Mga Batayang Estadistika

| Saham Institusional (Jangka Panjang) | 116,850,769 - 103.75% (ex 13D/G) - change of 5.31MM shares 4.76% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 2,094,020 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

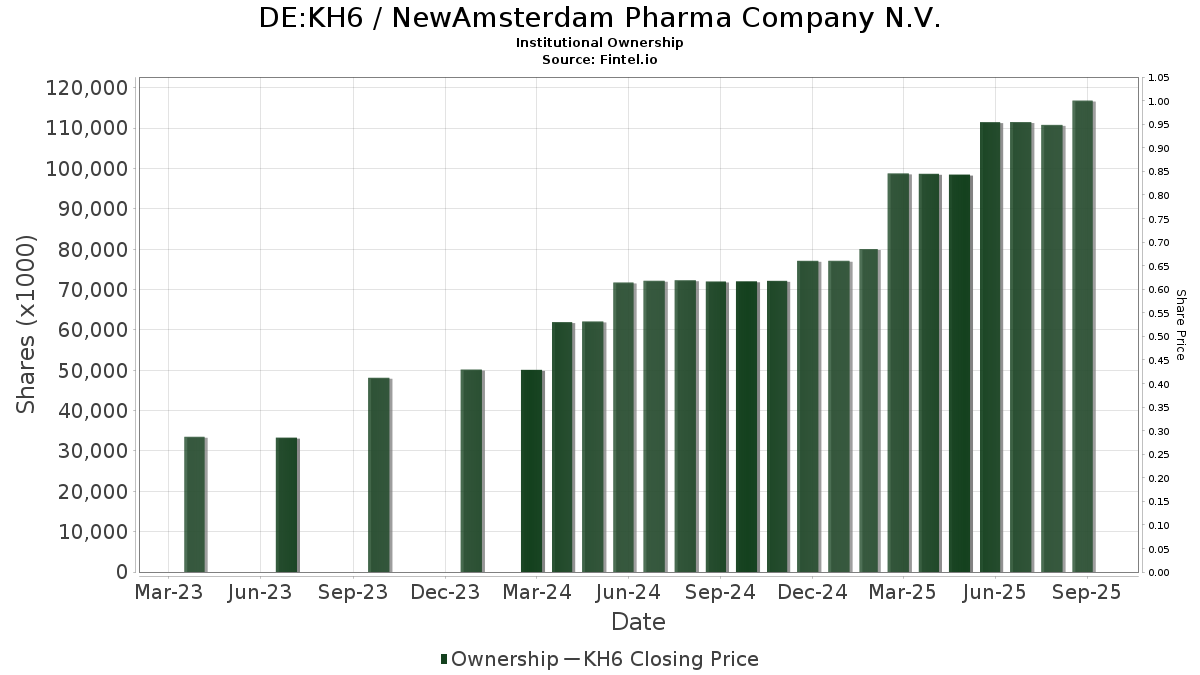

NewAmsterdam Pharma Company N.V. (DE:KH6) memiliki 150 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 116,850,769 saham. Pemegang saham terbesar meliputi Frazier Life Sciences Management, L.P., Bain Capital Life Sciences Investors, LLC, Fcpm Iii Services B.v., Ra Capital Management, L.p., Capital World Investors, Viking Global Investors Lp, Deerfield Management Company, L.p. (series C), Wellington Management Group Llp, Adage Capital Partners Gp, L.l.c., and Jennison Associates Llc .

Struktur kepemilikan institusional NewAmsterdam Pharma Company N.V. (DB:KH6) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.

| Tanggal File | Sumber | Investor | Ketik | Presyo ng Avg (Silangan) |

Saham | Δ Saham (%) |

Dilaporkan Nilai ($1000) |

Nilai Δ (%) |

Alokasi Port (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 13,100 | 237 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 74,400 | -13.99 | 1,347 | -23.90 | |||

| 2025-05-12 | 13F | Advisor Group Holdings, Inc. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Gilder Gagnon Howe & Co Llc | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 352,952 | 6,392 | ||||||

| 2025-08-12 | 13F | DCF Advisers, LLC | 172,500 | 0.00 | 3,124 | -11.55 | ||||

| 2025-08-12 | 13F | Swiss National Bank | 83,900 | 18.34 | 1,519 | 4.69 | ||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 325 | 0.00 | 6 | -16.67 | ||||

