Mga Batayang Estadistika

| Nilai Portofolio | $ 1,496,776,133 |

| Posisi Saat Ini | 60 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

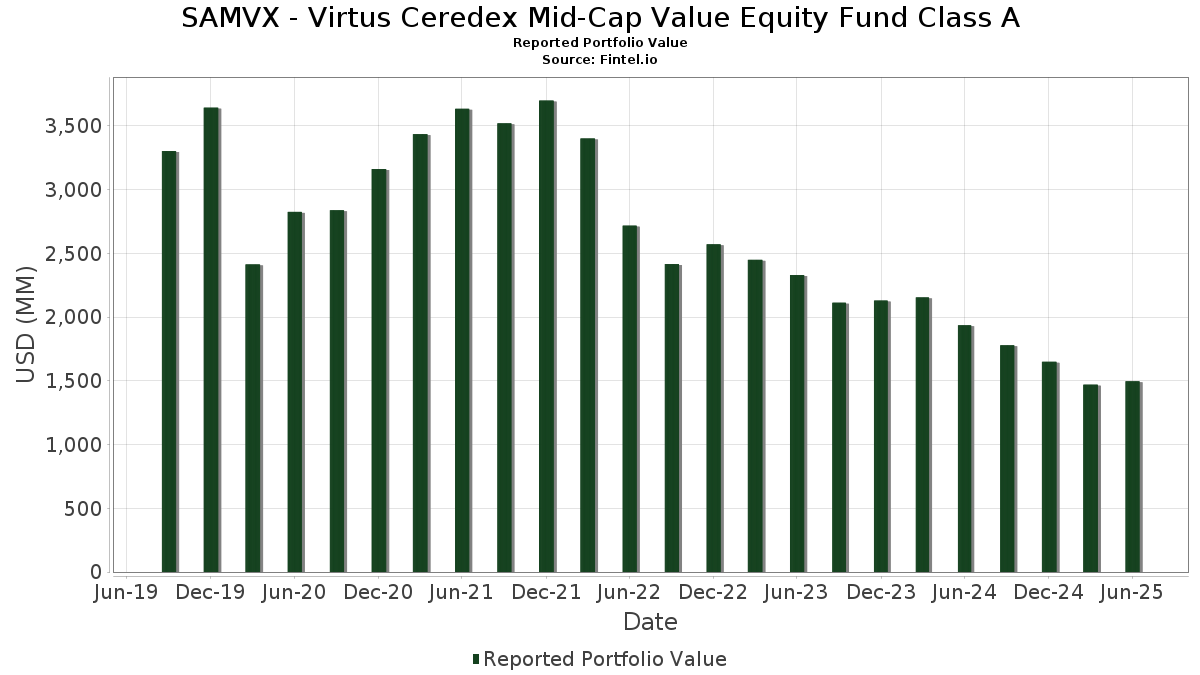

SAMVX - Virtus Ceredex Mid-Cap Value Equity Fund Class A telah mengungkapkan total kepemilikan 60 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,496,776,133 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SAMVX - Virtus Ceredex Mid-Cap Value Equity Fund Class A adalah First Citizens BancShares, Inc. (US:FCNCA) , KeyCorp (US:KEY) , Owens Corning (US:OC) , PPL Corporation (US:PPL) , and Ameren Corporation (US:AEE) . Posisi baru SAMVX - Virtus Ceredex Mid-Cap Value Equity Fund Class A meliputi: Corning Incorporated (US:GLW) , Crown Castle Inc. (US:CCI) , Ventas, Inc. (US:VTR) , DICK'S Sporting Goods, Inc. (US:DKS) , and The Williams Companies, Inc. (US:WMB) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.07 | 29.43 | 1.8894 | 1.8894 | |

| 0.54 | 28.40 | 1.8230 | 1.8230 | |

| 0.27 | 27.22 | 1.7476 | 1.7476 | |

| 0.42 | 27.20 | 1.7458 | 1.7458 | |

| 0.41 | 26.21 | 1.6824 | 1.6824 | |

| 0.13 | 25.72 | 1.6508 | 1.6508 | |

| 0.40 | 25.12 | 1.6128 | 1.6128 | |

| 0.04 | 24.07 | 1.5452 | 1.5452 | |

| 0.03 | 23.86 | 1.5319 | 1.5319 | |

| 0.80 | 23.70 | 1.5211 | 1.5211 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.07 | 15.89 | 1.0201 | -2.4325 | |

