Mga Batayang Estadistika

| Pemilik Institusional | 125 total, 125 long only, 0 short only, 0 long/short - change of -0.79% MRQ |

| Alokasi Portofolio Rata-rata | 0.6190 % - change of 99.16% MRQ |

| Saham Institusional (Jangka Panjang) | 16,327,537 (ex 13D/G) - change of -2.92MM shares -15.16% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 727,483 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

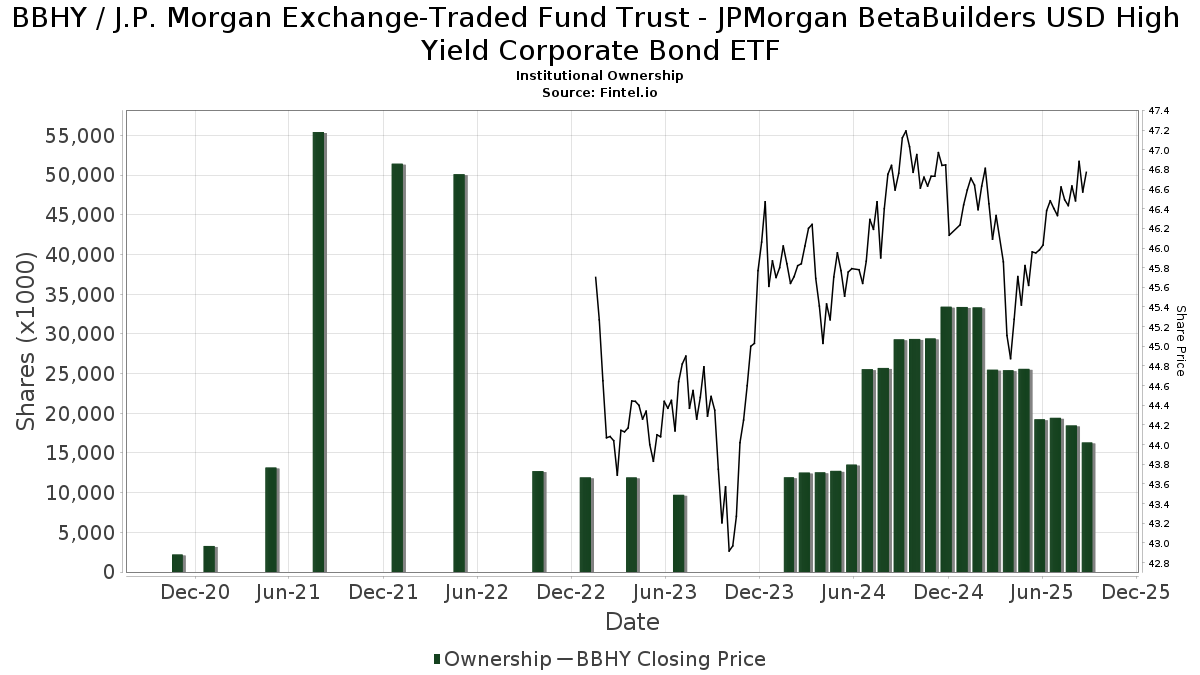

J.P. Morgan Exchange-Traded Fund Trust - JPMorgan BetaBuilders USD High Yield Corporate Bond ETF (US:BBHY) memiliki 125 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 16,327,537 saham. Pemegang saham terbesar meliputi Jpmorgan Chase & Co, LPL Financial LLC, Bank Of America Corp /de/, JSMAX - JPMorgan SmartRetirement 2030 Fund Class A, JNSAX - JPMorgan SmartRetirement 2025 Fund Class A, JRBEX - JPMorgan SmartRetirement* Blend 2030 Fund Class I, SRJAX - JPMorgan SmartRetirement 2035 Fund Class A, Vestmark Advisory Solutions, Inc., JBSSX - JPMorgan SmartRetirement* Blend 2025 Fund Class I, and BlackRock, Inc. .

Struktur kepemilikan institusional J.P. Morgan Exchange-Traded Fund Trust - JPMorgan BetaBuilders USD High Yield Corporate Bond ETF (BATS:BBHY) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

The share price as of September 5, 2025 is 46.76 / share. Previously, on September 9, 2024, the share price was 46.78 / share. This represents a decline of 0.05% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

Rasio Put/Call Institusional

Selain melaporkan isu ekuitas dan utang standar, institusi dengan aset di bawah manajemen lebih dari 100 juta dolar AS juga harus mengungkapkan kepemilikan opsi put dan call mereka. Karena opsi put umumnya menunjukkan sentimen negatif, dan opsi call menunjukkan sentimen positif, kita dapat mengetahui sentimen institusional secara keseluruhan dengan memplot rasio put terhadap call. Grafik di sebelah kanan memplot rasio put/call historis untuk instrumen ini.

Menggunakan Rasio Put/Call sebagai indikator sentimen investor mengatasi salah satu kekurangan utama dari penggunaan total kepemilikan institusional, yaitu sejumlah besar aset yang dikelola diinvestasikan secara pasif untuk melacak indeks. Dana yang dikelola secara pasif biasanya tidak membeli opsi, sehingga indikator rasio put/call lebih akurat dalam melacak sentimen dana yang dikelola secara aktif.

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.

| Tanggal File | Sumber | Investor | Ketik | Presyo ng Avg (Silangan) |

Saham | Δ Saham (%) |

Dilaporkan Nilai ($1000) |

Nilai Δ (%) |

Alokasi Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-15 | 13F | Morgan Stanley | 434,642 | -39.80 | 20,272 | -39.03 | ||||

| 2025-07-30 | NP | AGGA - Astoria Dynamic Core US Fixed Income ETF | 56,918 | 2,622 | ||||||

| 2025-07-31 | 13F | MN Wealth Advisors, LLC | 25,480 | -54.41 | 1,188 | -53.83 | ||||

| 2025-05-28 | NP | JAKAX - JPMorgan SmartRetirement 2060 Fund Class A | 76,131 | 3.58 | 3,506 | 3.51 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | -100.00 | 0 | |||||

| 2025-08-06 | 13F | Simmons Bank | 30,969 | -6.23 | 1,444 | -5.00 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 4,982 | -19.36 | 232 | -18.31 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 366,052 | -39.85 | 17 | -39.29 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 18,450 | 7.68 | 860 | 9.00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 2,089,235 | -4.91 | 97,442 | -3.69 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 25,947 | -73.59 | 1 | -75.00 | ||||

| 2025-08-14 | 13F | Acorn Wealth Advisors, LLC | 7,091 | 3.41 | 331 | 4.76 | ||||

| 2025-05-28 | NP | JSACX - JPMorgan SmartRetirement 2045 Fund Class C | 446,759 | 0.43 | 20,573 | 0.37 | ||||

| 2025-07-15 | 13F | Garrett Investment Advisors LLC | 5,784 | 0.23 | 270 | 1.51 | ||||

| 2025-07-11 | 13F | Windsor Capital Management, LLC | 115,019 | -2.99 | 5,364 | -1.74 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | 5T Wealth, LLC | 19,335 | -39.27 | 902 | -38.54 | ||||

| 2025-05-28 | NP | JPSRX - JPMorgan SmartRetirement* Blend 2035 Fund Class I | 433,598 | -0.63 | 19,967 | -0.69 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 196 | 0.00 | 9 | 0.00 | ||||

| 2025-05-15 | 13F | Two Sigma Securities, Llc | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 725 | 38.10 | 34 | 37.50 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 10,422 | -9.55 | 486 | -8.30 | ||||

| 2025-07-28 | 13F | Acorn Financial Advisory Services Inc /adv | 4,517 | 211 | ||||||