| 2025-05-15 | 13F | Lazard Asset Management Llc | 0 | -100.00 | 0 | |||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 99,457 | 15.88 | 1,800 | 2.51 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 89,827 | -39.73 | 1,627 | -46.69 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 30,311 | 2.19 | 549 | -9.72 | ||||

| 2025-08-13 | 13F | Siren, L.L.C. | 1,194,240 | -37.54 | 21,628 | -44.74 | ||||

| 2025-05-15 | 13F | Caption Management, LLC | Call | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-08 | 13F | TimesSquare Capital Management, LLC | 872,537 | -2.08 | 15,802 | -13.37 | ||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON Janus Henderson Enterprise Portfolio | 4,477 | 5.61 | 81 | -5.81 | ||||

| 2025-08-14 | 13F | Nicholas Investment Partners, LP | 115,739 | 2,096 | ||||||

| 2025-08-13 | 13F | Capital World Investors | 8,387,725 | 23.37 | 151,902 | 9.15 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 88 | 2 | ||||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 60,054 | -53.40 | 1,088 | -58.79 | ||||

| 2025-08-14 | 13F | State Street Corp | 81,304 | 21.90 | 1,472 | 7.84 | ||||

| 2025-05-15 | 13F | Tudor Investment Corp Et Al | 0 | -100.00 | 0 | |||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 1,400 | -0.64 | 25 | -10.71 | ||||

| 2025-08-07 | 13F | Lisanti Capital Growth, LLC | 49,110 | 0.00 | 889 | -11.54 | ||||

| 2025-07-28 | NP | IBBQ - Invesco Nasdaq Biotechnology ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4,318 | 22.67 | 78 | 6.85 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | Bryce Point Capital, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-28 | NP | DWAS - Invesco DWA SmallCap Momentum ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 107,316 | -7.01 | 1,943 | -19.81 | ||||

| 2025-05-15 | 13F | Boothbay Fund Management, Llc | Call | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-14 | 13F | Verition Fund Management LLC | 13,828 | -72.60 | 250 | -75.80 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 272 | -57.57 | 5 | -69.23 | ||||

| 2025-05-15 | 13F | Gmt Capital Corp | 0 | -100.00 | 0 | |||||

| 2025-08-18 | 13F/A | Hudson Bay Capital Management LP | Put | 30,000 | 543 | |||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 31,383 | 5.39 | 568 | -6.73 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 17,871 | 12.50 | 0 | |||||

| 2025-05-15 | 13F | Boothbay Fund Management, Llc | Put | 0 | -100.00 | 0 | -100.00 | |||

| 2025-06-26 | NP | KCXIX - Knights of Columbus U.S. All Cap Index Fund I Shares | 314 | 7.90 | 6 | 0.00 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-22 | 13F | Knights of Columbus Asset Advisors LLC | 32,833 | 595 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 637,707 | 45.75 | 11,549 | 28.94 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 200 | -60.00 | 4 | -70.00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 8 | 300.00 | 0 | |||||

| 2025-07-14 | 13F | Avanza Fonder AB | 7,505 | 20.95 | 136 | 20.54 | ||||

| 2025-05-15 | 13F | Acuta Capital Partners, Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Fcpm Iii Services B.v. | 10,632,113 | -2.77 | 192,548 | -13.98 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 68,092 | -5.95 | 1,233 | -16.75 | ||||

| 2025-08-14 | 13F | Quarry LP | 7,000 | 483.33 | 127 | 425.00 | ||||

| 2025-05-14 | 13F | HAP Trading, LLC | Call | 0 | -100.00 | 0 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 334,212 | 30.60 | 6,053 | 15.54 | ||||

| 2025-08-14 | 13F | Maverick Capital Ltd | 1,531,874 | 178.79 | 27,742 | 146.66 | ||||

| 2025-05-12 | 13F | Ovata Capital Management Ltd | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-24 | 13F | Cutter Capital Management, LP | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-05-15 | 13F | Two Sigma Advisers, Lp | 0 | -100.00 | 0 | |||||

| 2025-05-15 | 13F | Opaleye Management Inc. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-05-14 | 13F | Monashee Investment Management LLC | 0 | -100.00 | 0 | |||||

| 2025-08-01 | 13F | Jennison Associates Llc | 2,946,103 | -25.79 | 53,354 | -34.35 | ||||

| 2025-08-14 | 13F | Ikarian Capital, LLC | 206,800 | 3,745 | ||||||

| 2025-04-29 | 13F | Envestnet Asset Management Inc | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 134,035 | 12.70 | 2,427 | -0.29 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 1,816,725 | 0.26 | 32,902 | -11.30 | ||||

