Mga Batayang Estadistika

| Nilai Portofolio | $ 6,474,903,201 |

| Posisi Saat Ini | 125 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

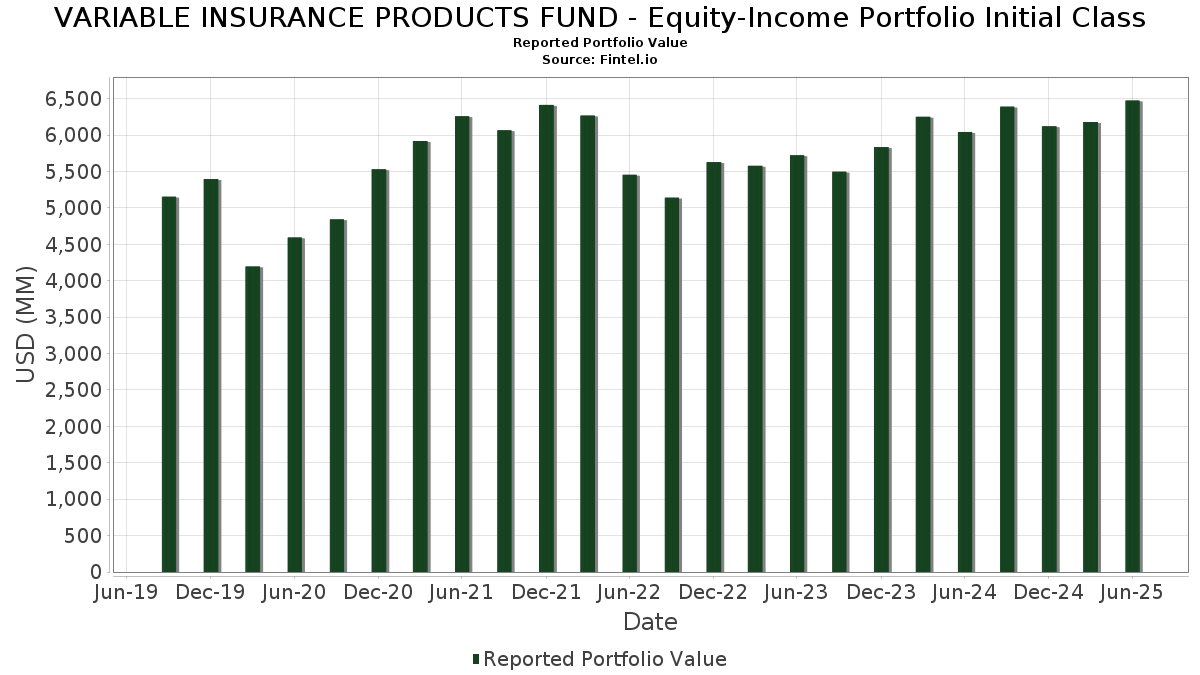

VARIABLE INSURANCE PRODUCTS FUND - Equity-Income Portfolio Initial Class telah mengungkapkan total kepemilikan 125 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 6,474,903,201 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama VARIABLE INSURANCE PRODUCTS FUND - Equity-Income Portfolio Initial Class adalah JPMorgan Chase & Co. (US:JPM) , Exxon Mobil Corporation (US:XOM) , Fidelity Cash Central Fund (US:US31635A1051) , Linde plc (US:LIN) , and Alphabet Inc. (US:GOOGL) . Posisi baru VARIABLE INSURANCE PRODUCTS FUND - Equity-Income Portfolio Initial Class meliputi: Meta Platforms, Inc. (IT:1FB) , Amazon.com, Inc. (BG:AMZ) , adidas AG (US:ADDDF) , Imperial Brands PLC (CH:IMB) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.81 | 141.98 | 2.2105 | 1.5764 | |

| 166.92 | 166.95 | 2.5992 | 1.1258 | |

| 0.04 | 32.92 | 0.5125 | 0.5125 | |

| 0.15 | 32.71 | 0.5092 | 0.5092 | |

| 0.72 | 89.46 | 1.3928 | 0.4074 | |

| 0.21 | 102.04 | 1.5887 | 0.3442 | |

| 0.19 | 61.50 | 0.9575 | 0.3366 | |

| 0.64 | 42.68 | 0.6644 | 0.3261 | |

| 0.95 | 75.49 | 1.1753 | 0.3255 | |

| 0.57 | 89.59 | 1.3948 | 0.3148 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.48 | 88.79 | 1.3823 | -1.0798 | |

