Mga Batayang Estadistika

| Pemilik Institusional | 66 total, 66 long only, 0 short only, 0 long/short - change of 8.20% MRQ |

| Alokasi Portofolio Rata-rata | 0.3578 % - change of 0.47% MRQ |

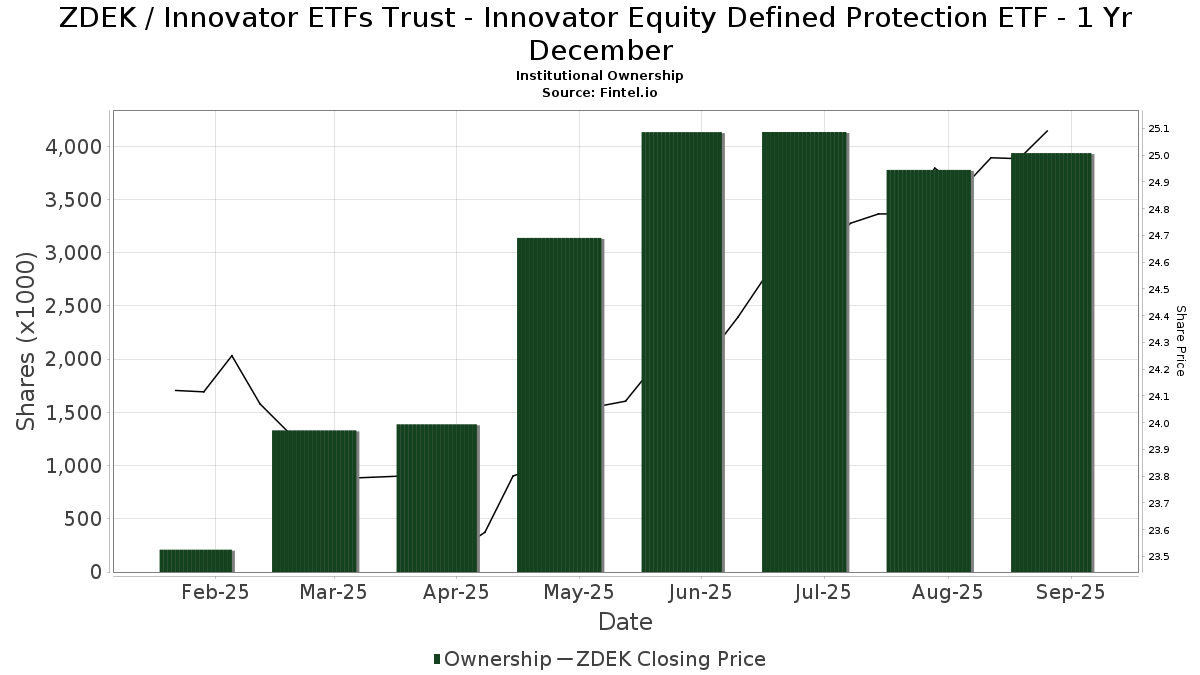

| Saham Institusional (Jangka Panjang) | 3,936,535 (ex 13D/G) - change of -0.20MM shares -4.75% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 86,131 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

Innovator ETFs Trust - Innovator Equity Defined Protection ETF - 1 Yr December (US:ZDEK) memiliki 66 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 3,936,535 saham. Pemegang saham terbesar meliputi VanWeelden Wealth Management, LLC, AE Wealth Management LLC, Harbour Investments, Inc., Legacy CG, LLC, Cary Street Partners Financial Llc, Commonwealth Equity Services, Llc, Raymond James Financial Inc, Kestra Advisory Services, LLC, Csenge Advisory Group, and Kfg Wealth Management, Llc .

