Mga Batayang Estadistika

| Profil Orang Dalam | DONALD SMITH & CO., INC. |

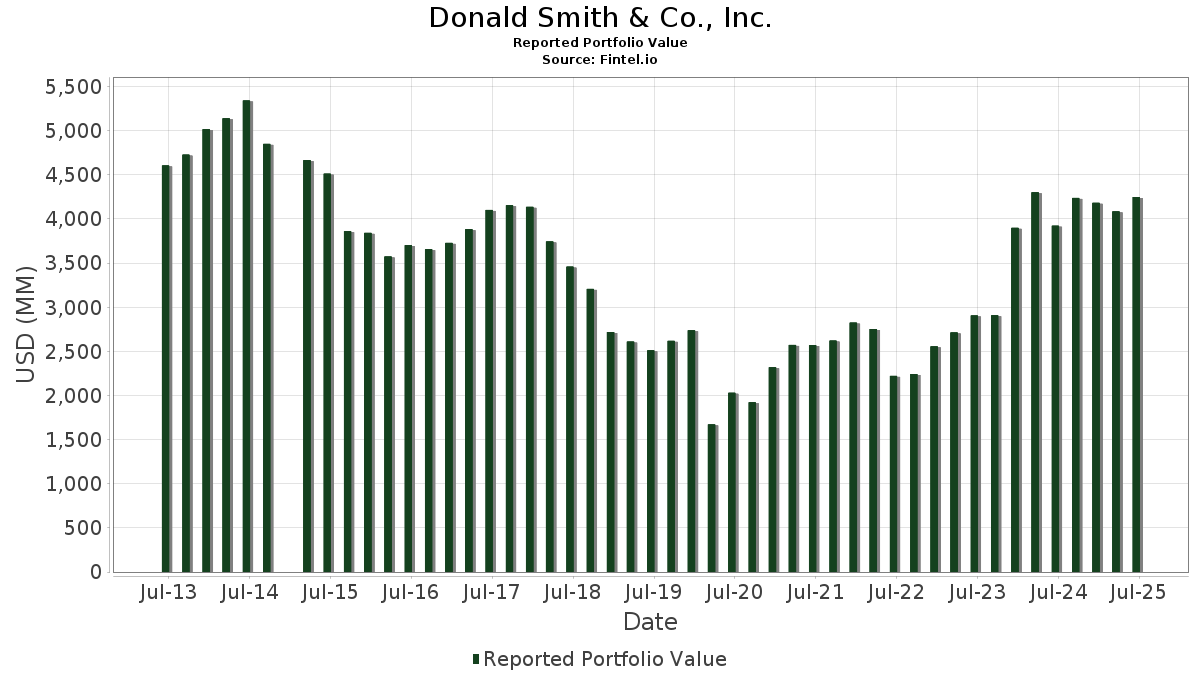

| Nilai Portofolio | $ 4,248,392,115 |

| Posisi Saat Ini | 61 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Donald Smith & Co., Inc. telah mengungkapkan total kepemilikan 61 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,248,392,115 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Donald Smith & Co., Inc. adalah AerCap Holdings N.V. (US:AER) , Eldorado Gold Corporation (US:EGO) , Genworth Financial, Inc. (US:GNW) , IAMGOLD Corporation (US:IAG) , and M/I Homes, Inc. (US:MHO) . Posisi baru Donald Smith & Co., Inc. meliputi: Mohawk Industries, Inc. (US:MHK) , Gerdau S.A. - Depositary Receipt (Common Stock) (US:GGB) , Hamilton Insurance Group, Ltd. (US:HG) , TimkenSteel Corporation (US:TMST) , and Ryerson Holding Corporation (US:RYI) . Industri unggulan Donald Smith & Co., Inc. adalah "Electric, Gas, And Sanitary Services " (sic 49) , "Furniture And Fixtures" (sic 25) , and "Coal Mining" (sic 12) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.52 | 130.22 | 3.0652 | 0.9575 | |

| 2.92 | 136.45 | 3.2118 | 0.9243 | |

| 7.44 | 78.97 | 1.8588 | 0.8277 | |

| 0.31 | 105.71 | 2.4881 | 0.6987 | |

| 0.28 | 29.08 | 0.6845 | 0.6845 | |

| 2.95 | 107.46 | 2.5294 | 0.4521 | |

| 5.97 | 17.44 | 0.4105 | 0.4105 | |

| 3.13 | 366.64 | 8.6300 | 0.3835 | |

| 0.66 | 14.27 | 0.3359 | 0.3359 | |

| 4.08 | 144.96 | 3.4121 | 0.3125 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.10 | 74.09 | 1.7440 | -1.1032 | |

| 4.48 | 123.30 | 2.9023 | -0.9829 | |

| 1.07 | 38.37 | 0.9032 | -0.7110 | |

| 1.81 | 145.85 | 3.4331 | -0.4322 | |

| 26.51 | 152.42 | 3.5877 | -0.4315 | |

| 0.47 | 19.64 | 0.4624 | -0.2865 | |

| 0.01 | 0.13 | 0.0031 | -0.2114 | |

| 12.04 | 123.21 | 2.9002 | -0.1267 | |

| 10.48 | 213.19 | 5.0181 | -0.1258 | |

| 6.04 | 41.62 | 0.9796 | -0.0936 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-08-15 | GAU / Galiano Gold Inc. | 26,092,047 | 25,509,371 | -2.23 | 9.90 | -2.94 | ||

| 2025-08-15 | SPNT / SiriusPoint Ltd. | 7,775,609 | 6,852,137 | -11.88 | 5.90 | -11.94 | ||

| 2025-08-15 | MHO / M/I Homes, Inc. | 1,098,418 | 1,408,390 | 28.22 | 5.30 | 32.17 | ||

| 2025-08-15 | TPC / Tutor Perini Corporation | 4,031,220 | 2,916,832 | -27.64 | 5.50 | -28.57 | ||

| 2025-08-15 | PK / Park Hotels & Resorts Inc. | 11,577,320 | 12,044,177 | 4.03 | 6.00 | 5.26 | ||

| 2025-08-15 | UVE / Universal Insurance Holdings, Inc. | 1,836,718 | 1,564,468 | -14.82 | 5.60 | -13.85 | ||

| 2025-08-15 | GSL / Global Ship Lease, Inc. | 3,220,085 | 3,238,868 | 0.58 | 9.10 | 1.11 | ||

| 2025-08-15 | HOFT / Hooker Furnishings Corporation | 1,007,122 | 984,761 | -2.22 | 9.20 | -2.13 | ||

| 2025-08-15 | GNW / Genworth Financial, Inc. | 27,114,581 | 26,198,280 | -3.38 | 6.30 | -3.08 | ||

| 2025-08-14 | MPAA / Motorcar Parts of America, Inc. | 1,024,058 | 959,394 | -6.31 | 4.90 | -5.77 | ||

| 2025-08-14 | IAG / IAMGOLD Corporation | 28,805,304 | 26,937,710 | -6.48 | 4.70 | -6.00 | ||

| 2025-08-13 | ALGT / Allegiant Travel Company | 1,506,633 | 8.30 | |||||

| 2025-08-13 | EGO / Eldorado Gold Corporation | 12,492,756 | 10,481,326 | -16.10 | 5.10 | -16.39 | ||

| 2025-08-13 | CLDT / Chatham Lodging Trust | 4,916,914 | 4,817,121 | -2.03 | 9.80 | -2.00 | ||

| 2025-08-13 | CLCO / Cool Company Ltd. | 3,432,111 | 3,564,815 | 3.87 | 6.70 | 4.69 | ||

| 2025-08-13 | ASTL / Algoma Steel Group Inc. | 8,088,120 | 6,040,168 | -25.32 | 5.80 | -24.68 | ||

| 2025-08-13 | BZH / Beazer Homes USA, Inc. | 3,122,510 | 3,106,887 | -0.50 | 10.30 | 3.00 | ||

| 2025-08-13 | EQX / Equinox Gold Corp. | 23,863,759 | 26,507,615 | 11.08 | 5.80 | 11.54 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AER / AerCap Holdings N.V. | 3.13 | -4.96 | 366.64 | 8.84 | 8.6300 | 0.3835 | |||

| EGO / Eldorado Gold Corporation | 10.48 | -16.10 | 213.19 | 1.46 | 5.0181 | -0.1258 | |||

| GNW / Genworth Financial, Inc. | 26.20 | -3.38 | 203.82 | 6.02 | 4.7976 | 0.0915 | |||

| IAG / IAMGOLD Corporation | 26.94 | -6.48 | 197.99 | 9.98 | 4.6604 | 0.2532 | |||

| MHO / M/I Homes, Inc. | 1.41 | 9.78 | 157.91 | 7.80 | 3.7169 | 0.1308 | |||

| EQX / Equinox Gold Corp. | 26.51 | 11.08 | 152.42 | -7.17 | 3.5877 | -0.4315 | |||

| JXN / Jackson Financial Inc. | 1.70 | 1.98 | 150.86 | 8.08 | 3.5510 | 0.1341 | |||

| UNM / Unum Group | 1.81 | -6.83 | 145.85 | -7.63 | 3.4331 | -0.4322 | |||

| CRBG / Corebridge Financial, Inc. | 4.08 | 1.81 | 144.96 | 14.49 | 3.4121 | 0.3125 | |||

| SPNT / SiriusPoint Ltd. | 6.85 | -11.88 | 139.72 | 3.92 | 3.2887 | -0.0025 | |||

| TPC / Tutor Perini Corporation | 2.92 | -27.64 | 136.45 | 46.02 | 3.2118 | 0.9243 | |||

| HOG / Harley-Davidson, Inc. | 5.52 | 61.83 | 130.22 | 51.25 | 3.0652 | 0.9575 | |||

| CIVI / Civitas Resources, Inc. | 4.48 | -1.50 | 123.30 | -22.31 | 2.9023 | -0.9829 | |||

| PK / Park Hotels & Resorts Inc. | 12.04 | 4.03 | 123.21 | -0.35 | 2.9002 | -0.1267 | |||

| TMHC / Taylor Morrison Home Corporation | 1.79 | -0.50 | 110.11 | 1.79 | 2.5917 | -0.0563 | |||

| MOS / The Mosaic Company | 2.95 | -6.24 | 107.46 | 26.64 | 2.5294 | 0.4521 | |||

| EG / Everest Group, Ltd. | 0.31 | 54.60 | 105.71 | 44.61 | 2.4881 | 0.6987 | |||

| TX / Ternium S.A. - Depositary Receipt (Common Stock) | 3.41 | 10.08 | 102.71 | 6.34 | 2.4177 | 0.0532 | |||

| ALLY / Ally Financial Inc. | 2.58 | -0.55 | 100.32 | 6.21 | 2.3615 | 0.0491 | |||

| GLNG / Golar LNG Limited | 2.43 | -0.48 | 100.29 | 7.91 | 2.3607 | 0.0854 | |||

| C / Citigroup Inc. | 1.16 | -2.64 | 99.15 | 16.73 | 2.3337 | 0.2546 | |||

| GSL / Global Ship Lease, Inc. | 3.24 | 0.58 | 85.21 | 15.81 | 2.0058 | 0.2046 | |||

| ALGT / Allegiant Travel Company | 1.51 | 11.57 | 82.79 | 18.69 | 1.9487 | 0.2412 | |||

| GM / General Motors Company | 1.66 | 0.19 | 81.50 | 4.83 | 1.9184 | 0.0152 | |||

| HBM / Hudbay Minerals Inc. | 7.44 | 34.12 | 78.97 | 87.49 | 1.8588 | 0.8277 | |||

| HHH / Howard Hughes Holdings Inc. | 1.10 | -30.08 | 74.09 | -36.29 | 1.7440 | -1.1032 | |||

| NMR / Nomura Holdings, Inc. - Depositary Receipt (Common Stock) | 11.06 | 6.25 | 72.80 | 13.68 | 1.7135 | 0.1459 | |||

| BZH / Beazer Homes USA, Inc. | 3.11 | -0.50 | 69.50 | 9.16 | 1.6359 | 0.0773 | |||

| CGAU / Centerra Gold Inc. | 8.05 | -2.85 | 58.05 | 10.31 | 1.3663 | 0.0781 | |||

| RLJ / RLJ Lodging Trust | 7.42 | 28.31 | 54.04 | 18.39 | 1.2720 | 0.1546 | |||

| UVE / Universal Insurance Holdings, Inc. | 1.56 | -14.82 | 43.38 | -0.34 | 1.0212 | -0.0445 | |||

| ASTL / Algoma Steel Group Inc. | 6.04 | -25.32 | 41.62 | -5.07 | 0.9796 | -0.0936 | |||