| 2025-06-23 | NP | PPNMX - SmallCap Growth Fund I R-3 | 153,014 | 14.45 | 2,927 | -1.78 | ||||

| 2025-08-14 | 13F | Cormorant Asset Management, LP | 2,175,000 | -23.01 | 39,389 | -31.88 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 4,471 | -31.67 | 81 | -39.85 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 0 | -100.00 | 0 | |||||

| 2025-05-14 | 13F | Walleye Capital LLC | 0 | -100.00 | 0 | |||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-26 | NP | GSCYX - SMALL CAP EQUITY FUND Institutional | 73,100 | -3.19 | 1,324 | -14.37 | ||||

| 2025-08-08 | 13F | Letko, Brosseau & Associates Inc | 11,775 | 213 | ||||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 7,540 | 25.88 | 137 | 11.48 | ||||

| 2025-05-15 | 13F | Voloridge Investment Management, Llc | 0 | -100.00 | 0 | |||||

| 2025-07-28 | NP | AVSC - Avantis U.S. Small Cap Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2,565 | 46 | ||||||

| 2025-08-14 | 13F | StemPoint Capital LP | 152,652 | 45.96 | 2,765 | 29.16 | ||||

| 2025-08-13 | 13F | Affinity Asset Advisors, LLC | Call | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-14 | 13F | Hrt Financial Lp | 26,208 | -19.71 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 500 | 9 | ||||||

| 2025-05-15 | 13F | Alyeska Investment Group, L.P. | 0 | -100.00 | 0 | |||||

| 2025-07-08 | 13F | Ptm Wealth Management, Llc | 12,900 | 256 | ||||||

| 2025-06-27 | NP | GURU - Global X Guru Index ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 29,452 | 563 | ||||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 7,640 | 0.00 | 138 | 20.00 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 44,235 | 33.52 | 801 | 18.14 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100.00 | 0 | |||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON Janus Henderson Venture Portfolio | 11,438 | -2.31 | 207 | -13.39 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 3 | 200.00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 5,604 | 121.68 | 0 | |||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 131,430 | 10.40 | 2,380 | -2.30 | ||||

| 2025-08-14 | 13F | ArrowMark Colorado Holdings LLC | 358,614 | -0.86 | 6,494 | -12.29 | ||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 0 | -100.00 | 0 | |||||

| 2025-05-15 | 13F | Crestline Management, LP | 0 | -100.00 | 0 | |||||

| 2025-03-31 | NP | JSFBX - John Hancock Seaport Long/Short Fund Class A | 22,123 | 493 | ||||||

| 2025-08-14 | 13F | Bellevue Group AG | 20,555 | -5.71 | 372 | -16.59 | ||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 1,962,060 | -10.80 | 35,592 | -25.69 | ||||

| 2025-08-18 | 13F/A | Hudson Bay Capital Management LP | 10,739 | 194 | ||||||

| 2025-06-27 | NP | AACRX - Strategic Allocation: Conservative Fund R Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 176 | 0.00 | 3 | 0.00 | ||||

| 2025-05-14 | 13F | Maven Securities LTD | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Caption Management, LLC | Put | 30,000 | 543 | |||||

| 2025-08-14 | 13F | Caption Management, LLC | 6,000 | -80.60 | 109 | -82.94 | ||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Slate Path Capital LP | 319,000 | 0.00 | 5,777 | -11.52 | ||||

| 2025-07-22 | 13F | Gf Fund Management Co. Ltd. | 2,365 | 0.00 | 43 | -12.50 | ||||

| 2025-08-14 | 13F | California State Teachers Retirement System | 47,862 | 146.66 | 867 | 118.14 | ||||

| 2025-08-14 | 13F | Polar Capital Holdings Plc | 2,517,779 | 11.90 | 45,597 | -1.00 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 208,081 | 118.68 | 3,768 | 93.53 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 320,143 | -53.05 | 5,798 | -58.47 | ||||

| 2025-04-30 | 13F | M&t Bank Corp | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 41,700 | -45.70 | 755 | -51.97 | |||

| 2025-07-25 | NP | CZMSX - Multi-Manager Small Cap Equity Strategies Fund Institutional Class | 104,025 | 1,884 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 36,500 | -57.51 | 661 | -62.40 | |||

| 2025-08-12 | 13F | Handelsbanken Fonder AB | 341,600 | 31.38 | 6 | 20.00 | ||||