| 0.00 | 0.00 | -1.9878 | ||

| 0.00 | 0.00 | -1.3125 | ||

| 0.00 | 0.00 | -1.2261 | ||

| 0.00 | 0.00 | -1.1776 | ||

| 0.20 | 19.34 | 1.2418 | -0.8807 | |

| 0.09 | 19.66 | 1.2623 | -0.7542 | |

| 0.67 | 23.99 | 1.5398 | -0.6791 | |

| 0.17 | 22.67 | 1.4553 | -0.6650 | |

| 0.10 | 26.08 | 1.6743 | -0.5689 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FCNCA / First Citizens BancShares, Inc. | 0.02 | 0.00 | 33.26 | 5.52 | 2.1351 | 0.0449 | |||

| KEY / KeyCorp | 1.80 | -10.00 | 31.36 | -1.95 | 2.0129 | -0.1078 | |||

| OC / Owens Corning | 0.22 | 2.33 | 30.25 | -1.47 | 1.9422 | -0.0940 | |||

| PPL / PPL Corporation | 0.89 | 20.61 | 30.25 | 13.19 | 1.9417 | 0.1697 | |||

| AEE / Ameren Corporation | 0.31 | 19.08 | 29.73 | 13.90 | 1.9088 | 0.1777 | |||

| VRT / Vertiv Holdings Co | 0.23 | -46.51 | 29.53 | -4.87 | 1.8959 | -0.1628 | |||

| MSI / Motorola Solutions, Inc. | 0.07 | 29.43 | 1.8894 | 1.8894 | |||||

| OWL / Blue Owl Capital Inc. | 1.52 | 8.93 | 29.30 | 4.42 | 1.8806 | 0.0201 | |||

| CNP / CenterPoint Energy, Inc. | 0.79 | -39.01 | 29.13 | -21.57 | 1.8701 | 0.1818 | |||

| ETR / Entergy Corporation | 0.35 | 16.30 | 29.00 | 13.07 | 1.8617 | 0.1610 | |||

| DOV / Dover Corporation | 0.15 | 14.81 | 28.40 | 19.75 | 1.8232 | 0.2504 | |||

| GLW / Corning Incorporated | 0.54 | 28.40 | 1.8230 | 1.8230 | |||||

| MCHP / Microchip Technology Incorporated | 0.40 | -18.37 | 28.15 | -28.45 | 1.8069 | -0.3373 | |||

| DELL / Dell Technologies Inc. | 0.23 | -40.00 | 27.59 | -19.30 | 1.7708 | -0.4958 | |||

| EGP / EastGroup Properties, Inc. | 0.17 | 13.79 | 27.57 | 7.96 | 1.7701 | 0.0764 | |||

| IP / International Paper Company | 0.58 | -2.50 | 27.40 | -14.42 | 1.7586 | -0.3640 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.18 | 8.82 | 27.38 | -3.89 | 1.7578 | -0.1314 | |||

| PPG / PPG Industries, Inc. | 0.24 | -14.29 | 27.30 | -10.84 | 1.7525 | -0.2778 | |||

| CCI / Crown Castle Inc. | 0.27 | 27.22 | 1.7476 | 1.7476 | |||||

| WDC / Western Digital Corporation | 0.42 | 27.20 | 1.7458 | 1.7458 | |||||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.16 | -21.95 | 26.99 | -6.85 | 1.7324 | -0.1887 | |||

| HUBB / Hubbell Incorporated | 0.07 | -27.78 | 26.55 | -10.86 | 1.7041 | -0.2708 | |||

| VTR / Ventas, Inc. | 0.41 | 26.21 | 1.6824 | 1.6824 | |||||

| VMC / Vulcan Materials Company | 0.10 | -31.03 | 26.08 | -22.90 | 1.6743 | -0.5689 | |||

| HXL / Hexcel Corporation | 0.46 | 12.20 | 25.99 | 15.74 | 1.6681 | 0.1793 | |||

| URI / United Rentals, Inc. | 0.03 | -14.25 | 25.84 | 3.08 | 1.6589 | -0.0034 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.13 | 25.72 | 1.6508 | 1.6508 | |||||

| ROP / Roper Technologies, Inc. | 0.04 | 12.50 | 25.51 | 8.16 | 1.6375 | 0.0736 | |||