| 0.26 | 79.82 | 1.2427 | -1.0383 | |

| 0.25 | 64.96 | 1.0114 | -0.9714 | |

| 0.31 | 60.73 | 0.9455 | -0.5465 | |

| 0.22 | 21.11 | 0.3286 | -0.3817 | |

| 1.69 | 182.25 | 2.8374 | -0.3596 | |

| 0.28 | 67.33 | 1.0483 | -0.3284 | |

| 0.60 | 75.56 | 1.1765 | -0.2775 | |

| 1.28 | 45.66 | 0.7108 | -0.2768 | |

| 0.27 | 78.51 | 1.2223 | -0.2112 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | 0.82 | -12.72 | 238.26 | 3.16 | 3.7094 | -0.0230 | |||

| XOM / Exxon Mobil Corporation | 1.69 | 1.63 | 182.25 | -7.88 | 2.8374 | -0.3596 | |||

| US31635A1051 / Fidelity Cash Central Fund | 166.92 | 83.10 | 166.95 | 83.10 | 2.5992 | 1.1258 | |||

| LIN / Linde plc | 0.31 | 0.00 | 147.27 | 0.76 | 2.2928 | -0.0690 | |||

| GOOGL / Alphabet Inc. | 0.81 | 217.49 | 141.98 | 261.82 | 2.2105 | 1.5764 | |||

| WFC / Wells Fargo & Company | 1.73 | 7.91 | 138.68 | 20.43 | 2.1591 | 0.2982 | |||

| WMT / Walmart Inc. | 1.31 | -14.97 | 127.99 | -5.29 | 1.9927 | -0.1911 | |||

| BAC / Bank of America Corporation | 2.69 | 0.00 | 127.28 | 13.40 | 1.9816 | 0.1678 | |||

| PG / The Procter & Gamble Company | 0.70 | 0.00 | 111.63 | -6.51 | 1.7379 | -0.1916 | |||

| CB / Chubb Limited | 0.36 | 0.00 | 105.08 | -4.06 | 1.6359 | -0.1340 | |||

| MSFT / Microsoft Corporation | 0.21 | 0.00 | 102.04 | 32.50 | 1.5887 | 0.3442 | |||

| GILD / Gilead Sciences, Inc. | 0.87 | -3.05 | 96.31 | -4.07 | 1.4995 | -0.1229 | |||

| JNJ / Johnson & Johnson | 0.61 | 0.00 | 93.48 | -7.89 | 1.4553 | -0.1847 | |||

| ITT / ITT Inc. | 0.57 | 10.40 | 89.59 | 34.04 | 1.3948 | 0.3148 | |||

| DIS / The Walt Disney Company | 0.72 | 16.77 | 89.46 | 46.71 | 1.3928 | 0.4074 | |||

| ABBV / AbbVie Inc. | 0.48 | -34.22 | 88.79 | -41.73 | 1.3823 | -1.0798 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.39 | -24.18 | 87.58 | 3.45 | 1.3635 | -0.0045 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.47 | -11.55 | 86.97 | -6.19 | 1.3540 | -0.1440 | |||

| CSCO / Cisco Systems, Inc. | 1.23 | 9.09 | 85.54 | 22.65 | 1.3317 | 0.2047 | |||

| UNH / UnitedHealth Group Incorporated | 0.26 | -5.07 | 79.82 | -43.45 | 1.2427 | -1.0383 | |||

| KO / The Coca-Cola Company | 1.12 | 20.51 | 78.99 | 19.05 | 1.2298 | 0.1576 | |||

| MCD / McDonald's Corporation | 0.27 | -5.38 | 78.51 | -11.50 | 1.2223 | -0.2112 | |||

| NEE / NextEra Energy, Inc. | 1.12 | 12.47 | 77.49 | 10.14 | 1.2064 | 0.0695 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.60 | -18.10 | 75.56 | -16.02 | 1.1765 | -0.2775 | |||

| MRK / Merck & Co., Inc. | 0.95 | 62.77 | 75.49 | 43.54 | 1.1753 | 0.3255 | |||

| TRV / The Travelers Companies, Inc. | 0.28 | 0.00 | 74.79 | 1.16 | 1.1644 | -0.0303 | |||

| TMUS / T-Mobile US, Inc. | 0.28 | -11.53 | 67.33 | -20.97 | 1.0483 | -0.3284 | |||

| MTB / M&T Bank Corporation | 0.34 | 0.00 | 66.28 | 8.53 | 1.0319 | 0.0450 | |||