| RDN / Radian Group Inc. | 1.07 | -46.57 | 38.37 | -41.81 | 0.9032 | -0.7110 | |||

| CLDT / Chatham Lodging Trust | 4.82 | -2.03 | 33.58 | -4.23 | 0.7903 | -0.0679 | |||

| GAU / Galiano Gold Inc. | 25.51 | -2.23 | 32.40 | 0.13 | 0.7626 | -0.0295 | |||

| MU / Micron Technology, Inc. | 0.26 | -27.91 | 31.98 | 2.26 | 0.7527 | -0.0128 | |||

| MHK / Mohawk Industries, Inc. | 0.28 | 29.08 | 0.6845 | 0.6845 | |||||

| GSM / Ferroglobe PLC | 7.81 | 19.76 | 28.67 | 18.46 | 0.6748 | 0.0824 | |||

| INSW / International Seaways, Inc. | 0.71 | 43.91 | 25.87 | 58.12 | 0.6088 | 0.2084 | |||

| CLCO / Cool Company Ltd. | 3.56 | 3.87 | 23.88 | 27.46 | 0.5622 | 0.1035 | |||

| NMIH / NMI Holdings, Inc. | 0.47 | -45.13 | 19.64 | -35.79 | 0.4624 | -0.2865 | |||

| GGB / Gerdau S.A. - Depositary Receipt (Common Stock) | 5.97 | 17.44 | 0.4105 | 0.4105 | |||||

| TWI / Titan International, Inc. | 1.46 | 92.23 | 14.99 | 135.30 | 0.3529 | 0.1969 | |||

| HG / Hamilton Insurance Group, Ltd. | 0.66 | 14.27 | 0.3359 | 0.3359 | |||||

| STNG / Scorpio Tankers Inc. | 0.28 | 10.84 | 0.2553 | 0.2553 | |||||

| MPAA / Motorcar Parts of America, Inc. | 0.96 | -6.31 | 10.75 | 10.45 | 0.2529 | 0.0148 | |||

| HOFT / Hooker Furnishings Corporation | 0.98 | -2.22 | 10.42 | 3.04 | 0.2452 | -0.0023 | |||

| TMST / TimkenSteel Corporation | 0.56 | 8.58 | 0.2019 | 0.2019 | |||||

| VTOL / Bristow Group Inc. | 0.25 | 112.62 | 8.27 | 121.97 | 0.1948 | 0.1035 | |||

| KBH / KB Home | 0.15 | -0.58 | 8.09 | -9.40 | 0.1905 | -0.0282 | |||

| AFLYY / Air France-KLM SA - Depositary Receipt (Common Stock) | 4.65 | -2.28 | 5.26 | 25.14 | 0.1238 | 0.0209 | |||

| ASIX / AdvanSix Inc. | 0.19 | 12.68 | 4.55 | 18.14 | 0.1072 | 0.0128 | |||

| GHLD / Guild Holdings Company | 0.21 | -44.65 | 4.17 | -28.48 | 0.0981 | -0.0446 | |||

| DC / Dakota Gold Corp. | 1.08 | 0.00 | 3.99 | 39.24 | 0.0938 | 0.0237 | |||

| PPTA / Perpetua Resources Corp. | 0.27 | 0.00 | 3.22 | 13.59 | 0.0757 | 0.0064 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.02 | 0.00 | 3.17 | 3.20 | 0.0745 | -0.0006 | |||

| RYI / Ryerson Holding Corporation | 0.11 | 2.40 | 0.0566 | 0.0566 | |||||

| AZREF / Azure Power Global Limited | 0.30 | 0.00 | 0.15 | -64.35 | 0.0035 | -0.0067 | |||

| KEP / Korea Electric Power Corporation - Depositary Receipt (Common Stock) | 0.01 | -99.23 | 0.13 | -98.52 | 0.0031 | -0.2114 | |||

| 761CVR042 / CONTRA RESOLUTE FOREST | 0.01 | 0.00 | 0.01 | 0.00 | 0.0002 | -0.0000 | |||

| GPL / Great Panther Mining Ltd | 0.47 | 0.00 | 0.00 | 0.0000 | -0.0000 | ||||

| X / United States Steel Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KE / Kimball Electronics, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CNA / CNA Financial Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |