Mga Batayang Estadistika

| Nilai Portofolio | $ 223,973,988 |

| Posisi Saat Ini | 105 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

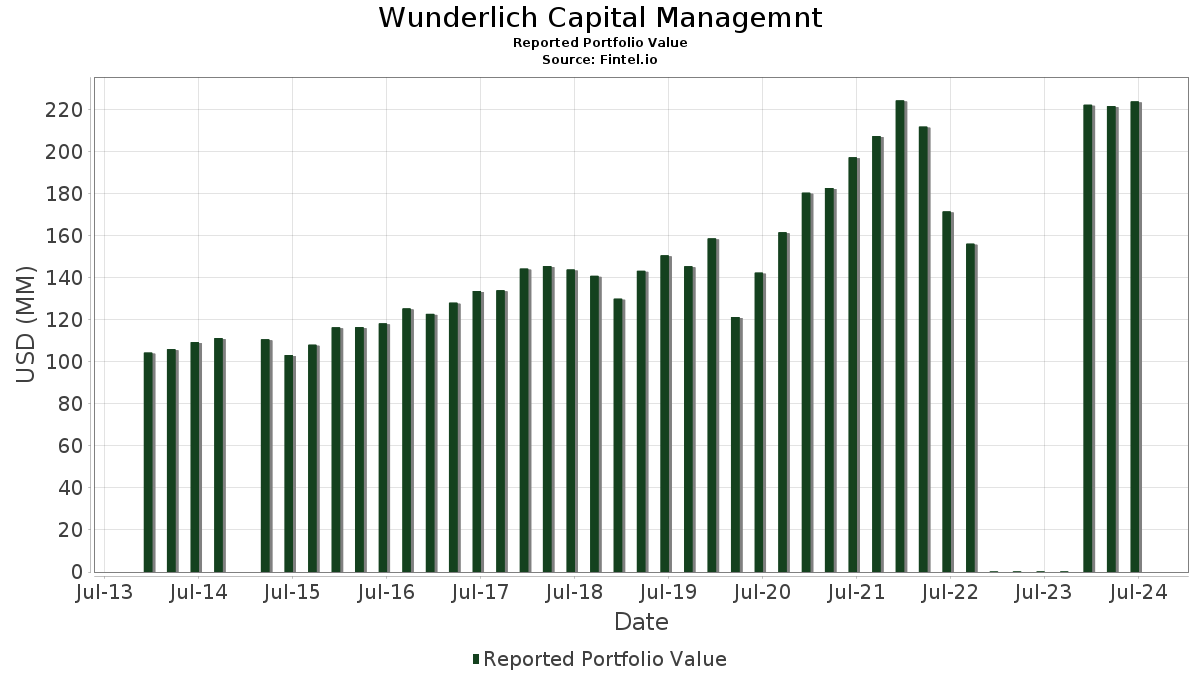

Wunderlich Capital Managemnt telah mengungkapkan total kepemilikan 105 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 223,973,988 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Wunderlich Capital Managemnt adalah J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Ultra-Short Income ETF (US:JPST) , Alphabet Inc. (US:GOOGL) , Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , and Apple Inc. (US:AAPL) . Posisi baru Wunderlich Capital Managemnt meliputi: The New York Times Company (US:NYT) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.32 | 16.27 | 7.2623 | 0.8504 | |

| 0.04 | 7.39 | 3.3008 | 0.5443 | |

| 0.03 | 6.74 | 3.0080 | 0.5259 | |

| 0.00 | 6.10 | 2.7225 | 0.4155 | |

| 0.00 | 0.72 | 0.3228 | 0.3107 | |

| 0.02 | 4.85 | 2.1652 | 0.2270 | |

| 0.04 | 6.79 | 3.0311 | 0.1921 | |

| 0.01 | 3.36 | 1.5004 | 0.1902 | |

| 0.03 | 4.15 | 1.8519 | 0.1889 | |

| 0.02 | 7.26 | 3.2424 | 0.1588 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | 0.0020 | -0.6768 | |

| 0.00 | 0.00 | 0.0019 | -0.3535 | |

| 0.00 | 0.00 | -0.2547 | ||

| 0.01 | 3.39 | 1.5145 | -0.2289 | |

| 0.01 | 3.20 | 1.4299 | -0.1964 | |

| 0.01 | 2.77 | 1.2363 | -0.1831 | |

| 0.00 | 0.00 | -0.1708 | ||

| 0.01 | 1.93 | 0.8600 | -0.1662 | |

| 0.01 | 3.74 | 1.6692 | -0.1322 | |

| 0.01 | 1.88 | 0.8414 | -0.1118 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2024-08-14 untuk periode pelaporan 2024-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPST / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Ultra-Short Income ETF | 0.32 | 14.35 | 16.27 | 14.40 | 7.2623 | 0.8504 | |||

