Mga Batayang Estadistika

| Pemilik Institusional | 183 total, 183 long only, 0 short only, 0 long/short - change of -1.60% MRQ |

| Alokasi Portofolio Rata-rata | 0.2607 % - change of 33.38% MRQ |

| Saham Institusional (Jangka Panjang) | 50,185,193 (ex 13D/G) - change of 2.50MM shares 5.24% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 243,182 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

Nuveen Credit Strategies Income Fund (US:JQC) memiliki 183 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 50,185,193 saham. Pemegang saham terbesar meliputi Morgan Stanley, Oak Hill Advisors Lp, Guggenheim Capital Llc, Invesco Ltd., Sit Investment Associates Inc, Wells Fargo & Company/mn, Absolute Investment Advisers Llc, PCEF - Invesco CEF Income Composite ETF, Pathstone Holdings, LLC, and Raymond James Financial Inc .

Struktur kepemilikan institusional Nuveen Credit Strategies Income Fund (NYSE:JQC) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

The share price as of September 5, 2025 is 5.45 / share. Previously, on September 6, 2024, the share price was 5.86 / share. This represents a decline of 7.00% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

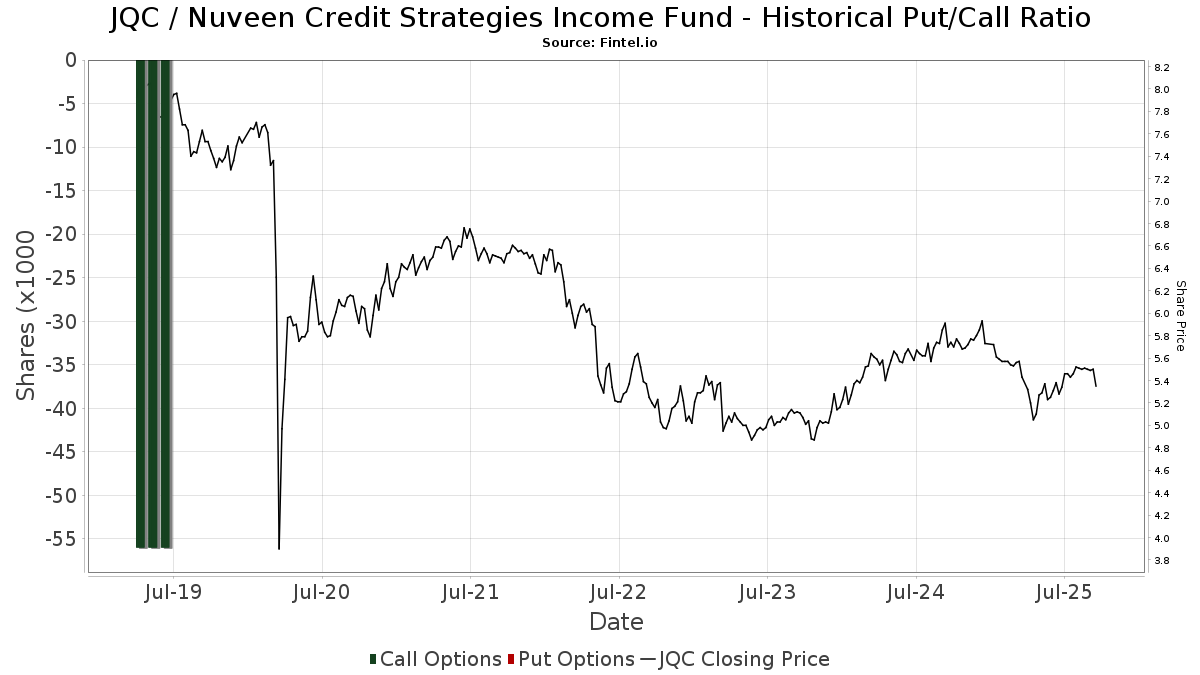

Rasio Put/Call Institusional

Selain melaporkan isu ekuitas dan utang standar, institusi dengan aset di bawah manajemen lebih dari 100 juta dolar AS juga harus mengungkapkan kepemilikan opsi put dan call mereka. Karena opsi put umumnya menunjukkan sentimen negatif, dan opsi call menunjukkan sentimen positif, kita dapat mengetahui sentimen institusional secara keseluruhan dengan memplot rasio put terhadap call. Grafik di sebelah kanan memplot rasio put/call historis untuk instrumen ini.

