Mga Batayang Estadistika

| Nilai Portofolio | $ 68,378,736 |

| Posisi Saat Ini | 351 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

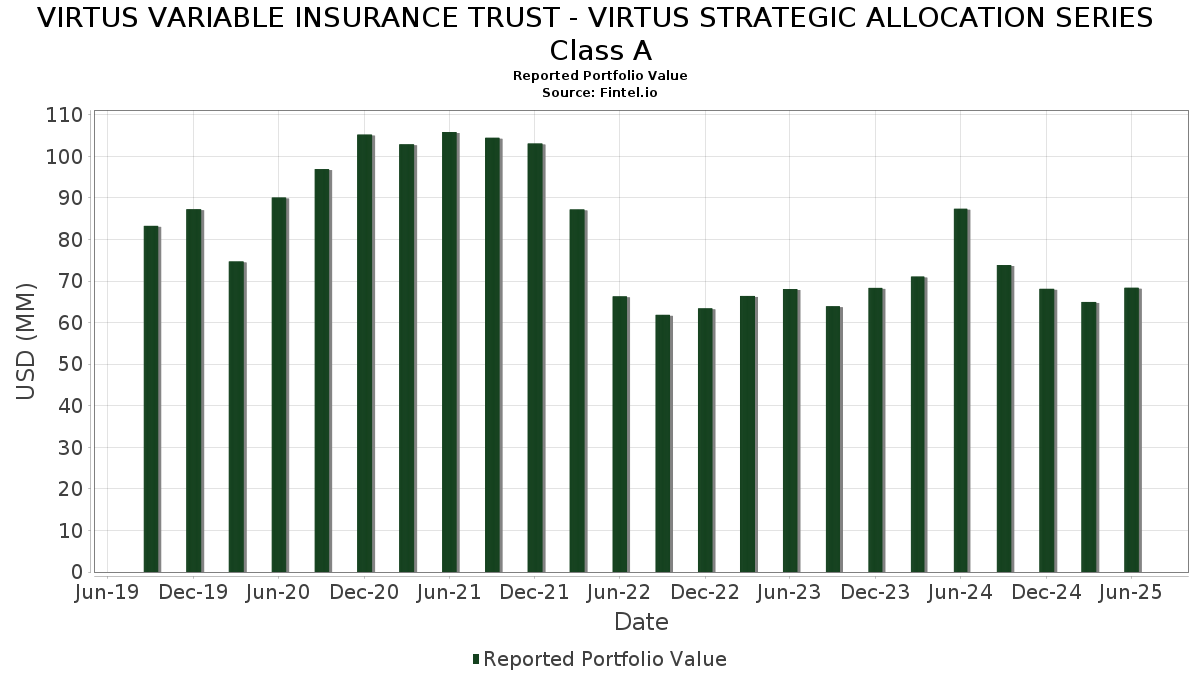

VIRTUS VARIABLE INSURANCE TRUST - VIRTUS STRATEGIC ALLOCATION SERIES Class A telah mengungkapkan total kepemilikan 351 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 68,378,736 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama VIRTUS VARIABLE INSURANCE TRUST - VIRTUS STRATEGIC ALLOCATION SERIES Class A adalah NVIDIA Corporation (US:NVDA) , Meta Platforms, Inc. (US:META) , Visa Inc. (US:V) , Amphenol Corporation (US:APH) , and Amazon.com, Inc. (US:AMZN) . Posisi baru VIRTUS VARIABLE INSURANCE TRUST - VIRTUS STRATEGIC ALLOCATION SERIES Class A meliputi: United States Treasury Note/Bond (US:US912810TN81) , UNITED STATES TREASURY BOND 1.25% 05/15/2050 (US:US912810SN90) , UMBS (US:US31418EJ760) , Hemnet Group AB (SE:SE0015671995) , and United States Treasury Note/Bond (US:US912810SP49) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 0.45 | 0.6426 | 0.6426 | |

| 0.01 | 1.66 | 2.3731 | 0.6075 | |

| 0.01 | 1.47 | 2.1034 | 0.5882 | |

| 0.00 | 1.02 | 1.4525 | 0.3562 | |

| 0.25 | 0.3515 | 0.3515 | ||

| 0.24 | 0.3501 | 0.3501 | ||

| 0.00 | 1.58 | 2.2675 | 0.3479 | |

| 0.02 | 0.23 | 0.3300 | 0.3300 | |

| 0.00 | 0.75 | 1.0730 | 0.3130 | |

| 0.09 | 0.64 | 0.9163 | 0.1998 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.13 | 1.26 | 1.7979 | -1.1362 | |

| 0.35 | 3.53 | 5.0498 | -0.6312 | |

| 0.15 | 1.49 | 2.1338 | -0.5634 | |

| 0.25 | 2.51 | 3.5987 | -0.2235 | |

| 0.00 | 0.00 | -0.2128 | ||

| 0.01 | 0.30 | 0.4225 | -0.2047 | |

| 0.05 | 0.50 | 0.7199 | -0.1861 | |

| 0.02 | 0.22 | 0.3117 | -0.1725 | |

| 0.00 | 0.72 | 1.0310 | -0.1544 | |

| 0.00 | 1.53 | 2.1948 | -0.1544 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Virtus Newfleet Residential Mortgage-Backed Securities Completion Fund / EC (US92839Q5027) | 0.35 | -7.34 | 3.53 | -6.96 | 5.0498 | -0.6312 | |||

| Virtus Newfleet Asset-Backed Securities Completion Fund / EC (US92839Q1067) | 0.25 | -1.66 | 2.51 | -1.49 | 3.5987 | -0.2235 | |||

| NVDA / NVIDIA Corporation | 0.01 | -3.50 | 1.66 | 40.75 | 2.3731 | 0.6075 | |||

| META / Meta Platforms, Inc. | 0.00 | -3.46 | 1.58 | 23.65 | 2.2675 | 0.3479 | |||

| V / Visa Inc. | 0.00 | -3.49 | 1.53 | -2.23 | 2.1948 | -0.1544 | |||

| Virtus Newfleet Commercial Mortgage-Backed Securities Completion Fund / EC (US92839Q2057) | 0.15 | -17.53 | 1.49 | -17.21 | 2.1338 | -0.5634 | |||

| APH / Amphenol Corporation | 0.01 | -3.50 | 1.47 | 45.30 | 2.1034 | 0.5882 | |||

