Mga Batayang Estadistika

| Nilai Portofolio | $ 39,250,090 |

| Posisi Saat Ini | 66 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

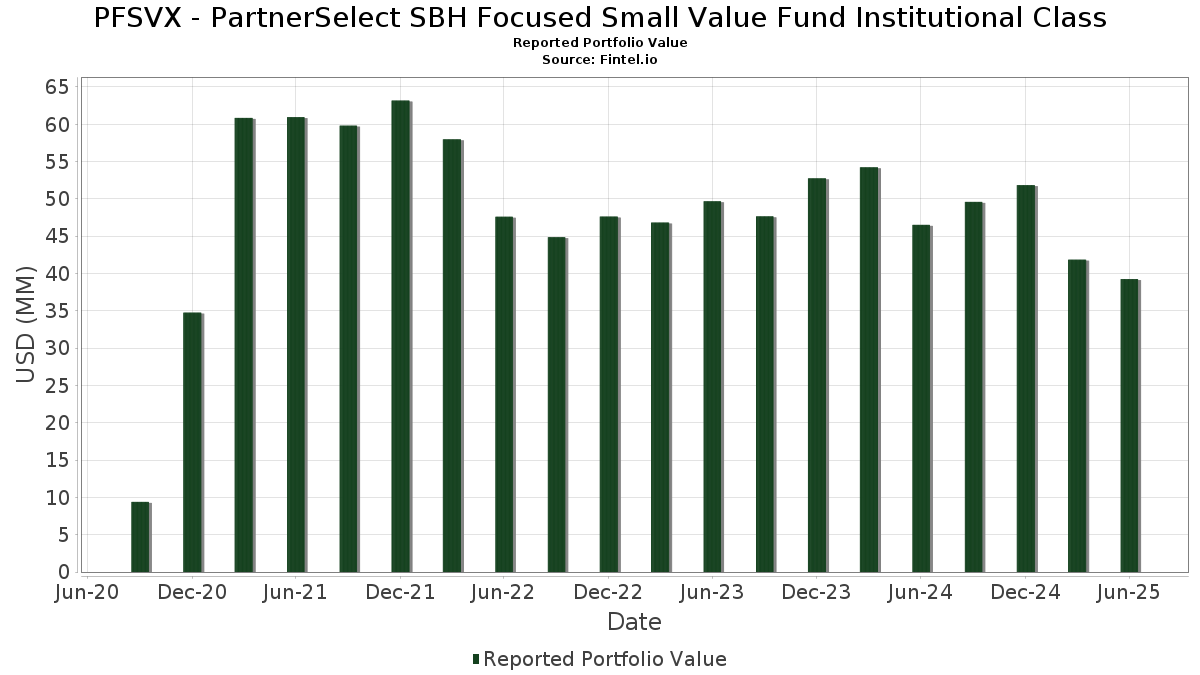

PFSVX - PartnerSelect SBH Focused Small Value Fund Institutional Class telah mengungkapkan total kepemilikan 66 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 39,250,090 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PFSVX - PartnerSelect SBH Focused Small Value Fund Institutional Class adalah O-I Glass, Inc. (US:OI) , Valmont Industries, Inc. (US:VMI) , REV Group, Inc. (US:REVG) , RBC Bearings Incorporated (US:RBC) , and Perimeter Solutions, Inc. (US:PRM) . Posisi baru PFSVX - PartnerSelect SBH Focused Small Value Fund Institutional Class meliputi: RBC Bearings Incorporated (US:RBC) , Perimeter Solutions, Inc. (US:PRM) , Manhattan Associates, Inc. (US:MANH) , AppFolio, Inc. (US:APPF) , and Casella Waste Systems, Inc. (US:CWST) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.85 | 2.1096 | 2.1096 | |

| 0.06 | 0.82 | 2.0216 | 2.0216 | |

| 0.00 | 0.76 | 1.8877 | 1.8877 | |

| 0.00 | 0.75 | 1.8527 | 1.8527 | |

| 0.01 | 0.74 | 1.8220 | 1.8220 | |

| 0.05 | 0.72 | 1.7918 | 1.7918 | |

| 0.01 | 0.70 | 1.7337 | 1.7337 | |

| 0.00 | 0.66 | 1.6266 | 1.6266 | |

| 0.01 | 0.65 | 1.6159 | 1.6159 | |

| 0.00 | 0.65 | 1.6143 | 1.6143 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.4559 | ||

| 0.01 | 0.73 | 1.8048 | -2.3469 | |

| 0.01 | 0.60 | 1.4737 | -2.2099 | |

| 0.01 | 0.35 | 0.8757 | -2.0878 | |

| 0.00 | 0.00 | -1.8292 | ||

| 0.00 | 0.00 | -1.7823 | ||

| 0.01 | 0.76 | 1.8856 | -1.6867 | |

| 0.00 | 0.57 | 1.4202 | -1.2406 | |

| 0.00 | 0.71 | 1.7510 | -0.9781 | |

| 0.02 | 0.86 | 2.1167 | -0.4424 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-27 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| OI / O-I Glass, Inc. | 0.08 | -1.86 | 1.17 | 26.08 | 2.8842 | 0.7160 | |||

| VMI / Valmont Industries, Inc. | 0.00 | -1.86 | 1.10 | 12.32 | 2.7300 | 0.4254 | |||

| REVG / REV Group, Inc. | 0.02 | -47.93 | 0.86 | -21.63 | 2.1167 | -0.4424 | |||

| RBC / RBC Bearings Incorporated | 0.00 | 0.85 | 2.1096 | 2.1096 | |||||

| PRM / Perimeter Solutions, Inc. | 0.06 | 0.82 | 2.0216 | 2.0216 | |||||

| NGVT / Ingevity Corporation | 0.02 | -1.86 | 0.80 | 6.82 | 1.9769 | 0.2222 | |||

| GT / The Goodyear Tire & Rubber Company | 0.07 | -1.86 | 0.77 | 10.20 | 1.8979 | 0.2642 | |||

| MANH / Manhattan Associates, Inc. | 0.00 | 0.76 | 1.8877 | 1.8877 | |||||

| MRCY / Mercury Systems, Inc. | 0.01 | -1.86 | 0.76 | 22.71 | 1.8856 | 0.4282 | |||

| CNM / Core & Main, Inc. | 0.01 | -59.94 | 0.76 | -49.93 | 1.8856 | -1.6867 | |||

| SLGN / Silgan Holdings Inc. | 0.01 | -1.86 | 0.76 | 3.97 | 1.8817 | 0.1665 | |||

| APPF / AppFolio, Inc. | 0.00 | 0.75 | 1.8527 | 1.8527 | |||||

| CWST / Casella Waste Systems, Inc. | 0.01 | 0.74 | 1.8220 | 1.8220 | |||||

| GSHD / Goosehead Insurance, Inc | 0.01 | -53.88 | 0.73 | -58.79 | 1.8048 | -2.3469 | |||

| HAYW / Hayward Holdings, Inc. | 0.05 | 0.72 | 1.7918 | 1.7918 | |||||

| HLNE / Hamilton Lane Incorporated | 0.00 | -36.37 | 0.71 | -39.21 | 1.7510 | -0.9781 | |||

| RGEN / Repligen Corporation | 0.01 | 0.70 | 1.7337 | 1.7337 | |||||

| ESI / Element Solutions Inc | 0.03 | 43.32 | 0.68 | 43.58 | 1.6881 | 0.5734 | |||

| SSB / SouthState Corporation | 0.01 | -1.79 | 0.68 | -2.72 | 1.6817 | 0.0442 | |||

| TCBI / Texas Capital Bancshares, Inc. | 0.01 | -1.86 | 0.66 | 4.28 | 1.6287 | 0.1484 | |||

| EXP / Eagle Materials Inc. | 0.00 | 0.66 | 1.6266 | 1.6266 | |||||

| NOVT / Novanta Inc. | 0.01 | 0.65 | 1.6159 | 1.6159 | |||||

| AIT / Applied Industrial Technologies, Inc. | 0.00 | 0.65 | 1.6143 | 1.6143 | |||||

| ALGM / Allegro MicroSystems, Inc. | 0.02 | -1.86 | 0.64 | 33.75 | 1.5788 | 0.4578 | |||

| KNSL / Kinsale Capital Group, Inc. | 0.00 | 0.63 | 1.5707 | 1.5707 | |||||

| MUSA / Murphy USA Inc. | 0.00 | 0.63 | 1.5610 | 1.5610 | |||||

| NBHC / National Bank Holdings Corporation | 0.02 | -1.85 | 0.62 | -3.42 | 1.5364 | 0.0262 | |||

| HEIA / Heico Corp. - Class A | 0.00 | 0.62 | 1.5293 | 1.5293 | |||||

| GWRE / Guidewire Software, Inc. | 0.00 | 0.61 | 1.5029 | 1.5029 | |||||

| AAP / Advance Auto Parts, Inc. | 0.01 | -7.80 | 0.60 | 9.22 | 1.4957 | 0.1985 | |||

| AZZ / AZZ Inc. | 0.01 | -1.86 | 0.60 | 11.03 | 1.4950 | 0.2169 | |||

| STAG / STAG Industrial, Inc. | 0.02 | -1.86 | 0.60 | -1.47 | 1.4914 | 0.0569 | |||

| CSW / CSW Industrials, Inc. | 0.00 | 0.60 | 1.4859 | 1.4859 | |||||

| SBCF / Seacoast Banking Corporation of Florida | 0.02 | -1.86 | 0.60 | 5.27 | 1.4842 | 0.1485 | |||

| BDC / Belden Inc. | 0.01 | -67.16 | 0.60 | -62.10 | 1.4737 | -2.2099 | |||

| COLB / Columbia Banking System, Inc. | 0.03 | -1.86 | 0.59 | -7.97 | 1.4584 | -0.0445 | |||

| FSS / Federal Signal Corporation | 0.01 | 0.58 | 1.4399 | 1.4399 | |||||

| GBCI / Glacier Bancorp, Inc. | 0.01 | -1.86 | 0.58 | -4.47 | 1.4299 | 0.0120 | |||

| AGYS / Agilysys, Inc. | 0.01 | 0.58 | 1.4292 | 1.4292 | |||||

| MORN / Morningstar, Inc. | 0.00 | 0.58 | 1.4291 | 1.4291 | |||||

| MEDP / Medpace Holdings, Inc. | 0.00 | -50.87 | 0.57 | -49.38 | 1.4202 | -1.2406 | |||

| DSGX / The Descartes Systems Group Inc. | 0.01 | 0.57 | 1.4170 | 1.4170 | |||||

| CADE / Cadence Bank | 0.02 | -1.86 | 0.57 | 3.25 | 1.4143 | 0.1172 | |||

| CRL / Charles River Laboratories International, Inc. | 0.00 | 0.57 | 1.4002 | 1.4002 | |||||

| LFUS / Littelfuse, Inc. | 0.00 | 8.52 | 0.56 | 25.11 | 1.3934 | 0.3370 | |||

| ENS / EnerSys | 0.01 | -0.67 | 0.56 | -6.95 | 1.3909 | -0.0266 | |||

| SPSC / SPS Commerce, Inc. | 0.00 | 0.55 | 1.3730 | 1.3730 | |||||

| SYNA / Synaptics Incorporated | 0.01 | 1.05 | 0.50 | 2.88 | 1.2372 | 0.0961 | |||

| ICUI / ICU Medical, Inc. | 0.00 | 13.30 | 0.49 | 7.69 | 1.2143 | 0.1466 | |||

| AHCO / AdaptHealth Corp. | 0.05 | -1.86 | 0.48 | -14.69 | 1.1939 | -0.1319 | |||

| APOG / Apogee Enterprises, Inc. | 0.01 | -2.09 | 0.48 | -14.13 | 1.1876 | -0.1247 | |||

| PCOR / Procore Technologies, Inc. | 0.01 | 0.48 | 1.1873 | 1.1873 | |||||

| PZZA / Papa John's International, Inc. | 0.01 | 23.45 | 0.47 | 47.32 | 1.1562 | 0.4108 | |||

| NX / Quanex Building Products Corporation | 0.02 | -1.86 | 0.46 | -0.22 | 1.1441 | 0.0570 | |||

| TECH / Bio-Techne Corporation | 0.01 | 0.46 | 1.1327 | 1.1327 | |||||

| KAI / Kadant Inc. | 0.00 | 0.44 | 1.0972 | 1.0972 | |||||

| WSBC / WesBanco, Inc. | 0.01 | 146.03 | 0.41 | 264.29 | 1.0117 | -0.0931 | |||

| MP / MP Materials Corp. | 0.01 | 0.38 | 0.9475 | 0.9475 | |||||

| VFC / V.F. Corporation | 0.03 | -1.86 | 0.36 | -25.72 | 0.8938 | -0.2467 | |||

| RMBS / Rambus Inc. | 0.01 | -77.34 | 0.35 | -72.05 | 0.8757 | -2.0878 | |||

| CRGY / Crescent Energy Company | 0.04 | 12.06 | 0.32 | -14.17 | 0.7948 | -0.0841 | |||

| AMBA / Ambarella, Inc. | 0.00 | -1.86 | 0.27 | 28.91 | 0.6732 | 0.1778 | |||

| THRM / Gentherm Incorporated | 0.01 | 26.58 | 0.27 | 34.17 | 0.6626 | 0.1935 | |||

| QDEL / QuidelOrtho Corporation | 0.01 | 2.42 | 0.27 | -15.77 | 0.6620 | -0.0816 | |||

| NEO / NeoGenomics, Inc. | 0.03 | 1.49 | 0.21 | -21.93 | 0.5212 | -0.1109 | |||

| ICHR / Ichor Holdings, Ltd. | 0.01 | -1.86 | 0.17 | -14.50 | 0.4231 | -0.0475 | |||

| BROS / Dutch Bros Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.8292 | ||||

| FAN / Fabrinet | 0.00 | -100.00 | 0.00 | -100.00 | -1.7823 | ||||

| OLLI / Ollie's Bargain Outlet Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.4559 |