| 2025-05-28 | NP | JACSX - JPMorgan SmartRetirement Blend 2060 Fund Class I | 61,445 | 1.87 | 2,830 | 1.80 | ||||

| 2025-05-28 | NP | JSSRX - JPMorgan SmartRetirement* Blend 2020 Fund Class I | 246,836 | -3.43 | 11,367 | -3.50 | ||||

| 2025-05-28 | NP | JSMOX - JPMorgan SmartRetirement 2065 Fund Class R6 | 6,396 | 28.85 | 295 | 28.95 | ||||

| 2025-07-15 | 13F | Missouri Trust & Investment Co | 375 | -6.25 | 17 | -5.56 | ||||

| 2025-04-25 | 13F | TBH Global Asset Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-05-28 | NP | SRJAX - JPMorgan SmartRetirement 2035 Fund Class A | 544,802 | 0.42 | 25,088 | 0.35 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 0 | -100.00 | 0 | |||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-28 | 13F | Midwestern Financial, LLC /IA | 10,414 | 486 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 39 | 2.63 | 2 | 0.00 | ||||

| 2025-08-12 | 13F | Vawter Financial, Ltd. | 5,717 | -92.67 | 267 | -92.59 | ||||

| 2025-05-28 | NP | JSBSX - JPMorgan SmartRetirement Blend 2065 Fund Class I | 5,815 | 17.50 | 268 | 17.11 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 4,668 | 218 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 500 | 706.45 | 23 | 1,050.00 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 9,651 | 1,975.48 | 0 | |||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 22,881 | -39.87 | 1,067 | -39.10 | ||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 154 | 1.99 | 7 | 16.67 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 33,305 | 33.76 | 1,553 | 35.51 | ||||

| 2025-05-28 | NP | JNSAX - JPMorgan SmartRetirement 2025 Fund Class A | 672,589 | -2.64 | 30,973 | -2.70 | ||||

| 2025-08-13 | 13F | WCG Wealth Advisors LLC | 24,105 | -4.00 | 1,124 | -2.77 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 62,648 | 2,906 | ||||||

| 2025-05-28 | NP | JNEAX - JPMorgan SmartRetirement* Blend 2050 Fund Class I | 187,321 | -0.07 | 8,626 | -0.13 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 460,964 | -2.62 | 21,499 | -1.37 | ||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 17,795 | -15.90 | 830 | -14.89 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 251 | 2.03 | 12 | 0.00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 4,528 | 15.48 | 211 | 17.22 | ||||

| 2025-07-21 | 13F | Ascent Group, LLC | 5,475 | -11.62 | 255 | -10.53 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 52,376 | -41.55 | 2,443 | -40.81 | ||||

| 2025-05-28 | NP | JSMAX - JPMorgan SmartRetirement 2030 Fund Class A | 816,910 | -0.95 | 37,619 | -1.02 | ||||

| 2025-05-13 | 13F | UBS Group AG | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-28 | 13F | Rosenberg Matthew Hamilton | 3,601 | 0.00 | 168 | 1.21 | ||||

| 2025-07-31 | 13F | Wright Fund Managment, LLC | 127,000 | 0.00 | 5,848 | 0.00 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 3,594 | 0.03 | 168 | 1.21 | ||||

| 2025-07-30 | 13F | LGT Financial Advisors LLC | 612 | -32.67 | 29 | -31.71 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 301 | 14 | ||||||

| 2025-07-16 | 13F | Blue Oak Capital, LLC | 7,603 | -89.54 | 355 | -89.42 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 9,757 | 1,820.67 | 455 | 1,878.26 | ||||

| 2025-07-18 | 13F | Lockerman Financial Group, Inc. | 7,893 | -52.22 | 368 | -51.58 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 140,512 | -43.85 | 6,553 | -43.14 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 887,664 | -17.23 | 41,401 | -16.17 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 65 | 0.00 | 3 | 50.00 | ||||

| 2025-08-13 | 13F | Gateway Wealth Partners, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 8,246 | -98.48 | 385 | -98.46 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1,417 | 147.29 | 66 | 153.85 | ||||

| 2025-08-13 | 13F | Menard Financial Group LLC | 42,510 | -3.37 | 1,983 | -0.70 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 14,978 | 699 | ||||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Bond Fund Investor Class Shares | 265,700 | 109.21 | 12,392 | 111.90 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 1,006,055 | -34.17 | 46,922 | -33.33 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 30,402 | -32.12 | 1,418 | -31.28 | ||||

| 2025-04-11 | 13F | Principia Wealth Advisory, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-08 | 13F | Emerald Investment Partners, Llc | 85 | 0.00 | 4 | 0.00 | ||||

| 2025-08-14 | 13F | Fort Point Capital Partners LLC | 5,392 | 251 | ||||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 212 | 0.00 | 10 | 0.00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 108,434 | 5,057 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 92 | -74.52 | 4 | -75.00 | ||||

| 2025-08-13 | 13F | Barclays Plc | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 320,194 | -58.11 | 14,934 | -57.57 | ||||

| 2025-07-09 | 13F | Massmutual Trust Co Fsb/adv | 12,041 | -56.14 | 562 | -55.62 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 34,070 | -46.08 | 2 | -50.00 | ||||

| 2025-07-16 | 13F | Investment Partners Asset Management, Inc. | 46,198 | -0.06 | 2,155 | 1.22 | ||||

| 2025-05-28 | NP | JMSSX - JPMorgan SmartRetirement* Blend 2045 Fund Class I | 343,279 | -1.52 | 15,808 | -1.58 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 74,491 | -48.92 | 3,474 | -48.27 | ||||

| 2025-05-28 | NP | JTSAX - JPMorgan SmartRetirement 2050 Fund Class A | 271,913 | -0.07 | 12,522 | -0.14 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 760 | 0.00 | 35 | 2.94 | ||||

| 2025-08-18 | 13F | N.E.W. Advisory Services LLC | 398 | 0.00 | 19 | 0.00 | ||||

| 2025-08-14 | 13F | Visionary Wealth Advisors | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 6,637 | 11.88 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 462,650 | 1.47 | 21,578 | 2.77 | ||||

| 2025-08-11 | 13F | Pinnacle Wealth Planning Services, Inc. | 103,361 | 5.95 | 4,821 | 7.30 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 82,991 | 134.06 | 3,841 | 135.15 | ||||

| 2025-05-08 | 13F | Nicolet Advisory Services, Llc | 0 | -100.00 | 0 | |||||

| 2025-05-28 | NP | SMTAX - JPMorgan SmartRetirement 2040 Fund Class A | 369,780 | -0.68 | 17,028 | -0.74 | ||||

| 2025-05-15 | 13F | Human Investing LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 44,757 | -6.63 | 2,087 | -5.44 | ||||

| 2025-05-28 | NP | JTTAX - JPMorgan SmartRetirement 2020 Fund Class A | 323,864 | -5.16 | 14,914 | -5.22 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 5,535 | 14.62 | 258 | 15.77 | ||||

| 2025-04-18 | 13F | Wolf Group Capital Advisors | 40,185 | 28.31 | 1,851 | 32.43 | ||||

| 2025-05-12 | 13F | Greenwich Wealth Management LLC | 0 | -100.00 | 0 | |||||

| 2025-05-28 | NP | JRBEX - JPMorgan SmartRetirement* Blend 2030 Fund Class I | 553,850 | -0.86 | 25,505 | -0.92 | ||||

| 2025-08-13 | 13F | Royal Fund Management, LLC | 103,486 | 3.61 | 4,827 | 4.71 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 863 | -45.65 | 40 | -45.21 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 0 | -100.00 | 0 | |||||