| GOOGL / Alphabet Inc. | 0.04 | 0.21 | 7.39 | 20.94 | 3.3008 | 0.5443 | |||

| MSFT / Microsoft Corporation | 0.02 | -0.03 | 7.26 | 6.22 | 3.2424 | 0.1588 | |||

| AMZN / Amazon.com, Inc. | 0.04 | 0.65 | 6.79 | 7.83 | 3.0311 | 0.1921 | |||

| AAPL / Apple Inc. | 0.03 | -0.35 | 6.74 | 22.40 | 3.0080 | 0.5259 | |||

| AVGO / Broadcom Inc. | 0.00 | -1.61 | 6.10 | 19.18 | 2.7225 | 0.4155 | |||

| META / Meta Platforms, Inc. | 0.01 | -1.03 | 5.51 | 2.78 | 2.4579 | 0.0422 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.06 | 1.42 | 5.33 | 0.34 | 2.3785 | -0.0157 | |||

| VMBS / Vanguard Scottsdale Funds - Vanguard Mortgage-Backed Securities ETF | 0.11 | 3.32 | 4.90 | 2.83 | 2.1891 | 0.0393 | |||

| AMAT / Applied Materials, Inc. | 0.02 | -1.40 | 4.85 | 12.82 | 2.1652 | 0.2270 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.07 | 1.15 | 4.73 | 0.34 | 2.1108 | -0.0138 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.06 | 1.05 | 4.49 | 1.01 | 2.0062 | 0.0001 | |||

| PWR / Quanta Services, Inc. | 0.02 | -2.25 | 4.33 | -4.39 | 1.9331 | -0.1091 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -0.55 | 4.29 | 8.59 | 1.9138 | 0.1338 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -1.59 | 4.19 | -0.62 | 1.8709 | -0.0306 | |||

| ORCL / Oracle Corporation | 0.03 | 0.05 | 4.15 | 12.48 | 1.8519 | 0.1889 | |||

| EOG / EOG Resources, Inc. | 0.03 | 2.13 | 4.14 | 0.56 | 1.8498 | -0.0082 | |||

| ETN / Eaton Corporation plc | 0.01 | -1.86 | 4.08 | -1.59 | 1.8219 | -0.0479 | |||

| HCA / HCA Healthcare, Inc. | 0.01 | -0.84 | 4.06 | -4.48 | 1.8106 | -0.1039 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -1.23 | 3.96 | 7.85 | 1.7663 | 0.1122 | |||

| MAR / Marriott International, Inc. | 0.02 | -0.23 | 3.81 | -4.39 | 1.7015 | -0.0960 | |||

| V / Visa Inc. | 0.01 | -0.49 | 3.74 | -6.41 | 1.6692 | -0.1322 | |||

| VCIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Corporate Bond ETF | 0.05 | 1.14 | 3.72 | 0.40 | 1.6613 | -0.0098 | |||

| MUB / iShares Trust - iShares National Muni Bond ETF | 0.03 | 2.08 | 3.47 | 1.08 | 1.5485 | 0.0012 | |||

| FDX / FedEx Corporation | 0.01 | 4.50 | 3.45 | 8.16 | 1.5382 | 0.1016 | |||

| WMT / Walmart Inc. | 0.05 | -1.54 | 3.40 | 10.78 | 1.5193 | 0.1344 | |||

| CRM / Salesforce, Inc. | 0.01 | 2.78 | 3.39 | -12.26 | 1.5145 | -0.2289 | |||

| ADBE / Adobe Inc. | 0.01 | 5.05 | 3.36 | 15.66 | 1.5004 | 0.1902 | |||

| C.WSA / Citigroup, Inc. | 0.00 | 0.96 | 3.30 | -4.65 | 1.4743 | -0.0874 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 5.47 | 3.26 | 8.56 | 1.4563 | 0.1016 | |||

| CB / Chubb Limited | 0.01 | -0.16 | 3.25 | -1.72 | 1.4505 | -0.0402 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 2.61 | 3.20 | -11.20 | 1.4299 | -0.1964 | |||

| UNP / Union Pacific Corporation | 0.01 | 1.95 | 3.11 | -6.21 | 1.3895 | -0.1067 | |||

| SUB / iShares Trust - iShares Short-Term National Muni Bond ETF | 0.03 | 1.58 | 3.02 | 1.41 | 1.3477 | 0.0054 | |||

| CMCSA / Comcast Corporation | 0.08 | 4.90 | 2.99 | -5.26 | 1.3354 | -0.0879 | |||

| AMGN / Amgen Inc. | 0.01 | 4.74 | 2.87 | 15.10 | 1.2831 | 0.1572 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | -0.43 | 2.77 | -12.01 | 1.2363 | -0.1831 | |||

| SCHW / The Charles Schwab Corporation | 0.04 | 0.45 | 2.69 | 2.32 | 1.2023 | 0.0155 | |||

| HON / Honeywell International Inc. | 0.01 | 2.55 | 2.63 | 6.69 | 1.1748 | 0.0626 | |||

| TXN / Texas Instruments Incorporated | 0.01 | -0.26 | 2.50 | 11.34 | 1.1184 | 0.1041 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 0.41 | 2.50 | 8.38 | 1.1148 | 0.0760 | |||

| STZ / Constellation Brands, Inc. | 0.01 | 4.48 | 2.35 | -1.10 | 1.0483 | -0.0222 | |||

| KR / The Kroger Co. | 0.04 | 6.32 | 2.24 | -7.07 | 0.9980 | -0.0868 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 1.78 | 2.20 | -8.51 | 0.9841 | -0.1026 | |||

| CSCO / Cisco Systems, Inc. | 0.04 | 1.49 | 2.08 | -3.38 | 0.9306 | -0.0422 | |||

| UBER / Uber Technologies, Inc. | 0.03 | 25.47 | 2.08 | 18.43 | 0.9300 | 0.1370 | |||

| BAC / Bank of America Corporation | 0.05 | 2.77 | 2.06 | 7.79 | 0.9210 | 0.0580 | |||

| FANG / Diamondback Energy, Inc. | 0.01 | 2.53 | 1.97 | 3.58 | 0.8796 | 0.0219 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.51 | 1.96 | -4.35 | 0.8738 | -0.0490 | |||

| IQV / IQVIA Holdings Inc. | 0.01 | 1.23 | 1.93 | -15.34 | 0.8600 | -0.1662 | |||

| A / Agilent Technologies, Inc. | 0.01 | 0.08 | 1.88 | -10.84 | 0.8414 | -0.1118 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -4.33 | 1.85 | -0.48 | 0.8269 | -0.0121 | |||

| COP / ConocoPhillips | 0.02 | 6.40 | 1.75 | -4.37 | 0.7812 | -0.0440 | |||

| WDAY / Workday, Inc. | 0.01 | 13.50 | 1.51 | -6.95 | 0.6753 | -0.0578 | |||

| WFC / Wells Fargo & Company | 0.02 | 10.66 | 1.45 | 13.39 | 0.6469 | 0.0707 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | -4.27 | 1.43 | -7.93 | 0.6379 | -0.0619 | |||

| PEP / PepsiCo, Inc. | 0.01 | 8.54 | 1.39 | 2.29 | 0.6196 | 0.0078 | |||

| HSY / The Hershey Company | 0.01 | 7.34 | 1.11 | 1.46 | 0.4969 | 0.0022 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.01 | 0.00 | 1.07 | -1.57 | 0.4760 | -0.0128 | |||

| ABBV / AbbVie Inc. | 0.01 | 0.81 | 1.03 | -5.07 | 0.4597 | -0.0293 | |||

| MRK / Merck & Co., Inc. | 0.01 | 6.39 | 1.02 | -0.20 | 0.4544 | -0.0054 | |||

| IEI / iShares Trust - iShares 3-7 Year Treasury Bond ETF | 0.01 | 6.09 | 1.00 | 5.85 | 0.4444 | 0.0201 | |||

| FI / Fiserv, Inc. | 0.01 | 9.43 | 0.90 | 2.05 | 0.4007 | 0.0041 | |||

| DE / Deere & Company | 0.00 | 6.11 | 0.80 | -3.48 | 0.3593 | -0.0167 | |||

| AZO / AutoZone, Inc. | 0.00 | 6.91 | 0.78 | 0.52 | 0.3481 | -0.0016 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 2,685.44 | 0.72 | 2,676.92 | 0.3228 | 0.3107 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -0.82 | 0.57 | 11.18 | 0.2534 | 0.0233 | |||

| EWJ / iShares, Inc. - iShares MSCI Japan ETF | 0.01 | -4.75 | 0.36 | -8.91 | 0.1602 | -0.0174 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.00 | 14.84 | 0.34 | 32.42 | 0.1515 | 0.0357 | |||

| AAXJ / iShares Trust - iShares MSCI All Country Asia ex Japan ETF | 0.00 | -3.15 | 0.34 | 3.05 | 0.1510 | 0.0028 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.01 | -5.39 | 0.34 | -9.16 | 0.1505 | -0.0172 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 1.28 | 0.34 | -2.33 | 0.1500 | -0.0050 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.01 | -2.91 | 0.33 | 0.60 | 0.1493 | -0.0005 | |||

| ICOW / Pacer Funds Trust - Pacer Developed Markets International Cash Cows 100 ETF | 0.01 | -2.67 | 0.31 | -7.55 | 0.1368 | -0.0126 | |||

| COWZ / Pacer Funds Trust - Pacer US Cash Cows 100 ETF | 0.01 | -2.79 | 0.29 | -8.86 | 0.1287 | -0.0139 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.00 | 0.28 | -11.56 | 0.1265 | -0.0182 | |||

| ADI / Analog Devices, Inc. | 0.00 | -0.91 | 0.27 | 14.29 | 0.1216 | 0.0142 | |||

| Canadian Pacific Railway / (13645T100) | 0.00 | 0.27 | 0.0000 | ||||||

| DHR / Danaher Corporation | 0.00 | -0.92 | 0.24 | -0.82 | 0.1082 | -0.0020 | |||

| WAT / Waters Corporation | 0.00 | -0.77 | 0.22 | -16.42 | 0.1001 | -0.0208 | |||

| C / Citigroup Inc. | 0.00 | 0.00 | 0.18 | 0.00 | 0.0803 | -0.0005 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.00 | 0.00 | 0.11 | -0.91 | 0.0490 | -0.0009 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.00 | 0.00 | 0.07 | 0.00 | 0.0320 | -0.0003 | |||

| SYY / Sysco Corporation | 0.00 | 0.07 | 0.0319 | 0.0319 | |||||

| MAA / Mid-America Apartment Communities, Inc. | 0.00 | 0.00 | 0.07 | 7.69 | 0.0315 | 0.0021 | |||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.00 | 0.00 | 0.06 | 0.00 | 0.0246 | -0.0004 | |||

| LULU / lululemon athletica inc. | 0.00 | -33.21 | 0.05 | -49.02 | 0.0233 | -0.0228 | |||

| TSCO / Tractor Supply Company | 0.00 | -67.86 | 0.04 | -66.97 | 0.0163 | -0.0333 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.04 | 0.0162 | 0.0162 | |||||

| NYT / The New York Times Company | 0.00 | 0.03 | 0.0148 | 0.0148 | |||||

| KMI / Kinder Morgan, Inc. | 0.00 | 0.03 | 0.0144 | 0.0144 | |||||

| MPC / Marathon Petroleum Corporation | 0.00 | 0.00 | 0.03 | -13.33 | 0.0116 | -0.0020 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.03 | 19.05 | 0.0115 | 0.0019 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 0.00 | 0.02 | 10.00 | 0.0102 | 0.0007 | |||

| DVN / Devon Energy Corporation | 0.00 | 0.00 | 0.01 | -7.14 | 0.0061 | -0.0004 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.01 | -7.14 | 0.0060 | -0.0008 | |||

| CME / CME Group Inc. | 0.00 | 0.00 | 0.01 | -7.69 | 0.0057 | -0.0006 | |||

| Apollo / (03769M109) | 0.00 | 0.01 | 0.0000 | ||||||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.01 | 0.0050 | 0.0050 | |||||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.00 | -75.56 | 0.01 | -76.74 | 0.0048 | -0.0147 | |||

| BX / Blackstone Inc. | 0.00 | 0.01 | 0.0048 | 0.0048 | |||||

| APD / Air Products and Chemicals, Inc. | 0.00 | 0.00 | 0.01 | 12.50 | 0.0041 | 0.0002 | |||

| AIG / American International Group, Inc. | 0.00 | 0.01 | 0.0037 | 0.0037 | |||||

| BA / The Boeing Company | 0.00 | -99.68 | 0.00 | -99.73 | 0.0020 | -0.6768 | |||

| PYPL / PayPal Holdings, Inc. | 0.00 | -99.36 | 0.00 | -99.49 | 0.0019 | -0.3535 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -100.00 | 0.00 | -100.00 | -0.1708 | ||||

| EGP / EastGroup Properties, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INTU / Intuit Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.2547 | ||||

| COST / Costco Wholesale Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0578 | ||||

| JNJ / Johnson & Johnson | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CSX / CSX Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| Palo Alto Netwroks / (416202103) | 0.00 | -100.00 | 0.00 | 0.0000 |