| AMZN / Amazon.com, Inc. | 0.01 | -3.48 | 1.46 | 11.32 | 2.0826 | 0.1243 | |||

| US912810TN81 / United States Treasury Note/Bond | 1.34 | -3.11 | 1.9157 | -0.1529 | |||||

| Virtus Newfleet Floating Rate Completion Fund / EC (US92839Q3048) | 0.13 | -36.32 | 1.26 | -35.89 | 1.7979 | -1.1362 | |||

| FICO / Fair Isaac Corporation | 0.00 | -3.05 | 1.10 | -3.92 | 1.5772 | -0.1406 | |||

| NFLX / Netflix, Inc. | 0.00 | -3.44 | 1.02 | 38.66 | 1.4525 | 0.3562 | |||

| Virtus Newfleet High Yield Completion Fund / EC (US92839Q4038) | 0.10 | -1.22 | 1.01 | -0.10 | 1.4514 | -0.0692 | |||

| BCG / Baltic Classifieds Group PLC | 0.19 | -11.17 | 0.97 | 16.79 | 1.3950 | 0.1455 | |||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 0.91 | -3.21 | 1.2955 | -0.1061 | |||||

| UBER / Uber Technologies, Inc. | 0.01 | -3.52 | 0.81 | 23.55 | 1.1572 | 0.1769 | |||

| SNOW / Snowflake Inc. | 0.00 | -3.49 | 0.75 | 47.73 | 1.0730 | 0.3130 | |||

| PGR / The Progressive Corporation | 0.00 | -3.47 | 0.72 | -8.98 | 1.0310 | -0.1544 | |||

| NOW / ServiceNow, Inc. | 0.00 | -3.45 | 0.72 | 24.65 | 1.0283 | 0.1651 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.01 | 1,349.54 | 0.71 | -8.72 | 1.0189 | -0.1504 | |||

| MAR / Marriott International, Inc. | 0.00 | -3.53 | 0.65 | 10.56 | 0.9301 | 0.0504 | |||

| RMV N / Rightmove plc | 0.06 | -17.86 | 0.64 | -0.16 | 0.9215 | -0.0442 | |||

| AJB / AJ Bell plc | 0.09 | 0.00 | 0.64 | 33.89 | 0.9163 | 0.1998 | |||

| US31418EJ760 / UMBS | 0.64 | -2.90 | 0.9124 | -0.0706 | |||||

| SHOP / Shopify Inc. | 0.01 | -3.51 | 0.64 | 16.67 | 0.9118 | 0.0932 | |||

| CXSE3 / Caixa Seguridade Participações S.A. | 0.22 | 0.00 | 0.61 | 2.72 | 0.8671 | -0.0152 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -3.36 | 0.60 | 29.53 | 0.8602 | 0.1648 | |||

| LLY / Eli Lilly and Company | 0.00 | -3.47 | 0.58 | -8.89 | 0.8366 | -0.1245 | |||

| SPGI / S&P Global Inc. | 0.00 | -3.48 | 0.57 | 0.18 | 0.8156 | -0.0366 | |||

| EFX / Equifax Inc. | 0.00 | -2.84 | 0.57 | 3.46 | 0.8139 | -0.0093 | |||

| SOP / SPINNAKER OPPORTUNITIES PLC | 0.00 | 0.00 | 0.55 | 30.95 | 0.7878 | 0.1587 | |||

| CDNS / Cadence Design Systems, Inc. | 0.00 | -3.42 | 0.55 | 17.13 | 0.7835 | 0.0827 | |||

| OML / oOh!media Limited | 0.46 | 0.00 | 0.52 | 21.65 | 0.7399 | 0.1030 | |||

| WDAY / Workday, Inc. | 0.00 | -3.50 | 0.51 | -0.78 | 0.7291 | -0.0403 | |||

| H02 / Haw Par Corporation Limited | 0.05 | -13.31 | 0.50 | -16.86 | 0.7199 | -0.1861 | |||

| ZTS / Zoetis Inc. | 0.00 | -3.51 | 0.50 | -8.64 | 0.7114 | -0.1033 | |||

| TTD / The Trade Desk, Inc. | 0.01 | -3.52 | 0.49 | 27.06 | 0.7065 | 0.1240 | |||

| ROP / Roper Technologies, Inc. | 0.00 | -3.46 | 0.47 | -7.24 | 0.6789 | -0.0866 | |||

| MTX / MTU Aero Engines AG | 0.00 | 0.00 | 0.47 | 27.95 | 0.6695 | 0.1215 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -3.49 | 0.47 | 5.91 | 0.6672 | 0.0078 | |||

| IUSDF / AS ONE Corporation | 0.03 | 30.10 | 0.46 | 45.14 | 0.6634 | 0.1845 | |||

| ECL / Ecolab Inc. | 0.00 | -3.41 | 0.45 | 2.51 | 0.6450 | -0.0126 | |||

| SE0015671995 / Hemnet Group AB | 0.02 | 0.45 | 0.6426 | 0.6426 | |||||

| FBK / FinecoBank Banca Fineco S.p.A. | 0.02 | 0.00 | 0.45 | 12.00 | 0.6423 | 0.0422 | |||

| CMOCTEZ / Corporación Moctezuma, S.A.B. de C.V. | 0.10 | 0.00 | 0.44 | 7.07 | 0.6284 | 0.0133 | |||

| BOUVET / Bouvet ASA | 0.05 | 0.00 | 0.42 | 10.93 | 0.5966 | 0.0346 | |||

| DHR / Danaher Corporation | 0.00 | 40.87 | 0.41 | 35.74 | 0.5933 | 0.1359 | |||

| HWDN / Howden Joinery Group Plc | 0.04 | 1.88 | 0.41 | 27.95 | 0.5906 | 0.1077 | |||

| 2UA / Auto Trader Group plc | 0.04 | 0.00 | 0.41 | 17.05 | 0.5898 | 0.0623 | |||

| CSGP / CoStar Group, Inc. | 0.01 | -3.51 | 0.41 | -2.17 | 0.5814 | -0.0401 | |||

| 3AD2 / Epiroc AB (publ) | 0.02 | 0.00 | 0.38 | 8.47 | 0.5505 | 0.0201 | |||

| ATE / Alten S.A. | 0.00 | 0.00 | 0.38 | -10.07 | 0.5500 | -0.0906 | |||

| 1882 / Haitian International Holdings Limited | 0.14 | 0.00 | 0.37 | -2.14 | 0.5225 | -0.0364 | |||

