Mga Batayang Estadistika

| Nilai Portofolio | $ 18,702,346,980 |

| Posisi Saat Ini | 107 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

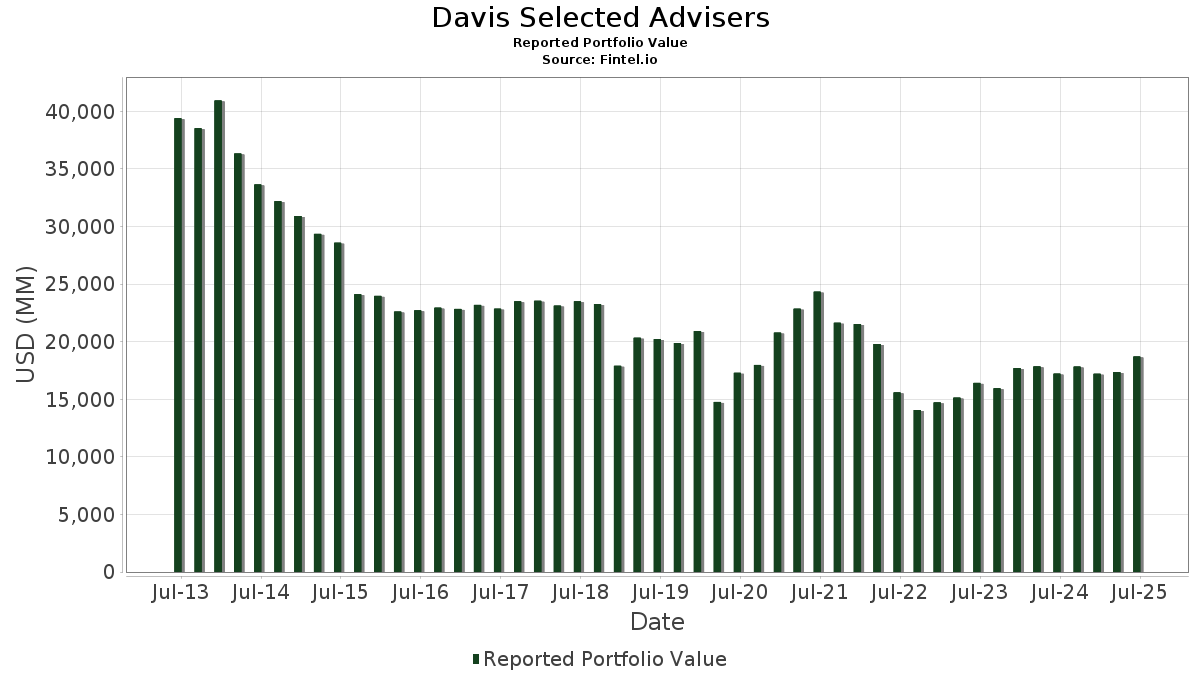

Davis Selected Advisers telah mengungkapkan total kepemilikan 107 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 18,702,346,980 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Davis Selected Advisers adalah Capital One Financial Corporation (US:COF) , Meta Platforms, Inc. (US:META) , Applied Materials, Inc. (US:AMAT) , U.S. Bancorp (US:USB) , and MGM Resorts International (US:MGM) . Posisi baru Davis Selected Advisers meliputi: NVIDIA Corporation (US:NVDA) , Realty Income Corporation (US:O) , Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , . Industri unggulan Davis Selected Advisers adalah "Wholesale Trade-durable Goods" (sic 50) , "Electric, Gas, And Sanitary Services " (sic 49) , and "Health Services" (sic 80) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.13 | 353.43 | 1.8897 | 1.7433 | |

| 9.34 | 237.00 | 1.2672 | 1.2672 | |

| 19.33 | 874.76 | 4.6773 | 1.0541 | |

| 2.11 | 1,555.76 | 8.3185 | 0.9760 | |

| 8.96 | 501.02 | 2.6789 | 0.9578 | |

| 8.96 | 1,905.42 | 10.1882 | 0.8877 | |

| 23.82 | 819.21 | 4.3802 | 0.8242 | |

| 4.96 | 907.59 | 4.8528 | 0.6763 | |

| 5.75 | 172.42 | 0.9219 | 0.1786 | |

| 11.64 | 137.42 | 0.7348 | 0.1592 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 776.17 | 4.1501 | -3.0199 | |

| 0.66 | 216.82 | 1.1593 | -1.5585 | |

| 1.65 | 404.06 | 2.1605 | -1.3951 | |

| 1.35 | 243.29 | 1.3009 | -1.0283 | |

| 0.55 | 269.04 | 1.4385 | -0.6441 | |

| 2.28 | 85.16 | 0.4554 | -0.2484 | |

| 11.59 | 799.26 | 4.2736 | -0.2363 | |

| 1.07 | 310.53 | 1.6604 | -0.2306 | |

| 4.95 | 290.24 | 1.5519 | -0.2302 | |

| 1.77 | 243.29 | 1.3008 | -0.1704 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-08-07 | MGM / MGM Resorts International | 20,815,057 | 23,821,109 | 14.44 | 9.50 | 17.28 | ||

| 2025-08-07 | VTRS / Viatris Inc. | 64,948,236 | 66,375,520 | 2.20 | 6.20 | 3.33 | ||

| 2024-11-12 | HOLI / Hollysys Automation Technologies Ltd. | 5,248,240 | 0 | -100.00 | 0.00 | -100.00 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-08 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| COF / Capital One Financial Corporation | 8.96 | -0.49 | 1,905.42 | 18.09 | 10.1882 | 0.8877 | |||

| META / Meta Platforms, Inc. | 2.11 | -4.63 | 1,555.76 | 22.13 | 8.3185 | 0.9760 | |||

| AMAT / Applied Materials, Inc. | 4.96 | -0.71 | 907.59 | 25.25 | 4.8528 | 0.6763 | |||

| USB / U.S. Bancorp | 19.33 | 29.84 | 874.76 | 39.16 | 4.6773 | 1.0541 | |||

| MGM / MGM Resorts International | 23.82 | 14.44 | 819.21 | 32.78 | 4.3802 | 0.8242 | |||

| CVS / CVS Health Corporation | 11.59 | 0.33 | 799.26 | 2.15 | 4.2736 | -0.2363 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -31.64 | 776.17 | -37.61 | 4.1501 | -3.0199 | |||

| MKL / Markel Group Inc. | 0.37 | -0.09 | 741.28 | 6.74 | 3.9636 | -0.0394 | |||

| AMZN / Amazon.com, Inc. | 3.27 | -7.12 | 717.22 | 7.09 | 3.8349 | -0.0251 | |||

| WFC / Wells Fargo & Company | 8.18 | -3.45 | 655.10 | 7.75 | 3.5027 | -0.0014 | |||

| VTRS / Viatris Inc. | 66.38 | 2.20 | 592.73 | 4.78 | 3.1693 | -0.0913 | |||

| GOOGL / Alphabet Inc. | 2.85 | -6.09 | 503.03 | 7.02 | 2.6897 | -0.0195 | |||

| TSN / Tyson Foods, Inc. | 8.96 | 91.39 | 501.02 | 67.79 | 2.6789 | 0.9578 | |||

| TXN / Texas Instruments Incorporated | 2.38 | -2.09 | 494.18 | 13.12 | 2.6423 | 0.1244 | |||

| TECK / Teck Resources Limited | 11.03 | -1.39 | 445.59 | 9.30 | 2.3826 | 0.0328 | |||

| SOLV / Solventum Corporation | 5.49 | 3.87 | 416.56 | 3.59 | 2.2273 | -0.0903 | |||

| HUM / Humana Inc. | 1.65 | -29.11 | 404.06 | -34.50 | 2.1605 | -1.3951 | |||

| UNH / UnitedHealth Group Incorporated | 1.13 | 2,234.93 | 353.43 | 1,290.84 | 1.8897 | 1.7433 | |||

| CB / Chubb Limited | 1.07 | -1.34 | 310.53 | -5.35 | 1.6604 | -0.2306 | |||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 4.95 | 1.78 | 290.24 | -6.13 | 1.5519 | -0.2302 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.55 | -18.37 | 269.04 | -25.54 | 1.4385 | -0.6441 | |||

| DGX / Quest Diagnostics Incorporated | 1.35 | -43.29 | 243.29 | -39.79 | 1.3009 | -1.0283 | |||

| OC / Owens Corning | 1.77 | -1.02 | 243.29 | -4.69 | 1.3008 | -0.1704 | |||

| CTRA / Coterra Energy Inc. | 9.34 | 237.00 | 1.2672 | 1.2672 | |||||

| QSR / Restaurant Brands International Inc. | 3.42 | 1.40 | 226.69 | 0.87 | 1.2121 | -0.0833 | |||

| CI / The Cigna Group | 0.66 | -54.24 | 216.82 | -54.02 | 1.1593 | -1.5585 | |||

| AGCO / AGCO Corporation | 1.80 | -10.99 | 186.16 | -0.80 | 0.9954 | -0.0863 | |||

| JPM / JPMorgan Chase & Co. | 0.64 | -0.60 | 184.39 | 17.48 | 0.9859 | 0.0813 | |||

| BK / The Bank of New York Mellon Corporation | 1.90 | -0.64 | 172.97 | 7.94 | 0.9248 | 0.0012 | |||

| CPNG / Coupang, Inc. | 5.75 | -2.14 | 172.42 | 33.69 | 0.9219 | 0.1786 | |||

| DUSA / Davis Fundamental ETF Trust - Davis Select U.S. Equity ETF | 3.38 | 0.00 | 156.58 | 9.36 | 0.8372 | 0.0119 | |||

| COP / ConocoPhillips | 1.59 | 13.09 | 142.29 | -3.37 | 0.7608 | -0.0879 | |||

| YMM / Full Truck Alliance Co. Ltd. - Depositary Receipt (Common Stock) | 11.64 | 48.81 | 137.42 | 37.62 | 0.7348 | 0.1592 | |||

| MSFT / Microsoft Corporation | 0.25 | -3.34 | 123.34 | 28.08 | 0.6595 | 0.1044 | |||

| GOOGL / Alphabet Inc. | 0.65 | 0.57 | 115.37 | 14.19 | 0.6169 | 0.0346 | |||

| FITB / Fifth Third Bancorp | 2.51 | 2.10 | 103.35 | 7.13 | 0.5526 | -0.0034 | |||

| DINT / Davis Fundamental ETF Trust - Davis Select International ETF | 3.89 | 0.00 | 100.60 | 11.90 | 0.5379 | 0.0197 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.50 | 1.32 | 93.65 | 7.46 | 0.5007 | -0.0016 | |||

| DAR / Darling Ingredients Inc. | 2.44 | -1.33 | 92.71 | 19.83 | 0.4957 | 0.0498 | |||

| DFNL / Davis Fundamental ETF Trust - Davis Select Financial ETF | 2.13 | 0.00 | 91.46 | 9.32 | 0.4890 | 0.0068 | |||

| AXP / American Express Company | 0.27 | -0.34 | 86.28 | 18.15 | 0.4614 | 0.0404 | |||

| IAC / IAC Inc. | 2.28 | -14.19 | 85.16 | -30.25 | 0.4554 | -0.2484 | |||

| NTES / NetEase, Inc. - Depositary Receipt (Common Stock) | 0.59 | -0.46 | 79.85 | 30.15 | 0.4270 | 0.0733 | |||

| DWLD / Davis Fundamental ETF Trust - Davis Select Worldwide ETF | 1.92 | 0.00 | 79.41 | 9.95 | 0.4246 | 0.0083 | |||

| APP / AppLovin Corporation | 0.22 | 31.94 | 75.29 | 74.32 | 0.4026 | 0.1536 | |||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 0.45 | -12.89 | 71.70 | 6.77 | 0.3834 | -0.0037 | |||

| L / Loews Corporation | 0.60 | -0.29 | 54.75 | -0.56 | 0.2928 | -0.0246 | |||

| BAC / Bank of America Corporation | 1.15 | -0.24 | 54.58 | 13.12 | 0.2918 | 0.0137 | |||

| WCC / WESCO International, Inc. | 0.29 | 12.47 | 53.85 | 34.13 | 0.2879 | 0.0565 | |||

| NTB / The Bank of N.T. Butterfield & Son Limited | 1.06 | -0.58 | 47.04 | 13.12 | 0.2515 | 0.0118 | |||

| RKT / Rocket Companies, Inc. | 3.13 | -0.21 | 44.42 | 17.23 | 0.2375 | 0.0191 | |||

| RNR / RenaissanceRe Holdings Ltd. | 0.14 | -0.51 | 34.75 | 0.69 | 0.1858 | -0.0131 | |||

| BEKE / KE Holdings Inc. - Depositary Receipt (Common Stock) | 1.85 | -0.41 | 32.87 | -12.07 | 0.1757 | -0.0397 | |||

| ORCL / Oracle Corporation | 0.13 | -3.52 | 28.77 | 50.87 | 0.1538 | 0.0439 | |||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 2.95 | 7.87 | 28.63 | 4.95 | 0.1531 | -0.0042 | |||

| SCHW / The Charles Schwab Corporation | 0.30 | -0.39 | 27.05 | 16.10 | 0.1446 | 0.0103 | |||

| JCI / Johnson Controls International plc | 0.25 | -39.30 | 25.91 | -19.97 | 0.1385 | -0.0481 | |||

| AMT / American Tower Corporation | 0.09 | 3.05 | 20.26 | 4.67 | 0.1083 | -0.0032 | |||

| ANGI / Angi Inc. | 1.18 | -71.60 | 18.04 | -65.23 | 0.0964 | -0.1243 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.05 | -38.56 | 14.22 | -30.40 | 0.0760 | -0.0417 | |||

| BXP / Boston Properties, Inc. | 0.21 | 3.04 | 14.14 | 3.47 | 0.0756 | -0.0032 | |||

| NVDA / NVIDIA Corporation | 0.09 | 14.08 | 0.0753 | 0.0753 | |||||

| CUZ / Cousins Properties Incorporated | 0.46 | 2.98 | 13.82 | 4.82 | 0.0739 | -0.0021 | |||

| PLD / Prologis, Inc. | 0.13 | -24.76 | 13.58 | -29.25 | 0.0726 | -0.0380 | |||

| EG / Everest Group, Ltd. | 0.04 | -0.41 | 13.42 | -6.84 | 0.0718 | -0.0113 | |||

| REXR / Rexford Industrial Realty, Inc. | 0.38 | 3.13 | 13.34 | -6.29 | 0.0713 | -0.0107 | |||

| BRX / Brixmor Property Group Inc. | 0.50 | 2.90 | 12.98 | 0.93 | 0.0694 | -0.0047 | |||

| VTR / Ventas, Inc. | 0.20 | -18.72 | 12.84 | -25.36 | 0.0687 | -0.0305 | |||

| EQIX / Equinix, Inc. | 0.02 | 1.89 | 12.46 | -0.60 | 0.0666 | -0.0056 | |||

| NOAH / Noah Holdings Limited - Depositary Receipt (Common Stock) | 1.02 | -38.27 | 12.20 | -22.00 | 0.0652 | -0.0249 | |||

| DLR / Digital Realty Trust, Inc. | 0.07 | 1.98 | 11.93 | 24.07 | 0.0638 | 0.0084 | |||

| PSA / Public Storage | 0.04 | -18.81 | 11.85 | -20.40 | 0.0634 | -0.0225 | |||

| AVB / AvalonBay Communities, Inc. | 0.06 | 2.07 | 11.77 | -3.22 | 0.0629 | -0.0072 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.16 | 3.22 | 11.34 | -18.97 | 0.0607 | -0.0200 | |||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.34 | -0.57 | 11.21 | -21.08 | 0.0599 | -0.0219 | |||

| SHO / Sunstone Hotel Investors, Inc. | 1.16 | 45.94 | 10.03 | 34.62 | 0.0536 | 0.0107 | |||

| MTB / M&T Bank Corporation | 0.05 | -0.46 | 9.88 | 8.02 | 0.0528 | 0.0001 | |||

| SPG / Simon Property Group, Inc. | 0.06 | -13.68 | 9.44 | -16.45 | 0.0505 | -0.0146 | |||