| 2025-08-14 | 13F | First Turn Management, LLC | 521,097 | 9,437 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 571,673 | 14.80 | 10,353 | 1.56 | ||||

| 2025-08-13 | 13F | Decheng Capital LLC | 770,000 | 0.00 | 13,945 | -11.53 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 27,345 | 91.22 | 495 | 69.52 | ||||

| 2025-08-13 | 13F | Cheviot Value Management, LLC | 796 | 20 | ||||||

| 2025-08-04 | 13F | Keybank National Association/oh | 0 | -100.00 | 0 | |||||

| 2025-06-26 | NP | USSCX - Science & Technology Fund Shares | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 3,322,997 | -6.18 | 60,179 | -17.00 | ||||

| 2025-07-14 | 13F/A | Venture Visionary Partners LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 41,700 | -10.52 | 755 | -20.78 | |||

| 2025-08-07 | 13F | Readystate Asset Management Lp | 231,194 | 0.67 | 4,187 | -10.96 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 4,747 | 31.24 | 86 | 14.86 | ||||

| 2025-08-14 | 13F | HighVista Strategies LLC | 19,274 | 349 | ||||||

| 2025-08-14 | 13F | Bvf Inc/il | 0 | -100.00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 0 | -100.00 | 0 | |||||

| 2025-08-15 | 13F | Duquesne Family Office LLC | 832,175 | 3.98 | 15 | -6.25 | ||||

| 2025-08-28 | 13F | China Universal Asset Management Co., Ltd. | 22,549 | 2.37 | 408 | -9.33 | ||||

| 2025-08-13 | 13F | Kennedy Capital Management, Inc. | 13,675 | 248 | ||||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 21 | 950.00 | 0 | |||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 9,100 | 51.67 | 165 | 34.43 | ||||

| 2025-07-07 | 13F | Roxbury Financial LLC | 264 | 282.61 | 5 | 300.00 | ||||

| 2025-07-08 | 13F | Medicxi Ventures Management (Jersey) Ltd | 2,869,565 | 0.00 | 51,968 | -11.53 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 29,277 | 4.49 | 530 | -7.50 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 45 | 1 | ||||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 735,032 | 95.04 | 13,311 | 72.56 | ||||

| 2025-07-15 | 13F | Yarbrough Capital, LLC | 23,960 | 0.00 | 434 | -11.63 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 320,804 | 11.34 | 5,810 | -1.51 | ||||

| 2025-08-12 | 13F | CenterBook Partners LP | 68,190 | -69.32 | 1,235 | -72.87 | ||||

| 2025-08-14 | 13F | Fred Alger Management, Llc | 22,037 | -19.63 | 399 | -28.88 | ||||

| 2025-06-27 | NP | ANONX - Small Cap Growth Fund I Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 453,541 | 65.92 | 8,676 | 42.42 | ||||

| 2025-06-27 | NP | TWSMX - Strategic Allocation: Moderate Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 757 | 0.00 | 14 | -12.50 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 14,279 | 259 | ||||||

| 2025-08-13 | 13F | Affinity Asset Advisors, LLC | Put | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-13 | 13F | Saturn V Capital Management LLC | 220,695 | 89.68 | 3,997 | 67.83 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 532,916 | 0.77 | 9,651 | -10.85 | ||||

| 2025-05-15 | 13F | Marshall Wace, Llp | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Deerfield Management Company, L.p. (series C) | 5,115,953 | 24.66 | 92,650 | 10.29 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 595 | 350.76 | 11 | 400.00 | ||||

| 2025-05-13 | 13F | Sei Investments Co | 9,382 | 0.60 | 240 | 0.42 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 1,458,897 | 47.17 | 26,421 | 30.20 | ||||

| 2025-07-14 | 13F | HealthInvest Partners AB | 157,223 | 45.87 | 2,847 | 29.06 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | -100.00 | 0 | |||||

| 2025-05-09 | 13F | Pamalican Asset Management Ltd | 0 | -100.00 | 0 | |||||

| 2025-08-13 | 13F | Capital International Investors | 2,062,535 | 0.00 | 37,353 | -11.53 | ||||

| 2025-08-14 | 13F | Artia Global Partners LP | 27,319 | 495 | ||||||

| 2025-05-14 | 13F | Arrowstreet Capital, Limited Partnership | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Parkman Healthcare Partners LLC | 0 | -100.00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 548 | -23.03 | 10 | -35.71 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 937 | 680.83 | 0 | |||||