Menggunakan Rasio Put/Call sebagai indikator sentimen investor mengatasi salah satu kekurangan utama dari penggunaan total kepemilikan institusional, yaitu sejumlah besar aset yang dikelola diinvestasikan secara pasif untuk melacak indeks. Dana yang dikelola secara pasif biasanya tidak membeli opsi, sehingga indikator rasio put/call lebih akurat dalam melacak sentimen dana yang dikelola secara aktif.

Pengajuan 13D/G

Kami menyajikan pengajuan 13D/G secara terpisah dari pengajuan 13F karena perlakuan yang berbeda oleh SEC. Pengajuan 13D/G dapat diajukan oleh kelompok investor (dengan satu pemimpin), sedangkan pengajuan 13F tidak bisa. Hal ini mengakibatkan situasi di mana seorang investor dapat mengajukan 13D/G yang melaporkan satu nilai untuk total saham (mewakili semua saham yang dimiliki oleh kelompok investor), tetapi kemudian mengajukan 13F yang melaporkan nilai yang berbeda untuk total saham (mewakili kepemilikan mereka sendiri). Ini berarti bahwa kepemilikan saham dari pengajuan 13D/G dan pengajuan 13F seringkali tidak dapat dibandingkan secara langsung, sehingga kami menyajikannya secara terpisah.

Catatan: Mulai 16 Mei 2021, kami tidak lagi menampilkan pemilik yang belum mengajukan 13D/G dalam setahun terakhir. Sebelumnya, kami menampilkan riwayat lengkap pengajuan 13D/G. Secara umum, entitas yang diwajibkan untuk mengajukan pengajuan 13D/G harus mengajukan setidaknya setiap tahun sebelum mengirimkan pengajuan penutupan. Namun, terkadang dana keluar dari posisi tanpa mengirimkan pengajuan penutupan (misalnya, mereka menghentikan operasi), sehingga menampilkan riwayat lengkap terkadang menyebabkan kebingungan tentang kepemilikan saat ini. Untuk mencegah kebingungan, kami sekarang hanya menampilkan pemilik 'saat ini' - yaitu - pemilik yang telah mengajukan dalam setahun terakhir.

Upgrade to unlock premium data.

| Tanggal File | Formulir | Investor | Sebelumnya Saham |

Terbaru Saham |

Δ Saham (Persen) |

Kepemilikan (Persen) |

Δ Pagmamay-ari (Persen) |

|

|---|---|---|---|---|---|---|---|---|

| 2024-11-08 | MORGAN STANLEY | 8,064,766 | 5,953,390 | -26.18 | 4.40 | -25.42 |

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.

| Tanggal File | Sumber | Investor | Ketik | Presyo ng Avg (Silangan) |

Saham | Δ Saham (%) |

Dilaporkan Nilai ($1000) |

Nilai Δ (%) |

Alokasi Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 82,452 | 0.00 | 444 | 0.23 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 2,529,455 | 9.70 | 13,634 | 9.90 | ||||

| 2025-08-12 | 13F | DCF Advisers, LLC | 371,713 | 14.47 | 2,004 | 14.72 | ||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 373,043 | -6.82 | 2,011 | -6.64 | ||||

| 2025-07-23 | 13F | Tcfg Wealth Management, Llc | 19,093 | 0.00 | 103 | 0.00 | ||||

| 2025-08-14 | 13F | Polar Asset Management Partners Inc. | 1,495,667 | 70.10 | 8,062 | 70.42 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 232,347 | -12.69 | 1,253 | -12.50 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 74,608 | 39.43 | 402 | 40.07 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Balanced Income Plus Portfolio Class A | 12,530 | 0.00 | 68 | 0.00 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1,262 | 0.00 | 7 | 0.00 | ||||

| 2025-07-10 | 13F | Atticus Wealth Management, Llc | 1,799 | 0.00 | 10 | 0.00 | ||||

| 2025-08-27 | NP | ACEFX - Absolute Strategies Fund Institutional Shares | 62,100 | 124,100.00 | 335 | |||||

| 2025-07-21 | 13F | Hilltop National Bank | 700 | 40.00 | 4 | 50.00 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 1,289,447 | 11.88 | 6,950 | 12.10 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 4,365 | 3.12 | 24 | 4.55 | ||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-17 | 13F | Venture Visionary Partners LLC | 483,595 | 0.00 | 2,607 | 0.19 | ||||