| 2025-05-28 | NP | JPTBX - JPMorgan SmartRetirement* Blend 2055 Fund Class I | 113,210 | 0.44 | 5,213 | 0.39 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 7,301 | -36.10 | 341 | -34.87 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 4,678 | 18.88 | 218 | 20.44 | ||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 541,156 | -4.19 | 25,240 | -2.96 | ||||

| 2025-07-25 | 13F | Richardson Financial Services Inc. | 1,339 | -37.46 | 62 | -36.73 | ||||

| 2025-05-15 | 13F | Creative Planning | 0 | -100.00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 183,166 | -41.40 | 9 | -42.86 | ||||

| 2025-08-12 | 13F | Wayfinding Financial, LLC | 5,884 | -62.16 | 0 | |||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 11,682 | 27.49 | 545 | 29.22 | ||||

| 2025-08-29 | 13F | Total Investment Management Inc | 357 | 17 | ||||||

| 2025-06-30 | NP | PFJDX - RiskPro® Dynamic 20-30 Fund Class R | 26,583 | -82.26 | 1,215 | -82.63 | ||||

| 2025-05-28 | NP | JFFAX - JPMorgan SmartRetirement 2055 Fund Class A | 177,897 | 1.32 | 8,192 | 1.26 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 4,995 | 232 | ||||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 621 | -7.73 | 29 | -6.67 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 52,715 | 20.19 | 2,459 | 21.74 | ||||

| 2025-07-17 | 13F | Halbert Hargrove Global Advisors, Llc | 3 | -25.00 | 0 | |||||

| 2025-05-19 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP JPMorgan Retirement Income Fund Standard Class | 100,279 | -2.08 | 4,618 | -2.14 | ||||

| 2025-05-28 | NP | JOBEX - JPMorgan SmartRetirement* Blend 2040 Fund Class I | 262,803 | -0.62 | 12,102 | -0.68 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 1,334 | 62 | ||||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 3 | 0.00 | 0 | |||||

| 2025-07-21 | 13F | Cape Cod Five Cents Savings Bank | 5,387 | 0.00 | 255 | 0.00 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 1,020 | -43.96 | 48 | -43.37 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-05-14 | 13F | Renaissance Technologies Llc | 0 | -100.00 | 0 | |||||

| 2025-05-28 | NP | JSRAX - JPMorgan SmartRetirement Income Fund Class A | 288,777 | -2.02 | 13,298 | -2.08 | ||||

| 2025-05-15 | 13F | Hrt Financial Lp | 0 | -100.00 | 0 | |||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 322 | 0.00 | 15 | 7.14 | ||||

| 2025-05-28 | NP | JIJSX - JPMorgan SmartRetirement* Blend Income Fund Class I | 203,683 | -2.64 | 9,380 | -2.71 | ||||

| 2025-07-17 | 13F | Albion Financial Group /ut | 51,186 | -0.06 | 2,387 | 1.23 | ||||

| 2025-07-15 | 13F | Graypoint LLC | 22,992 | -21.49 | 1,072 | -20.47 | ||||

| 2025-06-24 | NP | JFLI - JPMorgan Flexible Income ETF | 231,052 | 10,561 | ||||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 74,049 | 3,454 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 1,949 | -50.41 | 91 | -50.00 | ||||

| 2025-08-13 | 13F | Virtue Capital Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | Mission Wealth Management, Lp | 94,204 | 7.27 | 4,394 | 8.63 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 553 | 0.36 | 26 | 0.00 | ||||

| 2025-07-10 | 13F | Family Legacy Financial Solutions, LLC | 32 | 1 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 5,924 | -3.41 | 276 | -2.13 | ||||

| 2025-05-28 | NP | JBSSX - JPMorgan SmartRetirement* Blend 2025 Fund Class I | 503,535 | -3.62 | 23,188 | -3.68 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 43,226 | 0.00 | 2,016 | 1.31 |