| TJX / The TJX Companies, Inc. | 0.54 | -11.68 | 66.25 | -10.45 | 1.0314 | -0.1641 | |||

| GE / General Electric Company | 0.25 | -58.83 | 64.96 | -47.06 | 1.0114 | -0.9714 | |||

| SCHW / The Charles Schwab Corporation | 0.71 | 0.00 | 64.79 | 16.56 | 1.0087 | 0.1104 | |||

| NXPI / NXP Semiconductors N.V. | 0.29 | 0.03 | 63.45 | 14.99 | 0.9878 | 0.0962 | |||

| AZN / Astrazeneca plc | 0.45 | 0.00 | 63.06 | -5.23 | 0.9818 | -0.0935 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.28 | 0.18 | 62.07 | -10.25 | 0.9664 | -0.1512 | |||

| CEG / Constellation Energy Corporation | 0.19 | 0.00 | 61.50 | 60.08 | 0.9575 | 0.3366 | |||

| LOW / Lowe's Companies, Inc. | 0.27 | 0.00 | 60.86 | -4.87 | 0.9475 | -0.0863 | |||

| DHR / Danaher Corporation | 0.31 | -31.74 | 60.73 | -34.22 | 0.9455 | -0.5465 | |||

| KDP / Keurig Dr Pepper Inc. | 1.83 | 8.66 | 60.59 | 4.98 | 0.9433 | 0.0106 | |||

| LAMR / Lamar Advertising Company | 0.50 | 0.00 | 60.10 | 6.66 | 0.9357 | 0.0252 | |||

| NSC / Norfolk Southern Corporation | 0.23 | 0.00 | 59.85 | 8.07 | 0.9317 | 0.0369 | |||

| JCI / Johnson Controls International plc | 0.54 | 0.00 | 57.37 | 31.84 | 0.8932 | 0.1900 | |||

| T / AT&T Inc. | 1.98 | 5.74 | 57.24 | 8.21 | 0.8912 | 0.0364 | |||

| SO / The Southern Company | 0.61 | 0.00 | 56.35 | -0.13 | 0.8773 | -0.0345 | |||

| CR / Crane Company | 0.29 | -11.30 | 54.54 | 9.95 | 0.8491 | 0.0476 | |||

| COF / Capital One Financial Corporation | 0.25 | -5.79 | 54.18 | 11.79 | 0.8435 | 0.0603 | |||

| ACN / Accenture plc | 0.18 | 0.00 | 54.01 | -4.21 | 0.8409 | -0.0703 | |||

| BLK / BlackRock, Inc. | 0.05 | -0.35 | 53.85 | 10.47 | 0.8384 | 0.0507 | |||

| PSA / Public Storage | 0.18 | 61.16 | 53.48 | 58.00 | 0.8326 | 0.2856 | |||

| VZ / Verizon Communications Inc. | 1.23 | 0.00 | 53.39 | -4.61 | 0.8312 | -0.0732 | |||

| HBAN / Huntington Bancshares Incorporated | 3.09 | 0.00 | 51.83 | 11.66 | 0.8070 | 0.0568 | |||

| 005930 / Samsung Electronics Co., Ltd. | 1.15 | 17.26 | 50.93 | 30.84 | 0.7929 | 0.1639 | |||

| VST / Vistra Corp. | 0.26 | 0.00 | 50.33 | 65.03 | 0.7836 | 0.2908 | |||

| RR. / Rolls-Royce Holdings plc | 3.65 | 17.54 | 48.31 | 60.27 | 0.7521 | 0.2650 | |||

| SHEL N / Shell plc | 1.38 | 0.00 | 48.10 | -4.15 | 0.7489 | -0.0621 | |||

| USB / U.S. Bancorp | 1.06 | 7.09 | 47.82 | 14.78 | 0.7445 | 0.0713 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.44 | 10.77 | 47.30 | 4.68 | 0.7364 | 0.0063 | |||

| IMO / Imperial Oil Limited | 0.59 | -3.51 | 47.00 | 6.11 | 0.7318 | 0.0160 | |||

| GD / General Dynamics Corporation | 0.16 | 0.00 | 46.64 | 7.00 | 0.7261 | 0.0217 | |||

| NOC / Northrop Grumman Corporation | 0.09 | 6.34 | 46.10 | 3.85 | 0.7177 | 0.0003 | |||

| CMCSA / Comcast Corporation | 1.28 | -22.77 | 45.66 | -25.30 | 0.7108 | -0.2768 | |||

| CCK / Crown Holdings, Inc. | 0.44 | -17.27 | 45.24 | -4.56 | 0.7044 | -0.0616 | |||