| RRX / Regal Rexnord Corporation | 0.17 | -31.37 | 25.37 | -12.62 | 1.6285 | -0.2967 | |||

| ALL / The Allstate Corporation | 0.12 | 0.00 | 25.16 | -2.78 | 1.6154 | -0.1010 | |||

| WMB / The Williams Companies, Inc. | 0.40 | 25.12 | 1.6128 | 1.6128 | |||||

| SNX / TD SYNNEX Corporation | 0.18 | -2.63 | 25.10 | 12.66 | 1.6116 | 0.2873 | |||

| LPLA / LPL Financial Holdings Inc. | 0.07 | -18.75 | 24.37 | -6.87 | 1.5646 | -0.1709 | |||

| EME / EMCOR Group, Inc. | 0.04 | 24.07 | 1.5452 | 1.5452 | |||||

| AMH / American Homes 4 Rent | 0.67 | -24.86 | 23.99 | -28.32 | 1.5398 | -0.6791 | |||

| LVS / Las Vegas Sands Corp. | 0.55 | -3.51 | 23.93 | 8.68 | 1.5362 | 0.0761 | |||

| EQIX / Equinix, Inc. | 0.03 | 23.86 | 1.5319 | 1.5319 | |||||

| FCX / Freeport-McMoRan Inc. | 0.55 | -12.00 | 23.84 | 0.76 | 1.5306 | -0.0386 | |||

| SGI / Somnigroup International Inc. | 0.35 | 25.00 | 23.82 | 42.06 | 1.5289 | 0.4171 | |||

| PRMB / Primo Brands Corporation | 0.80 | 23.70 | 1.5211 | 1.5211 | |||||

| EXE / Expand Energy Corporation | 0.20 | -20.00 | 23.39 | -15.96 | 1.5014 | -0.3441 | |||

| GD / General Dynamics Corporation | 0.08 | -20.00 | 23.33 | -14.40 | 1.4978 | -0.3097 | |||

| ROST / Ross Stores, Inc. | 0.18 | 16.13 | 22.96 | 15.94 | 1.4742 | 0.1607 | |||

| JBL / Jabil Inc. | 0.10 | 22.90 | 1.4701 | 1.4701 | |||||

| VLO / Valero Energy Corporation | 0.17 | -24.44 | 22.85 | -23.10 | 1.4669 | -0.5036 | |||

| FLS / Flowserve Corporation | 0.43 | 22.77 | 1.4618 | 1.4618 | |||||

| PWR / Quanta Services, Inc. | 0.06 | -47.83 | 22.68 | -22.39 | 1.4562 | -0.4821 | |||

| FANG / Diamondback Energy, Inc. | 0.17 | -17.50 | 22.67 | -29.10 | 1.4553 | -0.6650 | |||

| KNSL / Kinsale Capital Group, Inc. | 0.04 | 21.78 | 1.3979 | 1.3979 | |||||

| EVR / Evercore Inc. | 0.08 | 21.60 | 1.3867 | 1.3867 | |||||

| VNT / Vontier Corporation | 0.57 | 21.22 | 1.3620 | 1.3620 | |||||

| IR / Ingersoll Rand Inc. | 0.25 | 20.80 | 1.3349 | 1.3349 | |||||

| TOL / Toll Brothers, Inc. | 0.17 | -28.57 | 19.97 | -22.80 | 1.2821 | -0.4333 | |||

| ROK / Rockwell Automation, Inc. | 0.06 | -36.84 | 19.93 | -18.81 | 1.2794 | -0.3483 | |||

| NXPI / NXP Semiconductors N.V. | 0.09 | -43.75 | 19.66 | -35.33 | 1.2623 | -0.7542 | |||

| RVTY / Revvity, Inc. | 0.20 | -37.50 | 19.34 | -45.84 | 1.2418 | -0.8807 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.15 | -30.23 | 19.03 | -28.46 | 1.2216 | -0.5424 | |||

| STZ / Constellation Brands, Inc. | 0.12 | -23.33 | 18.71 | -49.33 | 1.2010 | -0.3488 | |||

| EXR / Extra Space Storage Inc. | 0.11 | -26.67 | 16.22 | -27.19 | 1.0411 | -0.4359 | |||

| HUM / Humana Inc. | 0.07 | -67.50 | 15.89 | -74.91 | 1.0201 | -2.4325 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2261 | ||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1776 | ||||

| MU / Micron Technology, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.9878 | ||||

| MSCI / MSCI Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.3125 |