Mga Batayang Estadistika

| Pemilik Institusional | 121 total, 121 long only, 0 short only, 0 long/short - change of 120.00% MRQ |

| Alokasi Portofolio Rata-rata | 0.1587 % - change of -29.59% MRQ |

| Saham Institusional (Jangka Panjang) | 2,336,915 (ex 13D/G) - change of 0.58MM shares 32.76% MRQ |

| Nilai Institusional (Jangka Panjang) | $ 91,209 USD ($1000) |

Kepemilikan Institusional dan Pemegang Saham

Old Point Financial Corporation (US:OPOF) memiliki 121 pemilik institusional dan pemegang saham yang telah mengajukan formulir 13D/G atau 13F kepada Komisi Bursa Efek (Securities Exchange Commission/SEC). Lembaga-lembaga ini memegang total 2,336,915 saham. Pemegang saham terbesar meliputi PL Capital Advisors, LLC, Vanguard Group Inc, Old Point Trust & Financial Services N A, BlackRock, Inc., Chicago Capital Management, LLC, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, Geode Capital Management, Llc, IWM - iShares Russell 2000 ETF, VEXMX - Vanguard Extended Market Index Fund Investor Shares, and Northern Trust Corp .

Struktur kepemilikan institusional Old Point Financial Corporation (NasdaqCM:OPOF) menunjukkan posisi terkini di perusahaan oleh institusi dan dana, serta perubahan terbaru dalam ukuran posisi. Pemegang saham utama dapat mencakup investor individu, reksa dana, dana lindung nilai, atau institusi. Jadwal 13D menunjukkan bahwa investor memegang (atau pernah memegang) lebih dari 5% saham perusahaan dan bermaksud (atau pernah bermaksud) untuk secara aktif mengejar perubahan strategi bisnis. Jadwal 13G menunjukkan investasi pasif lebih dari 5%.

The share price as of August 29, 2025 is 42.10 / share. Previously, on September 9, 2024, the share price was 17.82 / share. This represents an increase of 136.25% over that period.

Skor Sentimen Dana

Skor Sentimen Dana (sebelumnya dikenal sebagai Skor Akumulasi Kepemilikan) menemukan saham-saham yang paling banyak dibeli oleh dana. Ini adalah hasil dari model kuantitatif multi-faktor yang canggih yang mengidentifikasi perusahaan dengan tingkat akumulasi institusional tertinggi. Model penilaian menggunakan kombinasi dari total peningkatan pemilik yang diungkapkan, perubahan dalam alokasi portofolio pada pemilik tersebut, dan metrik lainnya. Angka berkisar dari 0 hingga 100, dengan angka yang lebih tinggi menunjukkan tingkat akumulasi yang lebih tinggi dibandingkan dengan perusahaan sejenisnya, dan 50 adalah rata-ratanya.

Frekuensi Pembaruan: Setiap Hari

Lihat Ownership Explorer, yang menyediakan daftar perusahaan dengan peringkat tertinggi.

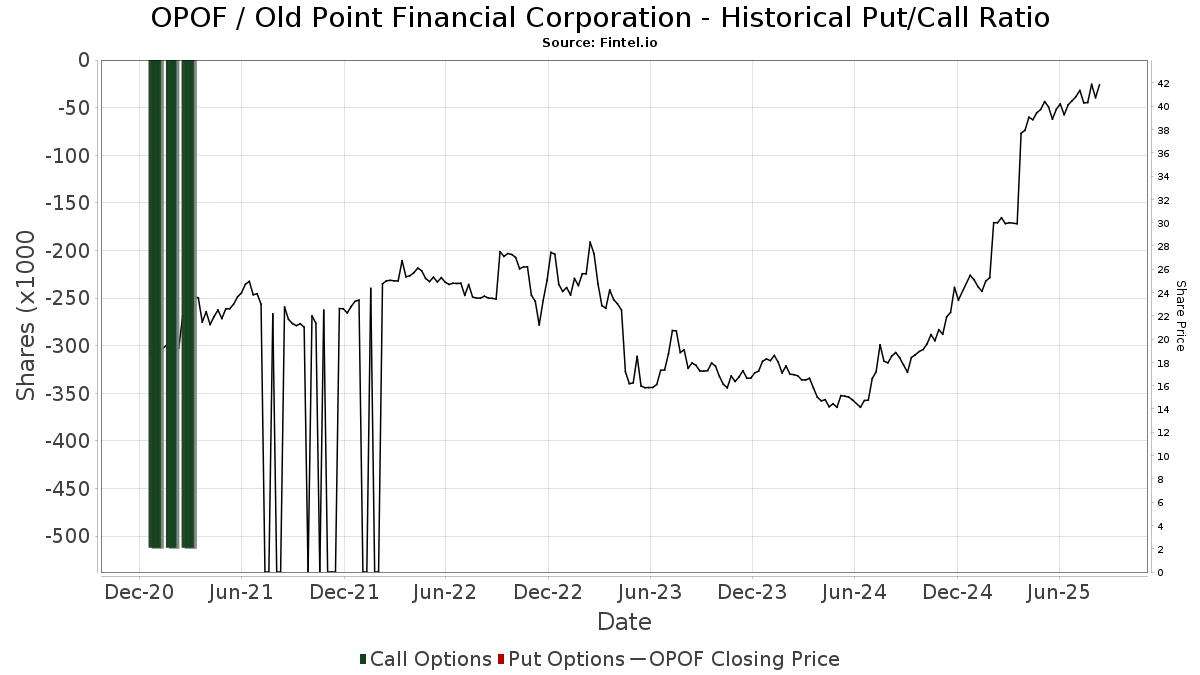

Rasio Put/Call Institusional

Selain melaporkan isu ekuitas dan utang standar, institusi dengan aset di bawah manajemen lebih dari 100 juta dolar AS juga harus mengungkapkan kepemilikan opsi put dan call mereka. Karena opsi put umumnya menunjukkan sentimen negatif, dan opsi call menunjukkan sentimen positif, kita dapat mengetahui sentimen institusional secara keseluruhan dengan memplot rasio put terhadap call. Grafik di sebelah kanan memplot rasio put/call historis untuk instrumen ini.

Menggunakan Rasio Put/Call sebagai indikator sentimen investor mengatasi salah satu kekurangan utama dari penggunaan total kepemilikan institusional, yaitu sejumlah besar aset yang dikelola diinvestasikan secara pasif untuk melacak indeks. Dana yang dikelola secara pasif biasanya tidak membeli opsi, sehingga indikator rasio put/call lebih akurat dalam melacak sentimen dana yang dikelola secara aktif.

Pengajuan 13D/G

Kami menyajikan pengajuan 13D/G secara terpisah dari pengajuan 13F karena perlakuan yang berbeda oleh SEC. Pengajuan 13D/G dapat diajukan oleh kelompok investor (dengan satu pemimpin), sedangkan pengajuan 13F tidak bisa. Hal ini mengakibatkan situasi di mana seorang investor dapat mengajukan 13D/G yang melaporkan satu nilai untuk total saham (mewakili semua saham yang dimiliki oleh kelompok investor), tetapi kemudian mengajukan 13F yang melaporkan nilai yang berbeda untuk total saham (mewakili kepemilikan mereka sendiri). Ini berarti bahwa kepemilikan saham dari pengajuan 13D/G dan pengajuan 13F seringkali tidak dapat dibandingkan secara langsung, sehingga kami menyajikannya secara terpisah.

Catatan: Mulai 16 Mei 2021, kami tidak lagi menampilkan pemilik yang belum mengajukan 13D/G dalam setahun terakhir. Sebelumnya, kami menampilkan riwayat lengkap pengajuan 13D/G. Secara umum, entitas yang diwajibkan untuk mengajukan pengajuan 13D/G harus mengajukan setidaknya setiap tahun sebelum mengirimkan pengajuan penutupan. Namun, terkadang dana keluar dari posisi tanpa mengirimkan pengajuan penutupan (misalnya, mereka menghentikan operasi), sehingga menampilkan riwayat lengkap terkadang menyebabkan kebingungan tentang kepemilikan saat ini. Untuk mencegah kebingungan, kami sekarang hanya menampilkan pemilik 'saat ini' - yaitu - pemilik yang telah mengajukan dalam setahun terakhir.

Upgrade to unlock premium data.

| Tanggal File | Formulir | Investor | Sebelumnya Saham |

Terbaru Saham |

Δ Saham (Persen) |

Kepemilikan (Persen) |

Δ Pagmamay-ari (Persen) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | Fourthstone LLC | 344,620 | 0 | -100.00 | 0.00 | -100.00 | ||

| 2025-04-04 | PL Capital Advisors, LLC | 720,861 | 720,861 | 0.00 | 14.10 | -0.70 | ||

| 2025-02-14 | OLD POINT TRUST & FINANCIAL SERVICES N A | 117,180 | 164,609 | 40.48 | 3.20 | 36.52 | ||

| 2025-02-11 | FJ Capital Management LLC | 0 | 0.00 |

Pengajuan 13F dan NPORT

Detail pada pengajuan 13F tersedia gratis. Detail pada pengajuan NP memerlukan keanggotaan premium. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup. Klik tautan ini ikon untuk melihat riwayat transaksi selengkapnya.

Tingkatkan

untuk membuka data premium dan mengekspor ke Excel ![]() .

.