0097 | |||

| 005830 / DB Insurance Co., Ltd. | 0.22 | 0.00 | 20.02 | 51.24 | 0.4404 | 0.1485 | |||

| 220 / Uni-President China Holdings Ltd | 15.97 | 0.00 | 19.33 | 5.12 | 0.4252 | 0.0197 | |||

| HWDN / Howden Joinery Group Plc | 1.64 | -16.65 | 19.25 | 4.63 | 0.4233 | 0.0177 | |||

| HZS / Kanadevia Corporation | 2.75 | 0.00 | 18.57 | 9.26 | 0.4084 | 0.0337 | |||

| 6277 / Hosokawa Micron Corporation | 0.48 | 0.00 | 16.56 | 25.52 | 0.3643 | 0.0733 | |||

| 9715 / transcosmos inc. | 0.59 | 0.00 | 14.26 | 13.33 | 0.3137 | 0.0362 | |||

| VTMTF / Vertu Motors plc | 16.29 | 0.00 | 14.18 | 27.80 | 0.3118 | 0.0672 | |||

| SSM1 / Sumitomo Heavy Industries, Ltd. | 0.63 | 0.00 | 12.83 | -0.18 | 0.2823 | -0.0012 | |||

| CLTN / COLTENE Holding AG | 0.14 | 0.00 | 12.14 | 19.63 | 0.2671 | 0.0433 | |||

| 75L / Taikisha Ltd. | 0.66 | 0.00 | 11.75 | 16.16 | 0.2585 | 0.0354 | |||

| 2531 / Takara Holdings Inc. | 1.32 | 0.00 | 10.93 | 8.04 | 0.2404 | 0.0173 | |||

| GOOGL / Alphabet Inc. | 0.06 | -85.25 | 10.08 | -83.19 | 0.2216 | -1.0998 | |||

| 005180 / Binggrae Co., Ltd. | 0.13 | 0.00 | 8.33 | -1.05 | 0.1833 | -0.0024 | |||

| 145720 / Dentium CO., LTD | 0.17 | 0.00 | 7.64 | -5.67 | 0.1680 | -0.0105 | |||

| 900925 / Shanghai Mechanical & Electrical Industry Co.,Ltd. | 6.46 | 0.00 | 7.12 | -4.89 | 0.1567 | -0.0085 | |||

| 383800 / LX Holdings Corp. | 0.99 | 0.00 | 7.04 | 62.53 | 0.1548 | 0.0593 | |||

| NKNSF / Nakanishi Inc. | 0.53 | 6.95 | 0.1529 | 0.1529 | |||||

| S8T / SThree plc | 2.00 | -21.95 | 6.71 | -23.77 | 0.1477 | -0.0465 | |||

| GBP/USD FORWARD / DFE (000000000) | 5.37 | 0.1182 | 0.1182 | ||||||

| SKFB / AB SKF (publ) | 0.17 | 0.00 | 3.86 | 12.36 | 0.0850 | 0.0092 | |||

| AGI / Alliance Global Group, Inc. | 22.61 | 0.00 | 3.62 | 50.71 | 0.0796 | 0.0267 | |||

| 5122 / Okamoto Industries, Inc. | 0.10 | 0.00 | 3.49 | -1.77 | 0.0769 | -0.0016 | |||

| 7839 / Shoei Co., Ltd. | 0.27 | 0.00 | 3.26 | 5.54 | 0.0717 | 0.0036 | |||

| 9347 / NIPPON KANZAI Holdings Co.,Ltd. | 0.16 | 0.00 | 3.09 | 5.71 | 0.0680 | 0.0035 | |||

| ADRS2 / Adris grupa d. d. - Preferred Stock | 0.03 | 0.00 | 2.77 | 35.71 | 0.0610 | 0.0159 | |||

| 2ZN / Star Micronics Co., Ltd. | 0.21 | -81.66 | 2.49 | -83.59 | 0.0547 | -0.2794 | |||

| 6250 / Yamabiko Corporation | 0.16 | 0.00 | 2.42 | -8.45 | 0.0531 | -0.0051 | |||

| TBK / Philip Morris CR a.s. | 0.00 | 0.00 | 2.32 | 7.25 | 0.0511 | 0.0033 | |||

| 41 / Great Eagle Holdings Limited | 1.31 | 0.00 | 2.29 | 1.24 | 0.0503 | 0.0005 | |||

| USD/JPY FORWARD / DFE (000000000) | 1.07 | 0.0236 | 0.0236 | ||||||

| 88 / Tai Cheung Holdings Limited | 2.50 | 0.00 | 1.03 | 5.42 | 0.0227 | 0.0011 | |||

| USD/JPY FORWARD / DFE (000000000) | 0.88 | 0.0193 | 0.0193 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.87 | 0.0191 | 0.0191 | ||||||

| USD/CAD FORWARD / DFE (000000000) | 0.52 | 0.0115 | 0.0115 | ||||||

| USD/JPY FORWARD / DFE (000000000) | 0.48 | 0.0106 | 0.0106 | ||||||

| USD/HKD FORWARD / DFE (000000000) | 0.23 | 0.0052 | 0.0052 | ||||||

| USD/JPY FORWARD / DFE (000000000) | 0.15 | 0.0034 | 0.0034 | ||||||

| USD/HKD FORWARD / DFE (000000000) | 0.02 | 0.0004 | 0.0004 | ||||||

| USD/JPY FORWARD / DFE (000000000) | 0.01 | 0.0003 | 0.0003 | ||||||

| USD/JPY FORWARD / DFE (000000000) | 0.01 | 0.0002 | 0.0002 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | -0.01 | -0.0003 | -0.0003 | ||||||

| USD/PHP FORWARD / DFE (000000000) | -0.02 | -0.0004 | -0.0004 | ||||||

| USD/PHP FORWARD / DFE (000000000) | -0.02 | -0.0005 | -0.0005 | ||||||

| USD/CAD FORWARD / DFE (000000000) | -0.03 | -0.0006 | -0.0006 | ||||||

| USD/PHP FORWARD / DFE (000000000) | -0.03 | -0.0007 | -0.0007 | ||||||

| USD/CLP FORWARD / DFE (000000000) | -0.04 | -0.0010 | -0.0010 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | -0.10 | -0.0022 | -0.0022 | ||||||

| USD/SGD FORWARD / DFE (000000000) | -0.12 | -0.0027 | -0.0027 | ||||||

| USD/CNH FORWARD / DFE (000000000) | -0.15 | -0.0033 | -0.0033 | ||||||

| USD/JPY FORWARD / DFE (000000000) | -0.17 | -0.0036 | -0.0036 | ||||||

| USD/SEK FORWARD / DFE (000000000) | -0.29 | -0.0064 | -0.0064 | ||||||

| USD/KRW FORWARD / DFE (000000000) | -0.31 | -0.0069 | -0.0069 | ||||||

| USD/MXN FORWARD / DFE (000000000) | -0.35 | -0.0078 | -0.0078 | ||||||

| USD/MXN FORWARD / DFE (000000000) | -0.36 | -0.0079 | -0.0079 | ||||||

| USD/SEK FORWARD / DFE (000000000) | -0.42 | -0.0091 | -0.0091 | ||||||

| USD/CHF FORWARD / DFE (000000000) | -0.45 | -0.0098 | -0.0098 | ||||||

| USD/CLP FORWARD / DFE (000000000) | -0.51 | -0.0112 | -0.0112 | ||||||

| USD/KRW FORWARD / DFE (000000000) | -0.60 | -0.0133 | -0.0133 | ||||||

| USD/MXN FORWARD / DFE (000000000) | -0.67 | -0.0147 | -0.0147 | ||||||

| USD/CAD FORWARD / DFE (000000000) | -0.73 | -0.0161 | -0.0161 | ||||||

| USD/JPY FORWARD / DFE (000000000) | -0.81 | -0.0177 | -0.0177 | ||||||

| USD/CLP FORWARD / DFE (000000000) | -0.91 | -0.0201 | -0.0201 | ||||||

| USD/JPY FORWARD / DFE (000000000) | -0.98 | -0.0216 | -0.0216 | ||||||

| USD/KRW FORWARD / DFE (000000000) | -1.06 | -0.0233 | -0.0233 | ||||||

| USD/CAD FORWARD / DFE (000000000) | -1.21 | -0.0267 | -0.0267 | ||||||

| USD/JPY FORWARD / DFE (000000000) | -1.37 | -0.0301 | -0.0301 | ||||||

| USD/CAD FORWARD / DFE (000000000) | -1.73 | -0.0381 | -0.0381 | ||||||

| USD/MXN FORWARD / DFE (000000000) | -1.74 | -0.0382 | -0.0382 | ||||||

| USD/KRW FORWARD / DFE (000000000) | -2.17 | -0.0478 | -0.0478 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -2.25 | -0.0495 | -0.0495 | ||||||

| USD/EUR FORWARD / DFE (000000000) | -2.51 | -0.0552 | -0.0552 | ||||||

| USD/EUR FORWARD / DFE (000000000) | -2.58 | -0.0567 | -0.0567 | ||||||

| USD/SGD FORWARD / DFE (000000000) | -2.75 | -0.0604 | -0.0604 | ||||||

| USD/SGD FORWARD / DFE (000000000) | -2.79 | -0.0613 | -0.0613 | ||||||

| USD/CHF FORWARD / DFE (000000000) | -2.89 | -0.0635 | -0.0635 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -3.33 | -0.0731 | -0.0731 | ||||||

| USD/EUR FORWARD / DFE (000000000) | -3.55 | -0.0781 | -0.0781 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | -3.61 | -0.0795 | -0.0795 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -4.02 | -0.0884 | -0.0884 | ||||||

| USD/KRW FORWARD / DFE (000000000) | -4.12 | -0.0907 | -0.0907 | ||||||

| USD/EUR FORWARD / DFE (000000000) | -4.40 | -0.0967 | -0.0967 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -5.65 | -0.1244 | -0.1244 | ||||||

| USD/EUR FORWARD / DFE (000000000) | -6.96 | -0.1530 | -0.1530 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -7.63 | -0.1679 | -0.1679 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -7.97 | -0.1754 | -0.1754 | ||||||

| USD/EUR FORWARD / DFE (000000000) | -7.99 | -0.1757 | -0.1757 | ||||||

| USD/EUR FORWARD / DFE (000000000) | -10.01 | -0.2202 | -0.2202 | ||||||

| USD/CHF FORWARD / DFE (000000000) | -10.99 | -0.2416 | -0.2416 | ||||||

| USD/CHF FORWARD / DFE (000000000) | -13.47 | -0.2962 | -0.2962 |