| ACN / Accenture plc | 0.00 | -3.46 | 0.36 | -7.49 | 0.5128 | -0.0676 | |||

| LPLA / LPL Financial Holdings Inc. | 0.00 | -1.82 | 0.34 | 12.83 | 0.4909 | 0.0343 | |||

| HD / The Home Depot, Inc. | 0.00 | -3.51 | 0.34 | -3.39 | 0.4900 | -0.0413 | |||

| ROST / Ross Stores, Inc. | 0.00 | -3.55 | 0.34 | -3.72 | 0.4814 | -0.0418 | |||

| ABNB / Airbnb, Inc. | 0.00 | -3.58 | 0.33 | 6.77 | 0.4744 | 0.0096 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.01 | 292.80 | 0.32 | 31.69 | 0.4584 | 0.0934 | |||

| WRB / W. R. Berkley Corporation | 0.00 | -1.80 | 0.32 | 1.59 | 0.4579 | -0.0148 | |||

| BSY / Bentley Systems, Incorporated | 0.01 | -1.81 | 0.32 | 35.17 | 0.4566 | 0.1018 | |||

| INW / Infrastrutture Wireless Italiane S.p.A. | 0.03 | 0.00 | 0.31 | 15.50 | 0.4492 | 0.0421 | |||

| HEIM / Heineken Malaysia Berhad | 0.05 | 0.00 | 0.31 | -0.64 | 0.4428 | -0.0243 | |||

| 012750 / S-1 Corporation | 0.01 | 0.00 | 0.30 | 15.83 | 0.4296 | 0.0409 | |||

| PSYTF / Pason Systems Inc. | 0.03 | 71.01 | 0.30 | 68.93 | 0.4291 | 0.1630 | |||

| MOL / Moltiply Group S.p.A. | 0.01 | -42.83 | 0.30 | -29.43 | 0.4225 | -0.2047 | |||

| US912810SP49 / United States Treasury Note/Bond | 0.29 | -3.30 | 0.4198 | -0.0343 | |||||

| NKE / NIKE, Inc. | 0.00 | -3.56 | 0.29 | 7.87 | 0.4127 | 0.0125 | |||

| AL0 / Allegro.eu S.A. | 0.03 | 0.00 | 0.29 | 18.26 | 0.4085 | 0.0471 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 0.28 | -1.40 | 0.4034 | -0.0249 | |||||

| 9744 / MEITEC Group Holdings Inc. | 0.01 | 0.00 | 0.28 | 13.36 | 0.4008 | 0.0295 | |||

| IT / Gartner, Inc. | 0.00 | -3.52 | 0.28 | -7.05 | 0.3968 | -0.0501 | |||

| 200596 / Anhui Gujing Distillery Co., Ltd. | 0.02 | 0.00 | 0.28 | -15.12 | 0.3943 | -0.0917 | |||

| US912810SU34 / United States Treasury Note/Bond | 0.26 | -2.94 | 0.3778 | -0.0304 | |||||

| MTEL / PT Dayamitra Telekomunikasi Tbk. | 7.65 | -16.02 | 0.26 | -15.81 | 0.3741 | -0.0915 | |||

| OLED / Universal Display Corporation | 0.00 | -1.80 | 0.26 | 8.75 | 0.3740 | 0.0141 | |||

| VACN / VAT Group AG | 0.00 | -45.93 | 0.26 | 67.76 | 0.3652 | 0.1644 | |||

| ALLE / Allegion plc | 0.00 | -1.79 | 0.25 | 8.62 | 0.3613 | 0.0128 | |||

| ROL / Rollins, Inc. | 0.00 | -1.81 | 0.25 | 2.48 | 0.3555 | -0.0074 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 0.25 | 0.3515 | 0.3515 | ||||||

| KBX / Knorr-Bremse AG | 0.00 | 0.00 | 0.25 | 6.52 | 0.3510 | 0.0051 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.24 | 0.3501 | 0.3501 | ||||||

| XYZ / Block, Inc. | 0.00 | -3.59 | 0.24 | 20.40 | 0.3474 | 0.0458 | |||

| 4478 / freee K.K. | 0.01 | 0.00 | 0.24 | 12.68 | 0.3439 | 0.0241 | |||

| PAYC / Paycom Software, Inc. | 0.00 | -3.57 | 0.24 | 2.16 | 0.3397 | -0.0084 | |||

| WSO / Watsco, Inc. | 0.00 | -1.87 | 0.23 | -14.76 | 0.3311 | -0.0754 | |||

| 9962 / MISUMI Group Inc. | 0.02 | 0.23 | 0.3300 | 0.3300 | |||||

| TDY / Teledyne Technologies Incorporated | 0.00 | -1.75 | 0.23 | 1.32 | 0.3299 | -0.0115 | |||

| ZWS / Zurn Elkay Water Solutions Corporation | 0.01 | -1.83 | 0.23 | 8.70 | 0.3233 | 0.0125 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.22 | -1.77 | 0.3191 | -0.0205 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.22 | -2.22 | 0.3152 | -0.0231 | |||||

| LII / Lennox International Inc. | 0.00 | -1.80 | 0.22 | 0.46 | 0.3125 | -0.0134 | |||

| ULS / UL Solutions Inc. | 0.00 | 63.05 | 0.22 | 110.68 | 0.3119 | 0.1569 | |||

| US31418ET678 / Fannie Mae Pool | 0.22 | -2.69 | 0.3118 | -0.0233 | |||||

| MABHF / Mortgage Advice Bureau (Holdings) plc | 0.02 | -45.66 | 0.22 | -32.82 | 0.3117 | -0.1725 | |||

| 3697 / SHIFT Inc. | 0.02 | -31.37 | 0.21 | 7.07 | 0.3040 | 0.0071 | |||

| JKHY / Jack Henry & Associates, Inc. | 0.00 | -1.78 | 0.21 | -3.26 | 0.2991 | -0.0239 | |||

| POOL / Pool Corporation | 0.00 | -1.78 | 0.21 | -10.34 | 0.2986 | -0.0489 | |||

| ZBRA / Zebra Technologies Corporation | 0.00 | -1.76 | 0.21 | 7.29 | 0.2956 | 0.0070 | |||