| 2025-08-06 | 13F | Disciplined Investors, L.L.C. | 13,329 | -18.73 | 72 | -19.32 | ||||

| 2025-07-14 | 13F | Occidental Asset Management, LLC | 13,477 | -0.44 | 73 | 0.00 | ||||

| 2025-07-24 | 13F | Accredited Investor Services, Llc | 30,496 | 17.79 | 164 | 17.99 | ||||

| 2025-08-15 | 13F | First Heartland Consultants, Inc. | 31,012 | 0.00 | 167 | 0.60 | ||||

| 2025-07-16 | 13F | Castleview Partners, Llc | 216,087 | 1,165 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 298,997 | -81.85 | 1,612 | -81.82 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 77,016 | -15.31 | 415 | -15.13 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 29,256 | 0.78 | 158 | 0.64 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 25,965 | 140 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 259,922 | 79.38 | 1,401 | 79.72 | ||||

| 2025-07-11 | 13F | Seacrest Wealth Management, Llc | 40,498 | -0.52 | 218 | -0.46 | ||||

| 2025-08-08 | 13F | Fiera Capital Corp | 185,336 | -0.89 | 999 | -0.80 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 67,933 | 10.87 | 366 | 11.25 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 65,559 | 264.22 | 353 | 267.71 | ||||

| 2025-08-08 | 13F | Creative Planning | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | StoneX Group Inc. | 18,492 | -37.49 | 100 | -37.74 | ||||

| 2025-07-15 | 13F | Absolute Investment Advisers Llc | 1,847,341 | 9,957 | ||||||

| 2025-05-30 | NP | Rivernorth Opportunities Fund, Inc. | 100 | -99.96 | 1 | -100.00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 248,766 | 96.94 | 1,341 | 97.35 | ||||

| 2025-08-14 | 13F | Quarry LP | 749,998 | 85.54 | 4,042 | 85.92 | ||||

| 2025-05-06 | 13F | AE Wealth Management LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-10 | 13F | Stolper Co | 238,694 | 10.71 | 1 | 0.00 | ||||

| 2025-07-09 | 13F | VisionPoint Advisory Group, LLC | 27,082 | 146 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 84,126 | -1.58 | 453 | -1.31 | ||||

| 2025-08-28 | NP | YYY - Amplify High Income ETF | 938,691 | 2.58 | 5,060 | 2.78 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 92,965 | 269.61 | 501 | 271.11 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Opportunity Income Plus Portfolio Class A | 25,612 | 0.00 | 138 | 0.73 | ||||

| 2025-07-15 | 13F | Retirement Income Solutions, Inc | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 1,631,883 | 2,002.35 | 8,796 | 1,858.80 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 251,166 | 15.15 | 1 | 0.00 | ||||

| 2025-08-14 | 13F | Robinson Capital Management, Llc | 120,650 | 650 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 17,787 | -76.66 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 794,908 | 35.41 | 4,285 | 35.66 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 24,290 | 64.85 | 131 | 64.56 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 198,167 | 7.14 | 1,079 | 7.26 | ||||

| 2025-07-30 | 13F | Forum Financial Management, LP | 15,000 | 0.00 | 81 | 0.00 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Diversified Income Plus Portfolio Class A | 31,444 | 0.00 | 169 | 0.00 | ||||

| 2025-05-14 | 13F | Huntington National Bank | 10 | |||||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 2,710 | 8.40 | 15 | 15.38 | ||||

| 2025-07-28 | NP | PCEF - Invesco CEF Income Composite ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1,717,513 | 30.35 | 8,983 | 22.84 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Multi-Hedge Strategies Fund Variable Annuity | 591 | 278.85 | 3 | |||||

| 2025-06-27 | NP | Calamos ETF Trust - Calamos CEF Income & Arbitrage ETF | 120,972 | 7.69 | 638 | 1.59 | ||||

| 2025-07-14 | 13F | Maryland Capital Advisors Inc. | 5,000 | 27 | ||||||

| 2025-08-05 | 13F | Fullcircle Wealth Llc | 104,188 | 37.87 | 573 | 48.06 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 401 | 0.00 | 2 | 0.00 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 32,140 | 190.60 | 173 | 193.22 | ||||