Struktur kepemilikan institusional Innovator ETFs Trust - Innovator Equity Defined Protection ETF - 1 Yr December (BATS:ZDEK) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

The share price as of September 5, 2025 is 25.01 / share. Previously, on December 2, 2024, the share price was 23.97 / share. This represents an increase of 4.34% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

Rasio Put/Call Institusional

Selain melaporkan isu ekuitas dan utang standar, institusi dengan aset di bawah manajemen lebih dari 100 juta dolar AS juga harus mengungkapkan kepemilikan opsi put dan call mereka. Karena opsi put umumnya menunjukkan sentimen negatif, dan opsi call menunjukkan sentimen positif, kita dapat mengetahui sentimen institusional secara keseluruhan dengan memplot rasio put terhadap call. Grafik di sebelah kanan memplot rasio put/call historis untuk instrumen ini.

Menggunakan Rasio Put/Call sebagai indikator sentimen investor mengatasi salah satu kekurangan utama dari penggunaan total kepemilikan institusional, yaitu sejumlah besar aset yang dikelola diinvestasikan secara pasif untuk melacak indeks. Dana yang dikelola secara pasif biasanya tidak membeli opsi, sehingga indikator rasio put/call lebih akurat dalam melacak sentimen dana yang dikelola secara aktif.

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.

| Tanggal File | Sumber | Investor | Ketik | Presyo ng Avg (Silangan) |

Saham | Δ Saham (%) |

Dilaporkan Nilai ($1000) |

Nilai Δ (%) |

Alokasi Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-28 | 13F | Harbour Investments, Inc. | 313,497 | 215.18 | 7,693 | 226.67 | ||||

| 2025-07-14 | 13F | Kfg Wealth Management, Llc | 80,299 | 1.46 | 1,971 | 5.12 | ||||

| 2025-08-05 | 13F | Integrity Wealth Solutions LLC | 20,940 | 0.00 | 514 | 3.64 | ||||

| 2025-08-04 | 13F | AlphaStar Capital Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-06 | 13F | Csenge Advisory Group | 110,672 | 447.80 | 2,672 | 463.50 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 14,629 | 21.87 | 0 | |||||

| 2025-07-17 | 13F | Alpine Bank Wealth Management | 18,750 | 460 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 42,752 | 1,049 | ||||||

| 2025-08-29 | 13F | Centaurus Financial, Inc. | 58,877 | -1.80 | 1 | 0.00 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 35,063 | 0.00 | 860 | 3.61 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 118,212 | -6.35 | 2,901 | -2.98 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 12,966 | 0.00 | 318 | 3.58 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 3,388 | 41.28 | 83 | 48.21 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 0 | -100.00 | 0 | |||||

| 2025-08-01 | 13F | FSA Advisors, Inc. | 39,144 | 73.26 | 961 | 79.44 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | 0 | -100.00 | 0 | |||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 69,439 | 18.76 | 1,704 | 23.12 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 334,083 | 17.28 | 8,198 | 21.54 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 76,986 | -6.22 | 1,889 | -2.83 | ||||

| 2025-07-30 | 13F | IMG Wealth Management, Inc. | 8,206 | 0.00 | 201 | 3.61 | ||||

| 2025-08-14 | 13F | FC Advisory LLC | 47,981 | 0.00 | 1,177 | 3.61 | ||||

| 2025-08-06 | 13F | Founders Financial Securities Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | First Commonwealth Financial Corp /pa/ | 10,395 | 0.00 | 255 | 3.66 | ||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 444 | 0.00 | 11 | 0.00 | ||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 34,276 | 0.00 | 841 | 3.70 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 8,967 | 0.00 | 0 | |||||

| 2025-08-11 | 13F | Wealthgarden F.s. Llc | 8,292 | 205 | ||||||

| 2025-05-13 | 13F | Soltis Investment Advisors LLC | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 30,612 | 0.00 | 1 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 18,697 | -6.29 | 0 | |||||

| 2025-08-11 | 13F | Brass Tax Wealth Management, Inc | 30,755 | 0.00 | 755 | 3.57 | ||||

| 2025-04-22 | 13F | VanWeelden Wealth Management, LLC | 689,069 | 16,317 | ||||||

| 2025-08-06 | 13F | Vantage Financial Partners, LLC | 18,240 | 0.00 | 448 | 3.71 | ||||

| 2025-07-16 | 13F | Owen LaRue, LLC | 68,326 | -0.26 | 1,677 | 3.33 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 626 | 0.00 | 15 | 7.14 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 0 | -100.00 | 0 | |||||

| 2025-07-30 | 13F | Brookstone Capital Management | 39,947 | -78.01 | 980 | -77.21 | ||||

| 2025-07-10 | 13F | Marshall Financial Group LLC | 29,520 | 0.00 | 725 | 3.72 | ||||

| 2025-07-31 | 13F | Blue Sky Capital Consultants Group, Inc. | 8,247 | 202 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 176,912 | -26.65 | 4,341 | -23.98 | ||||

| 2025-08-07 | 13F | Authentikos Wealth Advisory, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 226,268 | 1,754.66 | 5,553 | 1,827.78 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 50,110 | 1 | ||||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 31,783 | 780 | ||||||

| 2025-07-31 | 13F | FSR Wealth Management Ltd. | 12,379 | -5.01 | 304 | -1.62 | ||||

| 2025-07-23 | 13F | Prasad Wealth Partners, LLC | 76,135 | 0.00 | 1,868 | 3.66 | ||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 22,652 | 556 | ||||||

| 2025-07-22 | 13F | Legacy CG, LLC | 275,971 | 6,772 | ||||||

| 2025-04-22 | 13F | Castleview Partners, Llc | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 8,416 | 207 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 189,683 | 3.37 | 5 | 0.00 | ||||

| 2025-07-29 | 13F | AssuredPartners Investment Advisors, LLC | 23,305 | -17.68 | 572 | -14.78 | ||||

| 2025-08-14 | 13F | UBS Group AG | 3,005 | 34.93 | 74 | 40.38 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 1,046 | 26 | ||||||

| 2025-07-09 | 13F | Fermata Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 8,958 | -41.96 | 222 | -39.78 | ||||

| 2025-07-16 | 13F | Independent Wealth Network Inc. | 64,857 | 34.68 | 1,592 | 39.56 | ||||

| 2025-07-23 | 13F | Allegiance Financial Group Advisory Services LLC | 22,652 | 0.00 | 556 | 3.54 | ||||

| 2025-07-10 | 13F | Signal Advisors Wealth, LLC | 13,279 | 326 | ||||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 14,202 | -59.02 | 349 | -58.22 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 15,200 | 0.00 | 373 | 3.90 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 35,063 | 830 | ||||||

| 2025-07-23 | 13F | Heck Capital Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Archer Investment Corp | 54,413 | -3.47 | 1,335 | 0.07 | ||||

| 2025-07-14 | 13F | Chris Bulman Inc | 8,284 | 203 | ||||||

| 2025-07-28 | 13F | Sagespring Wealth Partners, Llc | 10,084 | 0.00 | 247 | 3.78 | ||||

| 2025-08-01 | 13F | Delta Investment Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 73,494 | -19.94 | 1,804 | -17.03 | ||||

| 2025-07-09 | 13F | Lineweaver Wealth Advisors, LLC | 17,093 | 0.00 | 419 | 3.71 | ||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 7,092 | 174 | ||||||

| 2025-08-04 | 13F | Family Wealth Group, LLC | 12,952 | -0.01 | 318 | 3.59 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 9,188 | 0.00 | 225 | 3.69 | ||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Tradition Wealth Management, LLC | 14,301 | 1.49 | 351 | 5.11 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 19,190 | 0 | ||||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 11,511 | 0.00 | 282 | 3.68 | ||||

| 2025-07-28 | 13F | IFG Advisors, LLC | 16,700 | 0.00 | 410 | 3.54 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 8,060 | 0 |