| NDSN / Nordson Corporation | 0.00 | -1.76 | 0.20 | 4.64 | 0.2908 | -0.0007 | |||

| United States Treasury Note/Bond / DBT (US91282CLY56) | 0.20 | 0.50 | 0.2877 | -0.0133 | |||||

| COO / The Cooper Companies, Inc. | 0.00 | -1.81 | 0.20 | -17.36 | 0.2870 | -0.0756 | |||

| United States Treasury Note/Bond / DBT (US91282CMD01) | 0.20 | 0.51 | 0.2860 | -0.0114 | |||||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.00 | -1.77 | 0.20 | -7.51 | 0.2830 | -0.0360 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | -3.46 | 0.19 | 23.57 | 0.2786 | 0.0421 | |||

| OLLI / Ollie's Bargain Outlet Holdings, Inc. | 0.00 | -1.78 | 0.19 | 11.18 | 0.2710 | 0.0160 | |||

| FORT / Forterra plc | 0.07 | 0.00 | 0.19 | 21.43 | 0.2680 | 0.0365 | |||

| US31418ERA00 / Fannie Mae Pool | 0.19 | -4.59 | 0.2679 | -0.0257 | |||||

| 030190 / NICE Information Service Co., Ltd. | 0.02 | 0.00 | 0.19 | 53.28 | 0.2679 | 0.0842 | |||

| CHH / Choice Hotels International, Inc. | 0.00 | -1.76 | 0.18 | -6.12 | 0.2634 | -0.0303 | |||

| THO / THOR Industries, Inc. | 0.00 | -1.77 | 0.18 | 15.19 | 0.2606 | 0.0236 | |||

| United States Treasury Note/Bond / DBT (US912810UE63) | 0.18 | -3.21 | 0.2591 | -0.0213 | |||||

| FDP / Fresh Del Monte Produce Inc. | 0.06 | 0.00 | 0.18 | -9.55 | 0.2585 | -0.0405 | |||

| BFAM / Bright Horizons Family Solutions Inc. | 0.00 | -1.76 | 0.18 | -4.28 | 0.2566 | -0.0244 | |||

| US3132DWJ465 / FHLG 30YR 5.5% 12/01/2053#SD8383 | 0.18 | -2.22 | 0.2519 | -0.0185 | |||||

| United States Treasury Note/Bond / DBT (US91282CLW90) | 0.16 | 0.00 | 0.2297 | -0.0106 | |||||

| IBJHF / Ibstock plc | 0.08 | 0.00 | 0.15 | -8.33 | 0.2204 | -0.0323 | |||

| SAIA / Saia, Inc. | 0.00 | -1.78 | 0.15 | -23.47 | 0.2160 | -0.0775 | |||

| United States Treasury Note/Bond / DBT (US912810TX63) | 0.14 | -3.42 | 0.2023 | -0.0164 | |||||

| TOWR / PT Sarana Menara Nusantara Tbk. | 4.64 | 0.00 | 0.14 | 0.71 | 0.2021 | -0.0090 | |||

| KNOS / Kainos Group plc | 0.01 | 0.00 | 0.13 | 19.64 | 0.1919 | 0.0236 | |||

| CHE / Chemed Corporation | 0.00 | -1.80 | 0.13 | -22.81 | 0.1902 | -0.0660 | |||

| HLNE / Hamilton Lane Incorporated | 0.00 | -1.80 | 0.12 | -6.06 | 0.1777 | -0.0204 | |||

| SITE / SiteOne Landscape Supply, Inc. | 0.00 | -1.76 | 0.12 | -2.42 | 0.1743 | -0.0121 | |||

| United States Treasury Note/Bond / DBT (US912810UG12) | 0.12 | 0.1741 | 0.1741 | ||||||

| TTAN / ServiceTitan, Inc. | 0.00 | -1.78 | 0.12 | 11.32 | 0.1689 | 0.0092 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 0.12 | -2.52 | 0.1662 | -0.0125 | |||||

| 7734 / Riken Keiki Co., Ltd. | 0.01 | 0.12 | 0.1653 | 0.1653 | |||||

| EXPO / Exponent, Inc. | 0.00 | -1.79 | 0.11 | -9.52 | 0.1644 | -0.0257 | |||

| US31418EKT63 / FNMA 30YR 4.5% 11/52#MA4805 | 0.11 | -2.61 | 0.1616 | -0.0114 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.11 | -1.83 | 0.1541 | -0.0107 | |||||

| US064058AH32 / BANK NEW YORK MELLON CORP 4.7%/VAR PERP | 0.10 | 0.00 | 0.1498 | -0.0065 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.10 | -2.02 | 0.1395 | -0.0089 | |||||

| US95000U3B74 / Wells Fargo & Co | 0.09 | 2.35 | 0.1245 | -0.0039 | |||||

| Q / Quálitas Controladora, S.A.B. de C.V. | 0.01 | 0.00 | 0.08 | 17.14 | 0.1185 | 0.0136 | |||

| US24906PAA75 / DENTSPLY SIRONA Inc | 0.08 | 2.53 | 0.1162 | -0.0033 | |||||

| US3132DWGS61 / Freddie Mac Pool | 0.08 | -4.71 | 0.1159 | -0.0122 | |||||

| US81685VAA17 / Sempra Infrastructure Partners LP | 0.08 | 1.28 | 0.1133 | -0.0043 | |||||

| Bank of America Corp / DBT (US06051GMD87) | 0.07 | 0.1073 | 0.1073 | ||||||

| US025816DK20 / American Express Co | 0.07 | -6.41 | 0.1054 | -0.0125 | |||||

| US125896BU39 / CMS ENERGY CORP 4.75/VAR 06/01/2050 | 0.07 | 2.86 | 0.1043 | -0.0013 | |||||

| US55354GAK67 / MSCI Inc | 0.07 | 1.41 | 0.1033 | -0.0033 | |||||

| US24736XAA63 / Delta Air Lines 2015-1 Class AA Pass Through Trust | 0.07 | 0.00 | 0.1028 | -0.0038 | |||||

| US33939HAA77 / FLEX INTERMEDIATE HOLDCO LLC | 0.07 | 1.43 | 0.1017 | -0.0037 | |||||

| US01166VAA70 / Alaska Airlines 2020-1 Class A Pass Through Trust | 0.07 | 0.00 | 0.1001 | -0.0042 | |||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 0.07 | 1.52 | 0.0967 | -0.0028 | |||||

| US11042CAA80 / British Airways 2021-1 Class A Pass Through Trust | 0.07 | -1.47 | 0.0964 | -0.0060 | |||||

| E1TR34 / Entergy Corporation - Depositary Receipt (Common Stock) | 0.07 | 3.08 | 0.0962 | -0.0023 | |||||

| US61747YFB65 / Morgan Stanley | 0.07 | 1.54 | 0.0957 | -0.0027 | |||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 0.07 | 1.54 | 0.0947 | -0.0032 | |||||

| S1NN34 / Smith & Nephew plc - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 0.0943 | -0.0031 | |||||

| US366651AE76 / Gartner Inc | 0.07 | 1.56 | 0.0937 | -0.0030 | |||||

| United States Treasury Note/Bond / DBT (US912810UK24) | 0.06 | 0.0925 | 0.0925 | ||||||

| US22160NAA72 / CoStar Group Inc | 0.06 | 1.59 | 0.0918 | -0.0029 | |||||

| US629377CT71 / NRG Energy Inc | 0.06 | 1.61 | 0.0911 | -0.0025 | |||||

| US46647PBX33 / JPMorgan Chase & Co | 0.06 | 1.61 | 0.0906 | -0.0024 | |||||

| US073096AC32 / BRLS 5.14 04/14/32 | 0.06 | 3.28 | 0.0902 | -0.0026 | |||||

| US092113AW94 / Black Hills Corp | 0.06 | 0.00 | 0.0901 | -0.0041 | |||||

| US316773DF47 / Fifth Third Bancorp | 0.06 | 1.64 | 0.0888 | -0.0029 | |||||

| US665859AS34 / Northern Trust Corp | 0.06 | 1.67 | 0.0875 | -0.0036 | |||||

| CRBD / Corebridge Financial, Inc. - Preferred Security | 0.06 | 0.00 | 0.0870 | -0.0038 | |||||

| US172967PA33 / CITIGROUP INC | 0.06 | 1.69 | 0.0863 | -0.0027 | |||||

| US04365XAA63 / Ascot Group Ltd | 0.06 | 7.27 | 0.0854 | 0.0019 | |||||

| US404119BZ18 / HCA Inc | 0.06 | 0.00 | 0.0826 | -0.0030 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 0.06 | 0.00 | 0.0823 | -0.0039 | |||||

| US59001ABD37 / MTH 3 7/8 04/15/29 | 0.06 | 0.00 | 0.0813 | -0.0028 | |||||

| US502431AQ20 / L3Harris Technologies Inc | 0.06 | 1.82 | 0.0808 | -0.0026 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.06 | 0.00 | 0.0804 | -0.0035 | |||||

| Enel Finance International NV / DBT (US29278GBE70) | 0.06 | 1.82 | 0.0802 | -0.0025 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.06 | -1.79 | 0.0795 | -0.0051 | |||||

| US05571AAS42 / BPCE SA | 0.05 | 0.00 | 0.0786 | -0.0029 | |||||

| US172967ME81 / Citigroup Inc | 0.05 | 0.00 | 0.0785 | -0.0028 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.0785 | -0.0027 | |||||

| DGZ / DB Gold Short ETN | 0.05 | 42.11 | 0.0783 | 0.0199 | |||||

| US05565QDV77 / COMPANY GUAR 12/99 VAR | 0.05 | 3.85 | 0.0779 | -0.0009 | |||||

| Blue Owl Finance LLC / DBT (US09581JAR77) | 0.05 | 51.43 | 0.0762 | 0.0236 | |||||

| US09951LAB99 / Booz Allen Hamilton Inc | 0.05 | 1.96 | 0.0756 | -0.0018 | |||||

| US45687VAB27 / Ingersoll Rand Inc | 0.05 | 0.0749 | 0.0749 | ||||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 0.05 | 0.0742 | 0.0742 | ||||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.05 | 2.00 | 0.0740 | -0.0022 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.05 | -22.73 | 0.0737 | -0.0253 | |||||

| Sodexo Inc / DBT (US833794AD25) | 0.05 | 0.0737 | 0.0737 | ||||||

| Icon Investments Six DAC / DBT (US45115AAC80) | 0.05 | 0.00 | 0.0731 | -0.0033 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.0729 | -0.0024 | |||||

| US21987BBG23 / Corp Nacional del Cobre de Chile | 0.05 | 0.00 | 0.0729 | -0.0029 | |||||

| JH North America Holdings Inc / DBT (US46593WAB19) | 0.05 | 0.0727 | 0.0727 | ||||||

| BlackRock Funding Inc / DBT (US09290DAC56) | 0.05 | -28.57 | 0.0727 | -0.0327 | |||||

| US11135FBP53 / SR UNSECURED 144A 11/35 3.137 | 0.05 | -24.24 | 0.0724 | -0.0269 | |||||

| US378272BE79 / Glencore Funding LLC | 0.05 | 2.04 | 0.0722 | -0.0016 | |||||

| Marvell Technology Inc / DBT (US573874AS31) | 0.05 | 0.0720 | 0.0720 | ||||||

| US114259AW41 / Brooklyn Union Gas Co/The | 0.05 | 0.00 | 0.0719 | -0.0032 | |||||

| US29250NBT19 / Enbridge, Inc. | 0.05 | 0.0717 | 0.0717 | ||||||

| Safehold GL Holdings LLC / DBT (US785931AB23) | 0.05 | 44.12 | 0.0715 | 0.0193 | |||||

| Mars Inc / DBT (US571676BC81) | 0.05 | 0.00 | 0.0714 | -0.0034 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.0712 | -0.0024 | |||||

| Harbour Energy PLC / DBT (US411618AD32) | 0.05 | 0.00 | 0.0711 | -0.0034 | |||||

| US72147KAK43 / Pilgrim's Pride Corp 6.250%, Due 07/01/33 | 0.05 | 2.08 | 0.0711 | -0.0018 | |||||

| US04505AAA79 / Ashtead Capital Inc | 0.05 | 2.08 | 0.0710 | -0.0021 | |||||

| VLTO / Veralto Corporation | 0.05 | 2.08 | 0.0708 | -0.0025 | |||||

| US097023CX16 / BOEING CO 5.93 5/60 | 0.05 | 2.08 | 0.0707 | -0.0025 | |||||

| US649840CV58 / NEW YORK STATE ELECTRIC & GAS CORP | 0.05 | 2.08 | 0.0706 | -0.0028 | |||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 0.05 | 0.0701 | 0.0701 | ||||||

