Bret Kenwell

Bret Kenwell has been publicly writing about and analyzing the stock market for more than 10 years. What started off as fundamental analysis of strong businesses has morphed into a rigorous process that blends both fundamental and technical analysis. While he still seeks out the strong businesses and dependable dividends he was attracted to early on, Bret has narrowed his focus to technology, automotive, and high-quality, high-growth businesses. In that effort, he seeks Future Blue Chips — which is also the name of his website and newsletter. Bret’s writing has sent him to unique places and events, like auto shows and industry conferences. Those excursions allowed him to fully grasp what Nvidia was showcasing at its GTC conferences and see some of the impressive updates on display at the automotive show. Through this he gained incredible insight into, and conviction in, what have become some of today’s best-performing stocks. It’s also allowed him to meet some very smart, very talented investors. Perhaps more than anything, their lessons, findings, and techniques have found a way into his process over the years. There are a million different ways to make money in the stock market. To find the process that works best for you is long and filled with setbacks. Bret’s hope is that part of his process can become part of yours; and together become better investors.

by Bret Kenwell

- 2023-07-28

Many investors brush off or ignore options trading because options are complex and misunderstood.

DIS

AAPL

LCID

XPEV

SNAP

NVDA

by Bret Kenwell

- 2023-07-25

While many investors brush off options, many others like to “follow the flow.” In other words, they want to know what the big funds and institutions are doing. We can follow their footsteps when looking for unusual options activity. Thankfully, there’s a leaderboard of options activity for both calls and puts, helping us keep track of it all when we see outsized volume. Notably, the options activi

MSFT

AMZN

XOM

MRK

TSLA

LCID

CVS

CAT

MSFT

ATVI

by Bret Kenwell

- 2023-07-14

Many investors don’t pay attention to them, because options are too confusing and there can be multiple implications from a single data point.

NKE

TSLA

META

NVDA

DIS

by Bret Kenwell

- 2023-05-22

Many investors don’t pay attention to unusual options activity because options are too confusing and there can be multiple implications from a single data point.

QCOM

NVDA

MRNA

MSFT

ENPH

META

by Bret Kenwell

- 2023-04-14

Many investors brush off unusual options activity, but others like to “follow the flow.

KRE

QQQ

GDX

XRT

EWY

XLF

by Bret Kenwell

- 2023-04-08

Unusual options activity is often ignored by many investors, but for some, it plays a key role in their trading strategies and approach.

AI

BABA

GOOGL

PYPL

NVDA

TSLA

NIO

WFC

by Bret Kenwell

- 2023-04-04

Like stocks, exchange-traded funds can have unusual options activity too. Many investors brush off or ignore ETF options trading because options are complex and misunderstood. However, many other traders have learned how to “follow the flow.” In other words, they want to know what the big funds and institutions are doing. When these buyers make their move in the options world, they leave a trail b

UNG

ARKK

EFA

SLV

XLU

KRE

SPY

by Bret Kenwell

- 2023-04-03

While many investors brush off options, many others like to “follow the flow.” They want to know what the big funds and institutions are doing. We can follow their footsteps when looking for unusual options activity. Fortunately, there’s Fintel's leaderboard of options activity for both calls and puts, helping us keep track of it all when we see outsized volume. What are we seeing? Let’s look at 1

TSLA

DIS

GOOGL

AMZN

SI

BABA

NVDA

JNJ

SQ

SPOT

by Bret Kenwell

- 2023-03-10

Many investors brush off unusual options activity, but others like to “follow the flow.

TSLA

HD

PYPL

AAPL

DIS

GS

NVDA

by Bret Kenwell

- 2023-02-27

While many investors brush off options, many others like to “follow the flow.” In other words, they want to know what the big funds and institutions are doing. We can follow their footsteps when looking for unusual options activity. Fortunately for Fintel readers, there’s a leaderboard of options activity for both calls and puts, helping us keep track of it all when we see outsized volume. With th

EEM

HYG

XLE

LQD

ITB

FXI

KWEB

XLK

UNG

GDX

by Bret Kenwell

- 2023-02-21

While many investors brush off options, many others like to “follow the flow.” In other words, they want to know what the big funds and institutions are doing. We can follow their footsteps when looking for unusual options activity. Thankfully, there’s a leaderboard of options activity for both calls and puts, helping us keep track of it all when we see outsized volume. With that in mind, let’s lo

BABA

AMGN

INTC

SNOW

XOM

ENPH

F

CRM

CVX

NIO

by Bret Kenwell

- 2023-01-15

While many investors brush off options, many others like to “follow the flow.” In other words, they want to know what the big funds and institutions are doing. We can follow their footsteps when looking for unusual options activity. Thankfully, there’s a leaderboard of options activity for both calls and puts, helping us keep track of it all when we see outsized volume. With that in mind, let’s lo

FSLR

ABBV

TMO

BRK.B

GOLD

JPM

WFC

LMT

UPS

by Bret Kenwell

- 2022-12-19

Elon Musk sold an additional 22 million shares of Tesla (US:TSLA) stock worth about $3.