| AMH / American Homes 4 Rent | 0.25 | 2.98 | 9.03 | -1.76 | 0.0483 | -0.0047 | |||

| CPT / Camden Property Trust | 0.08 | 2.80 | 8.86 | -5.28 | 0.0474 | -0.0065 | |||

| REG / Regency Centers Corporation | 0.12 | 3.12 | 8.68 | -0.42 | 0.0464 | -0.0038 | |||

| EXR / Extra Space Storage Inc. | 0.06 | -0.04 | 8.37 | -0.75 | 0.0448 | -0.0038 | |||

| ESS / Essex Property Trust, Inc. | 0.03 | 2.92 | 8.09 | -4.86 | 0.0432 | -0.0058 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.05 | 3.11 | 7.85 | -8.93 | 0.0420 | -0.0077 | |||

| EGP / EastGroup Properties, Inc. | 0.05 | 3.08 | 7.71 | -2.19 | 0.0412 | -0.0042 | |||

| STT / State Street Corporation | 0.07 | -0.62 | 7.68 | 18.04 | 0.0411 | 0.0036 | |||

| EQR / Equity Residential | 0.10 | 1.87 | 6.87 | -3.95 | 0.0367 | -0.0045 | |||

| DOC / Healthpeak Properties, Inc. | 0.39 | 57.69 | 6.81 | 36.55 | 0.0364 | 0.0077 | |||

| TFC / Truist Financial Corporation | 0.16 | -0.37 | 6.70 | 4.07 | 0.0358 | -0.0013 | |||

| UDR / UDR, Inc. | 0.16 | 2.13 | 6.61 | -7.68 | 0.0354 | -0.0059 | |||

| HPP / Hudson Pacific Properties, Inc. | 2.30 | -0.04 | 6.29 | -7.17 | 0.0336 | -0.0054 | |||

| TRNO / Terreno Realty Corporation | 0.10 | 3.34 | 5.84 | -8.35 | 0.0312 | -0.0055 | |||

| VICI / VICI Properties Inc. | 0.17 | 18.34 | 5.53 | 18.25 | 0.0296 | 0.0026 | |||

| CHCT / Community Healthcare Trust Incorporated | 0.33 | 10.12 | 5.53 | 0.84 | 0.0295 | -0.0020 | |||

| SUI / Sun Communities, Inc. | 0.04 | 53.23 | 4.85 | 50.67 | 0.0260 | 0.0074 | |||

| CCI / Crown Castle Inc. | 0.04 | 3.17 | 4.35 | 1.68 | 0.0232 | -0.0014 | |||

| DEI / Douglas Emmett, Inc. | 0.28 | 2.95 | 4.16 | -3.23 | 0.0223 | -0.0025 | |||

| CDP / COPT Defense Properties | 0.15 | 4.07 | 0.0218 | 0.0218 | |||||

| NTST / NETSTREIT Corp. | 0.22 | 91.81 | 3.73 | 104.88 | 0.0200 | 0.0095 | |||

| O / Realty Income Corporation | 0.05 | 2.82 | 0.0151 | 0.0151 | |||||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.01 | -44.31 | 2.15 | -42.89 | 0.0115 | -0.0102 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 1.63 | 0.0087 | 0.0087 | |||||

| LRCX / Lam Research Corporation | 0.01 | 0.00 | 1.20 | 33.97 | 0.0064 | 0.0012 | |||

| CCK / Crown Holdings, Inc. | 0.01 | 0.00 | 0.88 | 15.45 | 0.0047 | 0.0003 | |||

| RH / RH | 0.00 | 0.00 | 0.42 | -19.43 | 0.0023 | -0.0008 | |||

| AAPL / Apple Inc. | 0.00 | 0.26 | 0.0014 | 0.0014 | |||||

| XOM / Exxon Mobil Corporation | 0.00 | -99.01 | 0.22 | -98.82 | 0.0012 | -0.0465 | |||

| FRT / Federal Realty Investment Trust | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HIW / Highwoods Properties, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SKX / Skechers U.S.A., Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| YOU / Clear Secure, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INTC / Intel Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |