Mga Batayang Estadistika

| Profil Orang Dalam | MASTERS CAPITAL MANAGEMENT LLC |

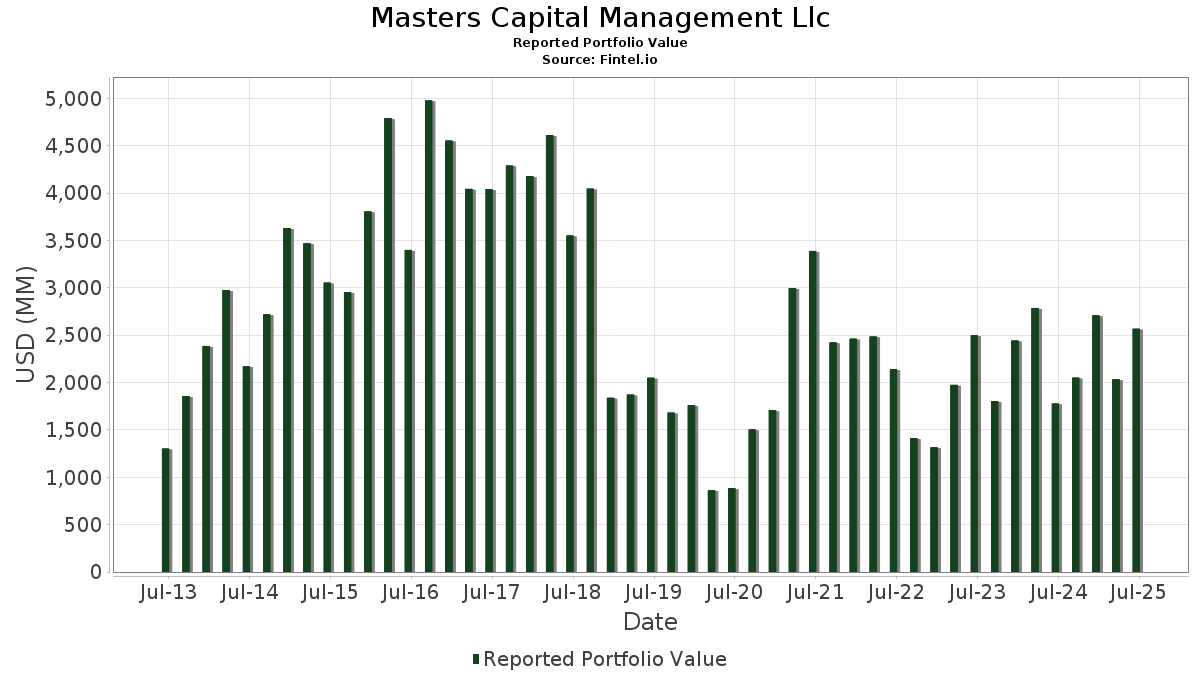

| Nilai Portofolio | $ 2,567,076,043 |

| Posisi Saat Ini | 72 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Masters Capital Management Llc telah mengungkapkan total kepemilikan 72 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 2,567,076,043 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Masters Capital Management Llc adalah SPDR S&P 500 ETF (US:SPY) , Citigroup Inc. (US:C) , Walmart Inc. (US:WMT) , iShares Trust - iShares 20+ Year Treasury Bond ETF (US:TLT) , and Freeport-McMoRan Inc. (US:FCX) . Posisi baru Masters Capital Management Llc meliputi: VanEck ETF Trust - VanEck Junior Gold Miners ETF (US:GDXJ) , Lionsgate Studios Corp. (US:LION) , PPG Industries, Inc. (US:PPG) , Mirion Technologies, Inc. (US:MIR) , and Denali Therapeutics Inc. (US:DNLI) . Industri unggulan Masters Capital Management Llc adalah "Home Furniture, Furnishings, And Equipment Stores" (sic 57) , "Personal Services" (sic 72) , and "Oil And Gas Extraction" (sic 13) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.00 | 617.85 | 21.1466 | 21.1466 | |

