Mga Batayang Estadistika

| Nilai Portofolio | $ 231,605,629 |

| Posisi Saat Ini | 65 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

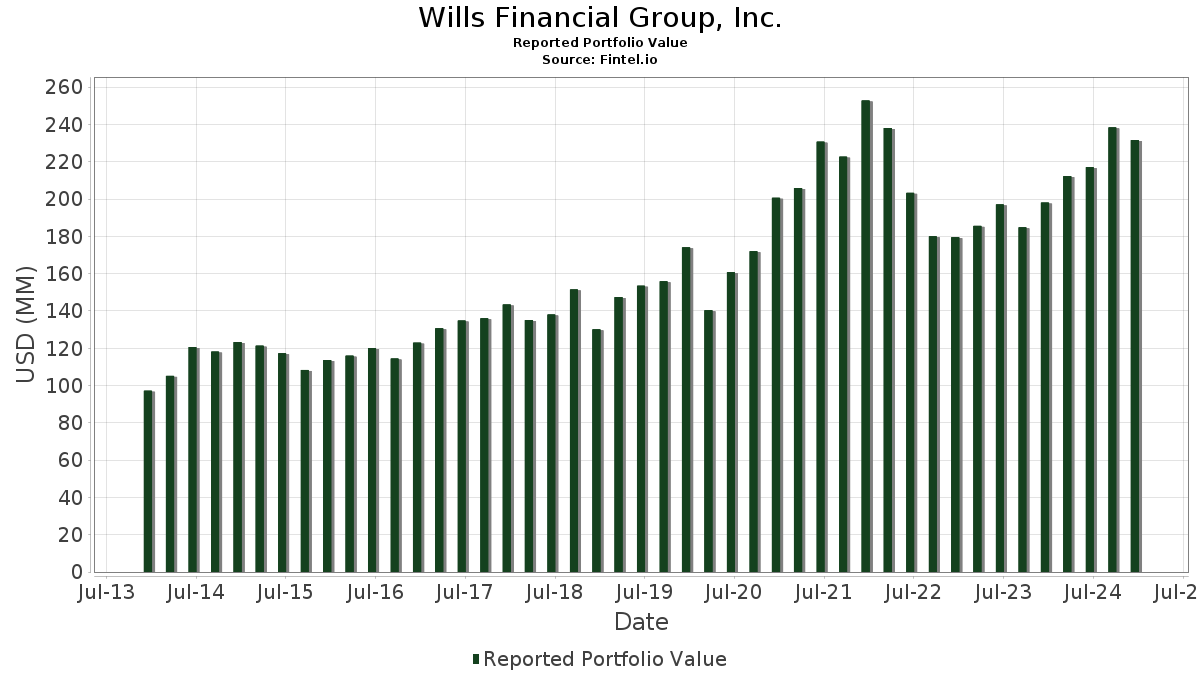

Wills Financial Group, Inc. telah mengungkapkan total kepemilikan 65 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 231,605,629 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Wills Financial Group, Inc. adalah Berkshire Hathaway Inc. (US:BRK.B) , Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , Lockheed Martin Corporation (US:LMT) , and Danaher Corporation (US:DHR) . Posisi baru Wills Financial Group, Inc. meliputi: Oaktree Specialty Lending Corporation (US:OCSL) , Tesla, Inc. (US:TSLA) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.17 | 2.54 | 1.0985 | 1.0985 | |

| 0.01 | 3.49 | 1.5077 | 0.7964 | |

| 0.04 | 8.20 | 3.5394 | 0.7742 | |

| 0.07 | 17.41 | 7.5163 | 0.6208 | |

| 0.04 | 8.17 | 3.5254 | 0.5236 | |

| 0.01 | 4.26 | 1.8379 | 0.5210 | |

| 0.02 | 4.54 | 1.9583 | 0.4893 | |

| 0.02 | 4.04 | 1.7451 | 0.3332 | |

| 0.28 | 5.99 | 2.5867 | 0.2362 | |

| 0.04 | 3.16 | 1.3636 | 0.2281 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 10.29 | 4.4421 | -1.1997 | |

| 0.02 | 1.46 | 0.6309 | -0.6899 | |

| 0.04 | 9.59 | 4.1426 | -0.6643 | |

| 0.04 | 17.15 | 7.4029 | -0.5968 | |

| 0.04 | 3.47 | 1.4995 | -0.3853 | |

| 0.08 | 4.43 | 1.9131 | -0.3737 | |

| 0.05 | 7.55 | 3.2600 | -0.2468 | |

| 0.06 | 4.80 | 2.0739 | -0.2384 | |

| 0.07 | 2.68 | 1.1592 | -0.2261 | |

| 0.02 | 3.49 | 1.5054 | -0.1580 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-02-14 untuk periode pelaporan 2024-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.05 | -0.89 | 21.23 | -2.39 | 9.1675 | 0.0432 | |||

| AAPL / Apple Inc. | 0.07 | -1.47 | 17.41 | 5.89 | 7.5163 | 0.6208 | |||

| MSFT / Microsoft Corporation | 0.04 | -8.22 | 17.15 | -10.10 | 7.4029 | -0.5968 | |||

| LMT / Lockheed Martin Corporation | 0.02 | -7.99 | 10.29 | -23.51 | 4.4421 | -1.1997 | |||

| DHR / Danaher Corporation | 0.04 | 1.40 | 9.59 | -16.28 | 4.1426 | -0.6643 | |||

| PANW / Palo Alto Networks, Inc. | 0.05 | 77.13 | 9.08 | -5.70 | 3.9187 | -0.1185 | |||

| PG / The Procter & Gamble Company | 0.05 | -0.05 | 8.44 | -3.26 | 3.6447 | -0.0152 | |||

| AMZN / Amazon.com, Inc. | 0.04 | 5.61 | 8.20 | 24.35 | 3.5394 | 0.7742 | |||

| GOOGL / Alphabet Inc. | 0.04 | -0.04 | 8.17 | 14.10 | 3.5254 | 0.5236 | |||

| PEP / PepsiCo, Inc. | 0.05 | 1.00 | 7.55 | -9.69 | 3.2600 | -0.2468 | |||

| KVUE / Kenvue Inc. | 0.28 | 15.83 | 5.99 | 6.91 | 2.5867 | 0.2362 | |||

| CVX / Chevron Corporation | 0.04 | 4.91 | 5.77 | 3.18 | 2.4934 | 0.1458 | |||

| UNP / Union Pacific Corporation | 0.03 | 1.82 | 5.74 | -5.79 | 2.4780 | -0.0776 | |||

| WTRG / Essential Utilities, Inc. | 0.16 | -2.64 | 5.69 | -8.32 | 2.4587 | -0.1467 | |||

| IAU / iShares Gold Trust | 0.11 | 0.07 | 5.67 | -0.30 | 2.4468 | 0.0624 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.06 | 4.60 | 4.80 | -12.86 | 2.0739 | -0.2384 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 1.80 | 4.63 | -9.33 | 1.9977 | -0.1426 | |||

| SPGI / S&P Global Inc. | 0.01 | 1.42 | 4.54 | -2.24 | 1.9594 | 0.0126 | |||

| AVGO / Broadcom Inc. | 0.02 | -3.64 | 4.54 | 29.50 | 1.9583 | 0.4893 | |||

| FERG / Ferguson Enterprises Inc. | 0.03 | 24.84 | 4.50 | 9.15 | 1.9417 | 0.2131 | |||

| D / Dominion Energy, Inc. | 0.08 | -12.80 | 4.43 | -18.73 | 1.9131 | -0.3737 | |||

| ACN / Accenture plc | 0.01 | 36.23 | 4.26 | 35.58 | 1.8379 | 0.5210 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | 5.62 | 4.04 | 20.05 | 1.7451 | 0.3332 | |||

| CF / CF Industries Holdings, Inc. | 0.04 | 4.37 | 3.67 | 3.79 | 1.5829 | 0.1012 | |||

| V / Visa Inc. | 0.01 | 79.16 | 3.49 | 105.96 | 1.5077 | 0.7964 | |||

| ZTS / Zoetis Inc. | 0.02 | 5.43 | 3.49 | -12.08 | 1.5054 | -0.1580 | |||

| MRK / Merck & Co., Inc. | 0.03 | 15.99 | 3.48 | 1.61 | 1.5027 | 0.0659 | |||

| COP / ConocoPhillips | 0.04 | -17.95 | 3.47 | -22.72 | 1.4995 | -0.3853 | |||

| SO / The Southern Company | 0.04 | 27.81 | 3.16 | 16.70 | 1.3636 | 0.2281 | |||

| VZ / Verizon Communications Inc. | 0.07 | -8.71 | 2.68 | -18.72 | 1.1592 | -0.2261 | |||

| OCSL / Oaktree Specialty Lending Corporation | 0.17 | 2.54 | 1.0985 | 1.0985 | |||||

| NEE.PRN / NextEra Energy Capital Holdings, Inc. - Corporate Bond/Note | 0.03 | 4.36 | 2.45 | -11.50 | 1.0567 | -0.1032 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.06 | 206.47 | 1.61 | -0.98 | 0.6950 | 0.0134 | |||

| NOC / Northrop Grumman Corporation | 0.00 | -2.96 | 1.60 | -13.80 | 0.6907 | -0.0876 | |||

| NSC / Norfolk Southern Corporation | 0.01 | -0.11 | 1.47 | -5.70 | 0.6363 | -0.0190 | |||

| NKE / NIKE, Inc. | 0.02 | -45.79 | 1.46 | -53.60 | 0.6309 | -0.6899 | |||

| MKC / McCormick & Company, Incorporated | 0.02 | -11.27 | 1.31 | -17.78 | 0.5671 | -0.1031 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.00 | 0.94 | 13.94 | 0.4062 | 0.0598 | |||

| ALB / Albemarle Corporation | 0.01 | -16.77 | 0.92 | -24.36 | 0.3955 | -0.1124 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 9.84 | 0.91 | -0.22 | 0.3921 | 0.0100 | |||

| CME / CME Group Inc. | 0.00 | 0.03 | 0.82 | 5.24 | 0.3561 | 0.0275 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.05 | 0.80 | -8.18 | 0.3445 | -0.0200 | |||

| JNJ / Johnson & Johnson | 0.01 | -5.58 | 0.79 | -15.83 | 0.3402 | -0.0520 | |||

| DUK / Duke Energy Corporation | 0.01 | -0.55 | 0.74 | -7.04 | 0.3196 | -0.0145 | |||

| BX / Blackstone Inc. | 0.00 | 47.49 | 0.73 | 66.21 | 0.3147 | 0.1306 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -2.58 | 0.71 | -18.08 | 0.3053 | -0.0568 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.06 | 0.66 | -3.94 | 0.2846 | -0.0032 | |||

| KO / The Coca-Cola Company | 0.01 | 0.26 | 0.64 | -13.13 | 0.2772 | -0.0328 | |||

| RDVY / First Trust Exchange-Traded Fund VI - First Trust Rising Dividend Achievers ETF | 0.01 | 83.43 | 0.49 | 82.90 | 0.2128 | 0.1000 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.24 | 0.46 | 10.71 | 0.1968 | 0.0243 | |||

| PM / Philip Morris International Inc. | 0.00 | 5.78 | 0.44 | 4.76 | 0.1903 | 0.0140 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.43 | -8.88 | 0.1865 | -0.0123 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 3.31 | 0.37 | 5.46 | 0.1589 | 0.0125 | |||

| JEPI / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Equity Premium Income ETF | 0.01 | 54.89 | 0.35 | 49.79 | 0.1522 | 0.0535 | |||

| RTX / RTX Corporation | 0.00 | -2.94 | 0.32 | -7.43 | 0.1401 | -0.0067 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | 0.00 | 0.31 | 1.30 | 0.1345 | 0.0055 | |||

| MCK / McKesson Corporation | 0.00 | 0.00 | 0.28 | 14.98 | 0.1230 | 0.0193 | |||

| PFE / Pfizer Inc. | 0.01 | -21.24 | 0.28 | -27.79 | 0.1203 | -0.0416 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.27 | 0.1147 | 0.1147 | |||||

| MKL / Markel Group Inc. | 0.00 | 0.00 | 0.25 | 10.36 | 0.1058 | 0.0124 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.00 | 0.23 | 5.88 | 0.1014 | 0.0087 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.22 | -4.68 | 0.0970 | -0.0020 | |||

| BKLC / BNY Mellon ETF Trust - BNY Mellon US Large Cap Core Equity ETF | 0.00 | -21.31 | 0.22 | -19.42 | 0.0968 | -0.0200 | |||

| HII / Huntington Ingalls Industries, Inc. | 0.00 | 2.20 | 0.22 | -27.00 | 0.0947 | -0.0312 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | 0.00 | 0.21 | 4.46 | 0.0914 | 0.0063 | |||

| ZBRA / Zebra Technologies Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1445 | ||||

| SWK / Stanley Black & Decker, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |