Mga Batayang Estadistika

| Nilai Portofolio | $ 682,967,687 |

| Posisi Saat Ini | 37 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

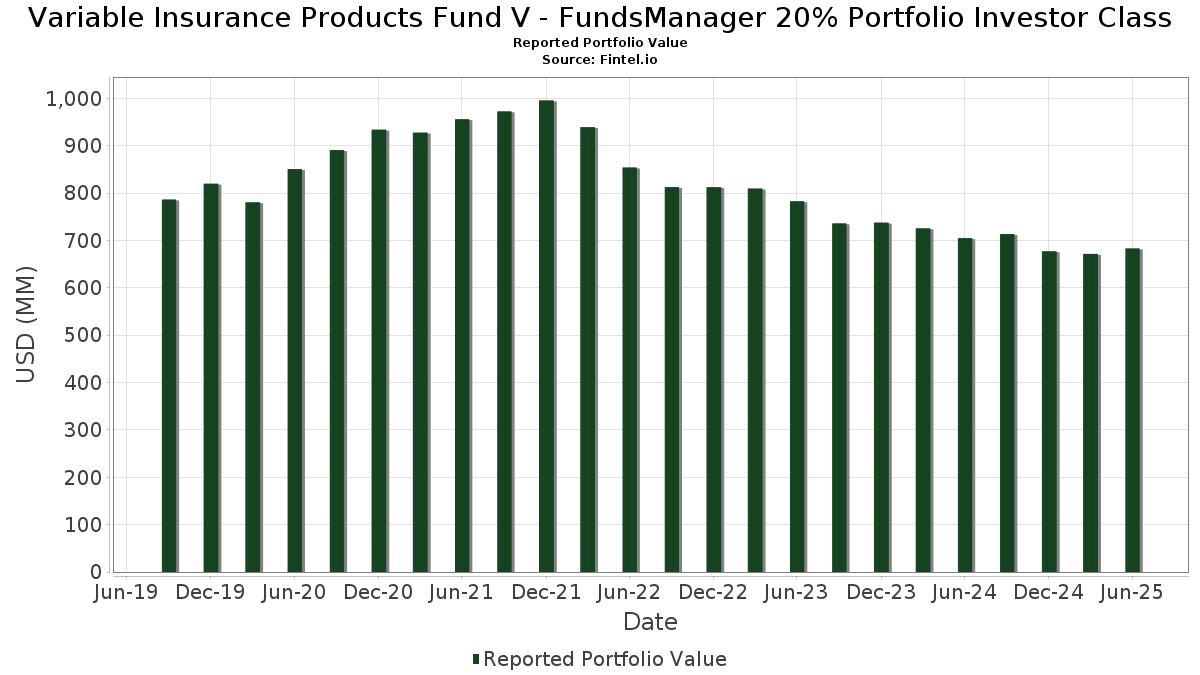

Variable Insurance Products Fund V - FundsManager 20% Portfolio Investor Class telah mengungkapkan total kepemilikan 37 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 682,967,687 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Variable Insurance Products Fund V - FundsManager 20% Portfolio Investor Class adalah Fidelity Investments Money Market Government Portfolio (US:US31607A7037) , VIP Investment Grade Bond II Portfolio - Investor Class (US:922178645) , Fidelity Income Fund /MA/ - Fidelity Total Bond (US:FTBFX) , VIP Stock Selector All Cap Portfolio - Investor Class (US:922174362) , and Fidelity Cash Central Fund (US:US31635A1051) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.71 | 13.75 | 2.0105 | 1.2360 | |

| 160.08 | 160.08 | 23.4100 | 1.1292 | |

| 4.77 | 60.88 | 8.9034 | 0.3660 | |

| 1.84 | 17.04 | 2.4914 | 0.3652 | |

| 0.65 | 9.02 | 1.3190 | 0.3599 | |

| 0.92 | 8.52 | 1.2454 | 0.2396 | |

| 0.22 | 16.84 | 2.4620 | 0.1761 | |

| 0.05 | 4.72 | 0.6903 | 0.1698 | |

| 0.33 | 14.37 | 2.1012 | 0.1677 | |

| 15.13 | 145.14 | 21.2265 | 0.1622 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 34.38 | 34.39 | 5.0290 | -3.4089 | |

| 0.04 | 1.49 | 0.2182 | -0.2672 | |

| 0.20 | 2.88 | 0.4211 | -0.0127 | |

| 0.56 | 5.17 | 0.7555 | -0.0103 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US31607A7037 / Fidelity Investments Money Market Government Portfolio | 160.08 | 6.74 | 160.08 | 6.74 | 23.4100 | 1.1292 | |||

| 922178645 / VIP Investment Grade Bond II Portfolio - Investor Class | 15.15 | 0.78 | 145.30 | 2.05 | 21.2490 | 0.0964 | |||

| FTBFX / Fidelity Income Fund /MA/ - Fidelity Total Bond | 15.13 | 2.05 | 145.14 | 2.37 | 21.2265 | 0.1622 | |||

| 922174362 / VIP Stock Selector All Cap Portfolio - Investor Class | 4.77 | -5.02 | 60.88 | 5.95 | 8.9034 | 0.3660 | |||

| US31635A1051 / Fidelity Cash Central Fund | 34.38 | -39.45 | 34.39 | -39.45 | 5.0290 | -3.4089 | |||