| 2025-08-14 | 13F | Cormorant Asset Management, LP | Call | 0 | -100.00 | 0 | -100.00 | |||

| 2025-08-14 | 13F | Legato Capital Management LLC | 18,789 | 340 | ||||||

| 2025-04-29 | 13F | Moody Aldrich Partners Llc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Ra Capital Management, L.p. | 10,138,938 | 0.00 | 183,616 | -11.53 | ||||

| 2025-07-30 | NP | SBIO - ALPS Medical Breakthroughs ETF | 76,222 | 6.28 | 1,380 | -8.37 | ||||

| 2025-08-13 | 13F | Arizona State Retirement System | 12,768 | 21.76 | 231 | 7.94 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 375 | 0.00 | 0 | |||||

| 2025-07-30 | 13F | Dupont Capital Management Corp | 1 | 0.00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 249 | 5 | ||||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 1,981 | 8.13 | 36 | -5.41 | ||||

| 2025-08-14 | 13F | ADAR1 Capital Management, LLC | 112,359 | 2,035 | ||||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 11,700 | 212 | ||||||

| 2025-08-14 | 13F | Viking Global Investors Lp | 6,978,534 | 0.00 | 126,381 | -11.53 | ||||

| 2025-08-14 | 13F | Bain Capital Life Sciences Investors, LLC | 10,719,110 | 0.00 | 194,123 | -11.53 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 4,337 | 18.01 | 79 | -1.27 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 484,004 | -26.59 | 8,765 | -35.05 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 225 | 4 | ||||||

| 2025-05-06 | 13F | Assetmark, Inc | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 1,904,550 | 97.60 | 34,491 | 74.82 | ||||

| 2025-08-14 | 13F | Algert Global Llc | 18,140 | 0 | ||||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | -100.00 | 0 | |||||

| 2025-08-19 | 13F | State of Wyoming | 550 | 10 | ||||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 2,331,583 | 4.00 | 42,225 | -7.99 | ||||

| 2025-05-15 | 13F | Cinctive Capital Management LP | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 4,594 | -1.59 | 83 | -12.63 | ||||

| 2025-08-14 | 13F | Frazier Life Sciences Management, L.P. | 16,607,074 | 3.04 | 300,754 | -8.84 | ||||

| 2025-08-13 | 13F | Affinity Asset Advisors, LLC | 275,000 | -15.38 | 4,980 | -25.14 | ||||

| 2025-08-14 | 13F | Avidity Partners Management LP | 0 | -100.00 | 0 | |||||

| 2025-06-27 | NP | AAARX - Strategic Allocation: Aggressive Fund R Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 911 | 0.00 | 17 | -15.00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 0 | -100.00 | 0 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 647 | -6.10 | 12 | -21.43 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 18,332 | 96.36 | 332 | 73.82 | ||||

| 2025-08-13 | 13F | Kilter Group LLC | 10 | 0 | ||||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 13,420 | 243 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 627,719 | 57.66 | 11,368 | 39.49 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Axa S.a. | 242,916 | 0.16 | 4,399 | -11.38 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 949,980 | 53.33 | 17,204 | 35.66 | ||||

| 2025-08-11 | 13F | Alps Advisors Inc | 60,551 | -22.33 | 1,097 | -31.29 | ||||

| 2025-08-15 | 13F/A | Exome Asset Management LLC | 36,574 | 662 | ||||||

| 2025-08-14 | 13F | Eversept Partners, LP | 414,430 | 47.51 | 7,505 | 30.50 | ||||

| 2025-08-14 | 13F | Rock Springs Capital Management LP | 536,111 | 0.00 | 9,709 | -11.54 | ||||

| 2025-08-28 | NP | NPSGX - NICHOLAS PARTNERS SMALL CAP GROWTH FUND Institutional Shares | 28,311 | 513 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 178,846 | 486.84 | 3,239 | 419.74 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 2,000 | 0.00 | 36 | -10.00 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 0 | 0 | ||||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 10,868 | 5.27 | 197 | -7.11 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 28,392 | -32.17 | 514 | -39.95 | ||||

| 2025-08-14 | 13F | Woodline Partners LP | 1,897,197 | -22.32 | 34,358 | -31.28 | ||||

| 2025-08-14 | 13F | Adage Capital Partners Gp, L.l.c. | 3,013,009 | 54.46 | 54,566 | 36.66 |

Other Listings

| US:NAMS | US$ 27.00 |