| US46647PDK93 / JPMORGAN CHASE & CO REGD V/R 5.71700000 | 0.05 | 0.00 | 0.0701 | -0.0022 | |||||

| US09261HAC16 / Blackstone Private Credit Fund | 0.05 | 0.0700 | 0.0700 | ||||||

| Apollo Global Management Inc / DBT (US03769MAD83) | 0.05 | 0.00 | 0.0698 | -0.0026 | |||||

| US852060AT99 / Sprint Capital Corp 8.750% Notes 03/15/32 | 0.05 | -20.00 | 0.0694 | -0.0206 | |||||

| US744320BL59 / PRUDENTIAL FINANCIAL INC | 0.05 | 0.00 | 0.0690 | -0.0029 | |||||

| US031162DT45 / Amgen Inc | 0.05 | 104.35 | 0.0685 | 0.0332 | |||||

| Apollo Debt Solutions BDC / DBT (US03770DAB91) | 0.05 | 0.00 | 0.0672 | -0.0027 | |||||

| F&G Annuities & Life Inc / DBT (US30190AAF12) | 0.05 | 2.22 | 0.0664 | -0.0022 | |||||

| GMZB / Ally Financial Inc. - Preferred Stock | 0.05 | 2.27 | 0.0653 | -0.0018 | |||||

| US05567SAA06 / Bnsf Funding Tru 6.613 12/15 Bond | 0.05 | 0.00 | 0.0646 | -0.0031 | |||||

| E1OG34 / EOG Resources, Inc. - Depositary Receipt (Common Stock) | 0.04 | 0.0629 | 0.0629 | ||||||

| CVS / CVS Health Corporation | 0.04 | 2.38 | 0.0618 | -0.0021 | |||||

| US25714PEF18 / Dominican Republic International Bond | 0.04 | 2.44 | 0.0607 | -0.0020 | |||||

| Berry Global Inc / DBT (US08576PAQ46) | 0.04 | -46.05 | 0.0591 | -0.0549 | |||||

| NNN / NNN REIT, Inc. | 0.04 | 2.50 | 0.0587 | -0.0015 | |||||

| US69370PAA93 / Pertamina Persero PT | 0.04 | 2.50 | 0.0587 | -0.0022 | |||||

| US842400ES88 / Southern California Edison 6% Due 1/15/34 | 0.04 | -2.44 | 0.0586 | -0.0032 | |||||

| US637432MT91 / National Rural Utilities Cooperative Finance Corp. | 0.04 | -2.44 | 0.0584 | -0.0031 | |||||

| H1BA34 / Huntington Bancshares Incorporated - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 0.0583 | -0.0020 | |||||

| XS2262961076 / ZF Finance GmbH | 0.04 | 0.00 | 0.0577 | -0.0025 | |||||

| Stellantis Finance US Inc / DBT (US85855CAL46) | 0.04 | 2.56 | 0.0575 | -0.0019 | |||||

| US7593518852 / Reinsurance Group of America Inc | 0.04 | 0.00 | 0.0570 | -0.0019 | |||||

| US105756CF53 / Brazilian Government International Bond | 0.04 | 2.63 | 0.0568 | -0.0015 | |||||

| US745310AN24 / Puget Energy, Inc. | 0.04 | 0.00 | 0.0566 | -0.0020 | |||||

| US253393AG77 / Dick's Sporting Goods, Inc. | 0.04 | 0.0562 | 0.0562 | ||||||

| SON / Sonoco Products Company | 0.04 | 0.00 | 0.0557 | -0.0016 | |||||

| US49326EEN94 / KEYCORP | 0.04 | 2.70 | 0.0544 | -0.0016 | |||||

| US808513CH62 / Charles Schwab Corp/The | 0.04 | 0.00 | 0.0542 | -0.0016 | |||||

| US958667AA50 / WESTERN MIDSTREAM OPERAT SR UNSECURED 02/50 5.25 | 0.04 | -2.63 | 0.0542 | -0.0033 | |||||

| US59156RCA41 / MetLife Inc | 0.04 | 0.00 | 0.0541 | -0.0021 | |||||

| IQVIA Inc / DBT (US46266TAF57) | 0.04 | 0.00 | 0.0538 | -0.0023 | |||||

| US91282CAD39 / United States Treasury Note/Bond | 0.04 | 2.78 | 0.0534 | -0.0018 | |||||

| US05369AAP66 / Aviation Capital Group LLC | 0.04 | 2.78 | 0.0532 | -0.0021 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 0.04 | 2.86 | 0.0523 | -0.0014 | |||||

| H1II34 / Huntington Ingalls Industries, Inc. - Depositary Receipt (Common Stock) | 0.04 | -28.00 | 0.0516 | -0.0238 | |||||

| XS1040508167 / Imperial Brands Finance plc | 0.04 | 0.00 | 0.0514 | -0.0017 | |||||

| TRT061124T11 / Turkey Government Bond | 0.04 | 0.00 | 0.0513 | -0.0013 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0.04 | 0.00 | 0.0513 | -0.0021 | |||||

| ANZ / ANZ Group Holdings Limited | 0.04 | 0.0509 | 0.0509 | ||||||

| H1FC34 / HF Sinclair Corporation - Depositary Receipt (Common Stock) | 0.04 | -50.00 | 0.0508 | -0.0545 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0.04 | -41.67 | 0.0508 | -0.0371 | |||||

| US49338CAD56 / KeySpan Gas East Corp | 0.04 | 2.94 | 0.0506 | -0.0016 | |||||

| US020002BB69 / The Allstate Cor 5.750 8/15 Bond | 0.03 | -15.00 | 0.0501 | -0.0099 | |||||

| US71654QCG55 / Petroleos Mexicanos | 0.03 | -20.93 | 0.0497 | -0.0159 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.0491 | -0.0021 | |||||

| US674599DJ13 / Occidental Petroleum Corp | 0.03 | 0.00 | 0.0490 | -0.0029 | |||||

| US90932LAJ61 / United Airlines 2023-1 Class A Pass Through Trust | 0.03 | 3.13 | 0.0474 | -0.0019 | |||||

| US05526DBX21 / BATSLN 7 3/4 10/19/32 | 0.03 | -47.46 | 0.0447 | -0.0446 | |||||

| US759470BB24 / Reliance Industries Ltd | 0.03 | 3.33 | 0.0444 | -0.0012 | |||||

| Capital Power US Holdings Inc / DBT (US14041TAB44) | 0.03 | 0.0443 | 0.0443 | ||||||

| RPRX / Royalty Pharma plc | 0.03 | 3.45 | 0.0435 | -0.0009 | |||||

| US445545AS56 / Hungary Government International Bond | 0.03 | 3.45 | 0.0431 | -0.0015 | |||||

| US731011AV42 / Republic of Poland Government International Bond | 0.03 | 0.00 | 0.0426 | -0.0015 | |||||

| South Bow USA Infrastructure Holdings LLC / DBT (US83007CAE21) | 0.03 | 0.00 | 0.0425 | -0.0015 | |||||

| FCT / Fincantieri S.p.A. | 0.03 | 0.00 | 0.0423 | -0.0011 | |||||

| US760942BA98 / Uruguay Government International Bond | 0.03 | 107.14 | 0.0422 | 0.0200 | |||||

| US912810SZ21 / United States Treasury Note/Bond | 0.03 | -3.45 | 0.0412 | -0.0033 | |||||

| US161175BT05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.03 | 0.0401 | 0.0401 | ||||||

| US46647PBP09 / JPMORGAN CHASE and CO 2.956/VAR 05/13/2031 | 0.03 | -81.63 | 0.0397 | -0.1054 | |||||

| US14040HCG83 / Capital One Financial Corp. | 0.03 | 3.85 | 0.0388 | -0.0005 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 0.03 | -58.73 | 0.0384 | -0.0561 | |||||

| US857477CG64 / State Street Corp | 0.03 | 0.00 | 0.0382 | -0.0011 | |||||

| K1EY34 / KeyCorp - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.0382 | -0.0014 | |||||

| PTPP / PT PP (Persero) Tbk | 0.03 | 4.00 | 0.0372 | -0.0010 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBK09) | 0.03 | 0.00 | 0.0372 | -0.0011 | |||||

| US949746TD35 / Wells Fargo & Co | 0.03 | -48.98 | 0.0368 | -0.0380 | |||||

| P1DT34 / Prudential Financial, Inc. - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.0367 | -0.0014 | |||||

| Panama Government International Bond / DBT (US698299BY91) | 0.03 | 4.17 | 0.0367 | -0.0005 | |||||

| US09951LAC72 / Booz Allen Hamilton Inc | 0.03 | 4.17 | 0.0367 | -0.0006 | |||||

| US38143YAC75 / Goldman Sachs Group 6.45% Notes 5/1/36 | 0.03 | 0.00 | 0.0367 | -0.0013 | |||||

| Global Atlantic Fin Co / DBT (US37959GAF46) | 0.03 | 0.00 | 0.0366 | -0.0014 | |||||

| Florida Gas Transmission Co LLC / DBT (US340711BC39) | 0.03 | 0.0366 | 0.0366 | ||||||

| H1BA34 / Huntington Bancshares Incorporated - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.0366 | -0.0013 | |||||

| US65480CAF23 / Nissan Motor Acceptance Co. LLC | 0.03 | 0.00 | 0.0365 | -0.0024 | |||||

| US06051GLH01 / Bank of America Corp. | 0.03 | 0.00 | 0.0365 | -0.0011 | |||||

| US350930AA10 / Foundry JV Holdco LLC | 0.03 | 0.0363 | 0.0363 | ||||||

| US68389XCQ60 / Oracle Corp | 0.03 | 0.00 | 0.0363 | -0.0015 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBQ78) | 0.03 | 4.17 | 0.0358 | -0.0013 | |||||

| US80413TBD00 / Saudi Government International Bond | 0.02 | 0.00 | 0.0358 | -0.0011 | |||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0.02 | 0.00 | 0.0357 | -0.0009 | |||||

| US06051GJT76 / Bank of America Corp | 0.02 | 4.35 | 0.0347 | -0.0009 | |||||

| US78081BAP85 / Royalty Pharma PLC | 0.02 | 0.00 | 0.0343 | -0.0008 | |||||

| U1HS34 / Universal Health Services, Inc. - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.0341 | -0.0014 | |||||

| US913903BA74 / Universal Health Services Inc | 0.02 | 0.00 | 0.0340 | -0.0011 | |||||

| South Bow USA Infrastructure Holdings LLC / DBT (US83007CAG78) | 0.02 | 0.00 | 0.0340 | -0.0018 | |||||

| US19828TAB26 / Columbia Pipelines Operating Co LLC | 0.02 | 4.55 | 0.0330 | -0.0010 | |||||

| US345370DA55 / Ford Motor Co | 0.02 | 0.00 | 0.0314 | -0.0007 | |||||

| US68389XBY04 / Oracle Corp | 0.02 | 0.00 | 0.0296 | -0.0013 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 0.02 | -53.49 | 0.0288 | -0.0367 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.02 | 0.0286 | 0.0286 | ||||||

| XS2384704800 / NIGERIA GOVERNMENT INTERNATIONAL BOND MTN 8.250000% 09/28/2051 | 0.02 | 0.0286 | 0.0286 | ||||||

| Ivory Coast Government International Bond / DBT (US221625AT38) | 0.02 | 0.0282 | 0.0282 | ||||||

| US29135LAF76 / Abu Dhabi Government International Bond | 0.02 | 0.00 | 0.0281 | -0.0015 | |||||

| Petronas Capital Ltd / DBT (US716743AX79) | 0.02 | 0.0260 | 0.0260 | ||||||

| US74730DAC74 / Qatar Petroleum | 0.02 | 0.00 | 0.0250 | -0.0008 | |||||

| US808513BJ38 / Charles Schwab Corp/The | 0.02 | -57.89 | 0.0239 | -0.0332 | |||||

| US95000U3H45 / Wells Fargo & Co | 0.02 | 0.00 | 0.0235 | -0.0008 | |||||

| 4020 / Saudi Real Estate Company | 0.02 | 0.00 | 0.0223 | -0.0007 | |||||

| US654579AE17 / Nippon Life Insurance Co | 0.02 | 0.0222 | 0.0222 | ||||||

| US035198AD29 / Angolan Government International Bond | 0.02 | 0.0220 | 0.0220 | ||||||