TSLA

SOFI

VFC

NRG

RKT

KRT

by Bret Kenwell

- 2022-12-19

On Friday morning, it was announced that Advent International would acquire Maxar Technologies (US:MAXR) for $6.

MAXR

:max_bytes(150000):strip_icc()/shutterstock_318403496.jpgoptionstrading-5c36153746e0fb00017f9287.jpg)

by Bret Kenwell

- 2022-12-05

Insiders can sell for a whole host of reasons, including to make other investments, buy a house and pay for life's expenses.

DDD

RKT

KRT

CVNA

PLD

LYV

AAPL

COSM

by Bret Kenwell

- 2022-11-23

Insider buying always draws interest from investors. Insiders can sell for a whole host of reasons, including to make other investments, buy a house and pay for life’s expenses. Put simply, insider selling doesn’t have to mean the insider is necessarily bearish on the underlying stock. However, insiders only buy for one reason and that’s because they believe the stock price is going higher. As Pet

INTC

HD

CRON

OSTK

by Bret Kenwell

- 2022-11-15

Unlike most funds, Berkshire Hathaway (US:BRK.A, US:BRK.B) is a public company, which means we get a good idea of what Warren Buffett and Charlie Munger are buying and selling when the company reports earnings. However, it also helps when the firm files its Form 13F with the U.S. Securities and Exchange Commission (SEC). The report, which comes 45 days after the end of the quarter, shows what Berk

BRK.A

BRK.B

OXY

CVX

USB

JEF

LPX

TSM

GM

ATVI

KR

BK

AAPL

by

- 2022-11-09

Now that his $44 billion purchase of Twitter is complete, Tesla (US:TSLA) CEO Elon Musk has sold more Tesla stock.

TSLA

by Bret Kenwell

- 2022-11-04

Many investors brush off options, but others like to “follow the flow.” When large investors — like hedge funds for example — make big moves in the options world, it shows up in a very interesting way. We refer to this as “unusual options activity” and it serves as a way to see what the big investors are doing. Luckily there’s a leaderboard of options activity for both calls and puts and it helps

CARG

LLY

GME

SOFI

ETSY

SCHW

RUM

PSX

FEZ

VOYA

by Bret Kenwell

- 2022-10-22

David Einhorn’s Greenlight Capital recently released its third-quarter letter to investors, reporting a 17.

CC

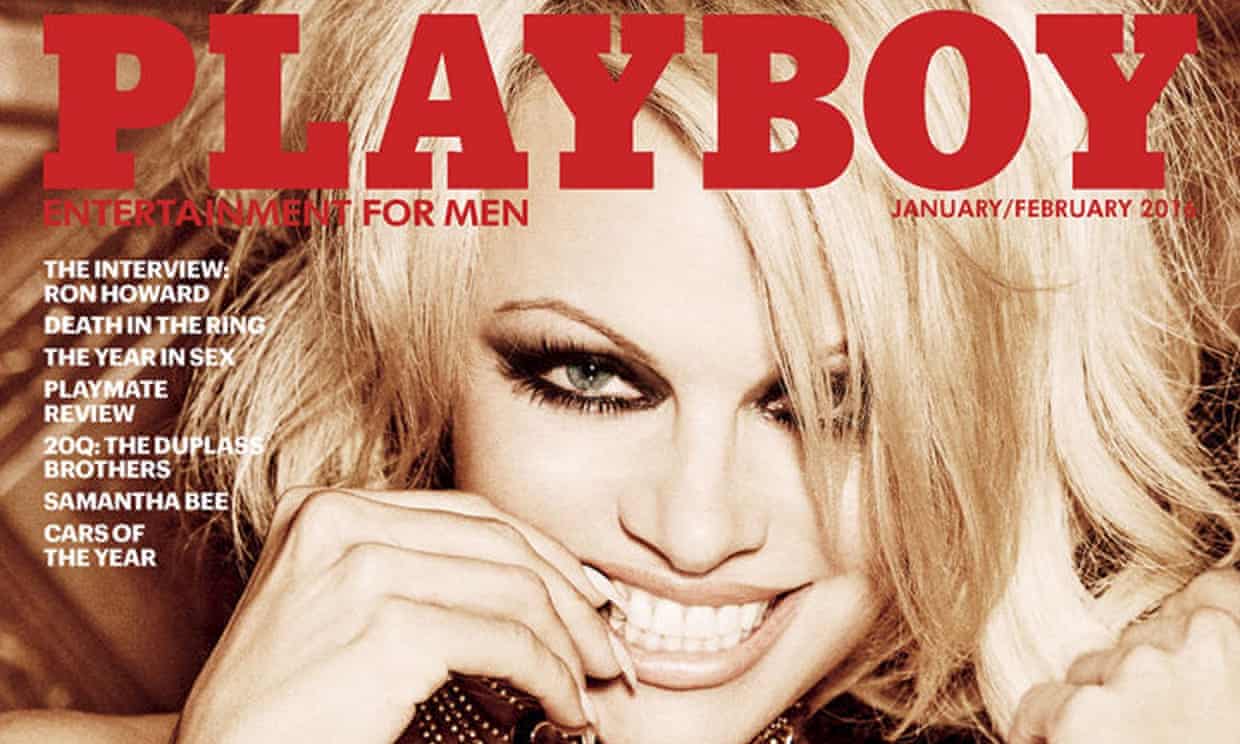

PLBY

INSW

by Bret Kenwell

- 2022-10-21

Unusual options activity is ignored by many investors, but for some, it plays a key role in their trading strategies and approach.

TSLA

INTC

GOLD

LMT

TWTR

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F22036102%2FNew_Beyond_Burger_Hero.jpg&w=1200&q=75)

by Bret Kenwell

- 2022-10-14

Plant-based protein company Beyond Meat (US:BYND) shares fell on Friday after the company revealed a series of cost-cutting plans, including a 20% companywide layoff and related $4 million charge, and said a scandal-plagued executive is leaving.

BYND

TSN

by Bret Kenwell

- 2022-10-07

While many investors brush off options, others like to “follow the flow.” In other words, they want to know what the big funds and institutions are doing. We can follow in their footsteps when looking for unusual options activity. Thankfully, there’s a leaderboard of options activity for both calls and puts, helping flag unusual volume. Mindful of that, here are ten stocks with heavy call flow las

CANO

FXI

NKLA

LI

FTCH

GOLD

QSR

PCVX

DPZ

KROS

by Bret Kenwell

- 2022-10-01

Insiders buying stocks generally indicates a positive outlook from investors most in the know.

SBUX

ADBE

LLY

NAUT

LPTV

UNFI

by Bret Kenwell

- 2022-09-12

Warren Buffett’s Berkshire Hathaway confirmed a 20.2% stake in Occidental Petroleum (US:OXY). Berkshire now controls a 28.6% stake, or 272.2 million shares, including warrants, of Occidental. Berkshire's stake passed 10% in March and topped 15% in May. Here is the complete timeline of Buffett's purchases. There are also reports Buffett has regulatory approval to acquire up to 50% of Occidental Pet

OXY

BRK.B

BRK.A

CVX

LSXMA

KHC

DVA

AXP

by Bret Kenwell

- 2022-09-07

There are a million reasons to sell a stock, but only one to buy: you believe the stock will rise.

RILY

AAT

COMM

TMCI

RKT

by Bret Kenwell

- 2022-08-16

It's 13F season, and as a result, we're getting an updated look at what some of today's best investors are doing, and outspoken China watcher Ray Dalio is selling Chinese stocks.

BABA

PG

JD

BILI

NTES

TME

BIDU

by Bret Kenwell

- 2022-08-13

Insider buying tends to draw investor attention, as it logically demonstrates confidence in future price performance, while insiders may sell for various reasons.

ENPH

FSLR

TDW

SONM

OXY

CVX

ET

by Bret Kenwell

- 2022-08-10

Warren Buffett and Berkshire Hathaway (US:BRK.A, US:BRK.B) spent more than $40 billion this year buying large chunks of several companies' shares after keeping their powder dry during the height of the COVID-19 pandemic. Over the last several years, low volatility and a constant grind higher in the stock market had left Berkshire, Buffett, and Charlie Munger sitting on a record cash balance. This

BRK.A

BRK.B

OXY

CVX

XOM

HPQ

AAPL

ATVI

C

MSFT

by Bret Kenwell

- 2022-07-30

Insider buying always draws interest from investors. Insiders can sell for a whole host of reasons: Making other investments, buying a house and paying for life’s expenses. Further, it doesn’t necessarily mean that the insider believes the stock will move lower. More likely, the stock is a large part of their compensation package. However, insiders generally buy for one reason: Because they believ

TSLA

TWTR

HCCI

UAL

TCBI

JEF

by Bret Kenwell

- 2022-07-27

Occidental Petroleum (US:OXY) continues to find a constant bid in its stock price.

OXY

BRK.A

BRK.B