| GEV / GE Vernova Inc. | 0.08 | -54.24 | 43.72 | -20.68 | 0.6807 | -0.2100 | |||

| LLY / Eli Lilly and Company | 0.06 | 0.00 | 42.92 | -5.61 | 0.6682 | -0.0666 | |||

| QSR / Restaurant Brands International Inc. | 0.64 | 104.83 | 42.68 | 103.82 | 0.6644 | 0.3261 | |||

| TPR / Tapestry, Inc. | 0.48 | 11.60 | 42.27 | 39.18 | 0.6582 | 0.1673 | |||

| ADI / Analog Devices, Inc. | 0.18 | 0.00 | 41.82 | 18.03 | 0.6511 | 0.0785 | |||

| AME / AMETEK, Inc. | 0.23 | -15.46 | 41.28 | -11.13 | 0.6427 | -0.1080 | |||

| DOX / Amdocs Limited | 0.45 | 0.00 | 41.23 | -0.28 | 0.6418 | -0.0263 | |||

| AFG / American Financial Group, Inc. | 0.31 | 21.76 | 39.37 | 17.00 | 0.6129 | 0.0692 | |||

| WSO / Watsco, Inc. | 0.09 | 0.00 | 37.96 | -13.12 | 0.5910 | -0.1150 | |||

| AMT / American Tower Corporation | 0.17 | 0.00 | 37.39 | 1.57 | 0.5821 | -0.0127 | |||

| APO / Apollo Global Management, Inc. | 0.26 | 0.00 | 37.00 | 3.60 | 0.5760 | -0.0011 | |||

| CNQ / Canadian Natural Resources Limited | 1.18 | 0.00 | 36.98 | 2.14 | 0.5758 | -0.0093 | |||

| HII / Huntington Ingalls Industries, Inc. | 0.15 | 10.23 | 36.44 | 30.44 | 0.5673 | 0.1159 | |||

| V / Visa Inc. | 0.10 | -25.27 | 35.99 | -24.29 | 0.5603 | -0.2078 | |||

| HIA1 / Hitachi, Ltd. | 1.24 | 23.85 | 35.91 | 53.31 | 0.5591 | 0.1806 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.18 | 13.95 | 35.61 | 11.83 | 0.5544 | 0.0398 | |||

| BALL / Ball Corporation | 0.63 | 0.00 | 35.17 | 7.72 | 0.5475 | 0.0200 | |||

| CI / The Cigna Group | 0.11 | -8.20 | 34.90 | -7.76 | 0.5434 | -0.0681 | |||

| HES / Hess Corporation | 0.25 | -8.61 | 34.74 | -20.73 | 0.5409 | -0.1674 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 1.08 | -13.39 | 33.62 | -21.33 | 0.5234 | -0.1672 | |||

| 1FB / Meta Platforms, Inc. | 0.04 | 32.92 | 0.5125 | 0.5125 | |||||

| TGT / Target Corporation | 0.33 | 12.00 | 32.89 | 5.87 | 0.5121 | 0.0100 | |||

| AMZ / Amazon.com, Inc. | 0.15 | 32.71 | 0.5092 | 0.5092 | |||||

| BURL / Burlington Stores, Inc. | 0.14 | 0.00 | 32.01 | -2.39 | 0.4983 | -0.0316 | |||

| MDLZ / Mondelez International, Inc. | 0.47 | 0.00 | 31.51 | -0.60 | 0.4905 | -0.0217 | |||

| SBUX / Starbucks Corporation | 0.33 | 184.72 | 29.98 | 165.98 | 0.4667 | 0.2846 | |||

| SIE / Siemens Aktiengesellschaft | 0.11 | 17.03 | 28.99 | 30.17 | 0.4513 | 0.0914 | |||

| MTRAF / Metro Inc. | 0.37 | 23.86 | 28.90 | 39.91 | 0.4499 | 0.1161 | |||

| GSKL / GSK plc | 1.51 | 38.32 | 28.84 | 38.00 | 0.4491 | 0.1113 | |||

| ROG / Roche Holding AG | 0.09 | -15.89 | 28.61 | -16.38 | 0.4455 | -0.1075 | |||

| UNA / Unilever PLC | 0.46 | 31.03 | 28.34 | 34.01 | 0.4412 | 0.0995 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0.57 | 29.23 | 28.23 | 30.25 | 0.4394 | 0.0893 | |||