| E1OG34 / EOG Resources, Inc. - Depositary Receipt (Common Stock) | 0.02 | 0.0218 | 0.0218 | ||||||

| TRT061124T11 / Turkey Government Bond | 0.02 | 0.0215 | 0.0215 | ||||||

| United Airlines 2024-1 Class AA Pass Through Trust / DBT (US90932WAA18) | 0.02 | 7.14 | 0.0215 | -0.0010 | |||||

| US836205AY00 / Republic of South Africa Government International Bond | 0.01 | 0.00 | 0.0214 | -0.0005 | |||||

| US91159HJG65 / US Bancorp | 0.01 | 0.00 | 0.0212 | -0.0004 | |||||

| Philippine Government International Bond / DBT (US718286DC88) | 0.01 | 0.00 | 0.0211 | -0.0007 | |||||

| Ivory Coast Government International Bond / DBT (US221625AU01) | 0.01 | 0.00 | 0.0206 | -0.0009 | |||||

| US195325EL56 / Colombia Government International Bond | 0.01 | -41.67 | 0.0202 | -0.0160 | |||||

| Republic of Kenya Government International Bond / DBT (US491798AN42) | 0.01 | 0.0188 | 0.0188 | ||||||

| Colombia Government International Bond / DBT (US195325ER27) | 0.01 | 0.0178 | 0.0178 | ||||||

| US69120VAU52 / BLUE OWL CREDIT 7.75 1/29 | 0.01 | 0.00 | 0.0177 | -0.0007 | |||||

| US80413TAC36 / Saudi Government International Bond | 0.01 | 0.00 | 0.0176 | -0.0008 | |||||

| US345370CQ17 / Ford Motor Company 4.75% 01/15/43 | 0.01 | 0.00 | 0.0165 | -0.0005 | |||||

| US23330JAA97 / DP World PLC | 0.01 | -9.09 | 0.0156 | -0.0010 | |||||

| US14040HDA05 / Capital One Financial Corp | 0.01 | 0.00 | 0.0152 | -0.0004 | |||||

| Apollo Debt Solutions BDC / DBT (US03770DAD57) | 0.01 | 0.00 | 0.0149 | -0.0006 | |||||

| Hungary Government International Bond / DBT (US445545AU03) | 0.01 | 0.0138 | 0.0138 | ||||||

| US836205BA15 / Republic of South Africa Government International Bond | 0.01 | 0.0138 | 0.0138 | ||||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0.01 | 0.00 | 0.0137 | -0.0007 | |||||

| US48667QAP00 / KazMunayGas National Co JSC | 0.01 | 0.00 | 0.0135 | -0.0008 | |||||

| US283875BW13 / El Salvador Government International Bond | 0.01 | 0.00 | 0.0134 | -0.0003 | |||||

| US617726AL82 / Morocco Government International Bond | 0.01 | 0.00 | 0.0121 | -0.0003 | |||||

| US900123CG37 / Turkey Government International Bond | 0.01 | 0.00 | 0.0121 | -0.0005 | |||||

| US817477AH51 / Serbia International Bond | 0.01 | 0.00 | 0.0120 | -0.0003 | |||||

| US401494AW96 / Guatemala Government Bond | 0.01 | -46.67 | 0.0116 | -0.0110 | |||||

| URUGUA / Uruguay Government International Bond | 0.01 | -12.50 | 0.0114 | -0.0006 | |||||

| US71654QDD16 / Petroleos Mexicanos | 0.01 | -76.92 | 0.0090 | -0.0274 | |||||

| US31407MZH14 / Fannie Mae Pool | 0.01 | 0.00 | 0.0088 | -0.0006 | |||||

| US71654QDC33 / Petroleos Mexicanos | 0.01 | 0.0083 | 0.0083 | ||||||

| US221597CR65 / Costa Rica Government International Bond | 0.01 | 0.00 | 0.0074 | -0.0002 | |||||

| US221597CV77 / Costa Rica Government International Bond | 0.01 | 0.00 | 0.0074 | -0.0003 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 0.01 | 25.00 | 0.0073 | -0.0001 | |||||

| US31424EAD40 / UAE INTERNATIONAL GOVERNMENT BOND | 0.00 | 0.00 | 0.0070 | -0.0003 | |||||

| US31414SX240 / Fannie Mae Pool | 0.00 | 0.00 | 0.0065 | -0.0008 | |||||

| US31413BLD19 / Fannie Mae Pool | 0.00 | 0.00 | 0.0063 | -0.0003 | |||||

| US836205AX27 / Republic of South Africa Government International Bond | 0.00 | 0.00 | 0.0054 | -0.0002 | |||||

| US31416AUG39 / Fannie Mae Pool | 0.00 | 0.00 | 0.0052 | -0.0003 | |||||

| US36213S2N43 / Ginnie Mae I Pool | 0.00 | 0.00 | 0.0047 | -0.0006 | |||||

| US31416M4C58 / Fannie Mae Pool | 0.00 | 0.00 | 0.0035 | -0.0002 | |||||

| US31416M4U56 / Fannie Mae Pool | 0.00 | 0.00 | 0.0028 | -0.0002 | |||||

| US31413MDE49 / Fannie Mae Pool | 0.00 | 0.00 | 0.0023 | -0.0001 | |||||

| US31415WAZ68 / Fannie Mae Pool | 0.00 | 0.00 | 0.0021 | -0.0001 | |||||

| US31416M4W13 / Fannie Mae Pool | 0.00 | 0.00 | 0.0021 | -0.0004 | |||||

| US31411UG965 / Fannie Mae Pool | 0.00 | 0.00 | 0.0017 | -0.0001 | |||||

| US31415QKZ80 / Fannie Mae Pool | 0.00 | 0.00 | 0.0016 | -0.0001 | |||||

| US31412MZA97 / Fannie Mae Pool | 0.00 | 0.0013 | -0.0001 | ||||||

| US31416ASK78 / Fannie Mae Pool | 0.00 | 0.0011 | -0.0001 | ||||||

| US31409YD539 / Fannie Mae Pool | 0.00 | 0.0008 | -0.0000 | ||||||

| US31371KDL26 / Fannie Mae Pool | 0.00 | 0.0007 | -0.0001 | ||||||

| XAG6903KAB98 / Paragon Offshore Finance Co | 0.00 | 0.0000 | 0.0000 | ||||||

| CRL / Charles River Laboratories International, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2128 |