| 2025-07-31 | 13F | Anchor Capital Management Group Inc | 175,000 | 0.00 | 943 | 0.21 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 375,696 | -9.74 | 2,025 | -9.56 | ||||

| 2025-05-30 | NP | RNDLX - RiverNorth/DoubleLine Strategic Income Fund Class R | 100 | -99.88 | 1 | -100.00 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 63,386 | -70.39 | 342 | -70.37 | ||||

| 2025-05-30 | NP | RNOTX - RiverNorth/Oaktree High Income Fund Class R | 100 | -99.87 | 1 | -100.00 | ||||

| 2025-08-15 | 13F | Prevail Innovative Wealth Advisors, Llc | 354,680 | 35.45 | 1,912 | 35.72 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 83,123 | 9.28 | 0 | |||||

| 2025-07-21 | 13F | Future Financial Wealth Managment LLC | 91,476 | 493 | ||||||

| 2025-07-08 | 13F | Allen Mooney & Barnes Investment Advisors LLC | 14,601 | 0.00 | 79 | 0.00 | ||||

| 2025-08-14 | 13F | First Foundation Advisors | 12,000 | 0.00 | 65 | 0.00 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 56,474 | 0.00 | 304 | 0.33 | ||||

| 2025-08-08 | 13F | Meridian Wealth Management, LLC | 57,762 | 1.49 | 311 | 1.63 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 18,860 | -21.09 | 102 | -21.09 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 163,884 | -19.09 | 883 | -18.92 | ||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 161,713 | -0.08 | 872 | 0.11 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 27,897 | -1.43 | 153 | 0.00 | ||||

| 2025-08-06 | 13F | North Capital, Inc. | 0 | -100.00 | 0 | |||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 10,325 | -4.62 | 56 | -9.84 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 85,296 | -0.12 | 460 | 0.00 | ||||

| 2025-08-11 | 13F | HHM Wealth Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 933 | 0.00 | 5 | 0.00 | ||||

| 2025-07-21 | 13F | First National Bank & Trust Co Of Newtown | 114,520 | -0.06 | 617 | 0.16 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 67,313 | 16.78 | 366 | 16.93 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100.00 | 0 | |||||

| 2025-07-24 | NP | DFRAX - DWS Floating Rate Fund Class A | 63,386 | -70.39 | 332 | -72.14 | ||||

| 2025-08-13 | 13F | Icon Advisers Inc/co | 64,776 | 349 | ||||||

| 2025-08-06 | 13F | Tabor Asset Management, LP | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 550 | 0.00 | 3 | 0.00 | ||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 150,459 | 19.80 | 811 | 20.00 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 34,629 | -1.85 | 187 | -1.59 | ||||

| 2025-07-15 | 13F | DKM Wealth Management, Inc. | 15,000 | 0.00 | 81 | 0.00 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 75,180 | 79.44 | 405 | 80.00 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 391,087 | -50.00 | 2 | -50.00 | ||||

| 2025-04-23 | 13F | Navis Wealth Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Elequin Capital Lp | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Keyes, Stange & Wooten Wealth Management, LLC | 26,820 | 2.44 | 145 | 2.86 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 10,147 | -12.67 | 55 | -12.90 | ||||

| 2025-08-13 | 13F | Fiduciary Group LLC | 12,950 | 0.00 | 70 | 0.00 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 35,771 | -1.84 | 193 | -7.25 | ||||

| 2025-08-14 | 13F | Garden State Investment Advisory Services LLC | 12,773 | 0.48 | 69 | 0.00 | ||||

| 2025-08-08 | 13F | City Of London Investment Management Co Ltd | 635,847 | 238.70 | 3,427 | 239.64 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 44,624 | 54.49 | 241 | 54.84 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 9,000 | 0.00 | 49 | 0.00 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100.00 | 0 | |||||

| 2025-06-26 | NP | ATCAX - Anchor Risk Managed Credit Strategies Fund Advisor Class Shares | 175,000 | 0.00 | 915 | -5.77 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1,912,762 | 1.42 | 10,310 | 1.61 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | -100.00 | 0 | |||||

| 2025-07-17 | 13F | Halbert Hargrove Global Advisors, Llc | 3,000 | 0.00 | 16 | 0.00 | ||||

| 2025-06-26 | NP | AABFX - Thrivent Balanced Income Plus Fund Class A | 12,898 | 0.00 | 68 | -6.94 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 15,250 | 82 | ||||||