| FCX / Freeport-McMoRan Inc. | 0.64 | -21.20 | 27.66 | -9.77 | 0.4306 | -0.0647 | |||

| RPRX / Royalty Pharma plc | 0.75 | 37.52 | 27.19 | 59.17 | 0.4233 | 0.1473 | |||

| HRB / H&R Block, Inc. | 0.48 | 0.00 | 26.31 | -0.04 | 0.4096 | -0.0157 | |||

| AAPL / Apple Inc. | 0.13 | 0.00 | 26.25 | -7.63 | 0.4086 | -0.0506 | |||

| EXC / Exelon Corporation | 0.56 | 15.00 | 24.43 | 8.36 | 0.3804 | 0.0160 | |||

| WEC / WEC Energy Group, Inc. | 0.23 | 0.00 | 23.86 | -4.39 | 0.3715 | -0.0318 | |||

| CNP / CenterPoint Energy, Inc. | 0.62 | 0.00 | 22.90 | 1.41 | 0.3566 | -0.0084 | |||

| KVUE / Kenvue Inc. | 1.09 | 0.00 | 22.86 | -12.72 | 0.3559 | -0.0673 | |||

| AVGO / Broadcom Inc. | 0.08 | 114.83 | 22.50 | 253.69 | 0.3503 | 0.2475 | |||

| AEE / Ameren Corporation | 0.23 | 0.00 | 21.91 | -4.34 | 0.3411 | -0.0290 | |||

| GEN / Gen Digital Inc. | 0.74 | 26.71 | 21.86 | 40.36 | 0.3403 | 0.0886 | |||

| SAN / Santander UK plc - Preferred Stock | 0.22 | -45.09 | 21.11 | -51.98 | 0.3286 | -0.3817 | |||

| VK / Vallourec S.A. | 1.13 | 0.00 | 20.97 | -2.02 | 0.3264 | -0.0194 | |||

| PCG / PG&E Corporation | 1.37 | 15.35 | 19.09 | -6.41 | 0.2972 | -0.0324 | |||

| FE / FirstEnergy Corp. | 0.47 | 19.05 | 18.95 | 18.58 | 0.2950 | 0.0368 | |||

| CXT / Crane NXT, Co. | 0.35 | 0.00 | 18.68 | 4.86 | 0.2908 | 0.0030 | |||

| PRY / Tion Renewables AG | 0.26 | 44.79 | 18.58 | 86.21 | 0.2893 | 0.1281 | |||

| VLTO / Veralto Corporation | 0.18 | 0.00 | 17.93 | 3.59 | 0.2792 | -0.0005 | |||

| SJM / The J. M. Smucker Company | 0.18 | 0.00 | 17.39 | -17.07 | 0.2708 | -0.0681 | |||

| VLO / Valero Energy Corporation | 0.13 | 0.00 | 17.22 | 1.78 | 0.2682 | -0.0053 | |||

| PSX / Phillips 66 | 0.14 | -17.62 | 16.89 | -20.41 | 0.2630 | -0.0800 | |||

| GFL / GFL Environmental Inc. | 0.31 | 0.51 | 15.79 | 5.04 | 0.2459 | 0.0029 | |||

| SWX / Southwest Gas Holdings, Inc. | 0.21 | 0.00 | 15.38 | 3.60 | 0.2395 | -0.0004 | |||

| KBR / KBR, Inc. | 0.29 | -24.04 | 13.71 | -26.89 | 0.2134 | -0.0896 | |||

| ACI / Albertsons Companies, Inc. | 0.55 | 38.29 | 11.92 | 35.28 | 0.1856 | 0.0432 | |||

| ADDDF / adidas AG | 0.05 | 11.17 | 0.1739 | 0.1739 | |||||

| COST / Costco Wholesale Corporation | 0.01 | 0.00 | 7.62 | 4.67 | 0.1187 | 0.0010 | |||

| IMB / Imperial Brands PLC | 0.13 | 4.95 | 0.0771 | 0.0771 | |||||

| HI / Hillenbrand, Inc. | 0.22 | -17.68 | 4.50 | -31.56 | 0.0701 | -0.0362 | |||

| COLM / Columbia Sportswear Company | 0.05 | 0.00 | 2.88 | -19.30 | 0.0448 | -0.0128 | |||

| US31635A3032 / Fidelity Securities Lending Cash Central Fund | 1.92 | 388.07 | 1.92 | 388.52 | 0.0298 | 0.0235 | |||

| RRX / Regal Rexnord Corporation | 0.00 | -97.38 | 0.35 | -96.67 | 0.0055 | -0.1647 |