| FIPBX / Fidelity Inflation-Protected Bond Index Fund | 1.84 | 18.78 | 17.04 | 19.04 | 2.4914 | 0.3652 | |||

| US3163431022 / Fidelity Overseas Fund | 0.22 | -3.13 | 16.84 | 9.42 | 2.4620 | 0.1761 | |||

| US3159108691 / FIDELITY EMERGING MARKETS FUND | 0.33 | -3.21 | 14.37 | 10.40 | 2.1012 | 0.1677 | |||

| US3161464066 / Fidelity High Income Fund | 1.71 | 156.80 | 13.75 | 163.71 | 2.0105 | 1.2360 | |||

| US31624J8449 / Fidelity Hedged Equity Fund | 0.65 | 27.36 | 9.02 | 39.72 | 1.3190 | 0.3599 | |||

| FNBGX / Fidelity Salem Street Trust - Fidelity Long-Term Treasury Bond Index Fund | 0.92 | 29.04 | 8.52 | 25.78 | 1.2454 | 0.2396 | |||

| FENI / Fidelity Covington Trust - Fidelity Enhanced International ETF | 0.18 | 0.00 | 5.93 | 11.76 | 0.8670 | 0.0789 | |||

| FDCAX / Fidelity Capital Trust - Fidelity Capital Trust Capital Appreciation Portfolio | 0.14 | -5.72 | 5.22 | 3.00 | 0.7638 | 0.0104 | |||

| FFRAX / Fidelity Advisor Series I - Fidelity Advisor Floating Rate High Income Class A | 0.56 | 0.00 | 5.17 | 0.23 | 0.7555 | -0.0103 | |||

| US31618H5494 / Fidelity Emerging Markets Discovery Fund | 0.27 | -1.09 | 4.86 | 15.60 | 0.7101 | 0.0860 | |||

| US31634R3075 / Fidelity Commodity Strategy Fund | 0.05 | 39.22 | 4.72 | 34.74 | 0.6903 | 0.1698 | |||

| US3159102082 / Fidelity International Discovery Fund | 0.07 | -3.50 | 4.04 | 11.32 | 0.5912 | 0.0517 | |||

| US3159108105 / Fidelity International Capital Appreciation Fund | 0.11 | -3.04 | 3.58 | 13.00 | 0.5239 | 0.0528 | |||

| US3159105622 / Fidelity International Small Cap Opportunities Fund | 0.15 | 0.65 | 3.57 | 18.62 | 0.5218 | 0.0749 | |||

| US3159104898 / FIDELITY ADVISOR INTERNATIONAL VALUE FUND | 0.25 | -2.28 | 3.21 | 8.91 | 0.4701 | 0.0316 | |||

| US9221766150 / VIP Value Strategies Portfolio - Investor Class | 0.20 | -6.58 | 2.88 | -1.37 | 0.4211 | -0.0127 | |||

| FBCG / Fidelity Covington Trust - Fidelity Blue Chip Growth ETF | 0.05 | 0.80 | 2.53 | 21.68 | 0.3702 | 0.0610 | |||

| FCNTX / Fidelity Contrafund - Fidelity Contra Fund | 0.10 | -4.12 | 2.39 | 11.72 | 0.3500 | 0.0318 | |||

| FFSM / Fidelity Covington Trust - Fidelity Fundamental Small-Mid Cap ETF | 0.08 | -4.83 | 2.25 | 2.55 | 0.3296 | 0.0030 | |||

| US3159107370 / Fidelity International Small Cap Fund | 0.05 | -3.19 | 1.72 | 10.34 | 0.2514 | 0.0200 | |||

| US3161382052 / FIDELITY REAL ESTATE INVESTMENT PORTFOLIO | 0.04 | -53.73 | 1.49 | -54.33 | 0.2182 | -0.2672 | |||

| US3159103072 / FID-CANADA FUND | 0.02 | -5.36 | 1.22 | 8.36 | 0.1784 | 0.0112 | |||

| US31618H1683 / FIDELITY INFRASTRUCTURE FUND | 0.06 | 0.12 | 0.89 | 8.91 | 0.1306 | 0.0089 | |||

| UST BILLS 0% 07/10/2025 / DBT (US912797LW51) | 0.84 | 0.1227 | 0.1227 | ||||||

| UST BILLS 0% 07/24/2025 / DBT (US912797PF82) | 0.28 | 0.0408 | 0.0408 | ||||||

| UST BILLS 0% 09/04/2025 / DBT (US912797MH75) | 0.24 | 0.0348 | 0.0348 | ||||||

| MSCI EAFE FUT SEP25 MFSU5 / DE (N/A) | 0.17 | 0.0243 | 0.0243 | ||||||

| US 10YR NOTE FUT (CBT)SEP25 TYU5 / DIR (N/A) | 0.14 | 0.0208 | 0.0208 | ||||||

| MSCI EMGMKT FUT SEP25 MESU5 / DE (N/A) | 0.13 | 0.0194 | 0.0194 | ||||||

| UST BILLS 0% 07/03/2025 / DBT (US912797NX17) | 0.13 | 0.0190 | 0.0190 | ||||||

| UST BILLS 0% 08/07/2025 / DBT (US912797MG92) | 0.03 | 0.0044 | 0.0044 | ||||||

| UST BILLS 0% 08/14/2025 / DBT (US912797PN17) | 0.02 | 0.0029 | 0.0029 |