| 2025-08-07 | 13F | Encompass More Asset Management | 125,476 | 0.80 | 676 | 1.05 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 10,414 | 56 | ||||||

| 2025-08-13 | 13F | Walleye Capital LLC | 0 | -100.00 | 0 | |||||

| 2025-08-28 | NP | RNCOX - RiverNorth Core Opportunity Fund Class R | 81,830 | 81,730.00 | 441 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 8,061 | 0.99 | 43 | 10.26 | ||||

| 2025-08-05 | 13F | Shaker Financial Services, LLC | 24,452 | 135 | ||||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 17,115 | 0.00 | 92 | 0.00 | ||||

| 2025-08-27 | NP | RYMSX - Guggenheim Multi-Hedge Strategies Fund Class P | 351 | 194.96 | 2 | |||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 948,351 | 3.64 | 5 | 25.00 | ||||

| 2025-05-30 | NP | Rivernorth/doubleline Strategic Opportunity Fund, Inc. | 100 | -99.97 | 1 | -100.00 | ||||

| 2025-08-14 | 13F | Alpine Global Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | NWF Advisory Services Inc. | 49,800 | 268 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 29,246 | -62.66 | 158 | -62.71 | ||||

| 2025-08-27 | NP | AAHYX - Thrivent Diversified Income Plus Fund Class A | 50,149 | 0.00 | 270 | 0.37 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 4,492 | 0.00 | 24 | 0.00 | ||||

| 2025-08-07 | 13F | Readystate Asset Management Lp | 291,903 | 1,573 | ||||||

| 2025-06-26 | NP | AAINX - Thrivent Opportunity Income Plus Fund Class A | 102,539 | 0.00 | 540 | -5.76 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-08 | 13F | Calamos Advisors LLC | 120,972 | 12.00 | 652 | 12.22 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 19,721 | 51.21 | 107 | 52.86 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 0 | -100.00 | 0 | |||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 56,940 | 89.80 | 307 | 90.06 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 846 | 20.00 | 5 | 33.33 | ||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 6,151 | -22.25 | 33 | -21.43 | ||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 130,257 | -2.25 | 702 | -1.96 | ||||

| 2025-04-21 | 13F | ORG Partners LLC | 0 | -100.00 | 0 | |||||

| 2025-07-11 | 13F | Annex Advisory Services, LLC | 16,725 | 0.00 | 90 | 1.12 | ||||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Sit Investment Associates Inc | 2,225,536 | 487.58 | 12 | 450.00 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 5,041 | 0.00 | 0 | |||||

| 2025-05-08 | 13F | Private Advisory Group LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-10 | 13F | Sovran Advisors, LLC | 214,914 | -44.28 | 1,173 | -39.29 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 1,532,147 | -4.91 | 8,258 | -4.73 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 10,640,087 | 8.66 | 57,350 | 8.87 | ||||

| 2025-06-30 | NP | CVY - Invesco Zacks Multi-Asset Income ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 130,300 | -3.40 | 687 | -8.90 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 3,000 | 0.00 | 0 | |||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 51,758 | 1.92 | 279 | 1.83 | ||||

| 2025-08-14 | 13F | Cohen & Steers, Inc. | 734,738 | 0.00 | 4 | 0.00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 81,153 | 437 | ||||||

| 2025-07-07 | 13F | Centurion Wealth Management LLC | 66,465 | -2.06 | 358 | -7.25 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100.00 | 0 | |||||

| 2025-08-08 | 13F | Family Firm, Inc. | 124,051 | 2.86 | 669 | 3.09 | ||||

| 2025-08-05 | 13F | Kesler, Norman & Wride, LLC | 11,151 | -1.02 | 60 | 0.00 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 552,310 | 20.37 | 2,977 | 20.58 | ||||

| 2025-08-08 | 13F/A | Ignite Planners, LLC | 17,891 | 28.68 | 98 | 32.43 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 56,897 | 310 | ||||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 360,249 | -9.05 | 1,942 | -8.92 | ||||

| 2025-08-14 | 13F | Cable Car Capital LLC | 0 | -100.00 | 0 | |||||

| 2025-07-30 | NP | HYIN - WisdomTree Alternative Income Fund N/A | 407,112 | 46.47 | 2,129 | 38.07 | ||||