| 1.00 | 79.63 | 2.7254 | 2.7254 | |

| 1.00 | 67.59 | 2.6330 | 2.6330 | |

| 1.00 | 52.78 | 1.8065 | 1.8065 | |

| 1.00 | 97.78 | 3.8090 | 1.6510 | |

| 0.50 | 46.65 | 1.5966 | 1.5966 | |

| 0.20 | 41.91 | 1.4343 | 1.4343 | |

| 0.30 | 31.45 | 1.0765 | 1.0765 | |

| 0.90 | 67.19 | 2.2998 | 1.0003 | |

| 1.00 | 51.14 | 1.7503 | 0.9630 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.00 | 88.25 | 3.0205 | -10.4054 | |

| 1.00 | 46.29 | 1.5843 | -4.4125 | |

| 0.00 | 0.00 | -4.0726 | ||

| 0.25 | 22.30 | 0.7633 | -2.4293 | |

| 0.50 | 61.62 | 2.1092 | -2.1626 | |

| 2.00 | 60.56 | 2.0727 | -1.2929 | |

| 1.00 | 7.60 | 0.2601 | -0.9522 | |

| 0.48 | 24.87 | 0.8511 | -0.9099 | |

| 2.10 | 178.75 | 6.1180 | -0.8621 | |

| 2.00 | 67.60 | 2.3137 | -0.7688 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2024-10-08 | VERO / Venus Concept Inc. | 581,016 | 168,229 | -71.05 | 2.30 | -71.25 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 1.00 | 617.85 | 21.1466 | 21.1466 | ||||

| C / Citigroup Inc. | Call | 2.10 | 5.00 | 178.75 | 25.90 | 6.1180 | -0.8621 | ||

| WMT / Walmart Inc. | Put | 1.00 | 100.00 | 97.78 | 122.76 | 3.8090 | 1.6510 | ||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | Call | 1.00 | -66.67 | 88.25 | -67.68 | 3.0205 | -10.4054 | ||

| FCX / Freeport-McMoRan Inc. | Call | 2.00 | 0.00 | 86.70 | 14.50 | 2.9674 | -0.7552 | ||

| UAL / United Airlines Holdings, Inc. | Call | 1.00 | 79.63 | 2.7254 | 2.7254 | ||||

| SLB / Schlumberger Limited | Call | 2.00 | 33.33 | 67.60 | 7.81 | 2.3137 | -0.7688 | ||

| GDXJ / VanEck ETF Trust - VanEck Junior Gold Miners ETF | Call | 1.00 | 67.59 | 2.6330 | 2.6330 | ||||

| INTC / Intel Corporation | Call | 3.00 | 50.00 | 67.20 | 47.95 | 2.3000 | 0.0670 | ||

| EMN / Eastman Chemical Company | Call | 0.90 | 200.00 | 67.19 | 154.20 | 2.2998 | 1.0003 | ||

| MU / Micron Technology, Inc. | Call | 0.50 | -50.00 | 61.62 | -29.08 | 2.1092 | -2.1626 | ||

| BAX / Baxter International Inc. | Call | 2.00 | 0.00 | 60.56 | -11.54 | 2.0727 | -1.2929 | ||

| ADM / Archer-Daniels-Midland Company | Call | 1.00 | 52.78 | 1.8065 | 1.8065 | ||||

| FLR / Fluor Corporation | 1.00 | 0.00 | 51.27 | 43.13 | 1.7548 | -0.0062 | |||

| W / Wayfair Inc. | Call | 1.00 | 100.00 | 51.14 | 219.33 | 1.7503 | 0.9630 | ||

| DAL / Delta Air Lines, Inc. | 1.00 | -8.39 | 49.18 | 3.33 | 1.9158 | -0.4241 | |||

| UBER / Uber Technologies, Inc. | Call | 0.50 | 46.65 | 1.5966 | 1.5966 | ||||

| BMY / Bristol-Myers Squibb Company | Call | 1.00 | -50.00 | 46.29 | -62.05 | 1.5843 | -4.4125 | ||

| TFC / Truist Financial Corporation | Call | 1.03 | 2.99 | 44.28 | 7.59 | 1.5154 | -0.5077 | ||

| BA / The Boeing Company | Call | 0.20 | 41.91 | 1.4343 | 1.4343 | ||||

| MHK / Mohawk Industries, Inc. | Call | 0.30 | 31.45 | 1.0765 | 1.0765 | ||||

| UPS / United Parcel Service, Inc. | 0.30 | 50.00 | 30.28 | 37.66 | 1.0364 | -0.0450 | |||

| AA / Alcoa Corporation | Call | 1.00 | 0.00 | 29.51 | -3.25 | 1.0100 | -0.4894 | ||

| FLR / Fluor Corporation | Call | 0.48 | -51.50 | 24.87 | -30.58 | 0.8511 | -0.9099 | ||

| NOV / NOV Inc. | 2.00 | 100.00 | 24.86 | 63.34 | 0.8509 | 0.1026 | |||

| DAL / Delta Air Lines, Inc. | Put | 0.50 | 24.59 | 0.9579 | 0.9579 | ||||

| ASTS / AST SpaceMobile, Inc. | 0.50 | -16.67 | 23.36 | 71.25 | 0.7997 | 0.1289 | |||

| INTC / Intel Corporation | 1.00 | 0.00 | 22.40 | -1.37 | 0.7667 | -0.3498 | |||

| COHR / Coherent Corp. | Call | 0.25 | -75.00 | 22.30 | -65.66 | 0.7633 | -2.4293 | ||

| VYX / NCR Voyix Corporation | 1.90 | 90.00 | 22.29 | 128.58 | 0.7628 | 0.2835 | |||

| ENVX / Enovix Corporation | 2.00 | 17.65 | 20.68 | 65.73 | 0.7078 | 0.0943 | |||

| EMN / Eastman Chemical Company | 0.25 | 25.00 | 18.66 | 5.92 | 0.6388 | -0.2275 | |||

| PRGO / Perrigo Company plc | Call | 0.70 | -30.26 | 18.63 | -33.54 | 0.6378 | -0.7407 | ||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.00 | -33.33 | 18.59 | -19.31 | 0.6363 | -0.4964 | |||

| CLF / Cleveland-Cliffs Inc. | 2.00 | -20.00 | 15.20 | -26.03 | 0.5202 | -0.4901 | |||

| FTK / Flotek Industries, Inc. | 1.00 | 100.00 | 14.76 | 254.38 | 0.5052 | 0.3004 | |||

| NXE / NexGen Energy Ltd. | 2.00 | 0.00 | 13.88 | 54.57 | 0.4751 | 0.0336 | |||

| EVEX / Eve Holding, Inc. | 2.00 | -2.44 | 13.72 | 101.59 | 0.4696 | 0.1350 | |||

| DOW / Dow Inc. | Call | 0.50 | 13.24 | 0.4532 | 0.4532 | ||||

| PONY / Pony AI Inc. - Depositary Receipt (Common Stock) | 1.00 | 0.00 | 13.20 | 49.66 | 0.4518 | 0.0182 | |||

| SMG / The Scotts Miracle-Gro Company | 0.20 | 13.19 | 0.4515 | 0.4515 | |||||

| BWAY / BrainsWay Ltd. - Depositary Receipt (Common Stock) | 1.00 | 0.00 | 13.15 | 38.86 | 0.4501 | -0.0155 | |||

| PBR / Petróleo Brasileiro S.A. - Petrobras - Depositary Receipt (Common Stock) | 1.00 | 0.00 | 12.51 | -12.76 | 0.4282 | -0.2768 | |||

| NOV / NOV Inc. | Call | 1.00 | 0.00 | 12.43 | -18.33 | 0.4254 | -0.3228 | ||

| VFC / V.F. Corporation | 1.00 | -9.09 | 11.75 | -31.17 | 0.4022 | -0.4371 | |||

| LION / Lionsgate Studios Corp. | 2.00 | 11.62 | 0.4527 | 0.4527 | |||||

| BMY / Bristol-Myers Squibb Company | 0.25 | 11.57 | 0.3961 | 0.3961 | |||||

| PPG / PPG Industries, Inc. | 0.10 | 11.38 | 0.4431 | 0.4431 | |||||

| ACHR / Archer Aviation Inc. | 1.00 | 0.00 | 10.85 | 52.60 | 0.3714 | 0.0218 | |||

| MIR / Mirion Technologies, Inc. | Call | 0.50 | 10.77 | 0.4193 | 0.4193 | ||||

| ADNT / Adient plc | Call | 0.50 | 9.73 | 0.3330 | 0.3330 | ||||

| AOMR / Angel Oak Mortgage REIT, Inc. | 1.00 | -9.09 | 9.42 | -10.14 | 0.3224 | -0.1930 | |||

| DNLI / Denali Therapeutics Inc. | 0.60 | 8.39 | 0.3270 | 0.3270 | |||||

| LYFT / Lyft, Inc. | Call | 0.50 | 7.88 | 0.3070 | 0.3070 | ||||

| CLF / Cleveland-Cliffs Inc. | Call | 1.00 | -66.67 | 7.60 | -69.18 | 0.2601 | -0.9522 | ||

| GSM / Ferroglobe PLC | 2.00 | 0.00 | 7.34 | -1.08 | 0.2512 | -0.1136 | |||

| TTI / TETRA Technologies, Inc. | 2.00 | 5.26 | 6.72 | 5.26 | 0.2300 | -0.0839 | |||

| QS / QuantumScape Corporation | Call | 1.00 | 0.00 | 6.72 | 61.54 | 0.2300 | 0.0255 | ||

| ETOR / eToro Group Ltd. | 0.10 | 6.66 | 0.2594 | 0.2594 | |||||

| TLS / Telos Corporation | 2.00 | -25.93 | 6.34 | -1.34 | 0.2170 | -0.0989 | |||

| GPRE / Green Plains Inc. | 1.00 | 100.00 | 6.03 | 148.66 | 0.2064 | 0.0872 | |||

| RUN / Sunrun Inc. | Call | 0.50 | -83.33 | 4.09 | -76.73 | 0.1400 | -0.7243 | ||

| BORR / Borr Drilling Limited | 2.10 | 7.14 | 3.84 | -10.46 | 0.1315 | -0.0795 | |||

| STIM / Neuronetics, Inc. | 1.00 | 0.00 | 3.49 | -5.16 | 0.1360 | -0.0450 | |||

| LUCD / Lucid Diagnostics Inc. | 2.73 | 0.00 | 3.14 | -22.82 | 0.1222 | -0.0776 | |||

| DOW / Dow Inc. | 0.10 | 2.65 | 0.0906 | 0.0906 | |||||

| SENS / Senseonics Holdings, Inc. | 4.50 | 0.00 | 2.14 | -27.41 | 0.0835 | -0.0616 | |||

| SRRK / Scholar Rock Holding Corporation | 0.05 | 1.77 | 0.0690 | 0.0690 | |||||

| PLUG / Plug Power Inc. | 1.00 | 0.00 | 1.49 | -3.87 | 0.0510 | -0.0140 | |||

| UP / Wheels Up Experience Inc. | 1.00 | 1.07 | 0.0417 | 0.0417 | |||||

| NG / NovaGold Resources Inc. | 0.10 | 0.41 | 0.0159 | 0.0159 | |||||

| INMB / INmune Bio, Inc. | Call | 0.10 | 0.23 | 0.0090 | 0.0090 | ||||

| SMR / NuScale Power Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CRC / California Resources Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| UBER / Uber Technologies, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| LION / Lionsgate Studios Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NVTS / Navitas Semiconductor Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VFC / V.F. Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| LVS / Las Vegas Sands Corp. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| GPRE / Green Plains Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| W / Wayfair Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FCX / Freeport-McMoRan Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AA / Alcoa Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MBLY / Mobileye Global Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NUE / Nucor Corporation | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| MIR / Mirion Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7129 | ||||

| DAL / Delta Air Lines, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -4.0726 | |||

| GOGO / Gogo Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AFK / VanEck ETF Trust - VanEck Africa Index ETF | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| RIG / Transocean Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DB / Deutsche Bank Aktiengesellschaft | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| LGFB / Lions Gate Entertainment Corp. - Class B | 0.00 | -100.00 | 0.00 | 0.0000 |