Mga Batayang Estadistika

| Nilai Portofolio | $ 93,101,000 |

| Posisi Saat Ini | 78 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

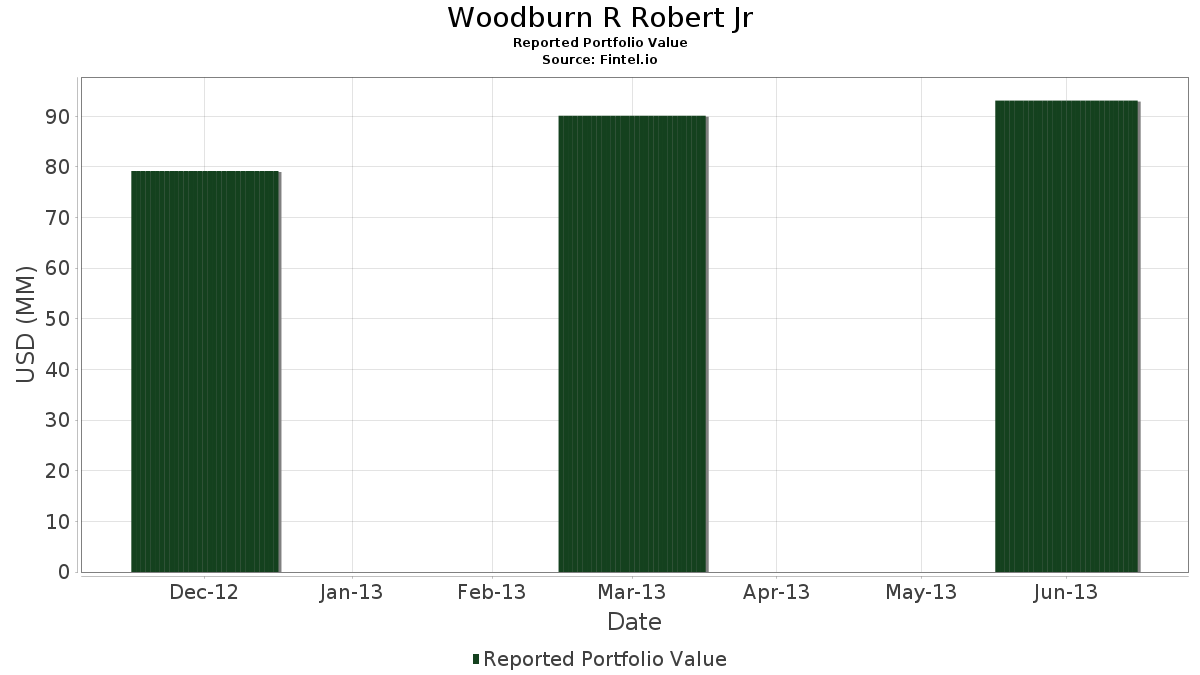

Woodburn R Robert Jr telah mengungkapkan total kepemilikan 78 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 93,101,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Woodburn R Robert Jr adalah Mac-gray Corp (US:TUC) , Exxon Mobil Corporation (US:XOM) , Johnson & Johnson (US:JNJ) , The Procter & Gamble Company (US:PG) , and Automatic Data Processing, Inc. (US:ADP) . Posisi baru Woodburn R Robert Jr meliputi: Apple Inc. (US:AAPL) , Global X Funds - Global X Emerging Markets Great Consumer ETF (US:EMC) , Roche Holding AG - Depositary Receipt (Common Stock) (US:RHHBY) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.13 | 16.11 | 17.3016 | 1.1891 | |

| 0.02 | 0.80 | 0.8550 | 0.8550 | |

| 0.01 | 0.78 | 0.8421 | 0.8421 | |

| 0.01 | 0.61 | 0.6541 | 0.6541 | |

| 0.00 | 0.47 | 0.5005 | 0.5005 | |

| 0.02 | 0.38 | 0.4071 | 0.4071 | |

| 0.00 | 0.33 | 0.3491 | 0.3491 | |

| 0.01 | 0.32 | 0.3469 | 0.3469 | |

| 0.00 | 0.28 | 0.3040 | 0.3040 | |

| 0.04 | 1.08 | 1.1568 | 0.2979 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 0.77 | 0.8228 | -0.6343 | |

| 0.14 | 12.88 | 13.8355 | -0.3971 | |

| 0.00 | 0.00 | -0.3629 | ||

| 0.00 | 0.20 | 0.2127 | -0.3522 | |

| 0.05 | 3.60 | 3.8668 | -0.2826 | |

| 0.00 | 0.00 | -0.2741 | ||

| 0.01 | 0.85 | 0.9162 | -0.2712 | |

| 0.00 | 0.00 | -0.2575 | ||

| 0.00 | 0.00 | -0.2464 | ||

| 0.00 | 0.00 | -0.2308 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2013-08-19 untuk periode pelaporan 2013-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TUC / Mac-gray Corp | 1.13 | 0.00 | 16.11 | 10.94 | 17.3016 | 1.1891 | |||

| XOM / Exxon Mobil Corporation | 0.14 | 0.17 | 12.88 | 0.44 | 13.8355 | -0.3971 | |||

| JNJ / Johnson & Johnson | 0.06 | -1.27 | 5.54 | 3.98 | 5.9505 | 0.0378 | |||

| PG / The Procter & Gamble Company | 0.05 | -3.63 | 3.60 | -3.72 | 3.8668 | -0.2826 | |||

| ADP / Automatic Data Processing, Inc. | 0.04 | 8.66 | 2.71 | 15.07 | 2.9119 | 0.2973 | |||

| PEP / PepsiCo, Inc. | 0.03 | 1.31 | 2.15 | 4.73 | 2.3061 | 0.0311 | |||

| SPTM / SPDR Series Trust - SPDR Portfolio S&P 1500 Composite Stock Market ETF | 0.02 | 0.00 | 2.04 | 2.20 | 2.1944 | -0.0240 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.02 | 0.00 | 1.92 | 2.07 | 2.0655 | -0.0253 | |||

| GE / General Electric Company | 0.08 | -0.37 | 1.89 | -0.05 | 2.0322 | -0.0686 | |||

| WMT / Walmart Inc. | 0.02 | -2.10 | 1.74 | -2.52 | 1.8668 | -0.1119 | |||

| EMR / Emerson Electric Co. | 0.03 | 2.08 | 1.74 | -0.34 | 1.8668 | -0.0686 | |||

| MSFT / Microsoft Corporation | 0.05 | -1.13 | 1.58 | 19.47 | 1.7003 | 0.2299 | |||

| INTC / Intel Corporation | 0.06 | -0.79 | 1.57 | 10.08 | 1.6885 | 0.1038 | |||

| MDT / Medtronic plc | 0.03 | -0.36 | 1.44 | 9.25 | 1.5478 | 0.0840 | |||

| FISV / Fiserv, Inc. | 0.02 | 2.05 | 1.41 | 1.51 | 1.5188 | -0.0271 | |||

| SLB / Schlumberger Limited | 0.02 | 13.17 | 1.36 | 8.29 | 1.4586 | 0.0670 | |||

| CVX / Chevron Corporation | 0.01 | 19.65 | 1.17 | 19.13 | 1.2578 | 0.1669 | |||

| MMM / 3M Company | 0.01 | 1.42 | 1.17 | 4.28 | 1.2567 | 0.0116 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | 7.08 | 1.11 | -2.29 | 1.1901 | -0.0684 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -4.90 | 1.09 | -2.59 | 1.1718 | -0.0711 | |||

| CSCO / Cisco Systems, Inc. | 0.04 | 19.44 | 1.08 | 39.15 | 1.1568 | 0.2979 | |||

| ABT / Abbott Laboratories | 0.03 | 4.93 | 0.96 | 3.65 | 1.0365 | 0.0033 | |||

| XLNX / Xilinx, Inc. | 0.02 | 0.00 | 0.96 | 3.88 | 1.0354 | 0.0056 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.01 | -22.06 | 0.85 | -20.28 | 0.9162 | -0.2712 | |||

| SYY / Sysco Corporation | 0.02 | 0.00 | 0.85 | -2.87 | 0.9087 | -0.0579 | |||

| STT / State Street Corporation | 0.01 | 0.00 | 0.82 | 10.35 | 0.8818 | 0.0562 | |||

| HD / The Home Depot, Inc. | 0.01 | -15.35 | 0.81 | -6.13 | 0.8711 | -0.0877 | |||

| ABBV / AbbVie Inc. | 0.02 | -12.69 | 0.80 | -11.56 | 0.8550 | 0.8550 | |||

| ROK / Rockwell Automation, Inc. | 0.01 | 68.93 | 0.78 | 62.66 | 0.8421 | 0.8421 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.02 | -5.06 | 0.78 | -6.34 | 0.8410 | -0.0867 | |||

| CVS / CVS Health Corporation | 0.01 | 45.88 | 0.78 | 51.75 | 0.8378 | 0.2674 | |||

| AEPFX / Europacific Growth Fund - EuroPacific Growth Fund, Class F-2 | 0.02 | -41.25 | 0.77 | -41.66 | 0.8228 | -0.6343 | |||

| RTX / RTX Corporation | 0.01 | 4.61 | 0.74 | 3.95 | 0.7916 | 0.0048 | |||

| SYK / Stryker Corporation | 0.01 | -4.33 | 0.71 | -5.18 | 0.7669 | -0.0687 | |||

| GIS / General Mills, Inc. | 0.01 | 0.00 | 0.67 | -1.47 | 0.7196 | -0.0350 | |||

| WAG / | 0.01 | -0.90 | 0.64 | -8.26 | 0.6917 | -0.0873 | |||

| MA / Mastercard Incorporated | 0.00 | 16.00 | 0.62 | 22.95 | 0.6616 | 0.1057 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.01 | 48.47 | 0.61 | 58.18 | 0.6541 | 0.6541 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.01 | 27.48 | 0.61 | 15.78 | 0.6541 | 0.0704 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | 35.74 | 0.61 | 34.67 | 0.6509 | 0.1515 | |||

| TGT / Target Corporation | 0.01 | 0.00 | 0.55 | 0.55 | 0.5865 | -0.0161 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.01 | 0.00 | 0.54 | -2.54 | 0.5779 | -0.0347 | |||

| PFE / Pfizer Inc. | 0.02 | 0.00 | 0.54 | -2.90 | 0.5757 | -0.0369 | |||

| AMGN / Amgen Inc. | 0.01 | 0.00 | 0.53 | -3.82 | 0.5682 | -0.0422 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 0.00 | 0.52 | -0.77 | 0.5532 | -0.0228 | |||

| JCI / Johnson Controls International plc | 0.01 | 23.19 | 0.50 | 25.69 | 0.5413 | 0.0963 | |||

| USB / U.S. Bancorp | 0.01 | 0.00 | 0.49 | 6.55 | 0.5242 | 0.0159 | |||

| US0325111070 / Anadarko Petroleum Corp. | 0.01 | -16.79 | 0.47 | -18.24 | 0.5102 | -0.1346 | |||

| AAPL / Apple Inc. | 0.00 | 0.47 | 0.5005 | 0.5005 | |||||

| APD / Air Products and Chemicals, Inc. | 0.01 | 0.00 | 0.47 | 4.97 | 0.4995 | 0.0078 | |||

| KO / The Coca-Cola Company | 0.01 | 0.00 | 0.42 | -0.93 | 0.4554 | -0.0196 | |||

| DYAX / Dyax Corp. | 0.11 | 0.00 | 0.40 | -20.52 | 0.4243 | -0.1273 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.01 | 0.00 | 0.39 | -9.49 | 0.4200 | -0.0594 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 0.00 | 0.38 | 8.57 | 0.4082 | 0.0197 | |||

| EMC / Global X Funds - Global X Emerging Markets Great Consumer ETF | 0.02 | 0.38 | 0.4071 | 0.4071 | |||||

| VANGUARD TOTAL STOCK MARKET IN / Equity Mutual Fu (922908488) | 0.01 | 0.37 | 0.0000 | ||||||

| SIAL / Sigma-Aldrich Corporation | 0.00 | -12.62 | 0.36 | -9.65 | 0.3920 | -0.0563 | |||

| GLW / Corning Incorporated | 0.02 | 6.58 | 0.35 | 13.82 | 0.3716 | 0.0343 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 0.34 | 5.20 | 0.3695 | 0.0066 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -22.00 | 0.33 | -13.61 | 0.3545 | -0.0695 | |||

| ILMN / Illumina, Inc. | 0.00 | 0.00 | 0.33 | 38.89 | 0.3491 | 0.3491 | |||

| ATR / AptarGroup, Inc. | 0.01 | 14.26 | 0.32 | 9.86 | 0.3469 | 0.3469 | |||

| CL / Colgate-Palmolive Company | 0.01 | 102.78 | 0.31 | -1.57 | 0.3373 | -0.0167 | |||

| FIS / Fidelity National Information Services, Inc. | 0.01 | 0.00 | 0.31 | 8.28 | 0.3373 | 0.0154 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | 0.00 | 0.30 | 9.96 | 0.3201 | 0.0193 | |||

| DIS / The Walt Disney Company | 0.00 | 0.00 | 0.29 | 11.11 | 0.3115 | 0.0218 | |||

| 61166W101 / Monsanto Co. | 0.00 | 8.12 | 0.28 | 1.07 | 0.3040 | 0.3040 | |||

| NUE / Nucor Corporation | 0.01 | 0.00 | 0.28 | -6.10 | 0.2975 | -0.0299 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.26 | 19.07 | 0.2750 | 0.0364 | |||

| AKAM / Akamai Technologies, Inc. | 0.01 | 0.00 | 0.25 | 20.67 | 0.2696 | 0.0388 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.00 | 0.25 | 0.2664 | 0.2664 | |||||

| BHI / Baker Hughes Inc. | 0.00 | -7.55 | 0.23 | -8.13 | 0.2427 | -0.0303 | |||

| DBC / Invesco DB Commodity Index Tracking Fund | 0.01 | 0.00 | 0.23 | -8.16 | 0.2417 | -0.0302 | |||

| ADI / Analog Devices, Inc. | 0.01 | 0.00 | 0.23 | -3.02 | 0.2417 | -0.0158 | |||

| CHD / Church & Dwight Co., Inc. | 0.00 | 0.00 | 0.22 | -4.39 | 0.2342 | 0.2342 | |||

| IBM / International Business Machines Corporation | 0.00 | -56.63 | 0.20 | -61.10 | 0.2127 | -0.3522 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.19 | 10.98 | 0.2062 | 0.2062 | |||

| CB / Chubb Limited | 0.00 | 0.00 | 0.17 | -3.43 | 0.1815 | 0.1815 | |||

| SPGI / S&P Global Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2308 | ||||

| STO / Statoil ASA | 0.00 | -100.00 | 0.00 | -100.00 | -0.2741 | ||||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.2575 | ||||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.00 | -100.00 | 0.00 | -100.00 | -0.2464 | ||||

| T / AT&T Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| NSC / Norfolk Southern Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.3629 |