| 2025-05-08 | 13F | Plante Moran Financial Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Virtu Financial LLC | 21,661 | 78.21 | 0 | |||||

| 2025-07-16 | 13F | PFS Partners, LLC | 1,000 | 5 | ||||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 211,630 | 10.18 | 1,141 | 10.36 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 16,200 | 0.00 | 87 | 0.00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 41 | -92.26 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Oak Hill Advisors Lp | 3,301,932 | -50.35 | 17,797 | -0.51 | ||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 0 | -100.00 | 0 | |||||

| 2025-07-23 | 13F | Sax Wealth Advisors, Llc | 12,374 | 0.00 | 67 | 0.00 | ||||

| 2025-07-25 | NP | FCEF - First Trust CEF Income Opportunity ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 144,026 | -26.36 | 753 | -30.60 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 48,686 | 262 | ||||||

| 2025-08-12 | 13F | Landscape Capital Management, L.l.c. | 291,952 | -11.23 | 1,574 | -11.08 | ||||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 137,766 | 20.00 | 743 | 20.26 | ||||

| 2025-06-25 | NP | VPC - Virtus Private Credit Strategy ETF | 225,536 | 41.95 | 1,189 | 33.78 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 0 | -100.00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 129,605 | 9.81 | 699 | 9.92 | ||||

| 2025-07-16 | 13F | Formidable Asset Management, LLC | 18,300 | 0.00 | 98 | 0.00 | ||||

| 2025-08-13 | 13F | Thomas J. Herzfeld Advisors, Inc. | 676,389 | 3,646 | ||||||

| 2025-05-15 | 13F | Ancora Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 235 | 1 | ||||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 19,780 | 0.00 | 107 | 0.00 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 45,378 | -11.87 | 245 | -11.91 | ||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 350 | 0.00 | 2 | 0.00 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100.00 | 0 | |||||

| 2025-07-15 | 13F | Main Street Group, LTD | 500 | 0.00 | 3 | 0.00 | ||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Almitas Capital LLC | 63,388 | 342 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 23,400 | 0.33 | 0 | |||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 330 | 0.00 | 2 | 0.00 | ||||

| 2025-04-15 | 13F | Noble Wealth Management PBC | 2,000 | 11 | ||||||

| 2025-05-07 | 13F | Sheaff Brock Investment Advisors, LLC | 12,650 | 0.00 | 68 | -4.23 | ||||

| 2025-07-11 | 13F | Quad-Cities Investment Group, LLC | 23,262 | -30.70 | 125 | -30.56 | ||||

| 2025-05-09 | 13F | Cornerstone Advisors, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 8,902 | 138.28 | 48 | 147.37 | ||||

| 2025-08-11 | 13F | SFI Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 36,748 | -4.34 | 0 | |||||

| 2025-08-25 | NP | IOBAX - ICON FLEXIBLE BOND FUND Investor Class | 64,776 | 349 | ||||||

| 2025-04-24 | 13F | Total Wealth Planning & Management, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 2,815,113 | 12.87 | 15,173 | 13.08 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 21,394 | 0.00 | 115 | 0.00 | ||||

| 2025-08-01 | 13F | Alexander Labrunerie & Co., Inc. | 47,903 | 32.37 | 258 | 32.99 | ||||

| 2025-05-06 | 13F | WT Wealth Management | 15,488 | 0.00 | 83 | -5.68 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 13,155 | 6.05 | 71 | 6.06 | ||||

| 2025-08-12 | 13F | Bokf, Na | 0 | -100.00 | 0 | |||||

| 2025-08-27 | NP | RBNAX - Robinson Opportunistic Income Fund Class A Shares | 120,000 | 647 | ||||||

| 2025-08-14 | 13F | Stifel Financial Corp | 340,699 | 1.79 | 1,836 | 2.00 | ||||

| 2025-07-15 | 13F | BKA Wealth Consulting, Inc. | 145,963 | -29.50 | 787 | -29.38 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 1,800 | 0.00 | 0 | |||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 46,963 | 95.03 | 253 | 96.12 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 55,101 | 1.97 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 2,230 | -40.21 | 12 | -40.00 | ||||

| 2025-08-13 | 13F | Yakira Capital Management, Inc. | 253,121 | -72.78 | 1,364 | -72.74 | ||||

| 2025-08-14 | 13F | Rivernorth Capital Management, Llc | 81,830 | 441 |